Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

10 Juli 2023 - 4:27PM

Edgar (US Regulatory)

JAPAN SMALLER CAPITALIZATION FUND, INC.

SCHEDULE OF INVESTMENTS

May 31, 2023 (unaudited)

| |

|

Shares

|

|

|

Fair Value

|

|

COMMON STOCKS — 98.1%

|

|

|

|

|

|

|

JAPAN — 98.1%

|

|

|

|

|

|

| |

|

|

|

|

|

|

Banks — 6.0%

|

|

|

|

|

|

|

Daishi Hokuetsu Financial Group, Inc.

|

|

|

64,100

|

|

|

$

|

1,372,736

|

|

Okinawa Financial Group, Inc.

|

|

|

158,900

|

|

|

|

2,411,829

|

|

Rakuten Bank, Ltd. (a)

|

|

|

193,600

|

|

|

|

2,561,854

|

|

The Akita Bank, Ltd.

|

|

|

195,400

|

|

|

|

2,272,597

|

|

The Keiyo Bank, Ltd.

|

|

|

376,600

|

|

|

|

1,365,732

|

|

The Musashino Bank, Ltd.

|

|

|

89,200

|

|

|

|

1,392,185

|

|

The Nanto Bank, Ltd.

|

|

|

26,600

|

|

|

|

450,167

|

|

The Taiko Bank, Ltd.

|

|

|

284,700

|

|

|

|

2,087,318

|

|

The Yamanashi Chuo Bank, Ltd.

|

|

|

29,900

|

|

|

|

239,961

|

| |

|

|

|

|

|

|

14,154,379

|

| |

|

|

|

|

|

|

|

|

Chemicals — 15.2%

|

|

|

|

|

|

|

|

|

Adeka Corporation

|

|

|

103,600

|

|

|

|

1,814,047

|

|

Aica Kogyo Company, Limited

|

|

|

56,400

|

|

|

|

1,192,103

|

|

C.I. Takiron Corporation

|

|

|

327,400

|

|

|

|

1,217,753

|

|

Fujikura Kasei Co., Ltd.

|

|

|

1,608,900

|

|

|

|

4,775,891

|

|

Fuso Chemical Co., Ltd.

|

|

|

107,600

|

|

|

|

2,982,368

|

|

Moriroku Holdings Company, Ltd.

|

|

|

38,700

|

|

|

|

530,930

|

|

Nichireki Co., Ltd.

|

|

|

146,800

|

|

|

|

1,764,057

|

|

Nippon Soda Co., Ltd.

|

|

|

96,900

|

|

|

|

3,188,298

|

|

Riken Technos Corporation

|

|

|

115,400

|

|

|

|

487,007

|

|

Sakai Chemical Industry Co., Ltd.

|

|

|

169,500

|

|

|

|

2,148,378

|

|

Sakata Inx Corporation

|

|

|

798,300

|

|

|

|

6,509,510

|

|

Sekisui Jushi Corporation

|

|

|

372,200

|

|

|

|

5,343,195

|

|

Shikoku Chemicals Corporation

|

|

|

246,100

|

|

|

|

2,545,407

|

|

Soken Chemical & Engineering Co., Ltd.

|

|

|

42,500

|

|

|

|

535,639

|

|

Yushiro Chemical Industry Co., Ltd.

|

|

|

89,000

|

|

|

|

602,225

|

| |

|

|

|

|

|

|

35,636,808

|

| |

|

|

|

|

|

|

|

|

Construction — 10.3%

|

|

|

|

|

|

|

|

|

Dai-Dan Co., Ltd.

|

|

|

27,300

|

|

|

|

480,172

|

|

EXEO Group, Inc.

|

|

|

300,100

|

|

|

|

5,701,267

|

|

Fudo Tetra Corporation

|

|

|

9,900

|

|

|

|

125,056

|

|

Kandenko Co., Ltd.

|

|

|

727,300

|

|

|

|

5,243,864

|

|

MIRAIT ONE Corporation

|

|

|

214,400

|

|

|

|

2,669,936

|

|

The Nippon Road Co., Ltd.

|

|

|

11,400

|

|

|

|

680,062

|

|

Toenec Corporation

|

|

|

82,700

|

|

|

|

2,043,765

|

|

Totetsu Kogyo Co., Ltd.

|

|

|

174,200

|

|

|

|

3,163,648

|

|

Yondenko Corporation

|

|

|

120,600

|

|

|

|

1,759,765

|

|

Yurtec Corporation

|

|

|

399,800

|

|

|

|

2,307,776

|

| |

|

|

|

|

|

|

24,175,311

|

| |

|

|

|

|

|

|

|

|

Electric Appliances — 2.5%

|

|

|

|

|

|

|

|

|

I-PEX Inc.

|

|

|

61,000

|

|

|

|

573,327

|

|

Mabuchi Motor Co., Ltd.

|

|

|

69,400

|

|

|

|

1,878,896

|

|

Meiko Electronics Co., Ltd.

|

|

|

109,100

|

|

|

|

1,911,133

|

|

Nisshinbo Holdings Inc.

|

|

|

79,600

|

|

|

|

584,737

|

|

Shindengen Electric Manufacturing Co., Ltd.

|

|

|

46,800

|

|

|

|

1,087,944

|

| |

|

|

|

|

|

|

6,036,037

|

|

Financing Business — 2.8%

|

|

|

|

|

|

|

|

|

Credit Saison Co., Ltd.

|

|

|

176,400

|

|

|

|

2,417,527

|

|

Mizuho Leasing Company, Limited

|

|

|

69,000

|

|

|

|

2,063,016

|

|

Ricoh Leasing Company, Ltd.

|

|

|

77,000

|

|

|

|

2,098,423

|

| |

|

|

|

|

|

|

6,578,966

|

| |

|

|

|

|

|

|

|

|

Food — 4.2%

|

|

|

|

|

|

|

|

|

Nichirei Corporation

|

|

|

239,400

|

|

|

|

5,113,182

|

|

S Foods, Inc.

|

|

|

215,200

|

|

|

|

4,725,611

|

| |

|

|

|

|

|

|

9,838,793

|

| |

|

|

|

|

|

|

|

|

Glass and Ceramics Products — 1.2%

|

|

|

|

|

|

|

|

|

Asia Pile Holdings Corporation

|

|

|

292,800

|

|

|

|

1,246,136

|

|

Nichiha Corporation

|

|

|

73,300

|

|

|

|

1,494,784

|

| |

|

|

|

|

|

|

2,740,920

|

| |

|

|

|

|

|

|

|

|

Information and Communication — 3.7%

|

|

|

|

|

|

|

|

|

Future Corporation

|

|

|

142,400

|

|

|

|

1,744,796

|

|

OBIC Co., Ltd.

|

|

|

6,800

|

|

|

|

1,098,759

|

|

Okinawa Cellular Telephone Company

|

|

|

21,600

|

|

|

|

448,362

|

|

Otsuka Corporation

|

|

|

139,900

|

|

|

|

5,263,574

|

| |

|

|

|

|

|

|

8,555,491

|

| |

|

|

|

|

|

|

|

|

Iron and Steel — 2.9%

|

|

|

|

|

|

|

|

|

Kyoei Steel Ltd.

|

|

|

260,700

|

|

|

|

3,434,851

|

|

Godo Steel, Ltd.

|

|

|

1,522,700

|

|

|

|

3,267,480

|

| |

|

|

|

|

|

|

6,702,331

|

| |

|

|

|

|

|

|

|

|

Machinery — 4.2%

|

|

|

|

|

|

|

|

|

Miura Co., Ltd.

|

|

|

98,200

|

|

|

|

2,605,930

|

|

Nitto Kohki Co., Ltd.

|

|

|

395,400

|

|

|

|

5,608,370

|

|

Sodick Co., Ltd.

|

|

|

164,000

|

|

|

|

823,490

|

|

TPR Co., Ltd.

|

|

|

72,200

|

|

|

|

729,204

|

| |

|

|

|

|

|

|

9,766,994

|

| |

|

|

|

|

|

|

|

|

Metal Products — 1.6%

|

|

|

|

|

|

|

|

|

Maruzen Co., Ltd.

|

|

|

86,500

|

|

|

|

1,304,260

|

|

Rinnai Corporation

|

|

|

88,600

|

|

|

|

1,876,504

|

|

Topre Corporation

|

|

|

52,900

|

|

|

|

532,008

|

| |

|

|

|

|

|

|

3,712,772

|

| |

|

|

|

|

|

|

|

|

Other Products — 4.4%

|

|

|

|

|

|

|

|

|

Kawai Musical Instruments Manufacturing Co., Ltd.

|

|

|

21,000

|

|

|

|

477,665

|

|

Komatsu Wall Industry Co., Ltd.

|

|

|

54,700

|

|

|

|

933,153

|

|

Nishikawa Rubber Co., Ltd.

|

|

|

287,900

|

|

|

|

2,382,606

|

|

Pigeon Corporation

|

|

|

119,200

|

|

|

|

1,690,738

|

|

Snow Peak, Inc.

|

|

|

71,900

|

|

|

|

964,804

|

|

The Pack Corporation

|

|

|

179,100

|

|

|

|

3,765,065

|

| |

|

|

|

|

|

|

10,214,031

|

| |

|

|

|

|

|

|

|

|

Pharmaceutical — 2.3%

|

|

|

|

|

|

|

|

|

Nippon Shinyaku Co., Ltd.

|

|

|

52,300

|

|

|

|

2,386,710

|

|

Santen Pharmaceutical Co., Ltd.

|

|

|

335,500

|

|

|

|

3,040,510

|

| |

|

|

|

|

|

|

5,427,220

|

| |

|

|

|

|

|

|

|

|

Precision Instruments — 1.0%

|

|

|

|

|

|

|

|

|

Nakanishi Inc.

|

|

|

109,500

|

|

|

|

2,302,707

|

| |

|

|

|

|

|

|

2,302,707

|

|

Retail Trade — 9.6%

|

|

|

|

|

|

|

|

|

ASKUL Corporation

|

|

|

95,700

|

|

|

|

1,236,252

|

|

Cosmos Pharmaceutical Corporation

|

|

|

4,800

|

|

|

|

455,263

|

|

Create SD Holdings Co., Ltd.

|

|

|

231,800

|

|

|

|

5,570,960

|

|

Izumi Co., Ltd.

|

|

|

107,500

|

|

|

|

2,460,570

|

|

JM Holdings Co., Ltd.

|

|

|

431,000

|

|

|

|

5,983,842

|

|

PAL GROUP Holdings Co., Ltd.

|

|

|

31,500

|

|

|

|

751,422

|

|

Seria Co., Ltd.

|

|

|

287,500

|

|

|

|

4,661,940

|

|

Yossix Holdings Co., Ltd.

|

|

|

90,600

|

|

|

|

1,434,773

|

| |

|

|

|

|

|

|

22,555,022

|

| |

|

|

|

|

|

|

|

|

Services — 3.6%

|

|

|

|

|

|

|

|

|

Kanamoto Co., Ltd.

|

|

|

147,600

|

|

|

|

2,298,381

|

|

Nippon Koei Co., Ltd.

|

|

|

21,600

|

|

|

|

573,198

|

|

Nishio Rent All Co., Ltd.

|

|

|

167,100

|

|

|

|

3,812,804

|

|

Step Co., Ltd.

|

|

|

147,100

|

|

|

|

1,867,619

|

| |

|

|

|

|

|

|

8,552,002

|

| |

|

|

|

|

|

|

|

|

Transportation and Warehousing — 1.4%

|

|

|

|

|

|

|

|

|

SG Holdings Co., Ltd.

|

|

|

15,700

|

|

|

|

229,989

|

|

Trancom Co., Ltd.

|

|

|

65,700

|

|

|

|

3,106,305

|

| |

|

|

|

|

|

|

3,336,294

|

| |

|

|

|

|

|

|

|

|

Transportation Equipment — 7.3%

|

|

|

|

|

|

|

|

|

Hi-Lex Corporation

|

|

|

442,700

|

|

|

|

3,575,039

|

|

Kyokuto Kaihatsu Kogyo Co., Ltd.

|

|

|

206,400

|

|

|

|

2,353,289

|

|

Morita Holdings Corporation

|

|

|

279,400

|

|

|

|

2,885,831

|

|

Nichirin Co., Ltd.

|

|

|

80,000

|

|

|

|

1,384,786

|

|

Nippon Seiki Co., Ltd.

|

|

|

414,000

|

|

|

|

2,543,729

|

|

NOK Corporation

|

|

|

240,900

|

|

|

|

3,187,762

|

|

Tokai Rika Co., Ltd.

|

|

|

90,400

|

|

|

|

1,225,335

|

| |

|

|

|

|

|

|

17,155,771

|

| |

|

|

|

|

|

|

|

|

Utilities — 5.0%

|

|

|

|

|

|

|

|

|

Kyushu Electric Power Company

|

|

|

664,200

|

|

|

|

4,147,538

|

|

Shikoku Electric Power Company

|

|

|

1,008,300

|

|

|

|

6,945,337

|

|

The Okinawa Electric Power Company

|

|

|

70,890

|

|

|

|

591,743

|

| |

|

|

|

|

|

|

11,684,618

|

| |

|

|

|

|

|

|

|

|

Wholesale Trade — 8.9%

|

|

|

|

|

|

|

|

|

Central Automotive Products, Ltd.

|

|

|

68,900

|

|

|

|

1,547,484

|

|

Kanaden Corporation

|

|

|

379,500

|

|

|

|

3,227,535

|

|

Kohsoku Corporation

|

|

|

166,600

|

|

|

|

2,257,004

|

|

Macnica Holdings, Inc.

|

|

|

94,900

|

|

|

|

3,455,105

|

|

Nagase & Co., Ltd.

|

|

|

85,300

|

|

|

|

1,386,838

|

|

Paltac Corporation

|

|

|

98,400

|

|

|

|

3,459,361

|

|

Ryoden Corporation

|

|

|

280,800

|

|

|

|

3,806,130

|

|

Sugimoto & Co., Ltd.

|

|

|

128,900

|

|

|

|

1,789,599

|

| |

|

|

|

|

|

|

20,929,056

|

| |

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS — 98.1% (cost $258,170,051)

|

|

|

|

|

|

$

|

230,055,523

|

|

TOTAL FOREIGN CURRENCY — 0.9% (cost $2,000,144) (b)

|

|

|

|

|

|

$

|

2,003,155

|

|

TOTAL INVESTMENTS AND FOREIGN CURRENCY — 99.0% (cost $260,170,195)

|

|

|

|

|

|

$

|

232,058,678

|

|

TOTAL OTHER ASSETS AND LIABILITIES — 1.0%

|

|

|

|

|

|

|

2,279,557

|

|

TOTAL NET ASSETS — 100.0%

|

|

|

|

|

|

$

|

234,338,235

|

(a) Non-income producing security.

(b) Japanese Yen - Interest bearing account.

Notes to Schedule of Investments (Unaudited)

Valuation of Securities

Investments traded in the over-the-counter market are fair valued at the last reported sales price as of the close of business on the day the securities are being valued or, if none is available, at the mean of the

bid and offer price at the close of business on such day or, if none is available, the last reported sales price. Portfolio securities which are traded on stock exchanges are fair valued at the last sales price on the principal market on which

securities are traded or, lacking any sales, at the last available bid price. Securities and other assets, including futures contracts and related options, that cannot be fair valued using one of the previously mentioned methods are stated at

fair value as determined in good faith by or under the direction of the Board of Directors of the Fund.

Fair Value Measurements

Fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date.

The three-tier hierarchy of inputs is summarized below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

• Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

At May 31, 2023, all of the Fund’s investments were determined to be Level 1 securities.

During the quarter ended May 31, 2023, the Fund did not hold any instrument which used significant unobservable inputs (Level 3) in determining fair value.

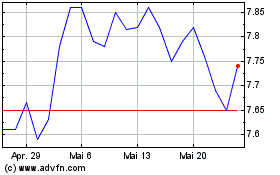

Japan Smaller Capitaliza... (NYSE:JOF)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Japan Smaller Capitaliza... (NYSE:JOF)

Historical Stock Chart

Von Mai 2023 bis Mai 2024