false000177794600017779462023-07-172023-07-170001777946irnt:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShare1Member2023-07-172023-07-170001777946irnt:CommonStockParValue00001PerShare2Member2023-07-172023-07-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 17, 2023

IronNet, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39125 |

|

83-4599446 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

7900 Tysons One Place, Suite 400

McLean, VA 22102

(Address of principal executive offices, including zip code)

(443) 300-6761

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.0001 per share |

|

IRNT |

|

The New York Stock Exchange |

Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share |

|

IRNT.WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On July 17, 2023, the board of directors of IronNet, Inc., a Delaware corporation (the “Company”) authorized the Company to voluntarily delist each class of its securities (including its warrants) from the New York Stock Exchange (the “Exchange”) pursuant to the Letter Agreement (the “Letter Agreement”) executed on June 16, 2023 and deemed effective on July 11, 2023, between the Company and C5 CC Ferrous, LLC, a Delaware limited liability company (as amended on July 11, 2023). On July 17, 2023, the Company delivered written notice to the Exchange of its intention to voluntarily delist each class of its common stock and its redeemable warrants from the Exchange. On the same day, the Company issued a press release announcing the decision to voluntarily delist each class of its securities.

The Company currently anticipates that it will file a Form 25 with the Securities and Exchange Commission relating to the delisting on or about July 27, 2023, and the Company anticipates that the delisting of its securities will become effective on or about August 6, 2023. Following delisting, the Company expects that its securities will be traded on over-the-counter markets. However, the Company cannot provide any assurance that trading of its securities will continue in the future on any over-the-counter trading market.

The Company does not expect that the delisting will have any adverse effects on its business operations, and the Company will remain subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended.

The foregoing description of the press release, dated July 17, 2022, is qualified in its entirety by the full text of the press release furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

Exhibit No. |

|

Document |

99.1 |

|

Press Release issued by IronNet, Inc. on July 17, 2023. |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

IRONNET, INC. |

|

|

|

|

By: |

/s/ Cameron D. Pforr |

|

|

Date: July 17, 2023 Cameron D. Pforr

President & Chief Financial Officer |

Exhibit 99.1

IronNet Announces Intention to Voluntarily Delist Securities from New York Stock Exchange

MCLEAN, VA (July 17, 2023) – IronNet, Inc. (together with its subsidiaries, “IronNet”, “we”, “us” or the “Company”) (NYSE: IRNT) announced today its intention to voluntarily delist from the New York Stock Exchange (“NYSE”).

This announcement follows the Company’s receipt of notice from the NYSE that the Company is not in compliance with the NYSE’s continued listing standards. The Company has been evaluating its options with respect to its NYSE listing. After discussions and deliberations on these matters, the Company’s board of directors has approved a resolution authorizing the Company to voluntarily delist from the NYSE.

On July 17, 2023, the Company notified NYSE of its intent to voluntarily delist its securities from NYSE. The Company currently anticipates that it will file a Form 25 with the Securities and Exchange Commission (the “SEC”) relating to the delisting on or about July 27, 2023, and anticipates that the delisting of its securities will become effective on or about August 6, 2023. Following delisting, the Company expects that its common stock will be traded on over-the-counter markets.

The Company does not expect that the delisting will have any adverse effects on its business operations, and the Company will remain subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended.

About IronNet, Inc.

Founded in 2014 by GEN (Ret.) Keith Alexander, IronNet, Inc. (NYSE: IRNT) is a global cybersecurity leader that is transforming how organizations secure their networks by delivering the first-ever collective defense platform operating at scale. Employing a number of former NSA cybersecurity operators with offensive and defensive cyber experience, IronNet integrates deep tradecraft knowledge into its industry-leading products to solve the most challenging cyber problems facing the world today.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding IronNet’s ability to provide visibility and detection of malicious behaviors and to help defend against increased cyber threats facing the globe. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside IronNet’s management’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: IronNet’s ability to continue as a going concern; IronNet’s ability to access additional sources of liquidity; the impact of the voluntary delisting of the Company’s securities from the NYSE on the Company’s business operations; whether following the voluntary delisting of the Company’s securities from the NYSE trading of the securities will continue on the over-the-counter markets; risks and uncertainties associated with a potential filing for relief under the United States Bankruptcy Code; IronNet’s inability to recognize the anticipated benefits of collaborations with IronNet’s partners and customers; IronNet’s ability to execute on its plans to develop and market new products and the timing of these development programs; the rate and degree of market acceptance of IronNet’s products; the success of other competing technologies that may become available; the performance of IronNet’s products; potential litigation involving IronNet; and general economic and market conditions impacting demand for IronNet’s products. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described under the heading “Risk Factors” in IronNet’s Annual Report on Form 10-K for the year ended January 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on May 2, 2022, IronNet’s most recent Quarterly Report on Form 10-Q for the quarter ended October 31, 2022, filed with the SEC on May 2, 2023, and other documents that IronNet files with the SEC from time to time. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and IronNet does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

IronNet Contacts:

Investor Contact: IR@ironnet.com

Media Contact: Media@ironnet.com

2

v3.23.2

Document and Entity Information

|

Jul. 17, 2023 |

| Document and Entity Information [Line Items] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001777946

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 17, 2023

|

| Entity Registrant Name |

IronNet, Inc.

|

| Entity Incorporation State Country Code |

DE

|

| Entity File Number |

001-39125

|

| Entity Tax Identification Number |

83-4599446

|

| Entity Address, Address Line One |

7900 Tysons One Place

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

McLean

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22102

|

| City Area Code |

443

|

| Local Phone Number |

300-6761

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Common Stock Par Value 0.0001 Per Share 2 [Member] |

|

| Document and Entity Information [Line Items] |

|

| Security 12b Title |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

IRNT

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants Each Whole Warrant Exercisable For One Share Of Common Stock At An Exercise Price Of 11.50 Per Share 1 [Member] |

|

| Document and Entity Information [Line Items] |

|

| Security 12b Title |

Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

IRNT.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=irnt_CommonStockParValue00001PerShare2Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=irnt_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShare1Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

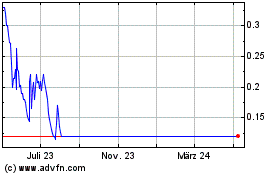

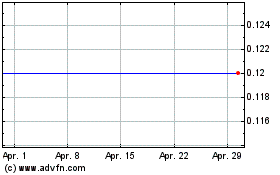

IronNet (NYSE:IRNT)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

IronNet (NYSE:IRNT)

Historical Stock Chart

Von Mai 2023 bis Mai 2024