HCI Group, Inc. (NYSE:HCI), a holding company with

operations in homeowners insurance, information technology

services, real estate, and reinsurance, reported net income of

$17.8 million, or $1.54 diluted earnings per share in the first

quarter of 2023, compared with net income of $2.8 million, or $0.09

diluted earnings per share, in the first quarter of 2022.

Adjusted net income (a non-GAAP measure which

excludes net unrealized gains or losses on equity securities) for

the first quarter of 2023 was $17.4 million, or $1.50 diluted

earnings per share, compared with adjusted net income of $5.5

million, or $0.34 diluted earnings per share, in the first quarter

of 2022. This press release includes an explanation of adjusted net

income as well as a reconciliation to net income and earnings per

share calculated in accordance with generally accepted accounting

principles (known as “GAAP”).

Management Commentary “We are

starting to see the benefits of the company’s underwriting and rate

actions as well as the bold leadership provided by the Florida

Legislature in 2022,” said HCI Group Chairman and Chief Executive

Officer Paresh Patel.

First Quarter 2023 Commentary

Consolidated gross premiums earned in the first quarter of 2023

increased to $180.1 million from $178.9 million in the first

quarter of 2022. The increase was primarily due to higher average

premium per policy offset by a decline in the number of policies in

force.

Premiums ceded for reinsurance increased to $70.5

million from $53.2 million in the first quarter of 2022. Ceded

premiums represented 39.2% and 29.7% of gross premiums earned in

the first quarters of 2023 and 2022, respectively.

Net investment income increased to $17.7 million

from $2.9 million in the first quarter of 2022. The increase

included a gain of $8.9 million from the sale of two real estate

investment properties at Greenleaf. Also included in investment

income was interest income of $7.7 million, which increased from

$0.6 million in the first quarter of 2022 reflecting higher yields

on fixed maturity securities, cash, and cash equivalents.

Losses and loss adjustment expenses decreased to

$60.6 million from $72.7 million in the same period of 2022. Losses

and loss adjustment expenses as a percent of gross premiums earned

declined to 33.6% from 40.6% in the first quarter of 2022. The

decrease was driven by lower claims and litigation frequency in

Florida.

Policy acquisition and other underwriting expenses

decreased to $22.7 million from $29.4 million in the same quarter

of 2022 and declined from 16.4% of gross premiums earned to 12.6%,

reflecting a higher mix of renewal policies and lower

commissions.

General and administrative personnel expenses

decreased to $13.5 million from $14.0 million for the first quarter

of 2022.

Conference Call HCI Group will

hold a conference call later today, May 9, 2023, to discuss these

financial results. Chairman and Chief Executive Officer Paresh

Patel, Chief Operating Officer Karin Coleman and Chief Financial

Officer Mark Harmsworth will host the call starting at 4:45 p.m.

Eastern time.

A replay of the call will be available after 8:00

p.m. Eastern time on the same day as the call and via the Investor

Information section of the HCI Group website at

www.hcigroup.com.

Listen-only toll-free number: (888) 506-0062

Listen-only international number: (973) 528-0011 Entry Code:

826822

Please call the conference telephone number 10

minutes before the start time. An operator will register your name

and organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at (949)

574-3860.

A replay of the call will be available by

telephone after 8:00 p.m. Eastern time on the same day as the call

and via the Investor Information section of the HCI Group website

at www.hcigroup.com through May 9, 2024.

Toll-free replay number: (877) 481-4010

International replay number: (919) 882-2331 Replay ID: 48147

About HCI Group, Inc. HCI Group,

Inc. owns subsidiaries engaged in diverse, yet complementary

business activities, including homeowners insurance, information

technology services, insurance management, real estate, and

reinsurance. HCI’s leading insurance operation, TypTap Insurance

Company, is a technology-driven homeowners insurance company.

TypTap’s operations are powered in large part by insurance-related

information technology developed by HCI’s software subsidiary,

Exzeo USA, Inc. HCI’s largest subsidiary, Homeowners Choice

Property & Casualty Insurance Company, Inc., provides

homeowners insurance primarily in Florida. HCI’s real estate

subsidiary, Greenleaf Capital, LLC, owns and operates multiple

properties in Florida, including office buildings, retail centers

and marinas.

The company's common shares trade on the New York

Stock Exchange under the ticker symbol "HCI" and are included in

the Russell 2000 and S&P SmallCap 600 Index. HCI Group, Inc.

regularly publishes financial and other information in the Investor

Information section of the company’s website. For more information

about HCI Group and its subsidiaries, visit www.hcigroup.com.

Forward-Looking Statements This

news release may contain forward-looking statements made pursuant

to the Private Securities Litigation Reform Act of 1995. Words such

as "anticipate," "estimate," "expect," "intend," "plan,"

"confident," "prospects" and "project" and other similar words and

expressions are intended to signify forward-looking statements.

Forward-looking statements are not guarantees of future results and

conditions, but rather are subject to various risks and

uncertainties. For example, the estimation of reserves for losses

and loss adjustment expenses is an inherently imprecise process

involving many assumptions and considerable management judgment.

Some of these risks and uncertainties are identified in the

company's filings with the Securities and Exchange Commission.

Should any risks or uncertainties develop into actual events, these

developments could have material adverse effects on the company's

business, financial condition and results of operations. HCI Group,

Inc. disclaims all obligations to update any forward-looking

statements.

Company Contact: Simon Rosenberg

Investor Relations HCI Group, Inc. Tel (813) 405-5261

srosenberg@hcigroup.com

Investor Relations Contact: Matt

Glover Gateway Group, Inc. Tel (949) 574-3860 HCI@gatewayir.com

|

|

|

HCI GROUP, INC. AND SUBSIDIARIES |

|

Selected Financial Metrics |

|

(Dollar amounts in thousands, except per share

amounts) |

|

|

|

|

Q1 2023 |

|

|

Q1 2022 |

|

|

FY 2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

Insurance Operations |

|

|

|

|

|

|

|

|

|

Gross Written Premiums: |

|

|

|

|

|

|

|

|

|

Homeowners Choice |

$ |

85,153 |

|

|

$ |

91,141 |

|

|

$ |

377,860 |

|

|

TypTap Insurance Company |

|

114,701 |

|

|

|

86,153 |

|

|

|

348,159 |

|

|

Total Gross Written Premiums |

|

199,854 |

|

|

|

177,294 |

|

|

|

726,019 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Premiums Earned: |

|

|

|

|

|

|

|

|

|

Homeowners Choice |

|

92,456 |

|

|

|

118,303 |

|

|

|

426,502 |

|

|

TypTap Insurance Company |

|

87,612 |

|

|

|

60,622 |

|

|

|

298,214 |

|

|

Total Gross Premiums Earned |

|

180,068 |

|

|

|

178,925 |

|

|

|

724,716 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Premiums Earned Loss Ratio |

|

33.6 |

% |

|

|

40.6 |

% |

|

|

51.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

Per Share Metrics |

|

|

|

|

|

|

|

|

|

GAAP Diluted EPS |

$ |

1.54 |

|

|

$ |

0.09 |

|

|

$ |

(6.24 |

) |

|

Non-GAAP Adjusted Diluted EPS |

$ |

1.50 |

|

|

$ |

0.34 |

|

|

$ |

(5.48 |

) |

|

|

|

|

|

|

|

|

|

|

|

Dividends per share |

$ |

0.40 |

|

|

$ |

0.40 |

|

|

$ |

1.60 |

|

|

|

|

|

|

|

|

|

|

|

|

Book value per share at the end of period |

$ |

20.97 |

|

|

$ |

31.66 |

|

|

$ |

18.91 |

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding at the end of period |

|

8,596,673 |

|

|

|

10,125,927 |

|

|

|

8,598,682 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HCI GROUP, INC. AND SUBSIDIARIES |

|

Consolidated Balance Sheets |

|

(Dollar amounts in thousands) |

|

|

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

|

|

(Unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

Fixed-maturity securities, available for sale, at fair value

(amortized cost: $531,899 and $494,197, respectively and allowance

for credit losses: $0 and $0, respectively) |

$ |

524,756 |

|

|

$ |

483,901 |

|

|

Equity securities, at fair value (cost: $38,575 and $36,272,

respectively) |

|

37,415 |

|

|

|

34,583 |

|

|

Limited partnership investments |

|

24,520 |

|

|

|

25,702 |

|

|

Investment in unconsolidated joint venture, at equity |

|

— |

|

|

|

18 |

|

|

Real estate investments |

|

43,562 |

|

|

|

71,388 |

|

|

Total investments |

|

630,253 |

|

|

|

615,592 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

302,025 |

|

|

|

234,863 |

|

|

Restricted cash |

|

2,987 |

|

|

|

2,900 |

|

|

Accrued interest and dividends receivable |

|

2,525 |

|

|

|

1,952 |

|

|

Income taxes receivable |

|

707 |

|

|

|

2,807 |

|

|

Premiums receivable, net (allowance: $10,054 and $5,362,

respectively) |

|

44,966 |

|

|

|

34,998 |

|

|

Prepaid reinsurance premiums |

|

27,063 |

|

|

|

66,627 |

|

|

Reinsurance recoverable, net of allowance for credit losses: |

|

|

|

|

|

|

Paid losses and loss adjustment expenses (allowance: $0 and $0,

respectively) |

|

36,896 |

|

|

|

71,594 |

|

|

Unpaid losses and loss adjustment expenses (allowance: $453 and

$454, respectively) |

|

559,804 |

|

|

|

616,765 |

|

|

Deferred policy acquisition costs |

|

46,632 |

|

|

|

45,522 |

|

|

Property and equipment, net |

|

26,734 |

|

|

|

17,910 |

|

|

Right-of-use-assets - operating leases |

|

1,466 |

|

|

|

777 |

|

|

Intangible assets, net |

|

7,686 |

|

|

|

10,578 |

|

|

Funds withheld for assumed business |

|

45,274 |

|

|

|

48,772 |

|

|

Other assets |

|

36,104 |

|

|

|

31,671 |

|

|

|

|

|

|

|

|

|

Total assets |

$ |

1,771,122 |

|

|

$ |

1,803,328 |

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

Losses and loss adjustment expenses |

$ |

806,308 |

|

|

$ |

863,765 |

|

|

Unearned premiums |

|

387,833 |

|

|

|

368,047 |

|

|

Advance premiums |

|

25,834 |

|

|

|

18,587 |

|

|

Reinsurance payable on paid losses and loss adjustment

expenses |

|

7,043 |

|

|

|

8,606 |

|

|

Ceded reinsurance premiums payable |

|

14,123 |

|

|

|

17,646 |

|

|

Accrued expenses |

|

20,633 |

|

|

|

14,534 |

|

|

Reinsurance recovered in advance on unpaid losses |

|

— |

|

|

|

19,863 |

|

|

Deferred income taxes, net |

|

3,160 |

|

|

|

1,704 |

|

|

Long-term debt |

|

196,158 |

|

|

|

211,687 |

|

|

Lease liabilities - operating leases |

|

1,422 |

|

|

|

721 |

|

|

Other liabilities |

|

35,886 |

|

|

|

23,361 |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

1,498,400 |

|

|

|

1,548,521 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

92,865 |

|

|

|

93,553 |

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Common stock, (no par value, 40,000,000 shares authorized,

8,596,673 and 8,598,682 shares issued and outstanding at March 31,

2023 and December 31, 2022, respectively) |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

332 |

|

|

|

— |

|

|

Retained income |

|

185,028 |

|

|

|

172,482 |

|

|

Accumulated other comprehensive loss, net of taxes |

|

(5,098 |

) |

|

|

(9,886 |

) |

|

Total stockholders' equity |

|

180,262 |

|

|

|

162,596 |

|

|

Noncontrolling interests |

|

(405 |

) |

|

|

(1,342 |

) |

|

Total equity |

|

179,857 |

|

|

|

161,254 |

|

|

|

|

|

|

|

|

|

Total liabilities, redeemable noncontrolling interest, and

equity |

$ |

1,771,122 |

|

|

$ |

1,803,328 |

|

| |

|

|

|

|

|

|

|

|

HCI GROUP, INC. AND SUBSIDIARIES |

|

Consolidated Statements of Income |

|

(Unaudited) |

|

(Dollar amounts in thousands, except per share

amounts) |

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2023 |

|

|

2022 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross premiums earned |

$ |

180,068 |

|

|

$ |

178,925 |

|

|

Premiums ceded |

|

(70,509 |

) |

|

|

(53,162 |

) |

|

|

|

|

|

|

|

|

Net premiums earned |

|

109,559 |

|

|

|

125,763 |

|

|

|

|

|

|

|

|

|

Net investment income |

|

17,715 |

|

|

|

2,868 |

|

|

Net realized investment losses |

|

(1,149 |

) |

|

|

(314 |

) |

|

Net unrealized investment gains (losses) |

|

529 |

|

|

|

(3,576 |

) |

|

Policy fee income |

|

1,090 |

|

|

|

1,057 |

|

|

Other |

|

1,285 |

|

|

|

1,242 |

|

|

|

|

|

|

|

|

|

Total revenue |

|

129,029 |

|

|

|

127,040 |

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Losses and loss adjustment expenses |

|

60,565 |

|

|

|

72,704 |

|

|

Policy acquisition and other underwriting expenses |

|

22,720 |

|

|

|

29,408 |

|

|

General and administrative personnel expenses |

|

13,502 |

|

|

|

14,034 |

|

|

Interest expense |

|

2,801 |

|

|

|

601 |

|

|

Other operating expenses |

|

6,305 |

|

|

|

6,292 |

|

|

|

|

|

|

|

|

|

Total expenses |

|

105,893 |

|

|

|

123,039 |

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

23,136 |

|

|

|

4,001 |

|

|

|

|

|

|

|

|

|

Income tax expense |

|

5,343 |

|

|

|

1,210 |

|

|

|

|

|

|

|

|

|

Net income |

$ |

17,793 |

|

|

$ |

2,791 |

|

|

Net income attributable to redeemable noncontrolling interest |

|

(2,324 |

) |

|

|

(2,248 |

) |

|

Net (income) loss attributable to noncontrolling interests |

|

(131 |

) |

|

|

360 |

|

|

|

|

|

|

|

|

|

Net income after noncontrolling interests |

$ |

15,338 |

|

|

$ |

903 |

|

|

|

|

|

|

|

|

|

Basic earnings per share |

$ |

1.78 |

|

|

$ |

0.09 |

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

$ |

1.54 |

|

|

$ |

0.09 |

|

|

|

|

|

|

|

|

|

Dividends per share |

$ |

0.40 |

|

|

$ |

0.40 |

|

| |

|

|

|

|

|

|

|

HCI GROUP, INC. AND SUBSIDIARIES

(Amounts in thousands, except per share amounts)

A summary of the numerator and denominator of

basic and diluted earnings per common share calculated in

accordance with GAAP is presented below.

|

|

Three Months Ended |

|

Three Months Ended |

|

GAAP |

March 31, 2023 |

|

March 31, 2022 |

|

|

Income |

|

|

Shares (a) |

|

Per Share |

|

Income |

|

|

Shares (a) |

|

Per Share |

|

|

(Numerator) |

|

|

(Denominator) |

|

Amount |

|

(Numerator) |

|

|

(Denominator) |

|

Amount |

|

Net income |

$ |

17,793 |

|

|

|

|

|

|

$ |

2,791 |

|

|

|

|

|

|

Less: Net income attributable to redeemable noncontrolling

interest |

|

(2,324 |

) |

|

|

|

|

|

|

(2,248 |

) |

|

|

|

|

|

Less: TypTap Group's net (income) loss attributable to non-HCI

common stockholders and TypTap Group's participating

securities |

|

(131 |

) |

|

|

|

|

|

|

360 |

|

|

|

|

|

|

Net income attributable to HCI |

|

15,338 |

|

|

|

|

|

|

|

903 |

|

|

|

|

|

|

Less: Income attributable to participating securities |

|

(564 |

) |

|

|

|

|

|

|

(52 |

) |

|

|

|

|

|

Basic Earnings Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income allocated to common stockholders |

|

14,774 |

|

|

|

8,278 |

|

$ |

1.78 |

|

|

851 |

|

|

|

9,479 |

|

$ |

0.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of Dilutive Securities: * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock options |

|

— |

|

|

|

45 |

|

|

|

|

— |

|

|

|

135 |

|

|

|

Convertible senior notes |

|

1,921 |

|

|

|

2,537 |

|

|

|

|

— |

|

|

|

— |

|

|

|

Warrants |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

153 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income available to common stockholders and assumed

conversions |

$ |

16,695 |

|

|

|

10,860 |

|

$ |

1.54 |

|

$ |

851 |

|

|

|

9,767 |

|

$ |

0.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Shares in thousands. |

|

* For the three months ended March 31, 2023, warrants were excluded

due to anti-dilutive effect. For the three months ended March 31,

2022, convertible senior notes were excluded due to anti-dilutive

effect. |

|

|

Non-GAAP Financial Measures

Adjusted net income is a Non-GAAP financial

measure that removes from net income of HCI's portion of the effect

of unrealized gains or losses on equity securities required to be

included in results of operations in accordance with Accounting

Standards Codification 321. HCI Group believes net income without

the effect of volatility in equity prices more accurately depicts

operating results. This financial measurement is not recognized in

accordance with accounting principles generally accepted in the

United States of America ("GAAP") and should not be viewed as an

alternative to GAAP measures of performance. A reconciliation of

GAAP Net income to Non-GAAP Adjusted net income and GAAP diluted

earnings per share to Non-GAAP Adjusted diluted earnings per share

is provided below.

Reconciliation of GAAP Net Income to

Non-GAAP Adjusted Net Income

|

|

Three Months Ended |

|

Three Months Ended |

|

|

March 31, 2023 |

|

March 31, 2022 |

|

GAAP Net income |

|

|

|

$ |

17,793 |

|

|

|

|

|

$ |

2,791 |

|

|

Net unrealized investment (gains) losses |

$ |

(529 |

) |

|

|

|

|

$ |

3,576 |

|

|

|

|

|

Less: Tax effect at 25.345% |

$ |

134 |

|

|

|

|

|

$ |

(906 |

) |

|

|

|

|

Net adjustment to Net income |

|

|

|

$ |

(395 |

) |

|

|

|

|

$ |

2,670 |

|

|

Non-GAAP Adjusted Net income |

|

|

|

$ |

17,398 |

|

|

|

|

|

$ |

5,461 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

HCI GROUP, INC. AND SUBSIDIARIES

(Amounts in thousands, except per share amounts)

A summary of the numerator and denominator of the

basic and diluted earnings per common share calculated with the

Non-GAAP financial measure Adjusted net income is presented

below.

|

|

Three Months Ended |

|

Three Months Ended |

|

Non-GAAP |

March 31, 2023 |

|

March 31, 2022 |

|

|

Income |

|

|

Shares (a) |

|

Per Share |

|

Income |

|

|

Shares (a) |

|

Per Share |

|

|

(Numerator) |

|

|

(Denominator) |

|

Amount |

|

(Numerator) |

|

|

(Denominator) |

|

Amount |

|

Adjusted net income (non-GAAP) |

$ |

17,398 |

|

|

|

|

|

|

$ |

5,461 |

|

|

|

|

|

|

Less: Net income attributable to redeemable noncontrolling

interest |

|

(2,324 |

) |

|

|

|

|

|

$ |

(2,248 |

) |

|

|

|

|

|

Less: TypTap Group's net (income) loss attributable to non-HCI

common stockholders and TypTap Group's participating

securities |

|

(127 |

) |

|

|

|

|

|

|

340 |

|

|

|

|

|

|

Net income attributable to HCI |

|

14,947 |

|

|

|

|

|

|

|

3,553 |

|

|

|

|

|

|

Less: Income attributable to participating securities |

|

(550 |

) |

|

|

|

|

|

|

(222 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings Per Share before unrealized gains/losses on

equity securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income allocated to common stockholders |

|

14,397 |

|

|

|

8,278 |

|

$ |

1.74 |

|

|

3,331 |

|

|

|

9,479 |

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of Dilutive Securities: * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock options |

|

— |

|

|

|

45 |

|

|

|

|

— |

|

|

|

135 |

|

|

|

Convertible senior notes |

|

1,921 |

|

|

|

2,537 |

|

|

|

|

— |

|

|

|

— |

|

|

|

Warrants |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

153 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings Per Share before unrealized gains/losses

on equity securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income available to common stockholders and assumed

conversions |

$ |

16,318 |

|

|

$ |

10,860 |

|

$ |

1.50 |

|

$ |

3,331 |

|

|

$ |

9,767 |

|

$ |

0.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Shares in thousands. |

|

* For the three months ended March 31, 2023, warrants were excluded

due to anti-dilutive effect. For the three months ended March 31,

2022, convertible senior notes were excluded due to anti-dilutive

effect. |

|

|

Reconciliation of GAAP Diluted EPS to

Non-GAAP Adjusted Diluted EPS

|

|

Three Months Ended |

|

Three Months Ended |

|

|

March 31, 2023 |

|

March 31, 2022 |

|

GAAP diluted Earnings Per Share |

|

|

|

$ |

1.54 |

|

|

|

|

|

$ |

0.09 |

|

|

Net unrealized investment (gains) losses |

$ |

(0.05 |

) |

|

|

|

|

$ |

0.37 |

|

|

|

|

|

Less: Tax effect at 25.345% |

$ |

0.01 |

|

|

|

|

|

$ |

(0.12 |

) |

|

|

|

|

Net adjustment to GAAP diluted EPS |

|

|

|

$ |

(0.04 |

) |

|

|

|

|

$ |

0.25 |

|

|

Non-GAAP Adjusted diluted EPS |

|

|

|

$ |

1.50 |

|

|

|

|

|

$ |

0.34 |

|

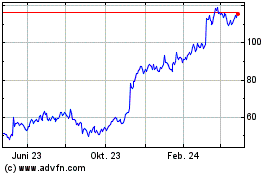

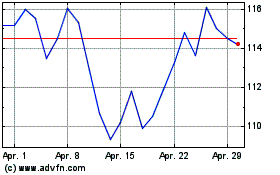

HCI (NYSE:HCI)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

HCI (NYSE:HCI)

Historical Stock Chart

Von Mai 2023 bis Mai 2024