SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE

ACT OF 1934

For the month of

November 2023

(Commission File

No. 001-32221)

GOL LINHAS AÉREAS

INTELIGENTES S.A.

(Exact name of registrant

as specified in its charter)

GOL INTELLIGENT

AIRLINES INC.

(Translation of

registrant’s name into English)

Praça Comandante

Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s

principal executive offices)

Indicate by check mark

whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check

mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

Conference Call Connection

Details

3Q23 Conference Call Monday,

November 06, 2023

Live webcast Access

at www.voegol.com.br/ir

| In Portuguese |

In English |

|

12:30 pm (Brasília time)

10:30 am (New York time)

Zoom |

11:00 am (Brasília time)

09:00 am (New York time)

Zoom |

| 1 |

|

| Results Report Third Quarter, 2023 |

GOL

announces record revenue of R$4.7 billion and 11.2 p.p. EBIT margin increase to 17.7% in 3Q23

EBITDA

income of R$1,25 billion and margin of 26.8%

3Q23

Highlights:

| • | Net operating

revenue reached a record-breaking R$4.7 billion for the 3Q, a 16.4% year-over-year increase; |

| • | Strong operational

performance achieved 620 daily flights, 156 markets served and over 8 million passengers transported; |

| • | EBITDA was

R$1.25 billion and margin reached 26.8%, a 9.5 p.p. increase compared to 3Q22; |

| • | Cash flow from

operating activities was R$0.9 billion; |

| • | Yields increased

4.5% compared to 3Q22 due to increased productivity and optimized inventory management; |

| • | CASK decreased

by 8.0% compared to 3Q22, and a new Boeing 737 MAX-8 aircraft was received in the quarter (elevating this highly efficient model to 28%

of the fleet); |

| • | Net leverage

reached 4.0x (5.5x using 7x leases and 3.2x excluding the SSN due 2028), 1.0x lower than 2Q23 and 4.2x decrease compared to 3Q22. |

São

Paulo, November 06, 2023 - GOL Linhas Aéreas Inteligentes S.A. (“GOL” or “Company”) (NYSE: GOL and B3:

GOLL4), a leading domestic airline in Brazil and part of Abra Group, today announced its consolidated

results for the third quarter of 2023 (3Q23). The Company maintains its ongoing focus on increasing productivity with an efficient fleet

and disciplined yield management, as well as delivering the best product to the Customers.

Celso Ferrer, CEO, commented: “Thanks to

the outstanding work of our Team of Eagles, our operational reliability continues to strengthen for our Customers, and we delivered record

third quarter revenue with a 17.7% operating margin, among the best in the industry. Our strategy to diversify our revenue streams, primarily

with Smiles and Gollog, capitalize on growth opportunities and continuously innovate to enhance our products for our Customers demonstrates

that we are in the right way and is permitting us to achieve consistent results for 2023.”

All information in this release is presented

in Reais (R$), in accordance with international accounting standards (IFRS) and with adjusted metrics, made available to enable comparison

of this quarter with the same period of the previous year (3Q22). Adjusted (recurring) indicators exclude non-recurring expenses related

to the quarter's results and are detailed in the respective tables.

Summary

of the Third Quarter of 2023 (vs. 3Q22)

| · | The number

of Revenue Passenger Kilometers (RPK) increased by 8.2%, while Available Seat Kilometers (ASK) grew by 5.2%; |

| · | Net Revenue

expanded 16.4% to R$4.7 billion. Ancillary Revenues, primarily Smiles and Gollog, increased 65.1%, to R$412.6 million; |

| · | Load factor

was 83.7%, an increase of 2.4 p.p. Domestic load factor was 83.8%, a 2.8 p.p. increase, and international load factor was 82.3%; |

| · | Operational

aircraft utilization increased by 2% to 11.3 hours per day; |

| · | The number

of passengers transported increased 16.4% to 8.1 million; |

| · | Net Revenue

per Available Seat Kilometer (RASK) grew 10.7% to 43.1 cents (R$); |

| · | Average yield

per passenger increased by 4.5%, to a third quarter record of 46.9 cents (R$); |

| · | Cost per Seat

Kilometer (CASK) for passenger operations decreased by 9.5% to 34.92 cents (R$) while CASK ex-fuel for passenger operations increased

by 5.0% to 22.28 cents (R$). CASK Fuel decreased 25.2% to 12.99 cents (R$), due to the 29.6% reduction in jet fuel prices. |

| · | EBITDA was

R$1.25 billion with a margin of 26.8%, while EBIT was R$825.1 million with a margin of 17.7%; |

| · | Net loss excluding

R$1.0 billion in negative exchange rate variation in the quarter was R$0.3 billion; |

| · | Cash flow from

operating activities reached R$0.9 billion due to higher operating volumes and working capital initiatives; |

| · | Net debt over

recurring LTM EBITDA ratio was 4.0x on 09/30/2023 (5.5x using 7x leases and 3.2x excluding the SSN due 2028), a decrease of 1.0x compared

to leverage on 06/30/2023. |

| 2 |

|

| Results Report Third Quarter, 2023 |

Management

Comments

GOL maintained its virtuous cycle in

3Q23 with a 5% growth in its supply (ASK) and an increase in unit revenues year-over-year. Combined with increased productivity and ancillary

revenues contribution, the Company achieved a record-breaking revenue for the 3Q with a sustainable EBITDA margin.

“Our third-quarter net revenue

increased 16.4% year-over-year, as GOL experienced a strong and steady domestic demand environment. Our operational fleet utilization

remained high at 11.3 hours per day, and we saw strength in our forward bookings with our quarterly sales volume reaching R$5.4 billion.

We believe that our discipline to maintain the lowest unit costs in the industry and our Team’s commitment to offering the best

experience to Customers will reinforce GOL’s already consolidated competitive position in the market,” added Celso Ferrer.

Continuous Net Revenue Growth

The 16.4% increase in net revenue was

driven by a balanced combination of increased capacity and higher yields, as well as the strengthening of leisure demand for air travel

in Brazil and a gradual recovery in the corporate market, which saw an 17.3% increase compared to the previous quarter.

During the quarter, the Company focused

on several strategic initiatives, including entering new regional markets, enhancing its digital channels to achieve a new level of 72%

in self-service capabilities, and continuous growth of its cargo (Gollog) and loyalty (Smiles) business units. These combined efforts

contributed to a 10.7% increase in RASK, with a 4.5% boost in yields and a significant 65.1% rise in ancillary revenues year-over-year.

“We continue to show quarterly

growth compared to last year, both in total revenue and in unit revenue. The trend and consistency that our numbers have shown each quarter,

with a steady recovery in demand, are indicators that we are harvesting results based on our strategy. We remain focused on delivering

the best experience to our customers through our product and our Team of Eagles”, said Carla Fonseca, Vice President of Customer

Experience, Marketing, Sales Channels and President of Smiles.

Additional Revenues Streams as Drivers

of RASK Growth

Smiles Viagens, our tourism operator

launched in 2Q23, maintained its pace of expansion during this quarter focusing on offering a unique experience for its members. With

products such as airline tickets, hotels, car rental, tickets, transfers and more than 8000 activities throughout Brazil and the world,

Smiles Viagens has been expanding its portfolio of products and partnerships, highlighting direct negotiations with hotels that already

there are more than 800 in addition to important brokers in the Brazilian and international segment.

Gollog, the cargo transportation business

unit, more than doubled its revenue year-over-year, reaching R$257 million in 3Q23. The Company added a fifth Boeing 737 freighter aircraft

to its fleet, as part of the exclusivity agreement with Mercado Livre. The cargo transportation contract with Mercado Livre is for six

cargo aircraft year end, with the possibility of further expansion to a total fleet of 12 cargo aircraft in the upcoming years.

Smiles expanded its customer base by

more than 8% year-over-year, reaching 22.1 million customers in 3Q23. This demonstrates the high value opportunity that is being captured

after the incorporation of Smiles by GOL in 2021.

“The combined revenue from Gollog

and Smiles already represent 30% of the third quarter Company’s total revenue generation and the growth rate remained high in 65.1%.

Since the integration of Smiles, synergies continue to be captured at an accelerated pace. Smiles has nearly doubled its turnover compared

to the pre-pandemic period. Now, with the activities of Smiles Viagens, we see additional revenue potential to be captured that will further

contribute to the sustained expansion of our ancillary revenues,” added Carla Fonseca.

Fleet Update

The Company has been impacted by delays and uncertainty

in the delivery schedule of new Boeing 737-MAX 8 aircraft from its manufacturer. From the total of 15 new aircraft expected to be delivered

this year, GOL added in this quarter, one new Boeing 737-MAX 8 aircraft to its fleet as well as its fifth Boeing 737-800BCF aircraft,

as part of the exclusive agreement with Mercado Livre for cargo transportation. In line with its fleet renewal plan and to recover operational

efficiency, the Company returned four Boeing 737-NG aircraft.

As of September 30, 2023, GOL had a total fleet

of 141 Boeing aircraft including 39 737-MAX, 97 737-NG and five 737-800BCF freighters.

As of September 30, 2023, GOL had 106 firm orders

for the acquisition of Boeing 737-MAX aircraft, 69 of which were for the 737-MAX 8 model and 37 for the 737-MAX 10 model.

Capacity Management and Productivity Increase

GOL maintains its focus on the optimization of

its operational capacity through the expansion of new bases with sustainable demand, particularly in regional markets. Although impacted

by the lower dilution of fixed costs due to delays in receiving new aircraft, which has caused the Company to reduce its growth for this

year, the Company’s expanded its capacity (ASKs) by approximately 5% in the third quarter while improving load factor to 83.7%,

a 2.4 p.p. year-over-year increase. CASK decreased by 8.0% while CASK for passenger operations decreased by 9.5% in comparison to 3Q22.

The operational aircraft utilization remained

high, at 11.3 hours per day, corroborating GOL’s focus on improving its productivity indicators and reducing its unit cost, to

remain the lowest-cost benchmark in the region. In the international market, the Company continued to increase its capacity (5.0% compared

to 3Q22), reaching approximately 52% of its total capacity in the third quarter of 2019.

| 3 |

|

| Results Report Third Quarter, 2023 |

Network Update

GOL expanded the total number of flights by 13%

year-over-year largely due to the reconfiguration of its network and the introduction of operations in regional markets. Cities such as

Araçatuba (São Paulo) and Uberaba (Minas Gerais) are now being served by Boeing 737 aircraft, providing connections to various

national destinations, including Rio de Janeiro, Salvador, Curitiba, and Brasília.

In the international market, the Company continues

to grow. International ASKs grew 5.0% year-over-year, reaching approximately 52% of the same period in 2019.

“These positive results observed in the

third quarter reflect the consistent and resilient management combined by a domestic market demand growing, that permitted to achieve

the best August ever according to ANAC (8.2 million passengers transported in Brazil), and GOL’s disciplined process of resuming

supply with high productivity and operational efficiency. These strong results were supported by our initiatives and continued strategic

investments in recent months,” concluded Celso Ferrer.

Liability Management Initiatives

This quarter, the Company completed the refinancing

of debentures of GOL Linhas Aéreas S.A. (GLA), resulting in the amortization of approximately R$100 million in September 2023,

with the R$900 million balance to be repaid over 30 monthly installments starting January 2024. This extends the maturity date of the

debentures until June 2026. This liability management initiative enhances GOL’s ability to maintain its financial discipline and

extend the debt profile.

As of September 29, 2023, the Company concluded

the conversion of US$1.2 billion in Senior Secured Notes (SSNs) with maturity date in 2028 issued by GOL Finance and held by Abra Global

Finance, into US$1.2 billion in Exchangeable Senior Secured Notes (ESSNs) issued by GOL Equity Finance and maturing in 2028. ESSNs are

an instrument convertible into shares and in this context, a total of 992 million warrants were issued by the Company, which can be subject

to a future conversion into shares at the exercise price of R$5.82 per share, which would result in the reduction of R$5.9 billion in

GOL's total debt.

Due to this conversion, and in compliance with

international accounting standards (IFRS 9 – financial instruments), which requires that debt instruments with convertibility characteristics

have design segregation between the fair value of the debt financial liability and the instrument derivative option to convert bonds into

shares, a total of R$3.4 billion was calculated relating to the fair value portion of the option and recognized as a long-term liability

for derivative operations with a counterpart in equity.

“Strengthening our balance sheet continues

to be a top priority. Our fundamentals continue to improve as the reduction in our leverage from 9.5x at the end of last year to 4.0x

on September 30, 2023 highlights. We remain focused on the execution of several initiatives to strengthen our balance sheet to sustain

the Company’s operational performance”, said Mario Liao, CFO.

GOL and Air France-KLM Commercial

Agreement

In October, the company renewed its exclusive

commercial agreement with AirFrance-KLM for another ten years, including certain commercial conditions that bring value to GOL and AFKL.

The renewal of the commercial agreement will provide better connectivity to more than 125 destinations covered in Europe and Brazil. Customers

will benefit from an optimized network between Europe and Brazil, spanning over 80 European destinations, 45 destinations in Brazil, and

in the future, new destinations across Latin America. The agreement includes expanded code-sharing, enhanced joint sales activities, and

more benefits for customers via Air France-KLM’s Flying Blue and GOL’s SMILES frequent flyer programs and includes an expansion

of the existing maintenance support by Air France Industries KLM Engineering & Maintenance (AFIKLME&M) to GOL’s CFM56 and

LEAP engines.

ESG Developments

The Company has concluded and published its Stakeholder

Relationship Policy to further advance its ESG strategies, and open space for the creation of initiatives and projects aimed at all GOL’s

Stakeholders.

In September, the Company launched the Green

Aircraft initiative in partnership with “Eu Reciclo” to further promote and maintain active its voluntary carbon compensation

strategy via the “#MeuVooCompensa” program (joint project with MOSS Earth). The Green Aircraft initiative aims to recycle

twice the amount of waste generated from in-flight service and provides for the compensation of 1,000 tons of material in one year.

| 4 |

|

| Results Report Third Quarter, 2023 |

Operational and Financial Indicators

| Traffic Data - GOL (in millions) |

3Q23 |

3Q22 |

% Var. |

| RPK GOL – Total |

9,050 |

8,361 |

8.2% |

| RPK GOL – Domestic |

8,225 |

7,555 |

8.9% |

| RPK GOL – Foreign Market |

825 |

806 |

2.4% |

| ASK GOL – Total |

10,813 |

10,283 |

5.2% |

| ASK GOL – Domestic |

9,810 |

9,327 |

5.2% |

| ASK GOL – Foreign Market |

1,003 |

956 |

4.9% |

| GOL Load Factor – Total |

83.7% |

81.3% |

2.4 p.p. |

| GOL Load Factor – Domestic |

83.8% |

81.0% |

2.8 p.p. |

| GOL Load Factor – Foreign Market |

82.3% |

84.3% |

-2.0 p.p. |

| Operating Data |

3Q23 |

3Q22 |

% Var. |

| Revenue Passengers - Pax on Board ('000) |

8,082 |

6,945 |

16.4% |

| Aircraft Utilization (Block Hours/Day) |

11.3 |

11.1 |

1.8% |

| Departures |

57,284 |

50,636 |

13.1% |

| Total Seats ('000) |

9,997 |

8,938 |

11.8% |

| Average Stage Length (km) |

1,064 |

1,150 |

(7.5%) |

| Fuel Consumption in the Period (mm liters) |

309 |

278 |

11.2% |

| Full-Time Employees (at period end) |

13,919 |

13,751 |

1.2% |

| Average Operating Fleet(4) |

108 |

102 |

5.9% |

| On-Time Departures |

87.3% |

92.7% |

(5.4 p.p.) |

| Flight Completion |

97.6% |

99.6% |

(2.0 p.p.) |

| Lost Baggage (per 1,000 pax) |

2.54 |

2.21 |

14.9% |

| Financial Data |

3Q23 |

3Q22 |

% Var. |

| Net YIELD (R$ cents) |

46.99 |

44.97 |

4.5% |

| Net PRASK (R$ cents) |

39.33 |

36.56 |

7.6% |

| Net RASK (R$ cents) |

43.15 |

38.99 |

10.7% |

| CASK (R$ cents) |

35.52 |

38.60 |

(8.0%) |

| CASK Ex-Fuel (R$ cents) |

22.53 |

21.24 |

6.1% |

| CASK for passenger operations (R$ cents) (5) |

34.92 |

38.60 |

(9.5%) |

| CASK ex-fuel for passenger operations (R$ cents) (5) |

22.28 |

21.24 |

4.9% |

| Breakeven Load Factor Ex-Non Recurring Expenses |

68.9% |

76.0% |

(7.1 p.p.) |

| Average Exchange Rate(1) |

4.88 |

5.25 |

(7.0%) |

| End of Period Exchange Rate(1) |

5.01 |

5.41 |

(7.4%) |

| WTI (Average per Barrel, US$)(2) |

82.26 |

91.56 |

(10.2%) |

| Fuel Price per Liter (R$)(3) |

4.62 |

6.56 |

(29.6%) |

| Gulf Coast Jet Fuel Cost (average per liter, US$)(2) |

0.58 |

0.64 |

(9.4%) |

(1) Source: Central Bank of Brazil; (2)

Source: Bloomberg; (3) Fuel expenses excluding hedge results and PIS and COFINS/liter s credits consumed; (4) Medium fleet excluding sub-leased

aircraft and MRO aircraft. Some figures may differ from quarterly information - ITR due to rounding. (5) Excludes non-recurring expenses.

Domestic

Market

Demand

in the domestic market reached 8,225 million RPK, an increase of 8.9% compared to 3Q22.

Supply

in the domestic market reached 9,810 million ASK, representing an increase of 5.2% compared to 3Q22.

Load

factor was 83.8% and the Company transported approximately 7.8 million Customers in 3Q23, an increase of 16.5% compared to the same quarter

of the previous year.

International

Market

The

supply in the international market, measured in ASK, was 1,003 million and the demand (in RPK) was 825 million. During this period GOL

transported approximately 326,000 passengers in this market.

Volume of Departures

and Total Seats

In

3Q23, the company's total take-off volume was 57,284, representing an increase of 13.1% compared to 3Q22. The total number of seats made

available on the market was 9.9 million, representing an increase of 11.8% compared to the same period in 2022.

| 5 |

|

| Results Report Third Quarter, 2023 |

PRASK,

RASK, and Yield

Net

PRASK in 3Q23 was 7.6% higher compared to 3Q22, reaching 39.33 cents (R$). The Company's net RASK was 43.15 cents (R$), representing an

increase of 10.7% compared to the same period of the previous year. Net yield recorded in 3Q23 was 46.99 cents (R$), resulting in an increase

of 4.5% compared to 3Q22.

All

profitability indicators for the quarter, described above, also showed significant evolution compared to the same period in 2019, demonstrating

the Company's continued and efficient capacity management and pricing.

Income

Statement

| Income Statements in IFRS (R$ MM) |

3Q23 |

3Q22 |

% Var. |

| Net Operating Revenue |

4,665.4 |

4,009.6 |

16.4% |

| Passenger Transportation |

4,252.9 |

3,759.7 |

13.1% |

| Cargo and Others |

412.6 |

249.9 |

65.1% |

| Operating Costs and Expenses |

(3,840.4) |

(3,968.9) |

(3.2%) |

| Personnel |

(613.2) |

(535.4) |

14.5% |

| Personnel – Operations |

(419.2) |

(388.8) |

7.8% |

| Personnel – Others |

(194.0) |

(146.6) |

32.3% |

| Jet Fuel |

(1,404.6) |

(1,785.1) |

(21.3%) |

| ICMS Tax on Fuel |

(134.5) |

(176.6) |

(23.8%) |

| Fuel (ex-ICMS) |

(1,270.0) |

(1,608.6) |

(21.0%) |

| Landing Fees |

(231.0) |

(202.7) |

14.0% |

| Passenger Costs |

(190.7) |

(244.4,) |

(22.0%) |

| Services |

(300.9) |

(246.5) |

22.1% |

| Sales and Marketing |

(228.9) |

(204.2) |

12.1% |

| Maintenance, Material and Repairs |

(257.7) |

(100.4) |

156.7% |

| Depreciation and Amortization |

(425.0) |

(433.5) |

(2.0%) |

| Others |

(188.3) |

(216.6) |

(13.1%) |

| Operating Income (Expenses) (EBIT) |

825.1 |

40.7 |

NM |

| Operating Margin |

17.7% |

1.0% |

16.7 p.p. |

| Other Financial Revenues (Expenses) |

(2,080.6) |

(1,577.9) |

31.9% |

| Interest on Loans and Financing |

(826.7) |

(673.6) |

22.7% |

| Gains from Short-Term Investments |

40.3 |

61.1 |

(34.4%) |

| Exchange Rate Cash Changes |

(1,002.5) |

(738.0) |

35.8% |

| Net Income (Loss) from Derivatives |

12.1 |

(34.7) |

NM |

| Income (Expenses) from ESN and Capped Calls |

(11.2) |

6.3 |

NM |

| Other Net Revenues (Expenses) |

(292.6) |

(199.1) |

47.0% |

| Income (Loss) before Income Tax/Social Contribution |

(1,255.6) |

(1,537.2) |

(18.3%) |

| Net Margin before Taxes |

(26.9%) |

(38.3%) |

11.4 p.p. |

| Income Tax |

(44.8) |

(11.7) |

282.9% |

| Current Income Tax |

(20.3) |

(11.7) |

73.5% |

| Deferred Income Tax |

(24.5) |

- |

NM |

| Net Income (Loss) after Minority Interest |

(1,300.4) |

(1.548.9) |

(16.0%) |

| Net Margin |

(27.9%) |

(38,.6%) |

10.7 p.p. |

| Earnings (Loss) Per Share (EPS) in R$ |

(3.11) |

(3.70) |

(15.9%) |

| Weighted Average Number of Shares (Million)(3) |

418.7 |

418.7 |

- |

| Earnings (Loss) Per ADS in US$ |

(1.24) |

(1.37) |

(9.5%) |

| Weighted Average Number of ADSs (Million)(3) |

209.4 |

209.3 |

- |

| Earnings (Loss) Per Share (EPS) in R$(5) |

- |

- |

NM |

| Weighted Average Number of Shares (Million)(4) |

449.4 |

455.1 |

(1.3%) |

| Earnings (Loss) Per ADS in US$(5) |

- |

- |

NM |

| Weighted Average Number of ADSs (Million)(4) |

224.7 |

227.5 |

1.2% |

| Recurring (R$ MM) |

3Q23 |

3Q22 |

% Var. |

| Net Income (Loss) before Minority Interest |

(1,300.4) |

(1,548.9) |

(16.0%) |

| Financial Expenses |

2,080.6 |

1,577.9 |

31.9% |

| Expenses with Income Taxes |

44.8 |

11.7 |

282.9% |

| Depreciation and Amortization |

425.0 |

433.5 |

(2.0%) |

| Non-Recurring Expenses |

- |

221.0 |

NM |

| Recurring EBITDA |

1,250.1 |

695.2 |

79.8% |

| Recurring EBITDA Margin |

26.8% |

17.3% |

9.5 p.p. |

| Recurring EBIT |

825.1 |

261.7 |

NM |

| Recurring EBIT Margin |

17.7% |

6.5% |

11.2 p.p. |

| Recurring Pre-Tax Income¹ |

(241.9) |

(584.6) |

(58.6%) |

| Recurring Pre-Tax Margin¹ |

(5.2%) |

(14.6%) |

9.4 p.p. |

| Recurring Net Income |

(286.7) |

(596.2) |

(51.9%) |

| Recurring Net Income Margin |

(6.1%) |

(14.9%) |

8.8 p.p. |

| Earnings Per Share (LPA) Diluted in R$ (1) (2) (4) (5) |

- |

- |

NM |

| Earnings Per ADS Equivalent Diluted in US$ (1) (2) (4) (5) |

- |

- |

NM |

(1)

Excludes unrealized gains and losses from esn/capped calls mark-to-market and gains and losses from exchange variation on debt. (2) Excludes

net exchange and monetary variations. (3) Excludes effects of options and warrants related to ESNs and ESSNs. (4) Includes options effects

and warrants related to ESNs. (5) Not applicable. there is no forecast of dilution of injury in international accounting standards (IFRS).

Net

Revenue

Net operating revenue in the third quarter

was a record R$4.7 billion, 16.4% higher than 3Q22 revenue and 25.8% higher than 3Q19. Ancillary revenues totaled R$412.6 million, up

65.1% compared to 3Q22 and 8.8% of total net revenue in 3Q23, an increase of 2.6 p.p. compared to 3Q22.

| 6 |

|

| Results Report Third Quarter, 2023 |

Operational Expenses

CASK in 3Q23 was 35.52 cents (R$), representing

a reduction of 8.0% compared to 3Q22, mainly influenced by the fall in fuel costs. The unit cost excluding fuel and cargo aircraft operations

increased by 5.0%. The unit cost of fuel fell by 25.2%, mainly due to the reduction in the price of aviation kerosene and greater use

of the new Boeing 737-MAX aircraft in GOL's operations.

The cost indicators per ASK are described

in this section and on a comparative basis. Explanations of the variations are based on the recurring reported figures.

| Operational

Expenses (R$ MM) |

3Q23 |

3Q22 |

%

Var. |

| Personnel |

(613.2) |

(535.4) |

14.5% |

| Personnel

– Operations |

(419.2) |

(388.8) |

7.8% |

| Personnel

– Others |

(194.0) |

(146.6) |

32.3% |

| Aviation

Fuel |

(1,404.6) |

(1,785.1) |

(21.3%) |

| ICMS

Tax on Fuel |

(134.5) |

(176.6) |

(23.8%) |

| Fuel

(ex-ICMS) |

(1,270.0) |

(1,608.6) |

(21.0%) |

| Landing

Fees |

231.0) |

(202.7) |

14.0% |

| Passenger

Costs |

(190.7) |

(244.4) |

(22.0%) |

| Services |

(300.9) |

(246.5) |

22.1% |

| Sales

and Marketing |

(228.9) |

(204.2) |

12.1% |

| Maintenance.

Material and Repairs |

(257.7) |

(100.4) |

156.7% |

| Depreciation

and Amortization |

(425.0) |

(433.5) |

(2,0%) |

| Other

Expenses |

(188.3) |

(216.6) |

(13.1%) |

| Total

Operating Expenses |

(3,840.4) |

(3,968.9) |

(3.2%) |

| Operating

Expenses Ex-Fuel |

(2,435.8) |

(2,183.8) |

11.5% |

| Non-Recurring

Expenses |

- |

(221.0) |

NM |

| Operating

Expenses per ASK |

3Q23 |

3Q22 |

%

Var. |

| Personnel |

(5.67) |

(5.21) |

8.8% |

| Personnel

– Operations |

(3.88) |

(3.78) |

2.6% |

| Personnel

– Others |

(1.79) |

(1.43) |

25.2% |

| Aviation

Fuel |

(12.99) |

(17.36) |

(25.2%) |

| ICMS

Tax on Fuel |

(1.24) |

(1.72) |

(27.9%) |

| Fuel

(ex-ICMS) |

(11.75) |

(15.64) |

(24.9%) |

| Landing

Fees |

(2.14) |

(1.97) |

8.6% |

| Passenger

Costs |

(1.76) |

(2.38) |

(26.1%) |

| Services |

(2.78) |

(2.40) |

15.8% |

| Sales

and Marketing |

(2.12) |

(1.99) |

6.5% |

| Maintenance.

Material and Repairs |

(2.38) |

(0.98) |

142.9% |

| Depreciation

and Amortization |

(3.93) |

(4.22) |

(6.9%) |

| Other

Expenses |

(1.74) |

(2.11) |

(17.5%) |

| CASK

(R$ cents) |

(35.52) |

(38.60) |

(8.0%) |

| CASK

Ex-Fuel |

(22.53) |

(21.24) |

6.1% |

| CASK

for passenger operations (R$ cents) (1) |

(34.92) |

(38.60) |

(9.5%) |

| CASK

Ex-Fuel for passenger operations (R$ cents) (1) |

(22.28) |

(21.24) |

4.9% |

(1)

Excludes non-recurring expenses.

Personnel

expenses per ASK: higher by 8.8%, mainly due to the payroll annual increase of 6% and costs associated to the number of non-operating

aircraft that remains temporary as part of our fleet.

Aviation

fuel expenses per ASK: 25.2% lower, mainly due to the reduction in jet fuel price (QAV) and gains from tax incentives in regional

operations combined with greater use of the new Boeing 737-MAX aircraft in GOL's operations.

Landing and take-off fees per

ASK: 8.6% higher, mainly as a result of the 5.8% increase

in tariffs due to accumulated inflation, the 7.5% reduction in the average stage and the resumption of international flights toa higher

tariffs.

Passenger expenses per ASK:

26.1% lower, mainly due to lower expenses related to accommodation and travel expenses

resulted from flight cancellations.

Services per ASK:

15.8% an increase of 15.8% due to the cost of international IT services, mainly due

to the increase in the number of international passengers transported.

Commercial and advertising per

ASK: 6.5% lower, mainly due to greater efficiency

in contracts and optimization of direct sales channels.

Maintenance and re pair material

per ASK: an increase of 142.9%, due to higher expenses

for the return of two aircraft, higher consumption of parts and components to support the growth of the operation.

Depreciation and amortization

per ASK: 6.9% lower, mainly due to the extension of

the average useful life for depreciation of capitalized maintenance.

| 7 |

|

| Results Report Third Quarter, 2023 |

Other

expenses per ASK: 17.5% lower, mainly due to a decrease in operational

aircraft idleness.

Operating Results

Recurring EBIT recorded in 3Q23 was R$825.1

million, representing a recurring operating margin of 17.7%. On a per available seat kilometer basis, recurring EBIT reached 7.6 cents

(R$).

Recurring EBITDA recorded in 3Q23 was R$1,250.1

million, representing a recurring margin of 26.8%. Recurring EBITDA on an available seat-kilometer basis in the period was 11.5 cents

(R$).

| EBIT and EBITDA Reconciliation (R$ MM) |

3Q23 |

3Q22 |

% Var. |

| Net Income (Loss) |

(1,300.4) |

(1,548.9) |

(16.0%) |

| (-) Non Recuring Events |

- |

(221.0) |

NM |

| Recuring Net Income (Loss) |

(1,300.4) |

(1,327.9) |

(2.1%) |

| (-) Income Tax |

44.8 |

11.7 |

282.9% |

| (-) Net Financial Result |

2,080.6 |

1,577.9 |

31.9% |

| Recurring EBIT (1) |

825.1 |

261.7 |

NM |

| Recuring EBIT margin (1) |

17.7% |

6.5% |

11.2 p.p. |

| (-) Depreciation and Amortization |

425.0 |

433.5 |

(2.0%) |

| Recurring EBITDA |

1,250.1 |

695.2 |

79.8% |

| Recurring EBITDA margin |

26.8% |

17.3% |

9.5 p.p. |

| EBITDA Calculation (R$ cents/ASK) |

3Q23 |

3Q22 |

% Var. |

| Net Revenue |

43.15 |

38.99 |

10.5% |

| Recurring Operating Costs and Expenses |

(35.52) |

(38.60) |

(8.0%) |

| Recurring EBIT (1) |

7.63 |

0.39 |

NM |

| Depreciation and Amortization |

(3.93) |

(3.90) |

(0.9%) |

| Recurring EBITDA (1) |

11.56 |

6.44 |

79.3% |

(1) Excludes non-recurring results.

*According to CVM Instruction No. 527. the Company presents the reconciliation of EBIT and EB/TOA. according to which: EBIT = net income

(loss) (+) taxes on income and social contributions (+) net financial result; and EB/TOA = net income (loss) (+) taxes on income and social

contributions (+) net financial result (+) depreciation and amortization. Some figures in the report may differ from quarterly information

- ITR due to rounding.

Results of Hedge

Operations

The Company uses hedge accounting

for the purpose of accounting for some of its derivative instruments. In 3Q23, GOL recognized a loss of R$12.1 million in its hedging

operations in the Company's financial results.

Fuel: GOL recognized net

losses of R$13.1 million in its hedging operations to mitigate the Company's exposure to changes in the price of aviation fuel on the

Company's financial results.

Interest:

Transactions to protect the cash flow of future leasing contracts, whose installments are exposed to floating rate volatility and the

loan interest rate swap transaction resulted in losses of R$1.7 million in financial results in 3Q23.

Exchange

rate: The Company recognized losses of R$0.7 million on foreign exchange hedging derivative transactions during

3Q23.

Income

Tax

In

3Q23, the expense of Income Tax and Contributions was R$44.8 million, an increase compared to 3Q22 due to the decrease in taxable income

in the period.

Net

Income and Earnings per Share

In 3Q23, the Company recorded a net loss

of R$1.3 billion (a net loss of R$0.3 million excluding gains from net exchange variation of R$1.0 billion and a variation of R$11.2 million

related to the results of Exchangeable Notes and Capped Calls). This result represents a net loss per share of R$3.11 and a net loss ADS

of US$1.27.

| 8 |

|

| Results Report Third Quarter, 2023 |

Net Income (Expenses) (R$ MM) |

3Q23 |

3Q22 |

% Var. |

| Net Income (Loss) |

(1,300.4) |

(1,548.9) |

(16.0%) |

| (-) Income (Expenses) from ESN and Capped Calls |

11.2 |

(6.3) |

NM |

| (-) Exchange Rate Changes. Net(1) |

1,002.5 |

738.0 |

35.8% |

| Net Income (Loss) for the Period(4) |

(286.7) |

(563.4) |

(49.1%) |

| Earnings Per Share and Per ADS |

3Q23 |

3Q22 |

% Var. |

| Weighted Average Number of Shares(2) |

418.7 |

418.7 |

0.0% |

| Weighted Average Number of ADS(3) |

209.4 |

209.3 |

0.0% |

| Basic Net Earnings (Loss) per Share in R$ |

(3.11) |

(3.70) |

(15.9%) |

| Basic Net Earnings (Loss) per ADS in US$ |

(1.27) |

(1.41) |

(9.9%) |

| Diluted Earnings per Share and per ADS |

3Q23 |

3Q22 |

% Var. |

| Diluted Weighted Average Number of Shares(2) |

449.4 |

455.1 |

(1.3%) |

| Diluted Weighted Average Number of ADS(3) |

224.7 |

227.5 |

(1.2%) |

| Diluted Earnings (Loss) per Share in R$(5) |

- |

- |

NM |

| Diluted Earnings (Loss) per ADS in US$(5) |

- |

- |

NM |

(1) The difference between the amount presented and

the amount disclosed in the income statement of the quarterly information – ITR for the period ended December 31. 2021. is allocated

to the results of ESN and capped calls. (2) Considers the ratio of 35 common shares per preferred share. The number of diluted shares

used for the calculation was 456.2 million in 4Q22. including the additional effects of converting ESNs into shares. (3) Considers the

ratio of 2 preferred shares per ADS. (4) Earnings per share excludes the results of (i) net exchange variation; (ii) Exchangeable and

capped calls; and (iii) non-recurring related. (5) Not applicable. there is no forecast of dilution of injury in international accounting

standards (IFRS).

Cash

flow

Operating activities generated cash flow of

approximately R$0.9 billion in 3Q23 due to working capital initiatives and the higher volume during the quarter.

Investment activities consumed approximately

R$0.2 billion net in the quarter, mainly due to investments in parts inventory and engine maintenance to increase the operating fleet.

Financing activities in 3Q23 consumed R$0.3 billion,

mainly impacted by R$0.2 billion in loan payments, R$0.5 billion in lease payments and R$0.5 billion in loan funding.

| Summarized Consolidated Cash Flow (R$ MM) |

3Q23 |

3Q22 |

% Var. |

| Net Income (Loss) for the Period |

(1,300,4) |

(1,548.9) |

(16.0%) |

| Non-Cash Items Adjustment |

1,467,4 |

1,935.6 |

(24.2%) |

| Net Profit After Non-Cash Items Adjustment |

167.0 |

386.7 |

(56.8%) |

| Net Cash for Operating Activities |

976.7 |

327.2 |

198.5% |

| Net Cash Used in Investing Activities |

(205.0) |

(233.5) |

(12.2%) |

| Net Cash Flow |

771.7 |

93.8 |

NM |

| Net Cash Used in Financing Activities |

(288.1) |

(467.2) |

(38.3%) |

| Net Increase (Decrease) in Liquidity(1) |

483.6 |

(373.4) |

NM |

| Total Liquidity at the Beginning of the Period |

1,554.8 |

1,912.4 |

(18.7%) |

| Trade Receivables at the Beginning of the Period |

841.2 |

1,091.9 |

(23.0%) |

| Trade Receivables at the End of the Period |

1,044.7 |

951.3 |

9.8% |

| Total Liquidity at the End of the Period |

2,038.4 |

1,539.0 |

32.4% |

| (1) | Includes cash balances, cash

equivalents, financial investments. trade receivables and securities and amounts receivable. |

| 9 |

|

| Results Report Third Quarter, 2023 |

Liquidity

and Indebtedness

In 3Q23, the Company's total liquidity

(cash and cash equivalents, financial investments, deposits and accounts receivable) was R$4.7 billion, an increase of 27.7% compared

to the same period a year earlier.

In September 2023, GOL recorded a total

of R$10.4 billion in Loans and Financing, of which R$1.2 billion is recorded in current liabilities. The total lease liability recorded

is R$9.8 billion.

On September 29, 2023, the conversion

of US$1.2 billion of Senior Secured Notes 2028 into Exchangeable Senior Secured Notes 2028 (ESSN) was completed. In accordance with current

accounting standards (IFRS 9 – financial instruments), at the time of issuing the ESSN, the Company assessed the fair value of this

new instrument, segregating the component of the conversion option into shares as Obligations with Derivative Operations in the amount

of US$680 million (or R$3.4 billion). The option to convert into shares will have its value updated to the market mark at each quarter

close during the term of the debt while the total balance of the debt that will be settled at maturity, or upon conversion into shares,

remains at the principal value of R$5.91 billion ($1.18 billion).

Total gross debt recorded in 3Q23 was

R$20.2 billion (R$26.8 billion assuming the LTMx7 payment methodology), representing a decrease of 13.8% and 7.7% compared to 3Q22 and

2Q23, respectively. The ratio of adjusted net debt to EBITDA LTM was 4.0x on 09/30/23 (5.5x in 7x leases). The average maturity of the

Company's debt, excluding aircraft leases and perpetual bonds, was 3.4 years. The average rate on debt in Reais was 17.8% and on obligations

in US Dollars, excluding aircraft leases and perpetual bonds, was 13.1%.

| Liquidity (R$ MM) |

3Q23 |

3Q22 |

% Var. |

| Cash. Short-Term Investments and Restricted Cash |

993.7 |

587.7 |

69.1% |

| Trade Receivables |

1,044.7 |

951.3 |

9.8% |

| Deposits |

2,690.8 |

2,168.1 |

24.1% |

| Total Liquidity |

4,729.2 |

3,707.1 |

27.6% |

| Total Liquidity as a % of LTM Net Revenue |

25.6% |

27.7% |

(2.1 p.p.) |

| Debt (R$ MM) |

3Q23 |

3Q22 |

% Var. |

| Bank Loans |

55.9 |

128.7 |

(56.6%) |

| Aircraft and Engines Financing and Maintenance |

160.3 |

431.2 |

(62.8%) |

| Leases (annual lease IFRS-16) |

9,808.0 |

12,081.0 |

(18.8%) |

| Bonds |

9,306.6 |

8,107.6 |

14.8% |

| Exchangeable Notes |

188.1 |

1,873.1 |

(90.0%) |

| Perpetual Notes |

708.5 |

849.3 |

(16.6%) |

| Total Loans and Financing |

20,227.4 |

23,470.8 |

(13.8%) |

| Financial Short-Term Debt (IFRS-16) |

1,152.1 |

869.4 |

32.5% |

| Financial Long-Term Debt (IFRS-16) |

9,267.3 |

10,520.5 |

(11.9%) |

| Long-Term Obligations with Derivatives |

3,380.6 |

- |

NM |

| Debt and Leverage (R$ MM) (Unaudited) |

3Q23 |

3Q22 |

% Var. |

| Gross Debt Ex-Perpetual Notes (R$ MM) |

19,518.9 |

22,621.6 |

(13.7%) |

| Total Cash (R$ MM) |

993.7 |

587.7 |

69.1% |

| Adjusted Net Debt (R$ MM) |

18,525.2 |

22,033.9 |

(15.9%) |

| % of Gross Debt in Foreign Currency |

46.8% |

43.2% |

3.6 p.p. |

| % of Short-Term Debt |

11.1% |

7.6% |

3.5 p.p. |

| % of Long-Term Debt |

88.9% |

92.4% |

(3.5 p.p.) |

| Total Loans and Financing |

20,227.4 |

23,470.8 |

(13.8%) |

|

- Perpetual Notes

|

708.5 |

849.3 |

(16.6%) |

|

- Total Cash

|

993.7 |

587.7 |

69.1% |

|

= Net Debt (Ex-Perpetual Notes) |

18,525.2 |

22,033.9 |

(15.9%) |

| Adjusted EBITDA LTM(2) |

4,670.2 |

2,695.8 |

73.2% |

| Net Debt / EBITDA LTM(2) |

4.0x |

8.2x |

(4.2x) |

|

Gross Debt / EBITDA LTM(2)

|

4.2x |

8.4x |

(4.2x) |

| Adjusted Net Debt / EBITDA LTM(1) |

5.5x |

9.3x |

(3.7x) |

|

Adjusted Gross Debt / EBITDA LTM(1) |

5.7x |

9.5x |

(3.7x) |

(1)

Debt and leverage consider the accounting Loans and Financing balance in the balance sheet andnot considers Derivative Obligations. The

ESSN2028 considers the fair value of the debt instrument, as recorded under Loans and Financing; (2) Excluding non-recurring expenses;

(3) Excluding perpetual notes and considering aircraft leases x 7 times.

| 10 |

|

| Results Report Third Quarter, 2023 |

Financial

Debt Amortization Schedule (in billions)1

| 1- | Considers the financial obligations of each debt, not the accounting value of the debt. ESN 2024

and ESSN 2028 assumes no conversion into equity |

| 2- | Excluding perpetual bonds |

Fleet

At the end of 3Q23, GOL's total fleet was 141

Boeing 737 aircraft, of which 97 were NGs, 39 were MAXs, and 5 were Cargo NGs. The Company's fleet is 100% composed of medium-sized aircraft

(narrowbodies), with 97% financed via operating leases and 3% financed via finance leases.

| Total Fleet at End of Period |

3Q23 |

3Q22 |

Var. |

2Q23 |

Var. |

| Boeing 737 |

141 |

145 |

-4 |

143 |

-2 |

| 737-700 NG |

19 |

21 |

-2 |

19 |

0 |

| 737-800 NG |

78 |

87 |

-9 |

82 |

-4 |

| 737-800 NG Freighters |

5 |

0 |

5 |

4 |

1 |

| 737-MAX 8 |

39 |

37 |

2 |

38 |

1 |

As of September 30, 2023, GOL had 106 firm orders for the acquisition of Boeing 737-MAX aircraft, 69 of which were for the 737-MAX 8 model

and 37 for the 737-MAX 10 model. Until the end of this quarter, the Company’s returned seven 737NG aircraft.

| 11 |

|

| Results Report Third Quarter, 2023 |

Outlook

GOL updates its financial projections

for 2023 to reflect the results achieved in the nine-months of the year, and the new level of expected jet fuel prices and capacity adjustments.

To assist investor and analysts in understanding how GOL approaches its short to medium term planning, the Company shares the following

indicators:

| Financial Outlook (Consolidated. IFRS) |

2023E

Previous |

2023E

Updated |

| Total operational fleet (average) |

114 – 118 |

110-114 |

| ASKs, System (% change) |

10 - 15% |

10 - 15% |

| Seats, System (% change) |

15 - 20% |

10 - 15% |

| Departures, System (% change) |

15 - 20% |

–5-10% |

| Average load factor (%) |

~81% |

~82% |

| Net revenues (R$bn) |

~19.3 |

~19.0 |

| Non-fuel CASK2 (US$ cents) |

~3.8 |

~4.1 |

| Fuel price (R$/liter) |

~5.1 |

~5.1 |

| EBITDA margin² (%) |

~25% |

~24% |

| EBIT margin² (%) |

~15% |

~14% |

| Net financial expense3 (R$bn) |

~2.1 |

~2.2 |

| Pre-tax margin3 (%) |

~4% |

~3% |

| Effective income tax rate (%) |

~24% |

~24% |

| Capex, net4 (R$mm) |

~600 |

~600 |

| Aircraft Acquisitions (R$mm) |

~500 |

~100 |

| Aircraft Debt (7x Annual Aircraft Rent) (US$bn) |

~3.5 |

~3.1 |

| Financial Debt (US$bn) |

~2.7 |

~2.7 |

| Net Debt5 / EBITDA2 (x) |

~5x |

~4.0x |

| Fully-diluted shares out.6 (mm) |

~435 |

~435 |

| EPS, fully diluted (R$)3 |

~0.3 |

~0.0 |

| Fully-diluted ADS out.6 (mm) |

~217.5 |

~217.5 |

| EPADS, fully diluted (US$)3 |

~0.2 |

~0.0 |

(1) Cargo. loyalty. buy-on-board

and other ancillary revenues; (2) Recurring operating results. excluding cargo aircraft; (3) Excluding currency gains and losses and Unrealized

losses on Exchangeable Senior Notes; (4) Capex. net is calculated as gross capex (capitalized aircraft maintenance) less financed capex

(credit facilities to finance assets and capitalized maintenance costs) ; (5) under IFRS16 and excluding perpetual bonds. Considers cash,

cash equivalents, short term investments and restricted cash. Does not consider accounts receivables; and (6) Includes stock option exercises

that may be issued from the stock option program and related to Exchangeable Senior Notes.

| 12 |

|

| Results Report Third Quarter, 2023 |

ESG Review

The company recently launched its Stakeholder

Relations Policy, advancing ESG strategies by creating guidelines to engage all Stakeholders, including Shareholders, communities, Employees

and Customers. In September, as part of its efforts to reduce its environmental footprint and promote voluntary carbon offsetting, the

Company introduced the Green Aircraft initiative in partnership with MOSS Earth and Eu Reciclo. This ambitious program aims to recycle

twice the amount of waste generated from in-flight service and offset 1,000 tons of material in one year, demonstrating the Company’s

commitment to sustainability and social responsibility.

Environment |

3Q23 |

2022 |

2021 |

2020 |

| Fuel |

|

|

|

|

| Total

Fuel Consumed (GJ X 1.000) |

10,778 |

37,630 |

26,188 |

25,232 |

| %

Renewable Fuel |

0 |

0 |

0 |

0 |

| Total

Fuel Consumed (Liters X 1.000 / ASK) |

28,1 |

27,8 |

27,7 |

28,8 |

| Scope

1 Gross Global Emissions |

|

|

|

|

| Greenhouse

gas (GHG) emissions (tons CO2) |

784,424 |

2,737,745 |

1,905,556 |

1,774,332 |

| Greenhouse

gas (GHG)/Emissions/Flight Hour (TONS CO2) |

8,3 |

8,0 |

8,5 |

9,2 |

| Greenhouse

gas (GHC) Compensated greenhouse gas (GHG) emissions (TONNES CO2) |

795 |

10,281 |

71 |

0 |

| Fleet |

|

|

|

|

| Fleet

Average Age |

10.8 |

10.4 |

10.4 |

10.7 |

| Social |

|

|

|

|

| Labor

Relations |

|

|

|

|

| Gender

of Employees (% Male/Female) |

56/44 |

56/44 |

56/44 |

56/44 |

| Age:

Under 30 Years (%) |

22 |

20 |

24 |

26 |

| Between

30 and 50 Years (%) |

66 |

68 |

65 |

63 |

| Over

50 Years (%) |

13 |

12 |

11 |

11 |

| Active

Workforce Covered by Collective Bargaining Agreements (%) |

100 |

100 |

100 |

100 |

| Number

and Duration of Strikes and Blocks (# Days) |

0 |

0 |

0 |

0 |

| Customer

and Company Behavior |

|

|

|

|

| Punctuality

(%) |

87.3 |

88.9 |

92.8 |

93.2 |

| Regularity

(%) |

97.6 |

99.2 |

99.0 |

97.9 |

| Loss

of Baggage (Per 1.000 Pax) |

2.54 |

2.37 |

2.06 |

2.10 |

| Safety |

|

|

|

|

| Number

of Fatalities |

0 |

0 |

0 |

0 |

| Number

of Government Surveillance and Security Actions |

0 |

0 |

0 |

0 |

| Governance |

|

|

|

|

| Administration |

|

|

|

|

| Independent

Directors (%) |

55 |

55 |

55 |

55 |

| Participation

of Women in Leadership Positions (%) |

35 |

35 |

35 |

35 |

| Committees

and Policies |

|

|

|

|

| Number

of Committees: All with Independent Members Included |

5 |

5 |

5 |

5 |

| Compliance

Policy (Available on the Company's IR Site) |

ü

|

ü

|

ü

|

ü

|

| Disclosure

of Information and Securities Trading Policy (Available on the Company's RI Website) |

ü

|

ü

|

ü

|

ü

|

| Shareholders'

Meetings |

|

|

|

|

| Representation

in the Voting Capital of the General Meetings (%) |

100 |

100 |

100 |

100 |

| 13 |

|

| Results Report Third Quarter, 2023 |

Consolidated

Income Statement

| Income Statement (R$ MM) |

3Q23 |

3Q22 |

% Var. |

| Net Operating Revenue |

4,665.4 |

4,009.6 |

16.3% |

| Passenger Transportation |

4,252.9 |

3,759.7 |

13.1% |

| Cargo and Others |

412.6 |

249.9 |

65.2% |

| Operating Costs and Expenses |

(3,840.4) |

(3,968.9) |

-3.3% |

| Personnel |

(613.2) |

(535.4) |

14.6% |

| Aviation Fuel |

(1,404.6) |

(1,785.1) |

-21.3% |

| Landing Fees |

(231.0) |

(202.7) |

13.8% |

| Passenger Costs |

(190.7) |

(244.4) |

-21.7% |

| Services |

(300.9) |

(246.5) |

22.4% |

| Sales and Marketing |

(228.9) |

(204.2) |

12.3% |

| Maintenance. Material and Repairs |

(257.7) |

(100.4) |

158.0% |

| Depreciation and Amortization |

(425.0) |

(400.7) |

6.0% |

| Others |

(188.3) |

(216.6) |

-13.4% |

| Equity Pickup |

- |

- |

NM |

| Operating Profit |

825.1 |

40.7 |

NM |

| Net Financial Result |

(2,080.6) |

(1,577.9) |

31.9% |

| Income (Loss) Before Income Taxes |

(1,255.6) |

(1,537.2) |

(18.3%) |

| Current Income Tax/Social Contribution |

(20.3) |

(11.7) |

66.7% |

| Deferred Income Tax/Social Contribution |

(24.5) |

- |

NM |

| Net Income (Loss) |

(1,300.4) |

(1,548.9) |

(16.1%) |

| Earnings (Loss) Per Share (EPS) in R$ |

(3.1) |

(3.7) |

(16.1%) |

| Earnings (Loss) Per ADS in US$ |

(1.2) |

(1.4) |

(9.4%) |

| Number of Shares at the End of the Period (in Millions) |

418.7 |

418.7 |

0,0% |

| 14 |

|

| Results Report Third Quarter, 2023 |

Consolidated

Balance Sheets

| Consolidated Balance Sheets (R$000) |

3Q23 |

3Q22 |

% Var. |

| ASSETS |

17,191,382 |

16,501,734 |

4.2% |

| Current |

3,539,095 |

3,087,436 |

14.6% |

| Cash and Cash Equivalents |

523,141 |

149,173 |

250.7% |

| Investments |

381,788 |

345,313 |

10.6% |

| Restrict Cash |

- |

- |

NM |

| Trade Receivables |

1044.73 3 |

951,337 |

9.8% |

| Inventories |

438,958 |

419,739 |

4.6% |

| Deposits |

277,569 |

394,305 |

(29.6%) |

| Advance to Suppliers and Third Parties |

387,387 |

382,232 |

1.3% |

| Taxes to Recover |

231,158 |

226,907 |

1.9% |

| Rights from Derivative Transactions |

16,418 |

22,981 |

(28.6%) |

| Other Credits |

237,943 |

195,449 |

21.7% |

| Non-current |

13,652,287 |

13,414,298 |

1.8% |

| Investments |

- |

- |

NM |

| Restricted Cash |

88,784 |

93,171 |

(4.7%) |

| Deposits |

2,413,217 |

1,773,817 |

36.0% |

| Advance to Suppliers and Third Parties |

100,269 |

69,785 |

43.7% |

| Taxes to Recover |

14,548 |

21,717 |

(33.0%) |

| Deferred Taxes |

76,169 |

71,573 |

6.4% |

| Other Credits |

22,164 |

20,700 |

7.1% |

| Rights from Derivative Transactions |

- |

21,845 |

NM |

| Investments |

- |

- |

NM |

| Property. Plant & Equipment |

9,036,277 |

9,480,501 |

(4.7%) |

| intangible Assets |

1,900,859 |

1,861,189 |

2.1% |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

17,191,382 |

16,501,734 |

4.2% |

| Current |

13,996,144 |

13,683,445 |

2.3% |

| Loans and Financing |

1,152,079 |

869,397 |

32.5% |

| Leases to Pay |

1,802,747 |

2,252,976 |

(20.0%) |

| Suppliers |

2,118,909 |

1,980,367 |

7.0% |

| Suppliers - Drawn risk |

40,253 |

29,941 |

34.4% |

| Labor Obligations |

670,415 |

514,389 |

30.3% |

| Taxes and Contributions to Collect |

185,813 |

245,423 |

(24.3%) |

| Airport Fees |

1,553,144 |

1,115,409 |

39.2% |

| Advance Ticket Sales |

3,637,213 |

3,715,259 |

(2.1%) |

| Frequent-Flyer Program |

1,591,674 |

1,534,839 |

3.7% |

| Advances from Ticket Sales |

373,511 |

133,744 |

179.3% |

| Provisions |

538,291 |

925,489 |

(41.8%) |

| Liabilities with Derivative Transactions |

- |

482 |

NM |

| Other Liabilities |

332,095 |

365,730 |

(9.2%) |

| Non-current |

25,224,242 |

24,541,732 |

2.8% |

| Loans and Financing |

9,267,296 |

10,520,485 |

(11.9%) |

| Leases to Pay |

8,005,255 |

9,827,989 |

(18.5%) |

| Suppliers |

112,204 |

54,154 |

107.2% |

| Labor Obligations |

532,095 |

248,993 |

113.7% |

| Taxes and Contributions to Collect |

359,949 |

175,285 |

105.4% |

| Airport Fees |

161,038 |

238,605 |

(32.5%) |

| Frequent-Flyer Program |

172,387 |

321,145 |

(46.3%) |

| Lp Provisions |

2,891,506 |

2,736,343 |

5.7% |

| Deferred Taxes |

40,193 |

14,046 |

186.2% |

| Other Liabilities |

3,682,319 |

404,687 |

NM |

| Shareholders' Equity |

(22,029,004) |

(21,723,443) |

1.4% |

| Share Capital |

4,040,661 |

4,040,397 |

0.0% |

| Shares to Issue |

- |

- |

NM |

| Treasury Shares |

(17,534) |

(38,911) |

(54.9%) |

| Capital Reserve |

441,472 |

1,165,672 |

(62.1%) |

| Equity Valuation Adjustments |

(600,669) |

(891,310) |

(32.6%) |

| Share-Based Compensation |

- |

- |

NM |

| Gains on Change in Investment |

(25,892,934) |

(25,999,291) |

(0.4%) |

| Non-Controlling Shareholders |

- |

- |

NM |

| 15 |

|

| Results Report Third Quarter, 2023 |

Consolidated

Cash Flow

| Consolidated Cash Flow (R$000) |

3Q23 |

3Q22 |

% Var. |

| Net Income (Loss) for the Period |

(1,300,367) |

(1,548,869) |

(16.0%) |

| Depreciation - Aircraft Right of Use |

228,339 |

279,357 |

(18.3%) |

| Depreciation and Amortization - Others |

196,656 |

154,158 |

27.6% |

| Provision for Doubtful Accounts |

(471) |

178 |

NM |

| Provisions for Inventory Obsolescence |

142 |

149 |

(4.7%) |

| Provision (Reversal) for Lower Deposits |

- |

- |

NM |

| Provision for Loss on Advances from Suppliers |

- |

(938) |

NM |

| Provision for Profit Sharing |

- |

- |

NM |

| Adjustment to Present Value of Assets and Liabilities |

44,575 |

58,669 |

(24.0%) |

| Deferred Taxes |

24,506 |

7,972 |

207.4% |

| Equity Pickup |

- |

- |

NM |

| Write-off of Property. Plant & Equipment and Intangible Assets |

48,296 |

38,886 |

24.2% |

| Sale-Leaseback |

(43,236) |

(77,562) |

(44.3%) |

| Amendment to Lease Agreements |

(109,859) |

- |

NM |

| Constitution (Reversal) of Provision |

177,617 |

58,429 |

204.0% |

| Actuarial Losses from Post-Employment Benefits |

- |

- |

NM |

| Exchange Rate and Cash Changes. Net |

(67,481) |

731,639 |

NM |

| Interest on Loans and Leases and Amortization of Costs. Premiums and Goodwill |

785,493 |

616,940 |

27.3% |

| Income (Expenses) from Derivatives Recognized in Income (Expenses) |

183,082 |

- |

- |

| Provision for Labor Obligations |

1,985 |

65,249 |

(97.0%) |

| Share-Based Compensation |

- |

- |

NM |

| Other Provisions |

3,268 |

3,721 |

(12.2%) |

| Actuarial Losses from Post-Employment Benefits |

(5,560) |

(1,283) |

333.4% |

| Adjusted Net Income (Loss) |

166,985 |

386,695 |

-56.8% |

| Changes in Operating Assets and Liabilities: |

|

|

|

| Investments |

901,118 |

(36,552) |

NM |

| Trade Receivables |

(200,130) |

139,435 |

NM |

| Inventories |

(47,066) |

(51,170) |

(8.0%) |

| Deposits |

(95,461) |

(49,688) |

92.1% |

| Advance to Suppliers and Third Parties |

(59,602) |

163,840 |

NM |

| Taxes to Recover |

(84,745) |

(7,004) |

NM |

| Variable Leases |

(3,284) |

2,107 |

NM |

| Suppliers |

(173,889) |

(22,212) |

NM |

| Suppliers - Forfaiting |

20,298 |

(59) |

NM |

| Advance Ticket Sales |

401,002 |

63,967 |

NM |

| Frequent-Flyer Program |

(12,162) |

194,739 |

NM |

| Advances from Ticket Sales |

(90,064) |

91,177 |

NM |

| Labor Obligations |

160,783 |

107,200 |

50.0% |

| Airport Fees |

161,372 |

1,681 |

NM |

| Taxes to Collect |

78,447 |

93,974 |

(16.5%) |

| Liabilities with Derivative Transactions |

(343) |

(12,986) |

(97.4%) |

| Provisions |

(195,374) |

(163,477) |

19.5% |

| Other Credits (Liabilities) |

(65,904) |

(174,484) |

(62.2%) |

| Interest Paid |

(161,874) |

(261,682) |

(38.1%) |

| Income Tax Paid |

- |

(113) |

NM |

| Net Cash in Operational Activities |

700,107 |

465,388 |

50.4% |

| Loans Receivable from Related Parties |

- |

- |

NM |

| Financial Investments in Subsidiary |

- |

- |

NM |

| Advance for Future Capital Increase in a Subsidiary |

- |

- |

NM |

| Dividends and Interest on Shareholders' Equity Received through subsidiary |

- |

- |

NM |

| Advance for Property, Plant & Equipment Acquisition, net |

- |

(49,123) |

NM |

| Acquisition of Property, Plant & Equipment |

(171,055) |

(162,079) |

5.5% |

| Return of Advance for Acquisition of Property, Plant & Equipment |

- |

- |

NM |

| Sale-Leaseback Transactions Received |

- |

- |

NM |

| Acquisition of Intangible Assets |

(33,910) |

(22,253) |

52.4% |

| Net Cash Used in Investment Activities |

(204,965) |

(233,455) |

(12.2%) |

| Fundraising in Loans and Financing |

449,686 |

110,000 |

308.8% |

| Loan Payments |

(193,307) |

(102,517) |

88.6% |

| Lease Payments - Aircraft |

(535,339) |

(469,520) |

14.0% |

| Lease Payments - Others |

(9,442) |

(5,218) |

81.0% |

| Sale of Treasury Shares |

- |

37 |

NM |

|

Dividends and Interest on Shareholders'

Equity Paid to Non-Controlling

Shareholders |

- |

- |

NM |

| Acquisition of Non-Controlling Shareholders |

- |

- |

NM |

| Capped Call Premium (Paid) Received |

- |

- |

NM |

| Capital Increase |

264 |

1,319 |

(80.0%) |

| Shares to Issue |

- |

(1,282) |

NM |

| Net Cash from Financing Activities |

(288,138) |

(467,181) |

(38.3%) |

| Exchange Rate Change of the Cash of Subsidiaries Abroad |

(23,127) |

(9,645) |

139.8% |

| Net Decrease in Cash and Cash Equivalents |

183,878 |

(244,893) |

NM |

| Cash and Cash Equivalents at the Start of the Period |

253,118 |

394,066 |

(35.8%) |

| Cash and Cash Equivalents at the End of the Period |

436,996 |

149,173 |

192.9% |

| 16 |

|

| Results Report Third Quarter, 2023 |

Glossary

of Industry Terms

| · | AIRCRAFT LEASING: An

agreement through which a company (the lessor). acquires a resource chosen by its client (the lessee) for subsequent rental to the latter

for a determined period. |

| · | AVAILABLE SEAT KILOMETERS

(ASK): The aircraft seating capacity is multiplied by the number of kilometers flown. |

| · | BARREL OF WEST TEXAS INTERMEDIATE

(WTI): Intermediate oil from Texas. a region that refers to the name for concentrating oil exploration in the USA. WTI is used as

a reference point in oil for the US derivatives markets. |

| · | BRENT: Refers to oil

produced in the North Sea. traded on the London Stock Exchange. serving as a reference for the derivatives markets in Europe and Asia. |

| · | TOTAL CASH: Total cash.

financial investments and restricted cash in the short- and long-term. |

| · | OPERATING COST PER AVAILABLE

SEAT KILOMETER (CASK): Operating expenses divided by the total number of available seat kilometers. |

| · | OPERATING COST PER AVAILABLE

SEAT KILOMETER EX-FUEL (CASK EX-FUEL): Operating cost divided by total available seat kilometers excluding fuel expenses. |

| · | AVERAGE STAGE LENGTH:

It is the average number of kilometers flown per stage performed. |

| · | EXCHANGEABLE SENIOR NOTES

(ESN): Securities convertible into shares. |

| · | AIRCRAFT CHARTER: Flight

operated by a Company that is out of its normal or regular operation. |

| · | BLOCK HOURS: Time in

which the aircraft is in flight. plus taxi time. |

| · | LESSOR: The party renting

a property or other asset to another party. the lessee. |

| · | LONG-HAUL FLIGHTS: Long-distance

flights (in GOL’s case. flights of more than four hours). |

| · | REVENUE PASSENGERS: Total

number of passengers on board who have paid more than 25% of the full flight fare. |

| · | REVENUE PASSENGER KILOMETERS

PAID (RPK): Sum of the products of the number of paying passengers on a given flight and the length of the flight. |

| · | PDP: Credit for financing

advances for the acquisition of aircraft. |

| · | Load

Factor: Percentage of the aircraft’s capacity used in terms of seats

(calculated by dividing the RPK/ASK). |

| · | Break-Even

Load Factor: Load factor required for operating revenues to correspond to

operating expenses. |

| · | Aircraft

Utilization Rate: Average number of hours per day that the aircraft was in

operation. |

| · | Passenger

Revenue per Available Seat Kilometer (PRASK):

Total passenger revenue divided by the total available seat kilometers. |

| · | Operating

Revenue per Available Seat Kilometers (RASK): The operating revenue is divided

by the total available seat kilometers. |

| · | Sale-Leaseback:

A financial transaction whereby a resource is sold and then leased back. enabling use of the resource without owning it. |

| · | SLOT:

The right of an aircraft to take off or land at a given airport for a determined period. |

| · | Sub-Lease:

An arrangement whereby a lessor in a rent agreement leases the item rented to a fourth

party. |

| · | Freight

Load Factor (FLF):

Measure of capacity utilization (% of AFTKs used). Calculated by dividing FTK by AFTK. |

| · | Freight

Tonne Kilometers (FTK):

The demand for cargo transportation is calculated as the cargo's weight in tons multiplied by the total distance traveled. |

| · | Available

Freight Tonne Kilometer (AFTK):

Weight of the cargo in tons multiplied by the kilometers flown. |

| · | Yield

per Passenger Kilometer: The average value paid by a passenger to fly one

kilometer. |

| 17 |

|

| Results Report Third Quarter, 2023 |

Contact

E-mail: ri@voegol.com.br

Phone: +55 (11) 2128-4700

Website: www.voegol.com.br/ri

About

GOL Linhas Aéreas Inteligentes S.A.

GOL

is a leading domestic airline in Brazil and part of Abra Group. Since it was founded in 2001, the Company has the lowest unit cost in

Latin America, democratizing air transportation. The Company has alliances with American Airlines and Air France-KLM and makes available

several codeshares and interline agreements available to Customers, bringing more convenience and simple connections to any place served

by these partnerships. With the purpose of “Being the First for All,” GOL offers the best travel experience to its passengers,

including: the largest number of seats and more space between seats; the greatest platform with internet, movies and live TV; and the

best frequent-flyer program, Smiles. In cargo transportation, Gollog delivers orders to different regions in Brazil and

abroad. The Company has a team of 13,900 highly qualified aviation professionals focused on Safety. GOL’s #1 value and operates

a standardized fleet of 141 Boeing 737 aircraft. The Company's shares are traded on the NYSE (GOL) and the B3 (GOLL4). For further information,

go to www.voegol.com.br/ir.

Disclaimer

This release contains forward-looking

statements relating to the prospects of the business, estimates for operating and financial income (expenses), and those related to growth

prospects of GOL, which are, by nature, subject to significant risks and uncertainties. The estimates and forecasts in this document involve

known and unknown risks, uncertainties, contingencies and other factors, many of which are beyond GOL’s control, and which may lead

to the results, performances or events to be substantially different from those expressed or implied in these statements. The forward-looking

statements in this document are based on several assumptions related to GOL’s current and future business strategies and GOL’s

future operating environment and are not a guarantee of future performance. GOL does not issue any statement or provide any guarantee

that the results anticipated by the estimates in this document will be equivalent to those achieved by GOL. Although GOL believes that

the estimates here are reasonable, they may prove to be incorrect, and the results may be different. These are merely estimates and projections

and, as such, are based exclusively on management's expectations for GOL. Such forward-looking statements depend, substantially, on external

factors and risks presented in the disclosure documents filed by GOL, apply exclusively to the date they were issued and are, therefore,

subject to change without prior notice.

Non-Accounting

Measures

To be consistent with industry

practice. GOL discloses so-called non-GAAP financial measures. which are not recognized under IFRS or U.S. GAAP, including “Net

Debt,” “total liquidity” and "EBITDA". GOL’s Management believes that disclosure of non-GAAP measures

provides useful information to investors, financial analysts and the public in their review of its operating performance and their comparison

of its operating performance to the operating performance of other companies in the same industry and other industries. However, these

non-GAAP items do not have standardized meanings and may not be directly comparable to similarly titled items adopted by other companies.

Potential investors should not rely on information not recognized under IFRS as a substitute for the GAAP measures of earnings or liquidity

in making an investment decision.

*****

| 18 |

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: November 5, 2023

| GOL LINHAS AÉREAS INTELIGENTES S.A. |

| |

|

| |

|

| By: |

/s/ Mario Tsuwei Liao |

|

| |

Name: Mario Tsuwei Liao

Title:Chief Financial and IR Officer |

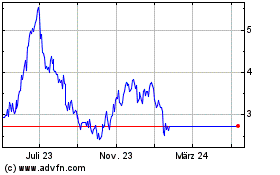

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

Von Mai 2023 bis Mai 2024