0001406587FALSE00014065872024-10-292024-10-29

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2024

______________________________

Forestar Group Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-33662 | | 26-1336998 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

2221 E. Lamar Blvd., Suite 790, Arlington, Texas 76006

(Address of principal executive offices)

(817) 769-1860

(Registrant’s telephone number, including area code)

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $1.00 per share | | FOR | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On October 29, 2024, Forestar Group Inc. issued a press release announcing its results and related information for its fourth quarter and fiscal year ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference in its entirety into this Item 2.02.

The information furnished in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document contained in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | Forestar Group Inc. |

| Date: | October 29, 2024 | | By: | /S/ JAMES D. ALLEN |

| | | | James D. Allen |

| | | | Executive Vice President and |

| | | | Chief Financial Officer |

FORESTAR REPORTS FOURTH QUARTER AND FISCAL 2024 RESULTS

ARLINGTON, Texas (Business Wire) - October 29, 2024 — Forestar Group Inc. (“Forestar”) (NYSE: FOR), a leading national residential lot developer, today reported financial results for its fourth quarter and fiscal year ended September 30, 2024.

Fiscal 2024 Fourth Quarter Highlights

All comparisons are year-over-year

•Net income increased 13% to $81.6 million or $1.60 per diluted share

•Pre-tax income increased 14% to $108.5 million, with a pre-tax profit margin of 19.7%

•Revenues of $551.4 million on 5,374 lots sold

Fiscal 2024 Highlights

All comparisons are year-over-year

•Net income increased 22% to $203.4 million or $4.00 per diluted share

•Pre-tax income increased 22% to $270.1 million, with a pre-tax profit margin of 17.9%

•Revenues increased 5% to $1.5 billion on 15,068 lots sold

•Owned and controlled 95,100 lots at September 30, 2024

•Return on equity improved 60 basis points to 13.8%

•Book value per share increased 15% to $31.47

Financial Results

Net income for the fourth quarter of fiscal 2024 increased 13% to $81.6 million, or $1.60 per diluted share, compared to $72.4 million, or $1.44 per diluted share, in the same quarter of fiscal 2023. Pre-tax income for the quarter increased 14% to $108.5 million from $95.4 million in the same quarter of fiscal 2023. Pre-tax income for the current quarter includes a gain on sale of assets of $4.5 million. Revenues totaled $551.4 million in the fourth quarter compared to $549.7 million in the same quarter of fiscal 2023.

Net income for the fiscal year ended September 30, 2024 increased 22% to $203.4 million, or $4.00 per diluted share, compared to $166.9 million, or $3.33 per diluted share, in fiscal 2023. Pre-tax income for fiscal 2024 increased 22% to $270.1 million from $221.6 million in fiscal 2023. Fiscal 2024 results include a total pre-tax gain on sale of assets of $9.5 million, and fiscal 2023 results include $19.4 million of pre-tax real estate impairment charges to cost of sales. Revenues for fiscal 2024 increased 5% to $1.5 billion from $1.4 billion in fiscal 2023.

The Company’s return on equity was 13.8% for fiscal 2024. Return on equity is calculated as net income for the year divided by average stockholders’ equity, where average stockholders’ equity is the sum of ending stockholders’ equity balances of the trailing five quarters divided by five.

Operational Results

Lots sold during the fourth quarter increased 8% to 5,374 lots compared to 4,986 lots in the same quarter of fiscal 2023. During the fourth quarter of fiscal 2024, Forestar sold 949 lots to customers other than D.R. Horton, Inc. (“D.R. Horton”), compared to 684 lots in the prior year quarter.

Lots sold during fiscal 2024 increased 7% to 15,068 lots compared to 14,040 lots in fiscal 2023. During fiscal 2024, 1,801 lots were sold to customers other than D.R. Horton compared to 1,791 lots in fiscal 2023. Lots sold to customers other than D.R. Horton in fiscal 2024 included 124 lots that were sold to a lot banker who expects to sell those lots to D.R. Horton at a future date compared to 252 lots in fiscal 2023.

The Company’s lot position at September 30, 2024 was 95,100 lots, of which 57,800 were owned and 37,300 were controlled through land and lot purchase contracts. Lots owned at September 30, 2024 included 6,300 that were fully developed. Of the Company’s owned lot position at September 30, 2024, 21,000 lots, or 36%, were under contract to be sold, representing approximately $1.9 billion of future revenue. Another 17,200 lots, or 30%, of the Company’s owned lots were subject to a right of first offer to D.R. Horton based on executed purchase and sale agreements at September 30, 2024.

Capital Structure, Leverage and Liquidity

During fiscal 2024, the Company issued 546,174 shares of common stock under its at-the-market equity offering program for proceeds of $19.7 million, net of commissions and other issuance costs.

Forestar ended the fiscal year with $481.2 million of unrestricted cash and $377.2 million of available borrowing capacity on its senior unsecured revolving credit facility for total liquidity of $858.4 million. Debt at September 30, 2024 totaled $706.4 million, with no senior note maturities until fiscal 2026. The Company’s net debt to total capital ratio at the end of the year was 12.4%. Net debt to total capital consists of debt net of unrestricted cash divided by stockholders’ equity plus debt net of unrestricted cash.

Outlook

Donald J. Tomnitz, Chairman of the Board, said, “The Forestar team finished the year with a strong fourth quarter, demonstrating the resiliency of the new home market and builder demand despite elevated mortgage interest rates. We delivered over 15,000 finished lots in fiscal 2024, and our revenues exceeded the high end of our most recent guidance range.

Over the last five years, Forestar invested approximately $6.7 billion in land acquisition and development and delivered over 70,000 finished lots to local, regional and national homebuilders. Over the same time period, our return on equity nearly tripled, and our book value per share increased 87%. Our improved profitability alongside our top line growth is creating meaningful value for our shareholders.

As we look forward to fiscal 2025, we currently expect to deliver between 16,000 and 16,500 lots, generating $1.6 billion to $1.65 billion of revenue. We are focused on maximizing returns by balancing our pace of sales and lot pricing in each of our projects.”

Tomnitz concluded, “Forestar is uniquely positioned to take advantage of the shortage of finished lots in the homebuilding industry. Our strong balance sheet and ample liquidity give us the flexibility to adapt to changing market conditions and to invest in land development opportunities that position the Company for growth in fiscal 2025 and beyond. We expect to continue aggregating significant market share over the next few years and will maintain our disciplined approach to investing capital to enhance the long-term value of Forestar.”

Conference Call and Webcast Details

The Company will host a conference call today (Tuesday, October 29) at 11:00 a.m. Eastern Time. The dial-in number is 888-506-0062, the entry code is 749922, and the call will also be webcast from the Company’s website at investor.forestar.com.

About Forestar Group Inc.

Forestar Group Inc. is a residential lot development company with operations in 59 markets and 24 states. Based in Arlington, Texas, the Company delivered more than 15,000 residential lots during its fiscal year ended September 30, 2024. Forestar is a majority-owned subsidiary of D.R. Horton, the largest homebuilder by volume in the United States since 2002.

Forward-Looking Statements

Portions of this document may constitute “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Although Forestar believes any such statements are based on reasonable assumptions, there is no assurance that actual outcomes will not be materially different. All forward-looking statements are based upon information available to Forestar on the date this release was issued. Forestar does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Forward-looking statements in this release include we currently expect to deliver between 16,000 and 16,500 lots, generating $1.6 billion to $1.65 billion of revenue; Forestar is uniquely positioned to take advantage of the shortage of finished lots in the homebuilding industry; our strong balance sheet and ample liquidity give us the flexibility to adapt to changing market conditions and to invest in land development opportunities that position the Company for growth in fiscal 2025 and beyond; we expect to continue aggregating significant market share over the next few years and will maintain our disciplined approach to investing capital to enhance the long-term value of Forestar.

Factors that may cause the actual results to be materially different from the future results expressed by the forward-looking statements include, but are not limited to: the effect of D.R. Horton’s controlling level of ownership on us and the holders of our securities; our ability to realize the potential benefits of the strategic relationship with D.R. Horton; the effect of our strategic relationship with D.R. Horton on our ability to maintain relationships with our customers; the cyclical nature of the homebuilding and lot development industries and changes in economic, real estate and other conditions; the impact of significant inflation, higher interest rates or deflation; supply shortages and other risks of acquiring land, construction materials and skilled labor; the effects of public health issues such as a major epidemic or pandemic; the impacts of weather conditions and natural disasters; health and safety incidents relating to our operations; our ability to obtain or the availability of surety bonds to secure our performance related to construction and development activities and the pricing of bonds; the impact of governmental policies, laws or regulations and actions or restrictions of regulatory agencies; our ability to achieve our strategic initiatives; continuing liabilities related to assets that have been sold; the cost and availability of property suitable for residential lot development; general economic, market or business conditions where our real estate activities are concentrated; our dependence on relationships with national, regional and local homebuilders; competitive conditions in our industry; obtaining reimbursements and other payments from governmental districts and other agencies and timing of such payments; our ability to succeed in new markets; the conditions of the capital markets and our ability to raise capital to fund expected growth; our ability to manage and service our debt and comply with our debt covenants, restrictions and limitations; the volatility of the market price and trading volume of our common stock; our ability to hire and retain key personnel; and the strength of our information technology systems and the risk of cybersecurity breaches and our ability to satisfy privacy and data protection laws and regulations. Additional information about issues that could lead to material changes in performance is contained in Forestar’s annual report on Form 10-K and its most recent quarterly report on Form 10-Q, both of which are or will be filed with the Securities and Exchange Commission.

Contact

Katie Smith, 817-769-1860

Vice President of Finance & Investor Relations

InvestorRelations@forestar.com

FORESTAR GROUP INC.

Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| September 30, |

| 2024 | | 2023 |

| | (In millions, except share data) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 481.2 | | | $ | 616.0 | |

| Real estate | 2,266.2 | | | 1,790.3 | |

| Investment in unconsolidated ventures | 0.3 | | | 0.5 | |

| Property and equipment, net | 7.1 | | | 5.9 | |

| Other assets | 85.3 | | | 58.0 | |

| Total assets | $ | 2,840.1 | | | $ | 2,470.7 | |

| LIABILITIES | | | |

| Accounts payable | $ | 85.9 | | | $ | 68.4 | |

| Accrued development costs | 144.6 | | | 104.1 | |

| Earnest money on sales contracts | 172.3 | | | 121.4 | |

| Deferred tax liability, net | 67.5 | | | 50.7 | |

| Accrued expenses and other liabilities | 68.3 | | | 61.2 | |

| Debt | 706.4 | | | 695.0 | |

| Total liabilities | 1,245.0 | | | 1,100.8 | |

| EQUITY | | | |

Common stock, par value $1.00 per share, 200,000,000 authorized shares, 50,653,637 and 49,903,713 shares issued and outstanding at September 30, 2024 and 2023, respectively | 50.7 | | | 49.9 | |

| Additional paid-in capital | 665.2 | | | 644.2 | |

| Retained earnings | 878.2 | | | 674.8 | |

| Stockholders' equity | 1,594.1 | | | 1,368.9 | |

| Noncontrolling interests | 1.0 | | | 1.0 | |

| Total equity | 1,595.1 | | | 1,369.9 | |

| Total liabilities and equity | $ | 2,840.1 | | | $ | 2,470.7 | |

FORESTAR GROUP INC.

Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Year Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In millions, except per share amounts) |

| Revenues | $ | 551.4 | | | $ | 549.7 | | | $ | 1,509.4 | | | $ | 1,436.9 | |

| Cost of sales | 419.5 | | | 434.1 | | | 1,150.1 | | | 1,132.8 | |

| Selling, general and administrative expense | 32.0 | | | 26.4 | | | 118.5 | | | 97.7 | |

| | | | | | | |

| Gain on sale of assets | (4.5) | | | — | | | (9.5) | | | (1.6) | |

| Interest and other income | (4.1) | | | (6.2) | | | (19.8) | | | (13.6) | |

| Income before income taxes | 108.5 | | | 95.4 | | | 270.1 | | | 221.6 | |

| Income tax expense | 26.9 | | | 23.0 | | | 66.7 | | | 54.7 | |

| | | | | | | |

| | | | | | | |

| Net income | $ | 81.6 | | | $ | 72.4 | | | $ | 203.4 | | | $ | 166.9 | |

| | | | | | | |

| Basic net income per common share | $ | 1.61 | | | $ | 1.45 | | | $ | 4.03 | | | $ | 3.34 | |

| Weighted average number of common shares | 50.7 | | | 50.1 | | | 50.4 | | | 50.0 | |

| | | | | | | |

| Diluted net income per common share | $ | 1.60 | | | $ | 1.44 | | | $ | 4.00 | | | $ | 3.33 | |

| Adjusted weighted average number of common shares | 51.0 | | | 50.4 | | | 50.8 | | | 50.1 | |

FORESTAR GROUP INC.

Revenues, Residential Lots Sold and Lot Position

| | | | | | | | | | | | | | | | | | | | | | | |

| REVENUES |

| Three Months Ended September 30, | | Year Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions) |

| Residential lot sales: | | | | | | | |

| Development projects | $ | 496.4 | | | $ | 485.4 | | | $ | 1,418.5 | | | $ | 1,275.7 | |

| Lot banking projects | 26.8 | | | — | | | 37.9 | | | — | |

| Decrease (increase) in contract liabilities | 0.3 | | | (4.1) | | | 2.9 | | | — | |

| 523.5 | | | 481.3 | | | 1,459.3 | | | 1,275.7 | |

| Deferred development projects | 4.5 | | | 4.3 | | | 8.1 | | | 29.0 | |

| 528.0 | | | 485.6 | | | 1,467.4 | | | 1,304.7 | |

| Tract sales and other | 23.4 | | | 64.1 | | | 42.0 | | | 132.2 | |

| Total revenues | $ | 551.4 | | | $ | 549.7 | | | $ | 1,509.4 | | | $ | 1,436.9 | |

| | | | | | | |

| | | | | | | |

| RESIDENTIAL LOTS SOLD |

| Three Months Ended September 30, | | Year Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Development projects | 5,176 | | | 4,986 | | | 14,769 | | | 14,040 | |

| Lot banking projects | 198 | | | — | | | 299 | | | — | |

| | | | | | | |

| | | | | | | |

| 5,374 | | | 4,986 | | | 15,068 | | | 14,040 | |

| | | | | | | |

Average sales price per lot (1) | $ | 97,300 | | | $ | 97,400 | | | $ | 96,600 | | | $ | 90,900 | |

| | | | | | | |

| | | | | | | |

| | | | | LOT POSITION |

| | | | | September 30, |

| | | | | 2024 | | 2023 |

| Lots owned | | 57,800 | | | 52,400 | |

| Lots controlled under land and lot purchase contracts | | 37,300 | | | 26,800 | |

| Total lots owned and controlled | | 95,100 | | | 79,200 | |

| | | | | | | |

| Owned lots under contract to sell to D.R. Horton | | 20,500 | | | 14,400 | |

| Owned lots under contract to customers other than D.R. Horton | | 500 | | | 600 | |

| Total owned lots under contract | | 21,000 | | | 15,000 | |

| | | | | | | |

| Owned lots subject to right of first offer with D.R. Horton based on executed purchase and sale agreements | | 17,200 | | | 17,000 | |

| Owned lots fully developed | | 6,300 | | | 6,400 | |

_____________

(1)Excludes any impact from change in contract liabilities.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

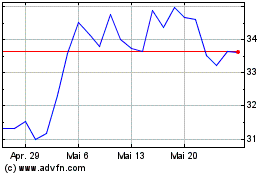

Forestar (NYSE:FOR)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Forestar (NYSE:FOR)

Historical Stock Chart

Von Nov 2023 bis Nov 2024