First Trust Strategic High Income Fund Declares Monthly Distribution for May of $0.16 Per Share

20 April 2007 - 10:49PM

Business Wire

First Trust Strategic High Income Fund (the "Fund") (NYSE:FHI)

today declared the Fund�s regularly scheduled monthly distribution,

payable on May 15, 2007 to shareholders of record as of May 3,

2007. The ex-dividend date is expected to be May 1, 2007. The

monthly distribution information for the Fund appears below. First

Trust Strategic High Income Fund (FHI): Distribution per share:

$0.16 Distribution Rate based on the April 19, 2007 NAV of $19.26:

9.97% Distribution Rate based on the April 19, 2007 closing market

price of $20.41: 9.41% The majority, and possibly all, of this

distribution will be paid out of net investment income earned by

the Fund. A portion of this distribution may come from net

short-term realized capital gains or return of capital. The final

determination of the source and tax status of all distributions

paid in 2007 will be made after the end of 2007. The Fund is a

closed-end management investment company that seeks to provide a

high level of current income. As a secondary objective, the Fund

seeks to provide capital growth. The Fund pursues these investment

objectives by investing at least 80% of its managed assets in

below-investment grade debt securities. The Fund employs leverage.

First Trust Advisors L.P. acts as the Fund�s investment advisor and

currently manages or supervises approximately $29 billion in

assets. Valhalla Capital Partners, LLC, the Fund�s sub-adviser

(�Valhalla�), is a boutique asset management firm focused on

managing high-yield portfolios with an emphasis on structured

finance securities. The three managing partners have 50 years

combined industry experience and the investment team has an average

of over 11 years experience in working with high-yield and

structured finance securities. Valhalla currently manages

approximately $650 million in assets. Past performance is no

assurance of future results. Investment return and market value of

an investment in the Fund will fluctuate. Shares, when sold, may be

worth more or less than their original cost. Principal Risk

Factors: Investment in this Fund involves investment and market

risk, management risk, value investing risk, below-investment grade

securities risk, fixed-income securities risk, mortgage-backed

securities risk, asset-backed securities risk, convertible

securities risk, municipal securities risk, foreign securities

risk, foreign government securities risk, equity securities risk,

currency risk, distressed securities risk, preferred stock risk,

inflation/deflation risk, market discount risk, leverage risk,

derivatives risk, market disruption risk, portfolio turnover risk,

and illiquid/restricted securities risk. Please see the Fund�s

prospectus for additional information on the risks of investing in

the Fund. The Fund�s daily closing New York Stock Exchange price

and net asset value per share as well as other information can be

found at www.ftportfolios.com or by calling 1-800-988-5891.

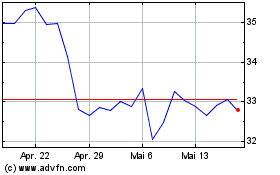

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

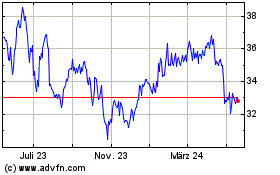

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024