Clearway Energy, Inc. Announces CEO Transition and Reiterates 2024 Financial Guidance

30 April 2024 - 10:05PM

Clearway Energy, Inc. (NYSE: CWEN, CWEN.A) (“Company”, “Clearway”)

today announced that effective June 30, 2024, Chris Sotos will move

on from his position as Clearway Energy, Inc.’s President and Chief

Executive Officer (“CEO”) and resign from his role as a member of

CWEN’s Board of Directors to pursue other opportunities. Craig

Cornelius, who is currently the CEO of the Company’s sponsor,

Clearway Energy Group (“Clearway Group”), will succeed Mr. Sotos as

CWEN’s CEO and will join CWEN’s Board of Directors.

"Chris's leadership has been critical to the

financial success that CWEN and its predecessor have achieved since

its 2013 IPO. On behalf of the CWEN Board, I want to thank him for

his many contributions that have put CWEN in an excellent position

for future growth,” said Jonathan Bram, Founding Partner of GIP and

Chairman of the Board of Clearway Energy, Inc. “Craig’s leadership

and vision has been instrumental in growing the renewable

development pipeline at Clearway Group by six times since GIP’s

investment while also effectively managing the teams that operate

CWEN’s assets. In his expanded role within the Clearway enterprise

as the incoming CEO of Clearway Energy, Inc., I’m confident CWEN

will continue to meet its growth objectives.”

"I have been with CWEN and its predecessor

entity since its inception in December 2012 and have been honored

to serve as its CEO since 2016. While I’ll miss my colleagues, I’m

comforted to know that I’m leaving behind a best-in-class team that

can continue to build upon Clearway’s strong track record of value

creation for its investors,” said Christopher Sotos, Clearway

Energy, Inc.’s outgoing President and Chief Executive Officer.

“I’ve worked with Craig for many years and know that CWEN will be

in an excellent position under his leadership to continue to grow

CWEN’s platform in a manner that is accretive to shareholders.”

Prior to becoming Clearway Group’s CEO at its

formation through a spin-out of NRG Energy Inc.’s (“NRG”) clean

energy businesses in 2018, Mr. Cornelius was President of NRG’s

renewables division. In this capacity, he oversaw origination,

development, engineering & construction, operations, and asset

management across the company’s businesses in wind and solar power.

He joined NRG in 2013 and initially led new business development

for renewables, including the establishment of new market segments,

acquisition of projects, and direction of process improvement

initiatives. Before joining NRG, Mr. Cornelius served for five

years as a Principal and then a Managing Director in the solar

investing practice at Hudson Clean Energy Partners. Previously, he

was the Program Manager of the U.S. Department of Energy’s Solar

Energy Technologies Program, where he led the creation of the $1.5

billion Solar America Initiative.

"Chris was an instrumental creator of the

business that became Clearway and has been a great colleague over

his incredible arc of service. It’s been a true privilege getting

to co-lead the enterprise alongside him. He’s built a solid

foundation for CWEN that will allow for a seamless transition as we

go forward. The Clearway enterprise has a talented employee base

across our organization that supports both Clearway Energy, Inc.

and Clearway Group. We remain well positioned to sustainably grow

CAFD per share and our clean energy fleet for years to come and

look forward to doing that,” said Craig Cornelius, Clearway Energy,

Inc.’s incoming President and Chief Executive Officer. “We continue

to expect CWEN to achieve the upper range of its 5% to 8% annual

dividend growth objective without needing external capital through

at least 2026. Furthermore, and consistent with prior

disclosures, we see potential for CWEN’s CAFD per share growth in

2027 to be in that same range if the balance of our gas fleet

contracts its capacity to deliver resource adequacy at the same or

better pricing as previously disclosed contract awards.”

Financial Guidance

The Company is reaffirming its 2024 full year

CAFD guidance of $395 million. The Company's 2024 financial

guidance factors in the contribution of committed growth

investments based on current expected closing timelines and

estimates for merchant energy gross margin at the conventional

fleet. 2024 CAFD guidance does not factor in the timing of when

CAFD is realized from new growth investments pursuant to 5-year

averages beyond 2024. Financial guidance is based on median

renewable energy production estimates for the full year.

First Quarter Earnings Call

Management plans to report first quarter 2024

financial results on Thursday, May 9. Management will present the

results during a conference call and webcast at 8:00 a.m. Eastern.

A live webcast of the conference call, including presentation

materials, can be accessed through the Company’s website at

http://www.clearwayenergy.com and clicking on “Presentations &

Webcasts” under the Investor Relations section. The webcast will be

archived on the site for those unable to listen in real time.

About Clearway Energy, Inc.

Clearway Energy, Inc. is one of the largest renewable energy

owners in the US with approximately 6,000 net MW of installed wind,

solar and energy storage projects. The Company's approximately

8,500 net MW of assets also include approximately 2,500 net MW of

environmentally-sound, highly efficient natural gas generation

facilities. Through this environmentally-sound diversified and

primarily contracted portfolio, Clearway Energy endeavors to

provide its investors with stable and growing dividend income.

Clearway Energy, Inc.’s Class C and Class A common stock are traded

on the New York Stock Exchange under the symbols CWEN and CWEN.A,

respectively. Clearway Energy, Inc. is sponsored by its controlling

investor, Clearway Energy Group LLC. For more information, visit

investor.clearwayenergy.com.

Safe Harbor Disclosure

This news release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Such forward-looking

statements are subject to certain risks, uncertainties and

assumptions, and typically can be identified by the use of words

such as “expect,” “estimate,” "target," “anticipate,” “forecast,”

“plan,” “outlook,” “believe” and similar terms. Such

forward-looking statements include, but are not limited to,

statements described above, including those regarding annual

dividend growth, the Company’s financial performance and/or

business results and other future events, and views of economic and

market conditions. Although Clearway Energy, Inc. believes that

these estimates and the other expectations stated herein are

reasonable, it can give no assurance that these estimates or other

expectations will prove to be correct, and actual results may vary

materially. Factors that could cause actual results to differ

materially from those contemplated above include, among others,

economic, competitive, governmental regulatory and market factors

affecting our business, operations, dividends and access to

capital. We identify the principal risks and uncertainties that

affect our Company in our Form10-K and other filings with the

Securities and Exchange Commission.

# # #

Investor:

Akil Marsh, 609-608-1500

investor.relations@clearwayenergy.com

Media:

Zadie Oleksiw, 202-836-5754

media@clearwayenergy.com

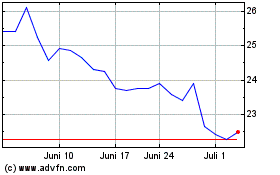

Clearway Energy (NYSE:CWEN.A)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

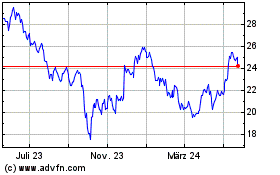

Clearway Energy (NYSE:CWEN.A)

Historical Stock Chart

Von Nov 2023 bis Nov 2024