Caterpillar Pushes Forecast Higher -- WSJ

31 Juli 2018 - 9:02AM

Dow Jones News

By Austen Hufford

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 31, 2018).

Caterpillar Inc. raised its profit outlook for the year,

predicting that higher prices and strong machinery sales in a

buoyant global economy will cover increased raw-material costs

related to tariffs.

The world's largest maker of heavy equipment for mining,

construction and energy companies on Monday beat analysts'

expectations in reporting a second-quarter profit that more than

doubled from a year earlier. Strong demand from oil, natural-gas

and mining customers, as well as construction companies in China,

pushed Caterpillar's equipment sales up 25%.

Even so, shares in Caterpillar fell 2% to $139.75 -- a 5% swing

from their pre-open level -- as the company said it expects to pay

more for materials as a result of tariffs this year. Caterpillar

also flagged supply-chain constraints that occurred as it boosted

production.

Caterpillar, based in Deerfield, Ill., said tariffs the Trump

administration has imposed on some metal and component imports

would increase its material costs by $100 million to $200 million

over the rest of 2018.

While the company buys most of its steel from domestic

suppliers, it imports some types of specialized steel. Caterpillar

said that trade tensions haven't affected its business in

China.

Caterpillar said price increases that went into effect this

month would help offset the higher costs. Other manufacturers have

also said they are passing on higher costs by raising prices.

Caterpillar told investors on Monday that rising material costs

would be just "one of many factors" when deciding whether to raise

prices again.

Freight costs rose as Caterpillar ramped up production and

expanded its use of more expensive expedited shipping to meet

demand. Higher fuel costs, as well as a shortage of trucks and

truck drivers, have pushed up shipping rates for many companies

this year.

Caterpillar has "seen some issues and challenges in our supply

base" as production of machinery accelerates and demand for parts

and components increases, interim Chief Financial Officer Joseph

Creed said in an interview.

The company's engineers have redesigned some parts and processes

to ease demands on suppliers. Higher volumes and prices during the

quarter helped offset the increased material and freight

expenses.

In another sign of increased production levels, Caterpillar

added 6,800 full-time workers in the second quarter compared with a

year earlier, reaching a total of 101,600 employees at the end of

June.

Caterpillar spooked investors in April when it called its first

quarter a "high-water mark" for the year. Executives later said

they were referring to margins, not sales or profit. On Monday,

Caterpillar reported adjusted earnings of $2.97 a share for its

second quarter, above the first-quarter results of $2.82 and

analyst expectations of $2.73.

Caterpillar said it now expects adjusted earnings per share this

year to be between $11 and $12, shifting its previous range up by

75 cents. Caterpillar said the improved outlook didn't take into

account the potential for a further increase in trade barriers.

Caterpillar sells its machinery in more than 190 countries.

Total second-quarter sales, including revenue from the company's

financial products, rose 24% to $14.01 billion.

In all, the company posted a second-quarter profit of $1.71

billion, or $2.82 a share, up from $802 million, or $1.35 a share,

a year earlier.

Analysts polled by Thomson Reuters had forecast $13.88 billion

in sales.

Caterpillar also disclosed a new $10 billion share-buyback

program beginning next year. Its current plan, which expires this

year, had $4.5 billion left of an original $10 billion in planned

repurchases. Caterpillar repurchased $750 million of shares in the

second quarter.

--Bob Tita contributed to this article.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 31, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

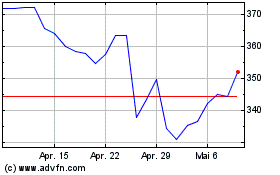

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Sep 2024 bis Okt 2024

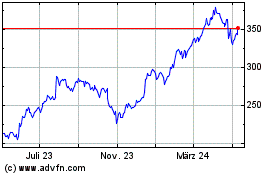

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Okt 2023 bis Okt 2024