By Michael Wursthorn

Growing tensions between the U.S. and China exacerbated

investors' fears of an all-out trade war between the world's

largest economies, shaving more than 550 points off the Dow Jones

Industrial Average on Friday as investors braced for more

turbulence ahead.

All 11 major sectors of the S&P 500 index declined, as

investors broadly sold stocks, with the deepest declines among big

industrial manufacturers like Boeing Co. and Caterpillar Inc. that

stand to suffer from an escalation in protectionist trade

policies.

Friday's session marked the S&P 500's ninth 1% swing up or

down in the past 11 trading days, a sign of stocks' uneasy footing

and resurgent volatility.

Investors were already grappling with concerns that technology

stocks won't be able to generate the massive gains of previous

years and the threat of inflation rising more quickly than

expected. Those fears were alleviated Friday when new data showed a

steady rise in wages last month.

But the issue of trade and how far the Trump administration is

willing to go with its protectionist agenda has become a driving

force behind the stock market's gyrations for more than a

month.

Those concerns deepened Friday after Chinese Commerce Ministry

spokesman Gao Feng acknowledged the two governments were now in a

battle and described President Donald Trump's consideration of

penalties on an additional $100 billion in Chinese goods as

"extremely wrong."

Investors worry the tit-for-tat responses between the U.S. and

China could translate into more severe and farther-reaching

sanctions that pressure American companies and raise prices for

consumers.

Investors say an escalation could crimp the global economic

growth engine that has acted as a key pillar for the latest leg of

the stock-market rally.

Several Trump administration officials, including Larry Kudlow,

head of the White House National Economic Council, Treasury

Secretary Steven Mnuchin and White House press secretary Sarah

Huckabee Sanders, tried to allay investors' concerns of a trade

conflict to little avail.

Mr. Mnuchin, speaking on CNBC, said it would take time for the

announced and potential U.S. tariffs to take effect, and meanwhile,

"we'll continue to have discussions. But there is the potential of

a trade war."

That last comment appeared to send the market sliding. The Dow

fell as much as 767 points in the late afternoon before paring its

decline to 572.46 points, or 2.3%, to 23932.76.

Ms. Sanders, meanwhile, said later Friday that, "this is

something that China has created and President Trump is trying to

fix it."

Federal Reserve Chairman Jerome Powell, who reiterated the

central bank's intent to proceed with a slow, steady path of rising

interest rates, added Friday that "tariffs can push up prices," but

went on to say that it is too early to predict what would be the

full economic impact of a trade war with China.

The growing uncertainty over a trade war and what that means for

businesses across the country prompted the stock market's most

nervous investors to sell Friday, said Kenny Polcari, managing

director at broker-dealer O'Neil Securities.

"It could get uglier over the weekend, and some are getting out

because it could go either way," said Mr. Polcari, who added that

trading volumes were light, suggesting the selling is being driven

more by smaller traders and investors rather than big money

managers. "If [the administration] calms the rhetoric down over the

weekend, then you'll likely see the market rally right back

Monday."

The S&P 500 declined 58.37 points, or 2.2%, to 2604.47,

while the Nasdaq Composite slid 161.44 points, or 2.3%, to 6915.11.

For the week, the Dow dropped 0.7%, the S&P 500 fell 1.4% and

the Nasdaq declined 2.1%. The S&P 500 is now off 2.6% for the

year and down 9.3% from its late January peak.

Investors moved into assets that tend to hold up better during

times of uncertainty, with so-called haven assets such as bonds and

gold rising. "There's genuine fear that this thing with China is

not going to go well, " said Jeff Lancaster, a principal of Bingham

Osborn & Scarborough, an advisory firm that manages $4.2

billion.

Shares of Boeing, which has been cited as a bellwether by

analysts to gauge investors' reaction to trade-sensitive stocks,

fell 3.1%. Heavy machinery manufacturers Caterpillar and Deere

& Co. dropped 3.5% and 3.9%.

Financial firms also weighed heavily on major indexes after

those stocks were hurt by stronger bond prices, which rose after

the latest trade salvos. Higher bond prices and lower yields tend

to narrow the gap between short- and long-dated Treasury notes and

crimp lenders' profits.

Shares of Goldman Sachs Group fell 2.3%, while the KBW Nasdaq

Bank Index of large U.S. lenders slid 2.7%.

The yield on the benchmark 10-year U.S. Treasury note fell to

2.779% from 2.830% on Thursday. Yields move inversely to

prices.

Meanwhile, the latest jobs report showed that wages grew as

expected from a year earlier, with average hourly earnings rising

2.7% in March. That eased worries among some investors that

inflation had been growing faster than expected this year and that

the Fed would have to hasten its pace of interest-rate hikes to

keep the economy from overheating.

"This should help moderate investors' expectations for the

[Federal Reserve] getting ahead of itself," said Doug Coté, Voya

Investment Management's chief market strategist.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

April 06, 2018 19:25 ET (23:25 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

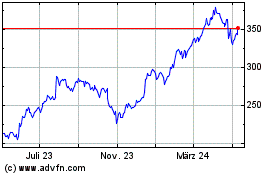

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

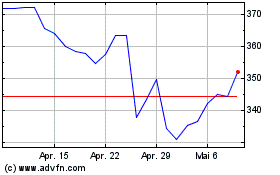

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024