Manufacturers Mixed on Prospect of a Donald Trump Presidency -- Update

09 November 2016 - 8:37PM

Dow Jones News

By Andrew Tangel and Bob Tita

Caterpillar Inc., the world's largest maker of heavy machinery,

is optimistic President-elect Donald Trump will increase spending

on U.S. infrastructure and reduce corporate tax and regulatory

burdens.

"We're looking forward to building those bridges -- we're good

at it and we have the right equipment for it," said Kathryn Dickey

Karol, Caterpillar's vice president for global government and

corporate affairs. She said the company was excited about Mr.

Trump's calls for improving the country's transportation

network.

Caterpillar was up more than 7% at $90.70 at the market open and

stocks for major U.S. manufacturers were broadly up across the

board in recent trading as investors weigh the prospect of Mr.

Trump's presidency following Tuesday'selection.

Trading in other companies in the sector were mixed on

uncertainty regarding Trump's pledge to renegotiate trade deals and

campaign promises to discourage companies from moving plants

overseas.

Auto makers Ford Motor Co. and General Motors and automotive

component makers were down in recent trading, while General

Electric and United Technologies were higher.

Ms. Karol said Peoria, Ill.-based Caterpillar, which has a

sprawling network of overseas facilities in countries including

China and Mexico, would continue to push for adoption of the

Trans-Pacific Partnership during the remaining days of the Obama

administration. While Mr. Trump was critical of that trade deal and

others, Ms. Karol said the company would continue advocating for

lowering trade barriers to expand its sales overseas.

"Worried, not worried -- I think we see opportunity to advocate

on the benefits of trade with this new administration and

Congress," she said. "We're going to be very vocal about that."

Martin Richenhagen, chairman and chief executive of farm

equipment manufacturer Agco Corp., said he is concerned about Mr.

Trump's repeated support for trade protectionism during the

campaign. Georgia-based Agco generates the majority of its sales in

Europe and South America. The company imports farm tractors and

components into the U.S.

"That would be a nightmare if we make life difficult for imports

and exports," said Mr. Richenhagen, who is in Germany this week.

"We need to explain that to him. The Europeans are very

concerned."

Some smaller company leaders said they supported Trump because

of the then-candidate's calls to throw out trade deals that he said

decimated the sector's employment and his support for U.S.

manufacturing.

"People really felt like this is a guy that gives them a voice,"

said Dan Larson, owner of Hydrosolutions of Duluth Inc., a

Minnesota company with 15 employees fabricating metal for the

aviation industry.

Many companies are likely to welcome Trump's promises to lower

taxes and reduce business regulations as well as a continuation of

business friendly Republican majorities in Congress.

Agco's Richenhagen predicted that Republican majorities in the

U.S. House and Senate will be receptive to Mr. Trump's domestic

strategy to revive business investment and economic growth with

lower taxes and less regulation. "Tax reform is easily done now,"

he said.

Ron DeFeo, chief executive of Pennsylvania-based Kennametal

Inc., which makes drilling tools for oil wells and metal-cutting

machines, predicted that U.S. businesses will warm up to Mr. Trump

if he is able to generate stronger U.S. economic growth in the

coming years.

"I don't think you can begin to address the global problems when

your domestic economy is stuck in neutral," he said.

He predicted that Mr. Trump will show a more measured approach

to trade policy as president than he showed during the campaign as

a candidate. "A little stiffer hand goes a long way to true up the

[trade] deals that exist, but overreach will scare people," he

said.

Marvin Cunningham, president of the Long-Stanton Manufacturing

Co. in the Cincinnati area, has about 35 employees and makes

components that wind up in products such as airplane brakes and gas

station pumps, many of which are exported. He fears possible

tariffs in response to Mr. Trump's potential trade policies. "We'll

have a smaller market now," Mr. Cunningham said. "I don't see how

that is good for us."

But referring to Mr. Trump's criticism of companies that move

jobs overseas, he noted that his small company had already shifted

production from China back to the U.S. "Dodged a grenade," Mr.

Cunningham said.

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Bob Tita at

robert.tita@wsj.com

(END) Dow Jones Newswires

November 09, 2016 14:22 ET (19:22 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

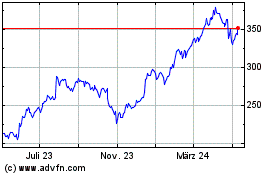

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

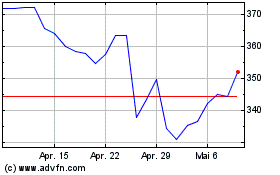

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024