AB InBev 2Q Net Profit Misses Expectations as US Volumes Dive -- Update

03 August 2023 - 8:11AM

Dow Jones News

By Ian Walker

Anheuser-Busch InBev has reported a massive fall in

second-quarter net profit--missing market expectations--as a fall

in U.S. volumes offset rises in other regions.

The world's largest brewer--which houses Stella Artois and

Budweiser among its portfolio--said Thursday that overall volumes

fell 1.4%, matching expectations. Within this, North America

volumes fell 14.5%.

Sales in the region have been falling since April when Dylan

Mulvaney, a transgender social-media star, made an Instagram post

about a personalized can of Bud Light that the brewer had sent her

as a gift. The post sparked a boycott that caused sales of Bud

Light, and other brands, to fall.

Net profit for the quarter fell to $339 million compared with

$1.60 billion for the comparable period a year earlier and a

FactSet consensus of $613.35 million.

Revenue for the quarter rose to $15.12 billion from $14.79

billion, driven by pricing actions, premiumization--the strategy of

emphasizing luxury versions of its products--and other

revenue-management moves. Revenue consensus was $15.38 billion.

On an organic basis, revenue grew 7.2%, beating a

company-provided market consensus of 6.4%.

In the U.S., sales to retailers fell 14.0%, underperforming the

industry, mainly due to lower Bud Light volumes.

Late last month the company laid off hundreds of workers at its

U.S. offices after months of slumping sales at Bud Light. It said

the cuts would affect less than 2% of its roughly 18,000 U.S.

workforce. The layoffs won't impact front-line workers such as

brewery and warehouse staff, the company added.

Normalized earnings before interest, tax, depreciation and

amortization--one of the company's preferred metrics which strips

out exceptional and other one-off items--fell to $4.91 billion from

$5.10 billion and compares with a consensus of $4.845 billion.

Looking ahead, AB InBev reiterated that it expects 2023 Ebitda

to grow in line with its medium-term outlook of between 4% and 8%

and revenue to grow ahead of Ebitda from a healthy combination of

volume and price.

Earlier this week Heineken cut its full-year outlook after

reporting a fall in key earnings for the first half, largely due to

lower volumes in the profitable Asia-Pacific region.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

August 03, 2023 01:56 ET (05:56 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

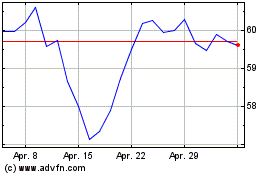

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

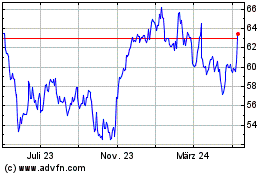

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024