Designed to Prevent Creeping Control and

Protect Long-Term Value for All Shareholders

The Rights Plan Committee (the “Committee”) of the Board of

Directors (the “Board”) of ASA Gold and Precious Metals Limited

(“ASA” or the “Company”) (NYSE:ASA) has unanimously adopted a

limited-duration shareholder rights plan (“Rights Plan”) to protect

the interests of the Company and all of its shareholders. The

Rights Plan is currently effective and will expire at the close of

business on December 20, 2024. The terms of the Rights Plan are

substantively identical to the terms of the shareholder rights plan

that was adopted by the Board on April 26, 2024.

The limited-duration Rights Plan was adopted in response to the

rapid and significant accumulation of ASA shares by Saba Capital

Management, LP (“Saba”) that occurred in late 2023, which was

followed by Saba’s proxy contest during the first quarter of 2024

to gain control of the Company’s Board. Based on public filings,

Saba’s current position in ASA represents approximately 17.02% of

ASA’s outstanding common shares. The Board is currently composed of

two directors who were proposed by Saba and elected at the

Company’s April 26, 2024 shareholder meeting, and two directors who

were proposed by the prior Board and re-elected at the April 26,

2024 shareholder meeting. The Rights Plan Committee was established

by the prior Board on April 26, 2024 to review, consider, make

determinations and approve or otherwise cause the Company to take

actions with respect to any matters relating to a shareholder

rights plan.

The Rights Plan is intended to prevent Saba’s unilateral attempt

to obtain creeping control of the Company, which the Committee

believes would be detrimental to ASA and its shareholders as a

whole. The Rights Plan is designed to enable ASA’s shareholders to

realize the long-term value of their investment, provide an

opportunity for shareholders to receive fair and equal treatment in

the event of any proposed takeover of ASA and guard against tactics

to gain control of ASA without paying shareholders what the Board

or the Committee considers to be an appropriate premium for that

control or recompense for the costs incurred by the Company in its

efforts to protect shareholder interests. The Rights Plan is not

intended to deter offers or preclude the Board or the Committee

from taking action that it believes is in the best interest of the

Company and its shareholders.

The Committee recognizes that Saba has a large share position

and affiliated status with the Company, and welcomes engagement

with Saba that is consistent with the Company’s status as a

non-diversified, equity closed-end fund that seeks long-term

capital appreciation through investing in the precious metals

sector of the global capital markets. The Committee believes that

the previous shareholder rights plans have been successful in

deterring Saba from accumulating additional shares of the Company

and thus achieving creeping control of the Company without paying

an appropriate control premium to the Company’s shareholders. If

Saba were to gain control, the Committee believes it is highly

likely that Saba would seek to dramatically modify the Company’s

core identity and strategy, including but not limited to using its

affiliate status to either become the Company’s investment adviser

(notwithstanding Saba’s lack of experience in precious metals

equities) or select another adviser in lieu of the Company’s

current adviser. Accordingly, it appears to the Committee that the

interests of the Company and its shareholders would be adversely

affected if Saba were to gain control of the Company. The Committee

seeks to work with the Board and shareholders, including Saba, to

develop possible courses of action and alternatives for the

Company. However, Saba has thus far chosen to not enter into

discussions regarding possible means of enhancing shareholder

value. Saba has instead indicated its intention is to nominate a

director slate at the next annual shareholder meeting to gain full

control of the Company. Saba has filed suit against the Company and

individuals who had previously served on the Board and two current

Board members for adopting the shareholder rights plans, seeking a

determination that such rights plans are illegal under the

Investment Company Act of 1940. The lawsuit is pending in the

Southern District of New York. With the new Rights Plan, the

Committee seeks to deter Saba from its efforts to take control of

the Company by purchasing more shares. However, the Committee

members will continue to engage with the full Board, Saba and other

shareholders to develop constructive ideas for the future of the

Company.

ASA will issue one right for each ASA common share outstanding

as of the close of business on September 9, 2024. All shareholders,

including Saba, will receive one right for each share owned. The

rights will initially trade with ASA’s common shares and will

become exercisable only if a person acquires 15% or more of ASA’s

outstanding common shares. Any shareholders with beneficial

ownership of 15% or more of ASA’s outstanding common shares

(including Saba) prior to this announcement are grandfathered at

their beneficial ownership levels at the date the Rights Plan was

adopted, but are not permitted to acquire additional common shares

representing 0.25% or more of the outstanding common shares without

triggering the Rights Plan.

Pursuant to the Rights Plan, should it be triggered, the

Committee may decide that:

- Each holder of a right (other than the acquiring person, whose

rights will have become void and will not be exercisable) will be

entitled to purchase, for a purchase price of $1.00 per share, one

ASA common share.

- Alternatively, (on a cashless basis) each outstanding right

(other than the rights held by the acquiring person, whose rights

will have become void) will be exchanged for one common share.

Further details about the Rights Plan will be contained in a

Form 8-K and Form 8-A to be filed by ASA with the U.S. Securities

and Exchange Commission.

About ASA

ASA is a non-diversified, closed-end fund that seeks long-term

capital appreciation primarily through investing in companies

engaged in the exploration for, development of projects in, or

mining precious metals and minerals.

It is a fundamental policy of ASA that at least 80% of its total

assets must be (i) invested in common shares or securities

convertible into common shares of companies engaged, directly or

indirectly, in the exploration, mining or processing of gold,

silver, platinum, diamonds or other precious minerals, (ii) held as

bullion or other direct forms of gold, silver, platinum or other

precious minerals, (iii) invested in instruments representing

interests in gold, silver, platinum or other precious minerals such

as certificates of deposit therefor, and/or (iv) invested in

securities of investment companies, including exchange-traded

funds, or other securities that seek to replicate the price

movement of gold, silver or platinum bullion.

ASA employs bottom-up fundamental analysis and relies on

detailed primary research, including meetings with company

executives, site visits to key operating assets, and proprietary

financial analysis in investment decisions. Investors are

encouraged to visit the ASA’s website http://www.asaltd.com/ for

additional information, including historical and current share

prices, news releases, financial statements, tax, and supplemental

information.

ASA is organized under the laws of Bermuda and is permitted to

register with the Securities and Exchange Commission as a closed

end investment company under the terms of an exemptive order issued

by the Commission in 1958. ASA is a “passive foreign investment

company” for United States federal income tax purposes. As a

result, United States shareholders holding shares in taxable

accounts are encouraged to consult their tax advisors regarding the

tax consequences of their investment in the Company’s common

shares.

About Merk

Merk Investments LLC, an SEC-registered investment adviser,

provides investment advice on liquid global markets, including

domestic and international equities, fixed income, commodities, and

currencies. For more information on Merk, please visit

www.merkinvestments.com. Merk Investments was approved as ASA’s

investment adviser on April 12, 2019 by a vote of ASA

shareholders.

Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of U.S. federal securities laws that are intended to be

covered by the safe harbors created thereunder. The Company’s

actual performance or results may differ from its beliefs,

expectations, estimates, goals and projections, and consequently,

investors should not rely on these forward-looking statements as

predictions of future events. Forward-looking statements are not

historical in nature and generally can be identified by words such

as “believe,” “anticipate,” “estimate,” “expect,” “intend,”

“should,” “may,” “will,” “seek,” or similar expressions or their

negative forms, or by references to strategy, plans, goals or

intentions. The absence of these words or references does not mean

that the statements are not forward-looking. The Company’s

performance or results can fluctuate from month to month depending

on a variety of factors, a number of which are beyond the Company’s

control and/or are difficult to predict, including without

limitation: the Company’s investment decisions, the performance of

the securities in its investment portfolio, economic, political,

market and financial factors, and the prices of gold, platinum and

other precious minerals that may fluctuate substantially over short

periods of time. The Company may or may not revise, correct or

update the forward-looking statements as a result of new

information, future events or otherwise.

The Company concentrates its investments in the gold and

precious minerals sector. This sector may be more volatile than

other industries and may be affected by movements in commodity

prices triggered by international monetary and political

developments. The Company is a non-diversified fund and, as such,

may invest in fewer investments than that of a diversified

portfolio. The Company may invest in smaller-sized companies that

may be more volatile and less liquid than larger more established

companies. Investments in foreign securities, especially those in

the emerging markets, may involve increased risk as well as

exposure to currency fluctuations. Shares of closed-end funds

frequently trade at a discount to net asset value. All performance

information reflects past performance and is presented on a total

return basis. Past performance is no guarantee of future results.

Current performance may differ from the performance shown.

This press release does not constitute an offer to sell or

solicitation of an offer to buy any securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240823158540/en/

Axel Merk Chief Operating Officer (650)

376-3135 or (800) 432-3378 info@asaltd.com

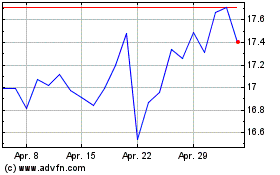

ASA Gold and Precious Me... (NYSE:ASA)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

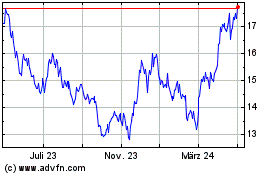

ASA Gold and Precious Me... (NYSE:ASA)

Historical Stock Chart

Von Nov 2023 bis Nov 2024