Mitek Systems, Inc. (NASDAQ: MITK, www.miteksystems.com, “Mitek”

or the “Company”), a global leader in digital identity

verification, mobile capture and fraud management, today reported

financial results for its fourth quarter ended September 30, 2024

and provided guidance for its 2025 fiscal year ending September 30,

2025.

“We reported a solid quarter of year over year revenue growth,

profitability and cash generation driven by our team’s hard work

and operational focus,” stated Mitek CFO, Dave Lyle. “The Mitek

team has done a tremendous job in delivering value to our customers

while we are focusing on driving efficient revenue growth over the

long-term.”

"Mitek has a rich and deep history with financial institutions

and other highly regulated businesses that require comprehensive,

enterprise level solutions. This experience, combined with our

market leading technologies, innovation and domain expertise,

position us well following a year of significant change,” commented

Ed West, Mitek’s recently appointed CEO. “By advancing our

AI-driven solutions and expanding our fraud and identity detection

capabilities, we are well positioned to address the growing fraud

threats of the digital economy. In the near term, we are focused on

refining strategies and optimizing resources to ensure organic

growth and operational excellence, while building a foundation for

long-term success and driving shareholder value,” added West.

Fiscal 2024 Fourth Quarter Financial Highlights

GAAP

- Revenue of $43.2 million grew 15% year-over-year,

compared to $37.7 million a year ago.

- GAAP operating income was $7.7 million, compared to

negative $3.3 million a year ago.

- GAAP operating margin was 18%, compared to negative 9% a

year ago.

- GAAP net income was $8.6 million, compared to a GAAP net

loss of $1.4 million a year ago.

- GAAP net income per diluted share was $0.18, compared to

negative $0.03 a year ago.

- Total cash and investments was $141.8 million at

September 30, 2024, an increase of $8.6 million from $133.2 million

at June 30, 2024.

- Mitek repurchased 1.4 million shares at an average per

share price of $9.94, totaling approximately $14.2 million.

Non-GAAP

- Adjusted EBITDA was $15.4 million, compared to $5.9

million a year ago.

- Adjusted EBITDA margin was 36%, compared to 16% a year

ago.

- Non-GAAP operating income was $15.0 million, compared to

$5.4 million a year ago.

- Non-GAAP operating margin was 35%, compared to 14% a

year ago.

- Non-GAAP net income was $15.5 million, compared to $6.9

million a year ago.

- Non-GAAP net income per diluted share was $0.33,

compared to $0.15 a year ago.

Fiscal 2024 Full Year Financial Highlights

GAAP

- Revenue was $172.1 million, compared to $172.6 million a

year ago.

- GAAP operating income was $2.2 million, compared to

$15.6 million a year ago.

- GAAP operating margin was 1%, compared to 9% a year

ago.

- GAAP net income was $3.3 million, compared to $8.0

million a year ago.

- GAAP net income per diluted share was $0.07, compared to

$0.17 per diluted share a year ago.

- Mitek repurchased 2.2 million shares at an average per

share price of $10.78, totaling approximately $24.2 million with a

plan that was authorized in May of this year.

Non-GAAP

- Adjusted EBITDA was $46.7 million, compared to $55.0

million a year ago.

- Adjusted EBITDA margin was 27%, compared to 32% a year

ago.

- Non-GAAP operating income was $44.9 million, compared to

$51.2 million a year ago.

- Non-GAAP operating margin was 26%, compared to 30% a

year ago.

- Non-GAAP net income was $45.4 million, compared to $44.4

million a year ago.

- Non-GAAP net income per diluted share was $0.96,

compared to $0.95 a year ago.

- Free Cash Flow was $30.3 million, compared to $30.6

million a year ago.

Fiscal 2025 Full Year Guidance

Mitek is providing guidance for its fiscal year ending September

30, 2025, as follows:

- Mitek expects fiscal 2025 full-year revenue to be between $170

million and $180 million.

- Mitek expects its fiscal 2025 full-year adjusted EBITDA margin

to be between 24% and 28%.

Conference Call Information

Mitek management will host a conference call and live webcast

for analysts and investors today at 2:00 p.m. Pacific Time (5:00

p.m. Eastern Time) to discuss the Company’s financial results for

its fiscal 2024 fourth quarter and full year ended September 30,

2024. To access the live call, dial 844-481-3005 (US and Canada) or

+1 412-317-1889 (International) and ask to be joined to the Mitek

call. A live and archived conference call webcast will also be

accessible on the Investor Relations section of the Company’s

website at www.miteksystems.com. A phone replay will be available

approximately two hours after the end of the call and will remain

available for one week. The phone call replay can be accessed by

dialing 877-344-7529 (US or Canada) or +1 412-317-0088

(International) and entering the passcode: 2834298.

About Mitek Systems, Inc.

Mitek (NASDAQ: MITK) is a global leader in digital access,

founded to bridge the physical and digital worlds. Mitek’s advanced

identity verification technologies and global platform make digital

access faster and more secure than ever, providing companies new

levels of control, deployment ease and operation, while protecting

the entire customer journey. With solutions trusted by 7,900

organizations around the world, including the majority of North

American financial institutions which rely on our mobile check

deposit solutions, Mitek helps companies reduce risk and meet

regulatory requirements. Learn more at www.miteksystems.com.

[(MITK-F)]

Follow Mitek on LinkedIn and YouTube, and read Mitek’s latest

blog posts here.

Notice Regarding Forward-Looking Statements

Statements contained in this news release relating to the

Company or its management’s intentions, hopes, beliefs,

expectations or predictions of the future, including, but not

limited to, statements relating to the Company’s fiscal 2025

guidance, are forward-looking statements. Such forward-looking

statements are subject to a number of risks and uncertainties,

including, but not limited to, risks related to the Company’s

ability to withstand negative conditions in the global economy, a

lack of demand for or market acceptance of the Company’s products,

the impact of the Company’s acquisition of HooYu Ltd. including any

operational or cultural difficulties associated with the

integration of the businesses of Mitek and HooYu Ltd., the

Company’s ability to continue to develop, produce and introduce

innovative new products in a timely manner, the Company’s ability

to capitalize on a growing market, quarterly variations in revenue,

the profitability of certain sectors of the Company, the

performance of the Company’s growth initiatives, the outcome of any

pending or threatened litigation or investigation, and the timing

of the implementation and launch of the Company’s products by the

Company’s signed customers.

Additional risks and uncertainties faced by the Company are

contained from time to time in the Company’s filings with the U.S.

Securities and Exchange Commission (SEC), including, but not

limited to, the Company’s Annual Report on Form 10-K for the fiscal

year ended September 30, 2024, as filed with the SEC on December

16, 2024 and its quarterly reports on Form 10-Q and current reports

on Form 8-K, which you may obtain for free on the SEC’s website at

www.sec.gov. Collectively, these risks and uncertainties could

cause the Company’s actual results to differ materially from those

projected in its forward-looking statements and you are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. The Company disclaims any

intention or obligation to update, amend or clarify these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

Note Regarding Use of Non-GAAP Financial Measures

This news release contains non-U.S. generally accepted

accounting principles (“GAAP”) financial measures for non-GAAP cost

of revenue, non-GAAP gross profit, non-GAAP gross margin, non-GAAP

net income, non-GAAP net income per share, non-GAAP operating

income, non-GAAP operating margin, adjusted EBITDA, adjusted EBITDA

margin and non-GAAP operating expense that exclude

acquisition-related costs and expenses, litigation and other legal

costs, executive transition costs, stock compensation expense,

non-recurring audit fees, enterprise risk, portfolio positioning

and other related costs, restructuring costs and amortization of

debt discount and issuance costs. These financial measures are not

calculated in accordance with GAAP and are not based on any

comprehensive set of accounting rules or principles. In evaluating

the Company’s performance, management uses certain non-GAAP

financial measures to supplement financial statements prepared

under GAAP. Management believes these non-GAAP financial measures

provide a useful measure of the Company’s operating results, a

meaningful comparison with historical results and with the results

of other companies, and insight into the Company’s ongoing

operating performance. Further, management and the Board of

Directors of the Company utilize these non-GAAP financial measures

to gain a better understanding of the Company’s comparative

operating performance from period-to-period and as a basis for

planning and forecasting future periods. Management believes these

non-GAAP financial measures, when read in conjunction with the

Company’s GAAP financial statements, are useful to investors

because they provide a basis for meaningful period-to-period

comparisons of the Company’s ongoing operating results, including

results of operations against investor and analyst financial

models, which helps identify trends in the Company’s underlying

business and provides a better understanding of how management

plans and measures the Company’s underlying business.

The Company has not provided a reconciliation of its forward

outlook for non-GAAP operating margin with its forward-looking GAAP

operating margin in reliance on the unreasonable efforts exception

provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company

is unable, without unreasonable efforts, to quantify share-based

compensation expense, which is excluded from our non-GAAP operating

margin, as it requires additional inputs such as the number of

shares granted and market prices that are not ascertainable due to

the volatility of the Company’s share price. Additionally, a

significant portion of the Company’s operations are in foreign

countries and the transactional currencies are primarily Euros and

British pound sterling and the Company is not able to predict

fluctuations in those currencies without unreasonable efforts. The

Company expects these items may have a potentially significant

impact on future GAAP financial results.

We define free cash flow as net cash provided by operating

activities, less cash used for purchases of property and equipment.

We define free cash flow margin as free cash flow as a percentage

of revenue. In addition to the reasons stated above, we believe

that free cash flow is useful to investors as a liquidity measure

because it measures our ability to generate or use cash in excess

of our capital investments in property and equipment in order to

enhance the strength of our balance sheet and further invest in our

business and potential strategic initiatives. A limitation of the

utility of free cash flow as a measure of our liquidity is that it

does not represent the total increase or decrease in our cash

balance for the period. We use free cash flow in conjunction with

traditional U.S. GAAP measures as part of our overall assessment of

our liquidity, including the preparation of our annual operating

budget and quarterly forecasts and to evaluate the effectiveness of

our business strategies. There are a number of limitations related

to the use of free cash flow as compared to net cash provided by

operating activities, including that free cash flow includes

capital expenditures, the benefits of which are realized in periods

subsequent to those when expenditures are made.

Mitek encourages investors to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures,

which it includes in press releases announcing quarterly financial

results, including this press release, and not to rely on any

single financial measure to evaluate Mitek’s business.

MITEK SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(amounts in thousands except

per share data)

Three Months Ended September

30,

Twelve Months Ended September

30,

2024

2023

2024

2023

Revenue

Software and hardware

$

18,341

$

15,291

$

81,872

$

88,374

Services and other

24,881

22,365

90,211

84,178

Total revenue

43,222

37,656

172,083

172,552

Operating costs and expenses

Cost of revenue—software and hardware

(exclusive of depreciation & amortization)

186

597

309

1,413

Cost of revenue—services and other

(exclusive of depreciation & amortization)

5,978

5,675

24,086

21,538

Selling and marketing

9,538

11,117

40,769

40,551

Research and development

6,073

6,484

34,642

28,988

General and administrative

9,908

13,212

52,993

43,338

Amortization and acquisition-related

costs

3,710

3,744

15,291

19,046

Restructuring costs

114

114

1,762

2,114

Total operating costs and expenses

35,507

40,943

169,852

156,988

Operating income (loss)

7,715

(3,287

)

2,231

15,564

Interest expense

2,364

2,401

9,259

9,063

Other income (expense), net

1,851

2,121

6,119

3,840

Income (loss) before income taxes

7,202

(3,567

)

(909

)

10,341

Income tax benefit (provision)

1,371

2,123

4,187

(2,314

)

Net income (loss)

$

8,573

$

(1,444

)

$

3,278

$

8,027

Net income (loss) per share—basic

$

0.19

$

(0.03

)

$

0.07

$

0.18

Net income (loss) per share—diluted

$

0.18

$

(0.03

)

$

0.07

$

0.17

Shares used in calculating net income

(loss) per share—basic

45,952

45,997

46,560

45,533

Shares used in calculating net income

(loss) per share—diluted

46,573

47,050

47,468

46,461

MITEK SYSTEMS, INC.

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(amounts in thousands except

share data)

September 30, 2024

September 30, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

93,456

$

58,913

Short-term investments

36,884

74,700

Accounts receivable, net

31,682

32,132

Contract assets, current portion

15,818

18,355

Prepaid expenses

4,514

3,513

Other current assets

2,697

2,396

Total current assets

185,051

190,009

Long-term investments

11,410

1,304

Property and equipment, net

2,564

2,829

Right-of-use assets

4,662

4,140

Goodwill and intangible assets

185,711

188,222

Deferred income tax assets

19,145

11,645

Contract assets, non-current portion

3,620

5,579

Other non-current assets

1,590

1,647

Total assets

$

413,753

$

405,375

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

7,236

$

7,589

Accrued payroll and related taxes

10,324

10,554

Accrued liabilities

424

26

Accrued interest payable

205

305

Income tax payables

162

4,329

Deferred revenue, current portion

21,231

17,360

Lease liabilities, current portion

805

1,902

Acquisition-related contingent

consideration

—

7,976

Other current liabilities

1,760

1,456

Total current liabilities

42,147

51,497

Convertible senior notes

143,601

135,516

Deferred revenue, non-current portion

753

957

Lease liabilities, non-current portion

4,230

2,867

Deferred income tax liabilities

3,889

6,476

Other non-current liabilities

4,332

2,874

Total liabilities

198,952

200,187

Stockholders’ equity:

Preferred stock, $0.001 par value,

1,000,000 shares authorized, none issued and outstanding

—

—

Common stock, $0.001 par value,

120,000,000 shares authorized, 44,998,939 and 45,591,199 issued and

outstanding, as of September 30, 2024 and September 30, 2023,

respectively

45

46

Additional paid-in capital

247,326

228,691

Accumulated other comprehensive loss

(2,302

)

(14,237

)

Accumulated deficit

(30,268

)

(9,312

)

Total stockholders’ equity

214,801

205,188

Total liabilities and stockholders’

equity

$

413,753

$

405,375

MITEK SYSTEMS, INC.

DISAGGREGATION OF REVENUE BY

PRODUCT AND TYPE

(Unaudited)

(amounts in thousands except

share data)

Three Months Ended September

30,

Twelve Months Ended September

30,

2024

2023

2024

2023

Deposits

Deposits software and hardware

Software

$

15,773

$

13,243

$

74,108

$

78,212

Hardware

—

—

—

—

Total deposits software and hardware

15,773

13,243

74,108

78,212

Deposits services

SaaS

1,799

1,281

6,406

4,299

Maintenance

5,846

5,511

22,275

20,710

Professional services / other

266

264

769

913

Total deposits services

7,911

7,056

29,450

25,922

Total deposits revenue

23,684

20,299

103,558

104,134

Identity

Identity software and hardware

Software

2,568

1,801

7,631

8,796

Hardware

—

247

133

1,366

Total identity software and hardware

2,568

2,048

7,764

10,162

Identity services

SaaS

16,188

14,178

57,182

55,149

Maintenance

463

723

2,074

1,910

Professional services / other

319

408

1,505

1,197

Total identity services

16,970

15,309

60,761

58,256

Total identity revenue

19,538

17,357

68,525

68,418

Total Revenue

$

43,222

$

37,656

$

172,083

$

172,552

MITEK SYSTEMS, INC.

NON-GAAP GROSS PROFIT

RECONCILIATION

(Unaudited)

(amounts in thousands)

Three Months Ended September

30,

Twelve Months Ended September

30,

2024

2023

2024

2023

Software and Hardware

Revenue

$

18,341

$

15,291

$

81,872

$

88,374

Cost of revenue (exclusive of depreciation

and amortization)

186

597

309

1,413

Depreciation and amortization

1,189

1,113

4,634

4,436

GAAP gross profit for software and

hardware

16,966

13,581

76,929

82,525

Depreciation and amortization

1,189

1,113

4,634

4,436

Non-GAAP gross profit for software and

hardware

$

18,155

$

14,694

$

81,563

$

86,961

GAAP gross margin for software and

hardware

92.5

%

88.8

%

94.0

%

93.4

%

Non-GAAP gross margin for software and

hardware

99.0

%

96.1

%

99.6

%

98.4

%

Services & Other

Services and other revenue

$

24,881

$

22,365

$

90,211

$

84,178

Cost of revenue (exclusive of depreciation

and amortization)

5,978

5,675

24,086

21,538

Depreciation and amortization

2,162

2,062

8,473

8,201

GAAP gross profit for services and

other

16,741

14,628

57,652

54,439

Depreciation and amortization

2,162

2,062

8,473

8,201

Stock-based compensation expense

127

152

574

468

Non-GAAP gross profit for services and

other

$

19,030

$

16,842

$

66,699

$

63,108

GAAP gross margin for services and

other

67.3

%

65.4

%

63.9

%

64.7

%

Non-GAAP gross margin for services and

other

76.5

%

75.3

%

73.9

%

75.0

%

Consolidated Results

Total revenue

$

43,222

$

37,656

$

172,083

$

172,552

Cost of revenue (exclusive of depreciation

and amortization)

6,164

6,272

24,395

22,951

Depreciation and amortization

3,351

3,175

13,107

12,637

GAAP gross profit

33,707

28,209

134,581

136,964

Depreciation and amortization

3,351

3,175

13,107

12,637

Stock-based compensation expense

127

152

574

468

Non-GAAP gross profit

$

37,185

$

31,536

$

148,262

$

150,069

GAAP gross margin

78.0

%

74.9

%

78.2

%

79.4

%

Non-GAAP gross margin

86.0

%

83.7

%

86.2

%

87.0

%

MITEK SYSTEMS, INC.

NON-GAAP OPERATING EXPENSE

RECONCILIATION

(Unaudited)

(amounts in thousands)

Three Months Ended September

30,

Twelve Months Ended September

30,

2024

2023

2024

2023

Selling and marketing

$

9,538

$

11,117

$

40,769

$

40,551

Non-GAAP adjustments:

Stock-based compensation expense

462

600

3,041

3,023

Non-GAAP Selling and marketing

$

9,076

$

10,517

$

37,728

$

37,528

Research and development

$

6,073

$

6,484

$

34,642

$

28,988

Non-GAAP adjustments:

Stock-based compensation expense

(383

)

660

3,368

2,757

Non-GAAP Research and

development

$

6,456

$

5,824

$

31,274

$

26,231

General and administrative

$

9,908

$

13,212

$

52,993

$

43,338

Non-GAAP adjustments:

Stock-based compensation expense

1,517

1,261

5,641

4,215

Litigation and other legal costs

251

250

3,496

1,369

Executive transition costs

599

7

2,632

679

Non-recurring audit fees

931

1,816

5,956

4,001

Enterprise risk, portfolio positioning and

other related costs

—

—

996

—

Non-GAAP General and

administrative

$

6,610

$

9,878

$

34,272

$

33,074

Total Non-GAAP Operating

Expense

$

22,142

$

26,219

$

103,274

$

96,833

MITEK SYSTEMS, INC.

STOCK-BASED COMPENSATION

EXPENSE

(Unaudited)

(amounts in thousands)

Three Months Ended September

30,

Twelve Months Ended September

30,

2024

2023

2024

2023

Cost of revenue

$

127

$

152

$

574

$

468

Selling and marketing

462

600

3,041

3,023

Research and development

(383

)

660

3,368

2,757

General and administrative

1,517

1,261

5,641

4,215

Total stock-based compensation

expense

$

1,723

$

2,673

$

12,624

$

10,463

MITEK SYSTEMS, INC.

NON-GAAP OPERATING INCOME

RECONCILIATION

(Unaudited)

(amounts in thousands)

Three Months Ended September

30,

Twelve Months Ended September

30,

2024

2023

2024

2023

GAAP operating income (loss)

$

7,715

$

(3,287

)

$

2,231

$

15,564

Non-GAAP adjustments:

Amortization of acquisition-related

intangibles

3,711

3,784

15,156

16,992

Net changes in estimated fair value of

acquisition-related contingent consideration

—

(38

)

136

2,056

Intellectual property litigation and other

legal costs

251

250

3,496

1,369

Executive transition costs

599

7

2,632

679

Stock-based compensation expense

1,723

2,673

12,624

10,463

Non-recurring audit fees

931

1,816

5,956

4,001

Enterprise risk, portfolio positioning and

other related costs

—

—

996

—

Restructuring costs

114

114

1,762

2,114

Non-GAAP operating income

(loss)

$

15,044

$

5,319

$

44,989

$

53,238

Revenue

$

43,222

$

37,656

$

172,083

$

172,552

Non-GAAP Operating Margin

35

%

14

%

26

%

31

%

MITEK SYSTEMS, INC.

GAAP NET INCOME TO ADJUSTED

EBITDA RECONCILIATION

(Unaudited)

(amounts in thousands except

per share data)

Three Months Ended September

30,

Twelve Months Ended September

30,

2024

2023

2024

2023

GAAP net income (loss)

$

8,573

$

(1,444

)

$

3,278

$

8,027

Add:

Income tax (benefit) provision

(1,371

)

(2,123

)

(4,187

)

2,314

Other (income) expense, net

(1,851

)

(2,121

)

(6,119

)

(3,840

)

Interest Expense

2,364

2,401

9,259

9,063

GAAP operating income (loss)

$

7,715

$

(3,287

)

$

2,231

$

15,564

Non-GAAP Adjustments

Depreciation and amortization

$

375

$

540

$

1,755

$

1,727

Amortization of intangibles

3,711

3,784

15,156

16,992

Net changes in estimated fair value of

acquisition-related contingent consideration

—

(38

)

136

2,056

Litigation and other legal costs

251

250

3,496

1,369

Executive transition costs

599

7

2,632

679

Stock-based compensation expense

1,723

2,673

12,624

10,463

Non-recurring audit fees

931

1,816

5,956

4,001

Enterprise risk, portfolio positioning and

other related costs

—

—

996

—

Restructuring costs

114

114

1,762

2,114

Adjusted EBITDA

$

15,419

$

5,859

$

46,744

$

54,965

Total revenue

$

43,222

$

37,656

$

172,083

$

172,552

Adjusted EBITDA margin

36

%

16

%

27

%

32

%

MITEK SYSTEMS, INC.

NON-GAAP NET INCOME

RECONCILIATION

(Unaudited)

(amounts in thousands except

per share data)

Three Months Ended September

30,

Twelve Months Ended September

30,

2024

2023

2024

2023

Net income (loss)

$

8,573

$

(1,444

)

$

3,278

$

8,027

Non-GAAP adjustments:

Amortization of acquisition-related

intangibles

3,711

3,784

15,156

16,992

Net changes in estimated fair value of

acquisition-related contingent consideration

—

(38

)

136

2,056

Litigation and other legal costs(1)

251

250

3,496

1,369

Executive transition costs

599

7

2,632

679

Stock-based compensation expense

1,723

2,673

12,624

10,463

Non-recurring audit fees

931

1,816

5,956

4,001

Enterprise risk, portfolio positioning and

other related costs(2)

—

—

996

—

Restructuring costs(3)

114

114

1,762

2,114

Amortization of debt discount and issuance

costs

2,112

1,937

8,169

7,546

Income tax effect of pre-tax

adjustments

(2,696

)

(1,002

)

(11,970

)

(10,115

)

Cash tax difference(4)

211

(1,175

)

3,151

1,235

Non-GAAP net income

$

15,529

$

6,922

$

45,386

$

44,367

Non-GAAP income per share—basic

$

0.34

$

0.15

$

0.97

$

0.97

Non-GAAP income per

share—diluted

$

0.33

$

0.15

$

0.96

$

0.95

Shares used in calculating non-GAAP net

income per share—basic

45,952

45,997

46,560

45,533

Shares used in calculating non-GAAP net

income per share—diluted

46,573

47,050

47,468

46,461

(1)

During the twelve months ended month

periods ended September 30, 2023 and September 30, 2024, our legal

team used third party legal experts to perform and provide advice

regarding a variety of activities including intellectual property

litigation matters and risk analysis and in providing support for

customers in their litigation, matters and options related to

getting our SEC filings current, the process for a potential

delisting from the Nasdaq Capital Market, ongoing litigation

support, and various other projects.

(2)

During the twelve months ended September

30, 2024, we used three third party experts to evaluate our product

portfolio positioning, competitive landscape, enterprise risk and

other related analyses.

(3)

Restructuring costs consist of employee

severance obligations and other related costs. Restructuring costs

were $1.8 million in the twelve months ended September 30, 2024 and

were related to expenses incurred to relocate employees and a

restructuring that occurred in the third quarter of fiscal 2024.

Restructuring costs were $2.1 million in the twelve months ended

September 30, 2023 and were related to a restructuring plan that

was initially implemented in June and November 2022.

(4)

The Company’s non-GAAP net income is

calculated using a cash tax rate of 9% in fiscal 2024 and 23% in

fiscal 2023. The estimated cash tax rate is the estimated annual

tax payable on the Company’s tax returns as a percentage of

estimated annual non-GAAP pre-tax net income. The Company uses an

estimated cash tax rate to adjust for the historical variation in

the effective book tax rate associated with the reversal of

valuation allowances, and the utilization of research and

development tax credits which currently have an overall effect of

reducing taxes payable. The Company believes that the cash tax rate

provides a more transparent view of the Company’s operating

results. The Company’s effective tax rate used for the purposes of

calculating GAAP net income for fiscal 2024 and 2023 was 461% and

22%, respectively.

MITEK SYSTEMS, INC.

NON-GAAP FREE CASH FLOW

RECONCILIATION

(Unaudited)

(amounts in thousands)

Twelve Months Ended September

30,

2024

2023

2022

Net cash provided by (used in)

operating activities

$

31,688

$

31,586

$

21,119

Less:

Purchases of property and equipment,

net

(1,438

)

(1,034

)

(1,126

)

Free Cash Flow

$

30,250

$

30,552

$

19,993

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241216914766/en/

Investor Contact: Todd Kehrli or Jim Byers MKR Investor

Relations, Inc. mitk@mkr-group.com

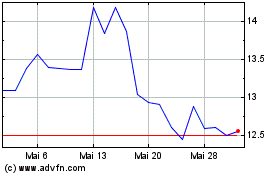

Mitek Systems (NASDAQ:MITK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Mitek Systems (NASDAQ:MITK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024