0000886744false00008867442025-01-132025-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 13, 2025

GERON CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

000-20859 |

75-2287752 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

919 E. HILLSDALE BLVD., SUITE 250

FOSTER CITY, CALIFORNIA 94404

(Address of principal executive offices, including zip code)

(650) 473-7700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 par value |

GERN |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02 |

Results of Operations and Financial Condition. |

Geron Corporation (the “Company” or “Geron”) will participate in various meetings with securities analysts and investors during the 43rd Annual J.P. Morgan Healthcare Conference the week of January 13, 2025, and will utilize a presentation handout during those meetings. Such presentation handout discloses that Geron expects to report that (i) net revenue from U.S. sales of RYTELO during the fourth quarter ended December 31, 2024 are expected to be approximately $45 million to $46 million, (ii) operating expenses for the year ended December 31, 2024 are expected to be approximately $250 million to $260 million, and (iii) cash, cash equivalents, restricted cash and marketable securities as of December 31, 2024 are expected to be approximately $500 million. The aforementioned financial information is included on slide #17 of the presentation handout, as furnished in Exhibit 99.1 to this Current Report, and is incorporated herein by reference. The Company has not yet completed its financial close process for the quarter and year ended December 31, 2024. These estimates of the Company’s net revenue, operating expenses and cash, cash equivalents, restricted cash and marketable securities for the applicable 2024 periods presented are preliminary, unaudited and are subject to change upon completion of the Company’s financial statement closing procedures and the audit of the Company’s consolidated financial statements.

|

|

Item 7.01 |

Regulation FD Disclosure. |

Geron will participate in various meetings with securities analysts and investors during the 43rd Annual J.P. Morgan Healthcare Conference the week of January 13, 2025, and will utilize a presentation handout during those meetings. The presentation handout, together with a slide setting forth certain cautionary language intended to qualify the forward-looking statements included in the presentation handout, is furnished as Exhibit 99.1 to this Current Report and is incorporated herein by reference. The presentation handout will also be made available in the Investors section of Geron’s website, located at www.geron.com.

The information contained in Items 2.02 and 7.01 and in the accompanying Exhibit 99.1 to this Current Report shall be deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act, and shall not be incorporated by reference into any filing made by the Company with the U.S. Securities and Exchange Commission under the Securities Act or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

GERON CORPORATION

|

|

|

|

|

Date: |

January 13, 2025 |

|

By: |

/s/ Scott A. Samuels |

|

|

|

Name: |

Scott A. Samuels |

|

|

|

Title: |

Executive Vice President, |

|

|

|

|

Chief Legal Officer and |

|

|

|

|

Corporate Secretary |

Corporate Presentation Our mission is to change lives by changing the course of blood cancer January 2025 Our mission is to change lives by changing the course of blood cancer

Forward-Looking Statements Except for the historical information contained herein, this presentation contains forward-looking statements made pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such statements, include, without limitation, those regarding: (i) the Company’s belief that RYTELO is a highly differentiated treatment with blockbuster potential for eligible LR-MDS patients, including the potential to achieve $1B+ in net revenue; (ii) the Company’s estimate of net revenues for the fourth quarter of 2024; (iii) the Company’s views, estimates and expectations concerning the commercial launch of RYTELO, including the size of market opportunity and ability to compete for market share; (iv) the Company’s assumptions and expectations regarding the expected commercial opportunity for RYTELO in R/R MF; (v) the Company’s projections of its ability to reach profitability without the need for additional financing if internal revenue and operating expense expectations are met; (vi) the potential for differentiated benefits associated with RYTELO’s mechanism of action; (vii) the Company’s views, estimates and expectations concerning the commercial launch of RYTELO, including size of market opportunity and ability to compete for market share; (viii) the potential impact on clinical decision-making, prescriber behavior, and reimbursement decisions of the inclusion of RYTELO in the NCCN Guidelines as a Category 1 and 2A treatment of symptomatic anemia in patients with lower-risk MDS and the favorability of RYTELO’s U.S. labeling; (ix) the market opportunity for RYTELO and the estimated treatment-eligible patient populations in LR-MDS and R/R MF; (x) the trajectory of RYTELO’s U.S. commercial launch, including breadth of prescriber penetration and payor coverage and product utilization across lines of therapy and RS status; (xi) that the Phase 3 IMpactMF trial has registrational intent and that an interim analysis is expected in early 2026 and a final analysis is expected in early 2027, together with the assumptions used in making these estimates; (xii) the status, plans and expected timing of the Company’s clinical programs on its pipeline chart; (xiii) the Company’s estimates of net revenues in the fourth quarter of 2024, operating expenses in 2024, and cash and marketable securities as of December 31, 2024; (xiv) that certain potential future events represent opportunities for value creation, including potential EU approval in LR-MDS, expected launch in select EU countries in LR-MDS, results from the expected interim and final analyses of the Company’s Phase 3 R/R MF trial, and results from the expected analysis of the Company’s Phase 1 IMprove MF trial; (xv) the significance of RYTELO’s commercial opportunity in LR-MDS as driven by Phase 3 IMerge data, favorability of U.S. Prescribing Information, and NCCN guidelines; (xvi) the expected length of regulatory, market and patent exclusivity and plans to file for patent term extension in the EU; (xvii) the potential for RYTELO to offer differentiated clinical benefits and become a second-line therapy of choice across LR-MDS patients irrespective of ring sideroblast status or high transfusion burden, including sustained and durable transfusion independence, increases in hemoglobin levels, and improvement in patient-reported fatigue, all within a well-characterized safety profile of generally manageable cytopenias; (xviii) the potential for LR-MDS patients who had prior treatment with luspatercept to experience clinical benefit from imetelstat treatment; (xix) the suggestion that imetelstat demonstrates clinical activity regardless of number or type of prior therapies; (xx) the association of clinical benefit and reduction of disease markers in imetelstat-treated MF and MDS patients; (xxi) any projections of revenue, patient populations, commercial opportunity and similar forecasts, along with the underlying assumptions; and (xxii) other statements that are not historical facts, constitute forward-looking statements. These forward-looking statements involve risks and uncertainties that can cause actual results to differ materially from those in such forward-looking statements. These risks and uncertainties, include, without limitation, risks and uncertainties related to: (a) whether Geron is successful in commercializing RYTELO (imetelstat) for the treatment of certain patients with LR-MDS with transfusion dependent anemia; (b) whether the European Commission will approve RYTELO for the treatment of patients with LR-MDS with transfusion dependent anemia and whether the FDA and European Commission will approve imetelstat for other indications on the timelines expected, or at all; (c) whether Geron overcomes potential delays and other adverse impacts caused by enrollment, clinical, safety, efficacy, technical, scientific, intellectual property, manufacturing and regulatory challenges in order to have the financial resources for and meet expected timelines and planned milestones; (d) whether regulatory authorities permit the further development of imetelstat on a timely basis, or at all, without any clinical holds; (e) whether RYTELO (imetelstat) may cause, or have attributed to it, adverse events that could delay or prevent the commencement and/or completion of clinical trials, impact its regulatory approval, or limit its commercial potential; (f) whether the IMpactMF Phase 3 trial for R/R MF has a positive outcome and demonstrates safety and effectiveness to the satisfaction of the FDA and international regulatory authorities, and whether the Company’s projected rates for enrollment and death events differ from actual rates, which may cause the interim and final analyses to occur later than anticipated; (g) whether any future safety or efficacy results of RYTELO treatment cause its benefit-risk profile to become unacceptable; (h) whether imetelstat actually demonstrates disease-modifying activity in patients and the ability to target the malignant stem and progenitor cells of the underlying disease; (i) whether Geron meets its post-marketing requirements and commitments in the U.S. for RYTELO; (j) whether there are failures or delays in manufacturing or supplying sufficient quantities of RYTELO (imetelstat) or other clinical trial materials that impact commercialization of RYTELO or the continuation of the IMpactMF trial and other trials; (k) whether Geron is able to establish and maintain effective sales, marketing and distribution capabilities, obtain adequate coverage and third-party payor reimbursement, and achieve adequate acceptance in the marketplace; (l) whether Geron is able to obtain and maintain the exclusivity terms and scopes provided by patent and patent term extensions, regulatory exclusivity, and have freedom to operate; (m) that Geron may be unable to successfully commercialize RYTELO due to competitive products, or otherwise; (n) that Geron may decide to partner and not to commercialize independently in the U.S. or in Europe and other international markets; (o) whether Geron stays in compliance with and satisfies its obligations under its debt and synthetic royalty agreements; and (p) the impact of general economic, industry or political climate in the U.S. or internationally and the effects of macroeconomic conditions on the Company’s business and business prospects, financial condition and results of operations. Additional information on the above risks and uncertainties and additional risks, uncertainties and factors that could cause actual results to differ materially from those in the forward-looking statements are contained in Geron’s filings and periodic reports filed with the Securities and Exchange Commission under the heading “Risk Factors” and elsewhere in such filings and reports, including Geron’s report on Form 10-Q for the quarter ended September 30, 2024, and subsequent filings and reports by Geron. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made, and the facts and assumptions underlying the forward-looking statements may change. Except as required by law, Geron disclaims any obligation to update these forward-looking statements to reflect future information, events, or circumstances.

A first-in-class telomerase inhibitor with a unique mechanism of action representing a highly differentiated treatment with blockbuster potential for eligible U.S. patients with lower-risk myelodysplastic syndromes (LR-MDS)* *RYTELO (imetelstat) is approved by FDA for adults with low- to intermediate-1 risk MDS with transfusion-dependent anemia requiring four or more red blood cell units over 8 weeks who have not responded to or have lost response to or are ineligible for erythropoiesis-stimulating agents (ESAs). See U.S. Prescribing Information and Medication Guide: https://pi.geron.com/products/US/pi/rytelopi.pdf

U.S. RYTELO commercial launch off to a very strong start: $28.2M Q3 2024 net revenues $45M-$46M Q4 2024 estimated net revenues* LR-MDS represents a potential blockbuster market opportunity for RYTELO based on high unmet need and significant product differentiation Phase 3 trial in JAKi R/R MF with overall survival (OS) primary endpoint is 75% enrolled; if positive, an approval in this indication would potentially double the RYTELO commercial opportunity Expect to reach profitability without additional financing if current internal sales and opex expectations are met LR-MDS = lower-risk myelodysplastic syndromes; JAKi R/R MF= Janus kinase inhibitor relapsed/refractory myelofibrosis *The estimate of net revenues is preliminary and unaudited and is subject to change upon completion of the Company’s financial statement closing procedures and the audit of the Company’s consolidated financial statements. Geron’s Value Drivers

Based on Nobel-Prize winning science, imetelstat is wholly owned by Geron Telomerase Inhibition Represents a Novel MOA with �Unique Benefits Scientific evidence suggests reduction in proliferation of malignant cells �and production of new healthy cells drive differentiated clinical benefits* Imetelstat binds to telomerase, inhibiting its activity Imetelstat Telomerase increased in malignant cells Malignant clones Upregulated telomerase Apoptosis of malignant cells and recovery of effective hematopoiesis Apoptotic �malignant �clones MOA = mechanism of action *Robinson NJ, Schiemann WP. Telomerase in Cancer: Function, Regulation, and Clinical Translation. Cancers. 2022;14(3):808; Schrank Z, Khan N, Osude C, et al. Oligonucleotides Targeting Telomeres and Telomerase in Cancer. Molecules. 2018;23(9):2267; Platzbecker U and Santini V, et al. The Lancet, 2024. https://doi.org/10.1016/S0140-6736(23)01724-5; Tefferi A et al. A Pilot Study of the Telomerase Inhibitor Imetelstat for Myelofibrosis. NEJM. 2015;373:908-919; Mascarenhas et al. Randomized, Single-Blind, Multicenter Phase II Study of Two Doses of Imetelstat in Relapsed or Refractory Myelofibrosis. JCO. 2021 Sep 10;39(26):2881-2892. Santini et al. Disease Modifying Activity of Imetelstat in Patients with Heavily Transfused Non-Del(5q) Lower-Risk Myelodysplastic Syndromes Relapsed/Refractory to Erythropoiesis Stimulating Agents in IMerge Phase 3. EHA 2023.

Strong U.S. Launch in LR-MDS with Significant Commercial Opportunity

LR-MDS = lower-risk myelodysplastic syndromes; ESA ineligible = erythropoiesis-stimulating agent ineligible (serum EPO level > 500 mU/mL); RS = ring sideroblast�*RYTELO (imetelstat) is approved by the Food and Drug Administration (FDA) for adults with low- to intermediate-1 risk MDS with transfusion-dependent anemia requiring four or more red blood cell units over 8 weeks who have not responded to or have lost response to or are ineligible for erythropoiesis-stimulating agents (ESAs). See U.S. Prescribing Information and Medication Guide: https://pi.geron.com/products/US/pi/rytelo_pi.pdf ^National Comprehensive Cancer Network® (NCCN®) makes no warranties of any kind whatsoever regarding their content, use or application and disclaims any responsibility for their application or use in any way. Favorable U.S. Label and NCCN Guidelines Position RYTELO to Compete for Significant Market Segments in LR-MDS 3rd line & later RS+(~25%) RS-(~75%) Market Segments Consistent With the FDA Label* MDS NCCN Guidelines^ 2nd line RS+(~25%) RS-(~75%) Category 1 treatment in �2nd line RS+/RS- patients regardless of prior treatment ESA Ineligible (~20%) 1st line Category 2A treatment �for 1st line ESA-ineligible�RS+/RS- patients

Sources: 2025 patient volumes based on IQVIA projected claims 2023, DRG LR MDS incidence projected growth rate (2022) *Assuming the duration of therapy observed in IMerge Phase 3 clinical trial (~8mo) and current net price Large U.S. Market Opportunity with Blockbuster Potential for RYTELO in LR-MDS ESA Ineligible: ~3,400 ∼ 16,800 ∼ 7,600 ∼ 4,400 ESA Eligible: ~13,400 RS-: ~5,700 RS+: ~1,900 RS+: ~1,100 RS-: ~3,300 ∼45% �1L patients expected �to progress to 2L treatment in 2025 ∼59% �2L patients expected to progress to 3L treatment in 2025 2025 U.S. RYTELO Treatment-Eligible Population Consistent with U.S. Label Potential for $1B+ in net revenue by treating only 1/3 of treatment-eligible patients* ~15,400 Treatment-eligible �LR-MDS patients consistent with FDA label in 2025

RYTELO U.S. Launch Off to a Strong Start Broad Payor Coverage ~80% �payor coverage as of the end of Q4 2024^ Permanent J-Code effective �as of Jan. 1, 2025 Breadth of Prescriptions ~590 ordering centers from launch through Q4 2024, representing ~70% of our �key targeted accounts Strong Early Launch Trajectory $28.2M Q3 2024 net revenue Utilization across 1L ESA ineligible, 2L and 3L patients (RS+/RS-) $45-$46M Q4 2024 estimated net revenue* *The estimate of net revenues is preliminary and unaudited and is subject to change upon completion of the Company’s financial statement closing procedures and the audit of the Company’s consolidated financial statements. ^Payors responsible for ~80% U.S. covered lives have implemented RYTELO medical coverage policies consistent with FDA label, clinical trials and/or NCCN Guidelines through Q4 2024

Compelling Opportunity in JAKi R/R Myelofibrosis

Source: US IQVIA Claims through 2023 (MF Market Sizing Report delivered March 2024); DRG Epi (2022 Report) Growth Rates applied through 2040 *Patient estimates as of 2028. Phase 3 Trial in JAKi R/R MF Would Potentially Double the RYTELO Commercial Opportunity, if Positive ~12,000 U.S. JAKi naïve / well-controlled MF patients �(currently only 3 approved treatments – all JAK inhibitors) 75% of those JAKi treated patients fail �or discontinue treatment Potential�to treat U.S. JAKi R/R MF patients* ~10,000

Mascarenhas et al. Randomized, Single-Blind, Multicenter Phase II Study of Two Doses of Imetelstat in Relapsed or Refractory Myelofibrosis. JCO. 2021 Sep 10;39(26):2881-2892; . Kuykendall AT, Shah S, Talati C et al. Between a rux and a hard place: evaluating salvage treatment and outcomes in myelofibrosis after ruxolitinib discontinuation. Ann. Hematol. 97(3), 435–441 (2018).; Mascarenhas J, Mehra M, He J, Potluri R, Loefgren C. Patient characteristics and outcomes after ruxolitinib discontinuation in patients with myelofibrosis. J. Med. Econ. 23(7), 721–727 (2020).; Newberry K, Patel K, Masarova L et al. Clonal evolution and outcomes in myelofibrosis after ruxolitinib discontinuation. Blood 130(9),1125–1131 (2017).; Palandri F, Breccia M, Bonifacio M et al. Life after ruxolitinib: reasons for discontinuation, impact of disease phase, and outcomes in 218 patients with myelofibrosis. Cancer 126(6), 1243–1252 (2020).; 6. Schain F, Vago E, Song C et al. Survival outcomes in myelofibrosis patients treated with ruxolitinib: a population-based cohort study in Sweden and Norway. Eur. J. Haematol. 103(6), 614–619 (2019) IMbark Phase 2 data compared to real world data (RWD) from a closely-matched cohort of patients at the Moffitt Cancer Center who had discontinued ruxolitinib and were subsequently treated with best available therapy (BAT) 29.9 months median OS Survival Probability 33.8 mos 12.0 mos BAT Moffitt Imetelstat 9.4 mg/kg Median OS in Phase 2 IMbark Compares Favorably Historical Controls (11-16 months) Median OS More than Double Compared to BAT in RWD Study Kuykendall et al. Favorable overall survival with imetelstat in relapsed/refractory myelofibrosis patients compared with real‑world data. Ann Hematol. 2022 Jan;101(1):139-146. RWD BAT vs. Imetelstat 9.4 mg/kg Survival Probability ClinicalTrials.gov Identifier: NCT02426086

INT-1/INT-2/HR MF = Intermediate-1/Intermediate-2/High Risk MF; TSS = total symptom score; SVR = spleen volume reduction; PROs = patient-reported outcomes *These projections are based on expectations about event rates (deaths) and enrollment, which can change over time and may differ from our current expectations # imetelstat salt form ^Best available therapies include hydroxyurea, corticosteroids, danazol, and others Phase 3 IMpactMF Trial Designed to Confirm Strong �OS Signal Observed in Phase 2 Study ClinicalTrials.gov Identifier: NCT04576156 Interim Analysis expected early 2026* Final Analysis expected early 2027* 75% Enrolled as of December 2024 Primary Endpoint: OS Secondary Endpoints: TSS (≥ 50%) at week 24, SVR (≥35%) at week 24, PROs, safety Imetelstat 9.4mg/kg IV# every 3 weeks (n ~214) Best Available �Therapy^ (n ~106) INT-1/INT-2/HR MF R/R to JAKi (n=320)

Development Pipeline

LR-MDS: lower-risk myelodysplastic syndromes; EU = European Union; R/R MF: relapsed/refractory myelofibrosis; MF: myelofibrosis; R/R AML: relapsed/refractory acute myeloid leukemia; HR-MDS: higher-risk myelodysplastic syndromes; TI: telomerase inhibitor *RYTELO (imetelstat) is approved by the FDA for adults with low- to intermediate-1 risk MDS with transfusion-dependent anemia requiring four or more red blood cell units over 8 weeks who have not responded to or have lost response to or are ineligible for erythropoiesis-stimulating agents (ESAs). See U.S. Prescribing Information and Medication Guide: https://pi.geron.com/products/US/pi/rytelo_pi.pdf ^These projections are based on expectations about event rates (deaths) and enrollment, which can change over time and may differ from our current expectations Exploring the Potential of Telomerase Inhibition Across Multiple Hematologic Malignancies Indications Discovery Preclinical Phase 1 Phase 2 Phase 3 Approved LR-MDS Single Agent R/R MF Single Agent Frontline MF Combination Therapy R/R AML & HR-MDS Single Agent R/R AML Combination Therapy Next Generation �TI Program IMpactMF IMproveMF IMpress TELOMERE* Ongoing; Investigator Led Planned; Investigator Led Ongoing; Company Sponsored Interim Analysis est. early 2026^ Final Analysis est. early 2027^ Dosing schedule modified for second cohort of patients August 2024 Leads identified; optimization ongoing Progressed to Part 2, designed to confirm the safety profile of imetelstat 9.4 mg/kg in combination with ruxolitinib To follow single agent data from IMpress EU approval expected 1H 2025 Approved in the U.S.*

Positioned for Profitability Without Additional Financing

*The estimate of net revenues is preliminary and unaudited and is subject to change upon completion of the Company’s financial statement closing procedures and the audit of the Company’s consolidated financial statements. Financial Overview Q3 2024 net �product revenue $28.2M Cash and marketable securities as of 12/31/24* ~$500M 2024 expected �OpEx range* $250M to $260M Net Revenue Cash Balance Operating Expenses $45-46M Q4 2024 estimated net product revenue* 2025 expected �OpEx range $270M to $285M Expect to Reach Profitability without Additional Financing if �Current Internal Sales and OpEx Expectations Are Met

Thank you! Contact: Investor Relations�investor@geron.com 18

Appendix

Multiple Opportunities to �Fuel Growth in 2025 & Beyond June 2024 FDA approval & U.S. launch of RYTELO in LR-MDS Q3 2024 $28.2M product revenue in first full commercial quarter Dec 2024 Positive CHMP opinion in LR-MDS 1H 2025 EU approval in LR-MDS Early 2026 Ph3 interim analysis in R/R MF* 2026 Primary analysis from Ph1 IMproveMF Early 2027 Ph3 final analysis �in R/R MF* Nov 2024 Secured up to $375M in �non-equity financings 2026 Launch in select EU countries in LR-MDS 2024 ACHIEVEMENTS EXPECTED OPPORTUNITIES FOR VALUE CREATION FDA = U.S. Food & Drug Administration; LR-MDS = lower-risk myelodysplastic syndromes; CHMP = Committee for Medicinal Products for Human Use; EU= European Union; R/R MF = relapsed/refractory myelofibrosis *These projections are based on expectations about event rates (deaths) and enrollment, which can change over time and may differ from our current expectations

LR-MDS Represents a �Significant Commercial Opportunity for RYTELO Phase 3 IMerge data, FDA label and NCCN Guidelines position RYTELO as highly differentiated treatment

If PTE Applied to COM3 COM Patent Term +2 years6 1. New Chemical Entity (NCE) exclusivity for 5 years after first approval. 2. Orphan drug exclusivity in U.S. for 7 years after any indication. 3. U.S. Patent Term Extension (PTE) can only be applied to one patent; if our composition of matter (COM), expected to confer exclusivity through December 2030, but if applied to our methods of use (MOU) patent, expected to confer exclusivity through August 2037 and may apply to all approved uses covered by the patent, i.e., both MDS and MF (if approved), under 35 USC 156(b)(2). 4. New Active Substance (NAS) exclusivity for 10 years after approval. 5. Orphan drug exclusivity in EU for 10 years after approval. 6. Pediatric exclusivity of 2 years could be added for successful completion of PIP. 7. PTE could extend EU patent term by as much as 5 years. Exclusivity for LR-MDS Expected into 2037 in the U.S. and 2038 in the EU Strong IP Position for RYTELO Supports Commercial Opportunity Expected Regulatory Exclusivities and Patent Terms If PTE Applied to MOU3 Mar 2033 Dec 2025 Dec 2030 Jun �2024 Jun �2031 Jun �2024 Jun �2029 U.S. Data/Market Exclusivity1 Patent Term Patent Term Extension (PTE) Orphan Drug Exclusivity Data/Market Exclusivity EU Data/Market Exclusivity4 EU Orphan Drug Exclusivity5 Q1 �2025 Q1� 2025 Q1 �2035 PTE7 US PTE Applications filed in U.S. for RYTELO patents PTE review can take years Strategy to retain optionality on PTE applications until review is completed RYTELO patents listed in FDA’s Orange Book Plans to file in the EU for PTE following expected MAA approval U.S. Methods of Use (MOU) Patent (MDS and MF) EU EU Methods of Use Patent (MDS) Aug 2037 TBD 2038 U.S. Orphan Drug Exclusivity2 Nov 2033

Thrombocytopenia Neutropenia Infusion-Related Reactions Embryo-Fetal Toxicity Warning and Precautions See U.S. Prescribing Information and Medication Guide: https://pi.geron.com/products/US/pi/rytelo_pi.pdf *imetelstat active moiety Favorable U.S. Prescribing Information for RYTELO �Supports Significant Market Opportunity RYTELO is indicated for the treatment of adult patients with low- to intermediate-1 risk myelodysplastic syndromes (MDS) with transfusion-dependent anemia requiring 4 or more red blood cell units over 8 weeks who have not responded to or have lost response to or are ineligible for erythropoiesis-stimulating agents (ESA). Indication and Usage No boxed warning No REMS program No contraindications 7.1 mg/kg* administered as an intravenous infusion over 2 hours every 4 weeks Recommended Dosage Most common adverse reactions (incidence ≥10% with a difference between arms of >5% compared to placebo), including laboratory abnormalities are decreased platelets, decreased white blood cells, decreased neutrophils, increased AST, increased alkaline phosphatase, increased ALT, fatigue, prolonged partial thromboplastin time, arthralgia/myalgia, COVID-19 infections, and headache. Adverse Reactions Complete blood counts and liver function tests are required, as detailed in the PI.

*Poor probability to respond to immunosuppressive therapy (IST) RS = ring sideroblast; ESA = erythropoietin stimulating agents; EPO = erythropoietin; HMA = hypomethylating agents; G-CSF = granulocyte-colony stimulating factor; NCCN Guidelines® = NCCN Clinical Practice Guidelines in Oncology # National Comprehensive Cancer Network® (NCCN®) makes no warranties of any kind whatsoever regarding their content, use or application and disclaims any responsibility for their application or use in any way. NCCN Guidelines®# Guide Clinical, Formulary and Treatment �Pathway Decision-Making and Position Imetelstat as 2nd Line Therapy of Choice MDS NCCN Guidelines include imetelstat for use in both RS+ and RS- 1st-line ESA ineligible patients�and in both RS+ and RS- 2nd-line patients, regardless of prior 1st line-treatment Treatment of Symptomatic Anemia in Patients �with LR-MDS In 1st line, �imetelstat is a Category 2A treatment for �RS+ and RS- ESA-ineligible patients 1ST�Line 2ND�Line RS- serum EPO� >500 mU/mL* serum EPO �≤500 mU/mL azacitidine (preferred) ESA (preferred) luspatercept Category 2a (preferred) imetelstat Category 2a Other HMA ivosidenib or olutasidenib or clinical trial �(if mIDH1) imetelstat Category 1 (preferred) ESA +/- G-CSF lenalidomide RS+ serum EPO �>500 mU/mL serum EPO �≤500 mU/mL luspatercept Category 1 (preferred) imetelstat Category 2a imetelstat Category 1 (preferred) ESA +/- G-CSF or luspatercept Category 2a (preferred, �if not previously used) 2+�Line luspatercept Category 1 (preferred, �if not previously used) ivosidenib (if MIDH1) or olutasidenib (if MIDH1) (Category 2b) azacitidine (preferred) Other HMA Consider lenalidomide Clinical trial or �consider allo-HCT �(if no MIDH1) luspatercept Category 1 (preferred) imetelstat Category 2a (preferred, �if not previously used) or or or In 2nd line, imetelstat is a Category 1 treatment for RS+ �and RS-patients regardless of prior treatment

8, 24-week data cut off was October 2022; 1-year represents 3 additional months of data (cut off January 2023) P-value is based on Cochran Mantel Haenszel test stratified for prior RBC transfusion burden (≤6 units or >6 units of RBCs/8 weeks) and baseline IPSS risk score (Low or Intermediate-1) 8-week TI = proportion of patients without any RBC transfusion for at least eight consecutive weeks since entry to the trial; 24-week TI = proportion of patients without any RBC transfusion for at least 24 consecutive weeks since entry to the trial; 1-year TI = proportion of patients without any RBC transfusion for at least 52 consecutive weeks since entry to the trial Platzbecker U and Santini V, et al. The Lancet, 2024. https://doi.org/10.1016/S0140-6736(23)01724-5 Durable Red Blood Cell Transfusion Independence �and Response Rates Differentiate Imetelstat Percentage of Patients (%) P<0.001 Nominal P=0.002 Imetelstat (n=118) Placebo (n=60) P<0.001 52 weeks median duration 80 weeks median duration 123 weeks median duration (exploratory endpoint) (secondary endpoint) (primary endpoint)

Platzbecker U and Santini V, et al. The Lancet, 2024. https://doi.org/10.1016/S0140-6736(23)01724-5. Meaningful Hemoglobin Rises and Reduction in �Transfusions Observed with Imetelstat 3.6 g/dL median Hgb rise in 8-week RBC-TI responders ≥4U/8 weeks transfusion reduction in ~60% of imetelstat-treated patients Nominal P-value is based on a mixed model for repeated measures with change in RBC transfusion as the dependent variable, week, stratification factors, prior transfusion burden, and treatment arm as the independent variables with autoregressive moving average (ARMA(1,1) covariance structure. NOTE: graph starts at Week 1-8 with the number of the patients with transfusion follow-up data available at least eight weeks on study for imetelstat and placebo arms Number of patients The mean changes from the minimum Hgb of the values that were after 14 days of transfusions in the 8 weeks prior to the first. Data points that have fewer than four patients are not shown. Nominal P-value is based on a mixed model for repeated measures with Hgb change as the dependent variable, week, stratification factors, dose date, and treatment arm as the independent variables with autoregressive moving average (ARMA(1,1) covariance structure. Number of patients Mean Change in HGB (g/dL; +/- SE) Imetelstat Placebo Mean Change in RBC Transfusion (units; +/- SE) Imetelstat Placebo Weeks Weeks Nominal P<0.001 Nominal P=0.042

RBC-TI = red blood cell trainsfusion-independence Exploratory Analysis; Cochran Mantel Haenszel test stratified for prior RBC transfusion burden (≤6 units or >6 units of RBCs/8 weeks) and baseline IPSS risk score (Low or Intermediate-1) ^ One patient on imetelstat arm missing RS category Platzbecker U and Santini V, et al. The Lancet, 2024. https://doi.org/10.1016/S0140-6736(23)01724-5. Consistent Responses Observed Across MDS �Subgroups with Imetelstat (≥ 8-week RBC-TI Responses) Imetelstat,� n/N (%) Placebo, n/N (%) % Difference (95% CI) Overall 47/118 (39⋅8) 9/60 (15⋅0) 24⋅8 (9⋅9–36⋅9) WHO category^ RS+ 33/73 (45⋅2) 7/37 (18⋅9) 26⋅3 (5⋅9–42⋅2) RS- 14/44 (31⋅8) 2/23 (8⋅7) 23⋅1 (-1⋅3 to 40⋅6) Prior RBC transfusion burden per IWG 2006 4-6 U/8 week 28/62 (45⋅2) 7/33 (21⋅2) 23⋅9 (1⋅9–41⋅4) >6 U/8 week 19/56 (33⋅9) 2/27 (7⋅4) 26⋅5 (4⋅7–41⋅8) IPSS risk category Low 32/80 (40⋅0) 8/39 (20.5) 19⋅5 (-0⋅1 to 35⋅2) Intermediate-1 15/38 (39⋅5) 1/21 (4⋅8) 34⋅7 (8⋅8–52⋅4) Baseline sEPO ≤500 mU/mL 39/87 (44⋅8) 7/36 (19⋅4) 25⋅4 (5⋅27–40⋅70) >500 mU/mL 7/26 (26⋅9) 2/22 (9⋅1) 17⋅8 (-8⋅17 to 40⋅25) -20 -10 0 10 20 30 40 50 60 Favors Imetelstat Favors Placebo

Exploratory analysis in the supplemental appendix of The Lancet: Platzbecker U and Santini V, et al. The Lancet, 2024. https://doi.org/10.1016/S0140-6736(23)01724-5. Improvement in Patient-Reported Fatigue Associated with �Clinical Responses with Imetelstat Per Exploratory Analysis Meaningful patient-reported fatigue improvements in 8 and 24-week RBC-TI responders Sustained meaningful improvement in fatigue reported in imetelstat-treated patients Patients, n/N Responders 33/47 3/9 24/33 1/2 50/75 13/31 Nonresponders 26/71 20/48 35/85 22/55 9/43 10/26 Kaplan-Meier estimate of time to first sustained meaningful improvement in the FACIT Fatigue score. HR is from the Cox proportional hazard model, stratified by prior RBC transfusion burden (≥4 to ≤6 vs >6 RBC units/8-weeks during a 16-week period prior to randomization) and baseline IPSS risk category (low vs intermediate-1), with treatment as the only covariate. Sustained Improvement in FACIT-Fatigue, % 100 90 80 70 60 50 40 30 20 10 0 Number at risk Time to first sustained improvement in the FACIT-Fatigue score, weeks 0 110 100 90 80 70 60 50 40 30 20 10 120 115 1 3 5 6 7 12 16 19 28 54 78 1 Imetelstat Placebo 56 0 1 1 4 7 10 14 16 32 40 Placebo Imetelstat Placebo: Imetelstat: 65.0 28.3 Censored HR=1.34 (95% CI, 0.82–2.20) Median time-to-episode (weeks) Sustained Improvement for ≥2 cycles 0% 20% 40% 60% 80% Patients, % 50.0% 40.4% Imetelstat Placebo

1. Platzbecker U and Santini V, et al. The Lancet, 2024. https://doi.org/10.1016/S0140-6736(23)01724-5. 2. Platzbecker U, Santini V, Zeidan AM, Sekeres MA, Fenaux P, Raza A, et al. Effect of Prior Treatments on the Clinical Activity of Imetelstat in Transfusion-Dependent Patients with Erythropoiesis-Stimulating Agent, Relapsed or Refractory/Ineligible Lower-Risk Myelodysplastic Syndromes. �66th American Society of Hematology (ASH) Annual Meeting and Exposition; December 2024; Presentation 352 ESA R/R/Ineligible LR-MDS Patients With Prior Luspatercept Treatment Experienced Clinical Benefit from Imetelstat Treatment Clinical activity of imetelstat was evident across lines of prior therapy (including luspatercept, lenalidomide and HMA) regardless of prior response �status, suggesting �that imetelstat demonstrates clinical activity regardless of number or type of prior therapies

These are familiar adverse reactions for hematologists who are experienced with managing cytopenias Well-Characterized Safety Profile with Generally Manageable �and Short-Lived Thrombocytopenia and Neutropenia Consistent with prior clinical experience, the most common imetelstat AEs were hematologic AEs were generally manageable with supportive care and dose modifications 74% of patients treated with imetelstat had dose modifications; mostly due to grade 3–4 neutropenia �and thrombocytopenia <15% of patients discontinued treatment due to TEAEs generally late in treatment (median 21.1 weeks) Non-hematologic AEs were generally low grade No cases of Hy’s Law or drug-induced liver injury observed Clinically relevant adverse reactions in < 5% of patients who received imetelstat included febrile neutropenia, sepsis, gastrointestinal hemorrhage, and hypertension AEs (≥10% of patients), n (%) Imetelstat (N=118) Placebo (N=59) Any Grade Grade 3–4 Any Grade Grade 3–4 Hematologic Thrombocytopenia 89 (75%) 73 (62%) 6 (10%) 5 (8%) Neutropenia 87 (74%) 80 (68%) 4 (7%) 2 (3%) Anemia 24 (20%) 23 (19%) 6 (10%) 4 (7%) Leukopenia 12 (10%) 9 (8%) 1 (2%) 0 Grade 3-4 thrombocytopenia and neutropenia: Most often reported during cycles 1-3 Lasted a median duration of less than two weeks Resolved to grade < 2 in under four weeks in more than 80% of patients Clinical consequences of Grade 3–4 infection and bleeding were low and similar for imetelstat and placebo Platzbecker U and Santini V, et al. The Lancet, 2024. https://doi.org/10.1016/S0140-6736(23)01724-5.

Imetelstat Represents a First-in-Class Treatment with a New Mechanism of Action in MF

First MF Trial with OS Primary Endpoint Based on Significant Imetelstat Clinical Experience N=320 Phase 3 Study in JAKi �R/R Int-2 or HR MF NCT04576156 Phase 2 Dose Finding �Study in JAKi R/R MF NCT02426086 Single Institution Pilot Study Pilot Study in HR/Int-2 MF (~50% of patients received prior JAKi therapy) N=59 (9.4 mg/kg), N=48 (4.7 mg/kg) First and only �Phase 3 trial in�MF with OS as �primary endpoint Pivotal Ph 3 Trial N=33 Ph 2 Dose Finding Study 2015 ongoing 2021

PK = pharmacokinetic profiles; VAF = variant allele frequency; SET = Study Evaluation Team; RP2D = Recommended Phase 2 Dose; DIPSS = dynamic international prognostic scoring system; int1 = intermediate-1; �int2 = intermediate-2; HR = high risk; TSS = total symptom score; SVR35 = spleen volume reduction > 35% Actively enrolling patients for dose confirmation with imetelstat 9.4mg/kg Part 1 Findings Suggest Tolerability of Imetelstat �Combined with Ruxolitinib in Patients with MF ClinicalTrials.gov Identifier: NCT05371964 Well-tolerated, and no dose-limiting toxicities were reported at any imetelstat dose level within the first 28 days of Cycle 1 The PK profiles were consistent with previous monotherapy studies Preliminary results showed VAF reductions in driver mutations associated with MF across all four dose cohorts Objective: Confirm safety of doses and evaluate efficacy Primary Week 24 Endpoints: Safety, TSS Other Week 24 Endpoints: TSS, SVR35, Fibrosis PART 1: Dose Finding�Results Presented at ASH 2024 Frontline treatment Initial results from �Part 2 expected 2026 Imetelstat 9.4 mg/kg + Ruxolitinib individualized �dose per patient INT-1/ INT-2/ HR MF Patients treated with �imetelstat 9.4 mg/kg �experienced stable �hematology values �over time Imetelstat �4.7mg/kg�(n=3) + Ruxolitinib doses Imetelstat �7.5 mg/kg �(n=4) + Ruxolitinib doses Imetelstat �6.0 mg/kg�(n=3) + Ruxolitinib doses Imetelstat �9.4 mg/kg �(n=7) + Ruxolitinib doses PART 2: Dose Confirmation & �Expansion Currently Enrolling ~20 JAKi naïve patients planned 9.4 mg/kg Imetelstat every 4 weeks selected for dose confirmation and expansion

Clinical Benefits Observed in �LR-MDS and MF with Unique Mechanism of Action

From left to right: Image A: Tefferi A, Lasho T, Begna K, Patnaik M, et al. A pilot study of the telomerase inhibitor imetelstat for myelofibrosis. New Engl J Med 2015;3;373(10)L:908-919.; Image B: Mascarenhas J, Komrokji R, Palandri F, et al. Randomized, Single-Blind, Multicenter Phase II Study of Two Doses of Imetelstat in Relapsed or Refractory Myelofibrosis. American Society of Clinical Oncology. p.JCO.20.02864, 2021.; Image C: Steensma DP, Fenaux P, Van Eygen K, Raza A, Santini V, Germing U, et al. Imetelstat Achieves Meaningful and Durable Transfusion Independence in High Transfusion-Burden Patients With Lower-Risk Myelodysplastic Syndromes in a Phase II Study. J Clin Oncol. 2021;39(1):48-56.; Image D: Santini V, Platzbecker U, Fenaux P, Sekeres MA, Savona MR, Madanat YF, et al. Disease modifying activity of imetelstat in patients with heavily transfused non-del(5q) lower-risk myelodysplastic syndromes relapsed/refractory to erythropoiesis stimulating agents in IMERGE Phase 3. European Hematology Association (EHA) 2023; Presentation S164 Association of Clinical Benefit and Reduction of Disease �Markers Observed in Imetelstat-Treated MF and MDS Patients Disappearance of bone marrow fibrosis in imetelstat treated HR MF patient Association of survival improvement and reduction in VAF for HR R/R imetelstat treated MF patients on MYF2001 Association of SF3B1 VAF reduction and longest TI in imetelstat treated LR MDS patients in PH2 and PH3 MDS3001 Association of SF3B1 VAF reduction and 8week, 24week and 1 yr TI duration in imetelstat treated LR MDS patients in PH2 and PH3 MDS3001 B A C D

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

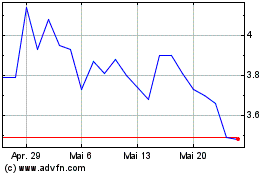

Geron (NASDAQ:GERN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Geron (NASDAQ:GERN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025