Filed pursuant to Rule 424(b)(3)

Registration No. 333-274217

PROSPECTUS SUPPLEMENT NO.

1

(to Prospectus dated September 1, 2023)

Up to 26,588,409

Shares of Common Stock

This prospectus supplement

updates and supplements the prospectus dated September 1, 2023 (as may be further supplemented or amended from time to time, the “Prospectus”),

which forms a part of our Registration Statement on Form S-1 (File No. 333-274217).

This prospectus supplement

is being filed to update and supplement the Prospectus with the information contained in our Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2023, filed with the U.S. Securities and Exchange Commission on February 12, 2024 (the “Quarterly Report”).

Accordingly, we have attached the Quarterly Report to this prospectus supplement.

This prospectus supplement

is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is required

to be delivered with this prospectus supplement. If there is any inconsistency between the information in the Prospectus and this prospectus

supplement, you should rely on the information in this prospectus supplement.

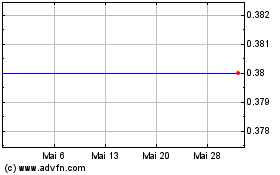

Our shares of Common Stock,

no par value per share (the “Common Stock”) are listed on the Nasdaq Stock Market LLC under the symbol “FUV.”

On February 9, 2024, the closing price of our Common Stock was $0.614 per share.

We are a “smaller reporting

company” as such term is defined under the federal securities laws and, as such, are subject to certain reduced public company reporting

requirements.

Investing in our securities

involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

beginning on page 5 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the Prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February

12, 2024.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒ QUARTERLY

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended: September 30, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ______________ to ______________

Commission

File Number 001-38213

ARCIMOTO,

INC.

(Exact

name of registrant as specified in its charter)

| Oregon |

|

26-1449404 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(IRS

Employer

Identification

No.) |

2034

West 2nd Avenue, Eugene, OR 97402

(Address

of principal executive offices and zip code)

(541)

683-6293

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

stock, no par value |

|

FUV |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was

required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of February 9, 2024, there were approximately 9,451,015 shares of the registrant’s common stock issued and outstanding.

ARCIMOTO,

INC.

FORM

10-Q

For

the Quarterly Period Ended September 30, 2023

TABLE

OF CONTENTS

ARCIMOTO, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

PART

I - FINANCIAL INFORMATION

Item

1. Financial Statements (Unaudited)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 232,827 | | |

$ | 462,753 | |

| Accounts receivable, net | |

| 346,942 | | |

| 262,643 | |

| Inventory | |

| 10,886,533 | | |

| 12,324,017 | |

| Prepaid inventory | |

| 1,479,982 | | |

| 1,439,060 | |

| Other current assets | |

| 656,027 | | |

| 1,594,218 | |

| Total current assets | |

| 13,602,311 | | |

| 16,082,691 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 27,116,231 | | |

| 29,822,794 | |

| Intangible assets, net | |

| 8,411,989 | | |

| 9,045,290 | |

| Operating lease right-of-use assets | |

| 821,065 | | |

| 1,336,826 | |

| Security deposits | |

| 116,297 | | |

| 120,431 | |

| Total assets | |

$ | 50,067,893 | | |

$ | 56,408,032 | |

| | |

| | | |

| | |

| LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 5,659,122 | | |

$ | 7,668,359 | |

| Accrued liabilities | |

| 2,142,921 | | |

| 455,808 | |

| Customer deposits | |

| 942,102 | | |

| 962,346 | |

| Mortgage loan | |

| 7,038,511 | | |

| — | |

| Short-term convertible note | |

| — | | |

| 5,639,231 | |

| Notes payable - related party | |

| 250,000 | | |

| — | |

| Warrant liabilities | |

| 10,296,963 | | |

| 374,474 | |

| Current portion of finance lease obligations | |

| 394,157 | | |

| 441,523 | |

| Current portion of equipment notes payable | |

| 349,932 | | |

| 388,940 | |

| Current portion of warranty reserve | |

| 633,640 | | |

| 519,889 | |

| Current portion of deferred revenue | |

| 86,327 | | |

| 207,556 | |

| Current portion of operating lease liabilities | |

| 505,548 | | |

| 666,542 | |

| Current portion of derivative liability | |

| 1,195,018 | | |

| — | |

| Total current liabilities | |

| 29,494,241 | | |

| 17,324,668 | |

| | |

| | | |

| | |

| Finance lease obligations | |

| 960,838 | | |

| 858,488 | |

| Equipment notes payable | |

| 701,797 | | |

| 962,351 | |

| Convertible note issued to related party | |

| 4,523,580 | | |

| 4,887,690 | |

| Derivative liability | |

| 2,239,309 | | |

| — | |

| Warranty reserve | |

| 320,581 | | |

| 264,748 | |

| Operating lease liabilities | |

| 366,871 | | |

| 744,142 | |

| Total long-term liabilities | |

| 9,112,976 | | |

| 7,717,419 | |

| | |

| | | |

| | |

| Total liabilities | |

| 38,607,217 | | |

| 25,042,087 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 12) | |

| | | |

| | |

| | |

| | | |

| | |

| Mezzanine equity: | |

| | | |

| | |

| Series D 8% Convertible Preferred Stock, no par value, 8,466 authorized; 5,542 and none issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | |

| 4,296,790 | | |

| — | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Series A-1 Preferred Stock, no par value, 1,500,000 authorized; none issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| — | | |

| — | |

| Class C Preferred Stock, no par value, 2,000,000 authorized; none issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| — | | |

| — | |

| Preferred Stock, no par value, 1,491,534 authorized, none issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| — | | |

| — | |

| Common Stock, no par value, 200,000,000 shares authorized; 8,930,196 and 3,209,838 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | |

| 192,009,340 | | |

| 184,682,027 | |

| Additional paid-in capital | |

| 16,168,385 | | |

| 13,555,718 | |

| Accumulated deficit | |

| (201,013,839 | ) | |

| (166,871,800 | ) |

| Total stockholders’ equity | |

| 7,163,886 | | |

| 31,365,945 | |

| Total liabilities, mezzanine equity and stockholders’ equity | |

$ | 50,067,893 | | |

$ | 56,408,032 | |

See accompanying notes to condensed consolidated

financial statements.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 1,110,251 | | |

$ | 2,024,205 | | |

$ | 4,224,125 | | |

$ | 4,173,779 | |

| Cost of goods sold | |

| 2,962,363 | | |

| 6,987,035 | | |

| 9,428,102 | | |

| 17,138,644 | |

| Gross loss | |

| (1,852,112 | ) | |

| (4,962,830 | ) | |

| (5,203,977 | ) | |

| (12,964,865 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 1,163,808 | | |

| 6,521,379 | | |

| 3,717,276 | | |

| 14,144,395 | |

| Sales and marketing | |

| 1,340,067 | | |

| 3,321,862 | | |

| 4,260,985 | | |

| 9,318,647 | |

| General and administrative | |

| 3,076,497 | | |

| 4,099,354 | | |

| 8,792,451 | | |

| 10,583,968 | |

| Loss on sale of asset | |

| 193,292 | | |

| 12,408 | | |

| 415,033 | | |

| 12,408 | |

| Total operating expenses | |

| 5,773,664 | | |

| 13,955,003 | | |

| 17,185,745 | | |

| 34,059,418 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (7,625,776 | ) | |

| (18,917,833 | ) | |

| (22,389,722 | ) | |

| (47,024,283 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other (income) expense: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 715,613 | | |

| 84,945 | | |

| 1,027,399 | | |

| 258,851 | |

| Financing costs | |

| 16,583,349 | | |

| — | | |

| 21,827,173 | | |

| — | |

| Unrealized (gain) loss on convertible notes, mortgage loan, warrants and derivatives fair value | |

| (10,979,457 | ) | |

| (2,122,828 | ) | |

| (14,148,595 | ) | |

| 22,712 | |

| Other expense, net | |

| 97,787 | | |

| 83,749 | | |

| 113,688 | | |

| 12,553 | |

| Loss on debt extinguishment | |

| — | | |

| — | | |

| 2,925,610 | | |

| — | |

| Total other (income) expense, net | |

| 6,417,292 | | |

| (1,954,134 | ) | |

| 11,745,275 | | |

| 294,116 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income tax expense | |

| (14,043,068 | ) | |

| (16,963,699 | ) | |

| (34,134,997 | ) | |

| (47,318,399 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| — | | |

| — | | |

| (7,042 | ) | |

| (3,200 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (14,043,068 | ) | |

$ | (16,963,699 | ) | |

$ | (34,142,039 | ) | |

$ | (47,321,599 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares - basic and diluted | |

| 8,954,919 | | |

| 2,247,818 | | |

| 7,741,214 | | |

| 2,042,891 | |

| Net loss per common share - basic and diluted (Note 2) | |

$ | (1.58 | ) | |

$ | (7.55 | ) | |

$ | (4.43 | ) | |

$ | (23.16 | ) |

See accompanying notes to condensed consolidated

financial statements.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF MEZZANINE

EQUITY AND STOCKHOLDERS’ EQUITY

FOR THE THREE MONTH PERIODS ENDED SEPTEMBER

30, 2023 and 2022

(Unaudited)

| | |

Common

Stock | | |

Additional | | |

| | |

Total | | |

Series

D 8% Convertible Preferred Stock | | |

Total | |

| | |

Number

of

Shares | | |

Amount | | |

Paid-In

Capital | | |

Accumulated

Deficit | | |

Stockholders’

Equity | | |

Number

of

Shares | | |

Amount | | |

Mezzanine

Equity | |

| Balance at

June 30, 2022 | |

| 2,088,539 | | |

$ | 166,999,962 | | |

$ | 10,528,288 | | |

$ | (134,350,302 | ) | |

$ | 43,177,948 | | |

| — | | |

$ | — | | |

$ | — | |

| Issuance

of common stock for cash, net of offering costs of $296,892 | |

| 188,664 | | |

| 10,177,356 | | |

| — | | |

| — | | |

| 10,177,356 | | |

| — | | |

| — | | |

| — | |

| Common

stock to external consultant | |

| 600 | | |

| — | | |

| 45,246 | | |

| — | | |

| 45,246 | | |

| — | | |

| — | | |

| — | |

| Equity

awards issued to external consultants | |

| — | | |

| — | | |

| 24,210 | | |

| — | | |

| 24,210 | | |

| — | | |

| — | | |

| — | |

| Exercise of warrants | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Exercise of stock options | |

| 223 | | |

| 10,806 | | |

| (3,170 | ) | |

| — | | |

| 7,636 | | |

| — | | |

| — | | |

| — | |

| Stock-based

compensation | |

| — | | |

| — | | |

| 1,550,007 | | |

| — | | |

| 1,550,007 | | |

| — | | |

| — | | |

| — | |

| Net

loss | |

| — | | |

| — | | |

| — | | |

| (16,963,699 | ) | |

| (16,963,699 | ) | |

| — | | |

| — | | |

| — | |

| Balance

at September 30, 2022 | |

| 2,278,026 | | |

$ | 177,188,124 | | |

$ | 12,144,581 | | |

$ | (151,314,001 | ) | |

$ | 38,018,704 | | |

| — | | |

$ | — | | |

$ | — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2023 | |

| 8,805,897 | | |

$ | 191,778,708 | | |

$ | 15,630,758 | | |

$ | (186,970,771 | ) | |

$ | 20,438,695 | | |

| — | | |

$ | — | | |

$ | — | |

| Issuance

of series D preferred stock, net of offering costs of $158,787 | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 5,646 | | |

| 4,259,228 | | |

| 4,259,228 | |

| Accretion

of series D preferred stock to redemption value | |

| — | | |

| — | | |

| (118,194 | ) | |

| — | | |

| (118,194 | ) | |

| — | | |

| 118,194 | | |

| 118,194 | |

| Issuance

of common stock for conversion of Series D preferred stock | |

| 108,963 | | |

| 80,632 | | |

| — | | |

| — | | |

| 80,632 | | |

| (104 | ) | |

| (80,632 | ) | |

| (80,632 | ) |

| Reduction

of offering costs | |

| — | | |

| 150,000 | | |

| — | | |

| — | | |

| 150,000 | | |

| — | | |

| — | | |

| — | |

| Issuance

of common stock for RSU, net of tax | |

| 15,336 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Stock-based

compensation | |

| — | | |

| — | | |

| 655,821 | | |

| — | | |

| 655,821 | | |

| — | | |

| — | | |

| — | |

| Net

loss | |

| — | | |

| — | | |

| — | | |

| (14,043,068 | ) | |

| (14,043,068 | ) | |

| — | | |

| — | | |

| — | |

| Balance

at September 30, 2023 | |

| 8,930,196 | | |

$ | 192,009,340 | | |

$ | 16,168,385 | | |

$ | (201,013,839 | ) | |

$ | 7,163,886 | | |

| 5,542 | | |

$ | 4,296,790 | | |

$ | 4,296,790 | |

See accompanying notes to condensed consolidated

financial statements.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF MEZZANINE

EQUITY AND STOCKHOLDERS’ EQUITY

FOR THE NINE MONTH PERIODS ENDED SEPTEMBER 30,

2023 and 2022

(Unaudited)

| | |

Common

Stock | | |

Additional | | |

| | |

Total | | |

Series

D 8% Convertible Preferred Stock | | |

Total | |

| | |

Number

of

Shares | | |

Amount | | |

Paid-In

Capital | | |

Accumulated

Deficit | | |

Stockholders’

Equity | | |

Number

of

Shares | | |

Amount | | |

Mezzanine

Equity | |

| Balance at December 31, 2021 | |

| 1,882,180 | | |

$ | 150,502,566 | | |

$ | 7,038,124 | | |

$ | (103,992,402 | ) | |

$ | 53,548,288 | | |

| — | | |

| — | | |

| — | |

| Issuance of common stock for

cash, net of offering costs of $894,614 | |

| 391,985 | | |

| 26,493,094 | | |

| — | | |

| — | | |

| 26,493,094 | | |

| — | | |

| — | | |

| — | |

| Issuance of common stock for

RSU, net of tax | |

| 460 | | |

| 46,746 | | |

| (76,200 | ) | |

| — | | |

| (29,454 | ) | |

| — | | |

| — | | |

| — | |

| Common stock to external consultant | |

| 800 | | |

| — | | |

| 68,361 | | |

| — | | |

| 68,361 | | |

| — | | |

| — | | |

| — | |

| Equity awards issued to external

consultants | |

| — | | |

| — | | |

| 375,782 | | |

| — | | |

| 375,782 | | |

| — | | |

| — | | |

| — | |

| Exercise of warrants | |

| 400 | | |

| 20,000 | | |

| — | | |

| — | | |

| 20,000 | | |

| — | | |

| — | | |

| — | |

| Exercise of stock options | |

| 2,201 | | |

| 125,718 | | |

| (34,623 | ) | |

| — | | |

| 91,095 | | |

| — | | |

| — | | |

| — | |

| Stock-based compensation | |

| — | | |

| — | | |

| 4,773,137 | | |

| — | | |

| 4,773,137 | | |

| — | | |

| — | | |

| — | |

| Net

loss | |

| — | | |

| — | | |

| — | | |

| (47,321,599 | ) | |

| (47,321,599 | ) | |

| — | | |

| — | | |

| — | |

| Balance at September 30,

2022 | |

| 2,278,026 | | |

$ | 177,188,124 | | |

$ | 12,144,581 | | |

$ | (151,314,001 | ) | |

$ | 38,018,704 | | |

| — | | |

$ | — | | |

$ | — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at December 31, 2022 | |

| 3,209,838 | | |

$ | 184,682,027 | | |

$ | 13,555,718 | | |

$ | (166,871,800 | ) | |

$ | 31,365,945 | | |

| — | | |

$ | — | | |

$ | — | |

| Issuance of common stock for

cash, net of offering costs of $427,304 | |

| 4,767,647 | | |

| 5,984,111 | | |

| — | | |

| — | | |

| 5,984,111 | | |

| — | | |

| — | | |

| — | |

| Reduction of offering costs | |

| — | | |

| 150,000 | | |

| — | | |

| — | | |

| 150,000 | | |

| — | | |

| — | | |

| — | |

| Issuance of series D preferred

stock, net of offering costs of $158,787 | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 5,646 | | |

| 4,259,228 | | |

| 4,259,228 | |

| Accretion of series D preferred

stock to redemption value | |

| — | | |

| — | | |

| (118,194 | ) | |

| — | | |

| (118,194 | ) | |

| — | | |

| 118,194 | | |

| 118,194 | |

| Issuance of common stock for

conversion of Series D preferred stock | |

| 108,963 | | |

| 80,632 | | |

| — | | |

| — | | |

| 80,632 | | |

| (104 | ) | |

| (80,632 | ) | |

| (80,632 | ) |

| Issuance of common stock for

partial payment of convertible note | |

| 123,612 | | |

| 1,112,500 | | |

| — | | |

| — | | |

| 1,112,500 | | |

| — | | |

| — | | |

| — | |

| Issuance of common stock for

RSU, net of tax | |

| 20,136 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Exercise of warrants | |

| 700,000 | | |

| 70 | | |

| — | | |

| — | | |

| 70 | | |

| — | | |

| — | | |

| — | |

| Stock-based compensation | |

| — | | |

| — | | |

| 2,730,861 | | |

| — | | |

| 2,730,861 | | |

| — | | |

| — | | |

| — | |

| Net

loss | |

| — | | |

| — | | |

| — | | |

| (34,142,039 | ) | |

| (34,142,039 | ) | |

| — | | |

| — | | |

| — | |

| Balance at September 30,

2023 | |

| 8,930,196 | | |

$ | 192,009,340 | | |

$ | 16,168,385 | | |

$ | (201,013,839 | ) | |

$ | 7,163,886 | | |

| 5,542 | | |

| 4,296,790 | | |

$ | 4,296,790 | |

See accompanying notes to condensed consolidated

financial statements.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| OPERATING ACTIVITIES | |

| | |

| |

| Net loss | |

$ | (34,142,039 | ) | |

$ | (47,321,599 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities | |

| | | |

| | |

| Depreciation and amortization | |

| 2,643,299 | | |

| 2,703,561 | |

| Non-cash operating lease costs | |

| 515,761 | | |

| 439,557 | |

| Non-cash financing costs | |

| 19,466,630 | | |

| — | |

| Non-cash offering costs | |

| 620,780 | | |

| — | |

| Interest expense paid in common stock | |

| 31,839 | | |

| — | |

| Debt issuance costs expensed - mortgage loan | |

| 600,000 | | |

| — | |

| Debt facility fee expensed - mortgage loan | |

| 300,000 | | |

| — | |

| Debt issuance costs - convertible note | |

| — | | |

| 232,669 | |

| Warrant and derivatives issuance costs - expensed | |

| 839,763 | | |

| — | |

| Loss on extinguishment of debt | |

| 2,925,610 | | |

| — | |

| Unrealized (gain) loss on convertible notes, mortgage loan, warrants and derivatives fair value | |

| (14,148,595 | ) | |

| 22,712 | |

| Common stock to external consultant | |

| — | | |

| 68,361 | |

| Equity awards issued to external consultants | |

| — | | |

| 375,782 | |

| Stock-based compensation | |

| 2,730,861 | | |

| 4,773,137 | |

| Loss on disposal of asset | |

| 415,033 | | |

| 12,408 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (84,299 | ) | |

| (204,259 | ) |

| Inventory | |

| 1,906,097 | | |

| (4,434,250 | ) |

| Prepaid inventory | |

| (40,922 | ) | |

| (472,703 | ) |

| Other current assets | |

| 938,191 | | |

| 557,369 | |

| Accounts payable | |

| (2,009,237 | ) | |

| 673,577 | |

| Accrued liabilities | |

| 1,687,113 | | |

| 1,755,419 | |

| Customer deposits | |

| (20,244 | ) | |

| 231,297 | |

| Operating lease liabilities | |

| (538,265 | ) | |

| (445,310 | ) |

| Warranty reserve | |

| 169,584 | | |

| 66,531 | |

| Deferred revenue | |

| (121,229 | ) | |

| 101,992 | |

| Net cash used in operating activities | |

| (15,314,269 | ) | |

| (40,863,749 | ) |

| | |

| | | |

| | |

| INVESTING ACTIVITIES | |

| | | |

| | |

| Purchase of property and equipment | |

| (331,566 | ) | |

| (9,371,913 | ) |

| Refund from return of equipment | |

| 611,476 | | |

| — | |

| Security deposits | |

| 4,134 | | |

| (2,205 | ) |

| Net cash provided by (used in) investing activities | |

| 284,044 | | |

| (9,374,118 | ) |

| | |

| | | |

| | |

| FINANCING ACTIVITIES | |

| | | |

| | |

| Proceeds from the sale of common stock and warrants | |

| 14,494,896 | | |

| 27,387,708 | |

| Proceeds from the sale of series D preferred stock and warrants | |

| 4,300,002 | | |

| — | |

| Payment of offering costs | |

| (1,133,100 | ) | |

| (870,614 | ) |

| Proceeds from notes payable - related party | |

| 500,000 | | |

| — | |

| Payment of notes payable - related party | |

| (250,000 | ) | |

| — | |

| Proceeds from the exercise of warrants | |

| 70 | | |

| 20,000 | |

| Proceeds from mortgage loan | |

| 6,000,000 | | |

| — | |

| Proceeds from convertible note | |

| — | | |

| 13,900,000 | |

| Debt issuance costs - mortgage loan | |

| (600,000 | ) | |

| — | |

| Debt facility fee - mortgage loan | |

| (300,000 | ) | |

| — | |

| Debt issuance costs - convertible note | |

| — | | |

| (232,669 | ) |

| Proceeds from the exercise of stock options | |

| — | | |

| 91,095 | |

| Payment on finance lease obligations | |

| (412,007 | ) | |

| (305,296 | ) |

| Payment of equipment notes | |

| (299,562 | ) | |

| (481,963 | ) |

| Proceeds from equipment notes | |

| — | | |

| 177,256 | |

| Payment of convertible note | |

| (7,500,000 | ) | |

| (161,652 | ) |

| Payment of notes payable | |

| — | | |

| (2,039,367 | ) |

| Net cash provided by financing activities | |

| 14,800,299 | | |

| 37,484,498 | |

| | |

| | | |

| | |

| Net cash and cash equivalents decrease for period | |

| (229,926 | ) | |

| (12,753,369 | ) |

| Cash and cash equivalents at beginning of period | |

| 462,753 | | |

| 16,971,320 | |

| Cash and cash equivalents at end of period | |

$ | 232,827 | | |

$ | 4,217,951 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 97,594 | | |

$ | 186,083 | |

| Cash paid during the period for income taxes | |

$ | 7,042 | | |

$ | 3,200 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES | |

| | | |

| | |

| Issuance of common stock for settlement of accounts payable | |

$ | — | | |

$ | 68,361 | |

| Accounts payable for purchase of property and equipment | |

$ | — | | |

$ | 649,180 | |

| Notes payable and accrued interest converted to common stock | |

$ | 1,112,500 | | |

$ | — | |

| Conversion of Series D 8% Convertible Preferred Stock to common stock | |

$ | 80,632 | | |

$ | — | |

| Accretion of Series D 8% Convertible Preferred Stock to redemption value | |

$ | 118,194 | | |

$ | — | |

| Transfers from FUV Rental Fleet to Inventory | |

$ | 468,613 | | |

$ | — | |

| Equipment acquired through finance leases | |

$ | 466,991 | | |

$ | 675,928 | |

See accompanying notes to condensed consolidated

financial statements.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

NOTE 1: NATURE OF OPERATIONS

Arcimoto, Inc. (the “Company”) was

incorporated in the State of Oregon on November 21, 2007. The Company’s mission is to catalyze the global shift to a sustainable

transportation system. Over the past 16 years, the Company has developed a new vehicle platform designed around the needs of everyday

drivers. Having approximately one-third the weight and one-third of the footprint of the average car, the Arcimoto platform’s purpose

is to bring the joy of ultra-efficient, pure electric driving to the masses. To date, the Company currently has two vehicle products built

on this platform that target specific niches in the vehicle market: its flagship product, the Fun Utility Vehicle® (“FUV®”),

for everyday consumer trips, and the Deliverator® for last-mile delivery and general fleet utility.

In February 2023, two wholly-owned subsidiaries

of the Company were formed, Arcimoto Property Holding Company, LLC and APHC Holdings, LLC. APHC Holdings, LLC is the parent of Arcimoto

Property Holding Company, LLC. Arcimoto Property Holding Company, LLC is the borrower in a loan obtained on February 17, 2023 for $6,000,000

that is secured by a guarantee provided by Arcimoto, Inc. and the real estate owned by the Company.

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

1-for-20 Reverse Stock Split

On November 11, 2022, the Board of Directors approved

a reverse stock split of 1-for-20. This action enabled the Company to access additional funds for operational needs by maintaining its

listing requirements. The 1-for-20 reverse stock split decreased the number of outstanding shares and increased net loss per common share.

All per share and share amounts presented have been retroactively adjusted for the effect of this reverse stock split for all periods

presented.

Going Concern

The accompanying financial statements have been

prepared on the basis that the Company is a going concern, which contemplates the realization of assets and satisfaction of liabilities

in the normal course of business. The Company has incurred significant losses since inception and management expects losses to continue

for the foreseeable future. In addition, the Company does not have sufficient cash on hand to pay obligations as they come due.

| ● | On January 14, 2022 the Company entered into an agreement with Canaccord

Genuity LLC (“Canaccord”) to raise the at-the-market (“ATM”) offering amount to $100,000,000, and on October 4,

2022, the Company signed an equity line of credit (“ELOC”) agreement with Tumim Stone Capital LLC whereby the investor will

provide up to $50,000,000 of financing with certain restrictions. On January 18, 2023, the Company obtained additional funds totaling

$12.0 million via a confidentially marketed public equity offering. Due to the terms of this offering, the Company is restricted from

variable rate transactions and, thus, unable to utilize the ATM and ELOC to raise additional capital for a period of one year from January

18, 2023, the date the Prospectus Supplement was filed. The terms of this offering also restricted equity transactions for a period of

90 days unless approved by more than 50% of the investors in the offering filed on January 18, 2023. After that 90-day period, the Company

became able to offer to sell its securities in a public offering under its S-3 registration. However, this ability to obtain additional

financing is dependent on the price and volume of the Company’s common stock and may be further restricted by certain Securities

and Exchange Commission (“SEC”) rules that limit the number of shares the Company is able to sell under its Form S-3 registration

statement. The Company is currently not able to utilize the ATM and ELOC to raise additional capital due to restrictions from the June

2023 and August 2023 offerings discussed below. |

| ● | On February 17, 2023, the Company obtained a loan that is secured by the Company’s land and buildings

as disclosed in Note 6 - Mortgage Loan. The principal amount of this loan is $6,000,000 and includes a discount of $600,000. The interest

rate on this loan was 20% and the loan was originally due in August 2023 unless an additional six-month extension was granted. The extension

could only be granted under certain conditions, which included, in part, payment of all accrued interest and a facility fee of $300,000

and that no event or potential event of a default existed. On July 14, 2023, the Company was granted an additional six-month extension

and the loan is now due in February 2024. As a result of the extension, interest is 0% as of August 18, 2023. |

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

| ● | In May 2023, the Company also received a $500,000 loan from a related party, which was subsequently paid

down $250,000 in June 2023 using the proceeds from the June 2023 offering discussed below. |

| ● | In June 2023, the Company raised approximately $2,300,000, net of fees, from a registered direct offering. |

| ● | On August 15, 2023, the Company received $4.2 million, net of fees, from an offering of Series D Convertible

Preferred Stock, as disclosed in Note 10 – Stockholders’ Equity. The holders of Series D Preferred Stock are entitled to cumulative

dividends at the rate of 8% per annum and payable each quarter. The Company is required to redeem the Series D Preferred Stock in monthly

installments and will redeem the full outstanding balance on the second anniversary of the issuance date. Each share of Series D Preferred

Stock is convertible at any time at the option of the holder into common stock. |

Furthermore, the Company’s accounts payable

balance is approximately $9,500,000 at February 9, 2024, of which a significant amount is more than 30 days past due.

Management has evaluated these conditions and

concluded that they raise substantial doubt about the Company’s ability to continue as a going concern for a period of at least

one year from the issuance of these unaudited financial statements. Management has initiated a series of actions to alleviate the Company’s

financial situation: (1) reducing headcount significantly via lay-offs and an unpaid furlough program that started at the beginning of

the fourth quarter of 2022 and that have continued; (2) temporarily suspending production in the first quarter of 2023 in order to relocate

operations to a new facility and focus purchases on the minimum needed to resume production, which was resumed in February 2023; (3) negotiating

payment plans with the Company’s vendors that are critical to the Company’s operations; and (4) monetizing assets that may

not be critical to the core business. Management also plans to pursue other financing solutions through the credit and equity markets.

There can be no assurance that the Company will be able to secure such additional financing or, if available, that it will be on favorable

terms or that the Company will be able to sufficiently reduce costs for any such additional financing to meet its needs. Therefore, the

plans cannot be deemed probable of being implemented. As a result, the Company has concluded that management’s plans do not alleviate

substantial doubt about the Company’s ability to continue as a going concern.

The financial statements do not include any adjustments

relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might

result from the outcome of this uncertainty.

Basis of Presentation and Principles of Consolidation

The accompanying unaudited condensed consolidated

financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United States

of America (“GAAP”) for interim financial information, and pursuant to the instructions to Form 10-Q promulgated by the United

States Securities and Exchange Commission (the “SEC”). Accordingly, they do not include all information and disclosures required

by GAAP for complete financial statement presentation. In the opinion of management, the accompanying unaudited condensed consolidated

financial statements contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly the Company’s

financial position as of September 30, 2023, and the results of its operations for the three and nine months ended September 30,

2023 and 2022 and its cash flows for the nine months ended September 30, 2023 and 2022. Results for the three and nine months ended

September 30, 2023 are not necessarily indicative of the results to be expected for the year ending December 31, 2023. The information

included in this Quarterly Report on Form 10-Q should be read in conjunction with the audited financial statements and notes thereto for

the year ended December 31, 2022 included in the Company’s Annual Report on Form 10-K filed with the SEC on April 14, 2023.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

The preparation of financial statements in conformity

with U.S GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues

and expenses and its related disclosures. Actual amounts could differ materially from those estimates.

The consolidated financial statements include

the accounts of the Company. and its wholly-owned subsidiaries. All intercompany accounts and transactions have been eliminated upon consolidation.

Inventory

Inventory is stated at the lower of cost (using

the first-in, first-out method (“FIFO”)) or net realizable value. Inventories consist mainly of purchased electric motors,

electrical storage and transmission equipment, and component parts. Raw materials include parts that have been sub-assembled and manufactured

parts.

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Raw materials | |

$ | 9,217,444 | | |

$ | 11,491,555 | |

| Work in progress | |

| 199,521 | | |

| — | |

| Finished goods | |

| 1,469,568 | | |

| 832,462 | |

| Total | |

$ | 10,886,533 | | |

$ | 12,324,017 | |

The Company is required to remit partial prepayments

for some purchases of its inventories acquired from overseas vendors which are included in prepaid inventory. The Company is currently

selling vehicles below the base cost of a finished unit. Accordingly, the Company expensed all labor and overhead as period costs and

recorded an allowance to reduce certain inventories to net realizable value of approximately $849,000 and $1,280,000 as of September 30,

2023 and December 31, 2022, respectively. The amount expensed for all labor and overhead was approximately $5,219,000 and $11,362,000

for the nine months ended September 30, 2023 and 2022, respectively, and $1,763,000 and $4,289,000 for the three months ended September

30, 2023 and 2022, respectively.

Intangible Assets

Intangible assets primarily consist of trade names/trademarks,

proprietary technology, and customer relationships. They are amortized using the straight-lined method over a period of 10 to 14 years.

The Company assesses the recoverability of its finite-lived intangible assets when there are indications of potential impairment.

Net Loss per Share

The Company’s computation of loss per share

(“EPS”) includes basic and diluted EPS. Basic EPS is measured as the loss available to common shareholders divided by the

weighted average number of common shares outstanding for the period. Diluted EPS is similar to basic EPS but presents the dilutive effect

on a per share basis of potential common shares (e.g., common stock warrants and common stock options) as if they had been converted at

the beginning of the periods presented, or issuance date, if later. Potential common shares that have an anti-dilutive effect (i.e., those

that increase income per share or decrease loss per share) are excluded from the calculation of diluted EPS.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

The following table presents the reconciliation

of the numerator and denominator for calculating net loss per share:

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Numerator: | |

| | |

| | |

| | |

| |

| Net loss | |

$ | (14,043,068 | ) | |

$ | (16,963,699 | ) | |

$ | (34,142,039 | ) | |

$ | (47,321,599 | ) |

| Accretion of Series D 8% Convertible Preferred Stock to redemption value | |

| (118,194 | ) | |

| — | | |

| (118,194 | ) | |

| — | |

| Net loss attributable to common shareholders | |

| (14,161,262 | ) | |

| (16,963,699 | ) | |

| (34,260,233 | ) | |

| (47,321,599 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Denominator | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding - basic and diluted | |

| 8,954,919 | | |

| 2,247,818 | | |

| 7,741,214 | | |

| 2,042,891 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share - basic and diluted | |

$ | (1.58 | ) | |

$ | (7.55 | ) | |

$ | (4.43 | ) | |

$ | (23.16 | ) |

During the three and nine months ended September

30, 2023 and 2022, the Company excluded the outstanding Employee Equity Plans (“EEP”) and other securities summarized below

calculated using the Treasury Stock Method for options and other instruments and the If-Converted Method for convertible notes, which

entitled the holders thereof to ultimately acquire shares of common stock, from its calculation of earnings per share, as their effect

would have been anti-dilutive.

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Options and other instruments under the 2012, 2015, 2018, and 2022 Plans to purchase common stock | |

| — | | |

| 23,734 | | |

| — | | |

| 45,820 | |

| Conversion of convertible notes, if-converted method | |

| 59,440 | | |

| 86,809 | | |

| 59,440 | | |

| 42,556 | |

| Total | |

| 59,440 | | |

| 110,543 | | |

| 59,440 | | |

| 88,376 | |

All options and warrants were excluded from the

table above as they are out of the money.

Fair Value Measurements

ASC 820, Fair Value Measurements and Disclosures,

defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal

or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date.

ASC 820 also establishes a fair value hierarchy based on the observability of the inputs and distinguishes between (1) market participant

assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions

about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The

fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for

identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value

hierarchy are described below:

Level 1 – Unadjusted quoted prices in active

markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

Level 2 – Inputs other than quoted prices

included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar

assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active;

inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are derived principally

from or corroborated by observable market data by correlation or other means.

Level 3 – Inputs that are both significant

to the fair value measurement and unobservable.

Fair value estimates discussed herein were based

upon certain market assumptions and pertinent information available to management as of September 30, 2023 and December 31, 2022. The

respective carrying value of certain on-balance-sheet financial instruments approximated their fair values due to the short-term nature

of these instruments.

The Company measures convertible notes, the mortgage

loan, derivative liabilities and warrant liabilities at fair value on a recurring basis. Refer to Note 15, Fair Value Measurements, for

details.

Convertible Notes, Mortgage Loan, Derivative

Liabilities and Warrants

We have elected the fair value option under ASC

825-10-25 to account for the convertible notes as well as the mortgage loan, derivative liabilities and warrants. The fair value measurements

are classified as Level 2 under the fair value hierarchy as provided by ASC 820, “Fair Value Measurement”. The fair valuation

of these convertible notes, mortgage loan, derivative liabilities, and warrants use inputs other than quoted prices that are observable

either directly or indirectly. Under this option, changes in fair value are recorded as unrealized gain/loss on convertible notes, mortgage

loan and warrants fair value in the Condensed Consolidated Statements of Operations.

Refer to Note 6 – Mortgage Loan, Note 9

– Convertible Notes, and Note 10 – Stockholders’ Equity for additional details regarding the fair value and significant

assumptions utilized.

Accounting Pronouncements Recently Adopted

In June 2016, the FASB issued ASU No. 2016-13,

Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”)

which replaces the current incurred loss methodology with an expected loss methodology which is referred to as the current expected credit

loss (“CECL”) methodology. The measurement of credit losses under the CECL methodology is applicable to financial assets measured

at amortized cost, including loans receivable and trade accounts receivables and held-to-maturity debt securities. It also applies to

off-balance sheet credit exposures not accounted for as insurance (loan commitments, standby letters of credit, financial guarantees and

other similar instruments) and net investment in leases recognized by a lessor in accordance with Accounting Standards Codification (“ASC”)

Topic 842 – Leases. ASU 2016-13 also made changes to the accounting for available-for-sale debt securities and requires credit losses

to be presented as an allowance rather than as a write-down on such securities management does not intend to sell or believes that it

is more likely than not, they will be required to sell. The Company adopted the provisions of this ASU effective January 1, 2023. The

adoption did not have a material impact on the Company’s unaudited condensed consolidated financial statements.

In November 2023, the FASB issued ASU No. 2023-07,

Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU 2023-07) which aims to improve reportable segment

disclosure requirements, primarily through enhanced disclosures regarding segment expenses. The amendments in ASU 2023-07 are effective

for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. The Company

is required to adopt ASU 2023-07 on January 1, 2024 and has not yet completed its assessment of ASU 2023-07’s impact on its financial

statements.

The Company does not believe there are any other

recently issued and effective or not yet effective pronouncements that would have or are expected to have any significant effect on the

Company’s financial position, results of operations, or cash flows.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

NOTE 3: PROPERTY AND EQUIPMENT

As of September 30, 2023 and December 31,

2022, the Company’s property and equipment consisted of the following:

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Land | |

$ | 4,743,526 | | |

$ | 4,743,526 | |

| Buildings | |

| 8,006,474 | | |

| 8,006,474 | |

| Machinery and equipment | |

| 9,949,028 | | |

| 8,443,047 | |

| Fixed assets in process | |

| 413,847 | | |

| 8,569,163 | |

| Leasehold improvements | |

| 7,725,469 | | |

| 1,193,771 | |

| FUV fleet | |

| 750,902 | | |

| 1,089,888 | |

| FUV rental fleet | |

| 1,949,037 | | |

| 2,646,379 | |

| Computer equipment and software | |

| 226,915 | | |

| 226,915 | |

| Vehicles | |

| 681,316 | | |

| 748,707 | |

| Furniture and fixtures | |

| 52,007 | | |

| 52,007 | |

| Total property and equipment | |

| 34,498,521 | | |

| 35,719,877 | |

| Less: Accumulated depreciation | |

| (7,382,290 | ) | |

| (5,897,083 | ) |

| Total | |

$ | 27,116,231 | | |

$ | 29,822,794 | |

Fixed assets in process are primarily comprised

of building improvements that have not yet been completed and machinery and equipment not yet placed into service. Completed assets are

transferred to their respective asset class and depreciation begins when the asset is placed in service. FUV fleet consists of marketing

and other non-revenue generating vehicles. FUV rental fleet consists of rental revenue generating vehicles.

Depreciation expense was approximately $629,000

and $2,010,000 during the three and nine months ended September 30, 2023 and $767,000 and $2,074,000 during the three and nine months

ended September 30, 2022, respectively.

NOTE 4: INTANGIBLE ASSETS

The following table summarizes the Company’s intangible assets:

| | |

| | |

September 30, 2023 | |

| | |

Estimated

Useful Life

(Years) | | |

Gross Carrying

Amount at

September 30,

2023 | | |

Accumulated

Amortization | | |

Net Book Value | |

| Tradename and trademarks | |

14 | | |

$ | 2,052,000 | | |

$ | (383,437 | ) | |

$ | 1,668,563 | |

| Proprietary technology | |

13 | | |

| 7,010,000 | | |

| (1,431,529 | ) | |

| 5,578,471 | |

| Customer relationships | |

10 | | |

| 1,586,000 | | |

| (421,045 | ) | |

| 1,164,955 | |

| | |

| | |

$ | 10,648,000 | | |

$ | (2,236,011 | ) | |

$ | 8,411,989 | |

| | |

| | |

December 31, 2022 | |

| | |

Estimated

Useful Life

(Years) | | |

Gross Carrying

Amount at

December 31,

2022 | | |

Accumulated

Amortization | | |

Net Book Value | |

| Tradename and trademarks | |

14 | | |

$ | 2,052,000 | | |

$ | (273,508 | ) | |

$ | 1,778,492 | |

| Proprietary technology | |

13 | | |

| 7,010,000 | | |

| (1,027,107 | ) | |

| 5,982,893 | |

| Customer relationships | |

10 | | |

| 1,586,000 | | |

| (302,095 | ) | |

| 1,283,905 | |

| | |

| | |

$ | 10,648,000 | | |

$ | (1,602,710 | ) | |

$ | 9,045,290 | |

Amortization expense was approximately $211,000

and $633,000 during the three and nine months ended September 30, 2023 and approximately $208,000 and $629,000 during the three and nine

months ended September 30, 2022, respectively.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

NOTE 5: CUSTOMER DEPOSITS

The Company has received refundable customer pre-orders

ranging from $100 to $500 per vehicle for purposes of securing a place in a line to order its utility vehicle. As of September 30,

2023 and December 31, 2022, these refundable pre-orders total $402,100 and $410,000, respectively. In addition, the Company also

received non-refundable customer deposits of $2,500, which was reduced to $500 during the quarter ended June 30, 2022, that are required

for the Company to start production of their vehicles. When a customer’s order is ready to enter the production process, the customer

is notified that if they would like to proceed with the purchase of a vehicle, their pre-orders will no longer be refundable and additional

deposit required must be paid prior to the start of the manufacturing process. As of September 30, 2023 and December 31, 2022,

these non-refundable deposits total $324,700 and $268,300, respectively and are presented as Customer Deposits on the Company’s Condensed

Consolidated Balance Sheets.

The Company has also received approximately $74,000

and $112,000 of refundable deposits related to its TMW product line as of September 30, 2023 and December 31, 2022, respectively.

The Company also receives non-refundable deposits as final payment prior to delivery of the final product. These non-refundable deposits

total approximately $21,100 and $51,400 as of September 30, 2023 and December 31, 2022, respectively, and are presented as Customer

Deposits on the Company’s Condensed Consolidated Balance Sheets.

During the second quarter of 2022, the Company

began to receive refundable deposits of $100 per unit for the recently announced Mean-Lean-Machine (“MLM”), the electric tilting

trike. As of September 30, 2023 and December 31, 2022, the balance of such deposits was $120,200 and $120,600, respectively

and are included as part of Customer Deposits on the Company’s Condensed Consolidated Balance Sheets.

As of September 30, 2023 and December 31,

2022, the Company’s balance of deposits received was approximately $942,100 and $962,300, respectively. Deposits are included in

current liabilities in the accompanying Condensed Consolidated Balance Sheets. The Company also has customer deposits from its employees.

However, the balances of these deposits as of September 30, 2023 and December 31, 2022 are not material.

NOTE 6: MORTGAGE LOAN

On February 17, 2023, the Company’s wholly-owned

subsidiary, Arcimoto Property Holding Company, LLC (“Borrower”) entered into a loan (“Mortgage Loan”) with HRE

FUV Lending, LLC (the “Lender”) and issued a related Promissory Note (the “Note”) payable to the Lender. Pursuant

to the Mortgage Loan and the Note, the Borrower is receiving a $6,000,000 loan secured by all the real properties of the Borrower and

all equity interests of Borrower. The loan (i) has an initial term of six months with the possibility of a further six month extension

upon the satisfaction of certain conditions; (ii) has an interest rate equal to 20% per annum of the first six months (with the possibility

of retroactive reduction to 10% if repaid in full within such six (6) months without an event of default having occurred) and zero percent

(0%) per annum for the six (6) month extension period; (iii) requires an upfront fee to Lender of $600,000 on the date the loan is made

(and an additional facility fee to Lender of $300,000 if the loan is not repaid in full within the first six (6) months or if an event

of default occurs); (iv) requires that, in the event of prepayment, a minimum of $600,000 in interest must have been paid (with the possibility

of reduction to $300,000 if repaid in full within the first six (6) months if no event of default has occurred); (v) provides that $500,000

of the loan amount is retained as a holdback by Lender for disbursement to Borrower only after certain construction is completed at the

real property and the cost of such construction is paid in full by Borrower; (vi) contemplates an increase in the interest rate if an

event of default occurs; (vii) is fully guaranteed by Holdings and is subject to a limited recourse guaranty by the Company. The $500,000

holdback was received by the Company during the quarter ended June 30, 2023. On July 14, 2023, the Company extended the maturity date

of the loan six months to February 2024. As a result of the extension, the Company paid a $300,000 facility fee and accrued an additional

$600,000 fee to facilitate the extension, which were expensed as financing costs and interest expense, respectively.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

The Company elected to account for this mortgage

loan using the fair value option. In estimating the fair value of this debt, a discounted cash flows model was used. The required inputs

include the principal, payment terms, maturity date, and yield of 10.71%. The note’s fair value measurement is classified as Level

2 under the fair value hierarchy as provided by ASC 820, “Fair Value Measurement.” The fair valuation of this mortgage loan

uses inputs other than quoted prices that are observable either directly or indirectly in a discounted cash flows model. Under this option,

changes in fair value of the debt are recorded as an unrealized loss on mortgage loan fair value in the Unaudited Condensed Consolidated

Statements of Operations at inception of $336,194. For the three and nine months ended September 30, 2023, the Company recorded an unrealized

gain of $551,574 and loss of $1,038,511, respectively. The fair value of the loan was $7,038,511 as of September 30, 2023. The Company

recorded the $600,000 upfront fee to lender as financing costs in the Unaudited Condensed Consolidated Statement of Operations.

NOTE 7: EQUIPMENT NOTES PAYABLE

As of September 30, 2023, the Company has

financed a total of approximately $1,936,000 of its capital equipment purchases with notes payable having monthly payments ranging from

approximately $300 to $12,000, repayment terms ranging from 60 to 72 months, and effective interest rates ranging from 1.99% to 9.90%.

Monthly payments for all equipment financing notes payable as of September 30, 2023 are approximately $36,300. These equipment notes

mature ranging from November 2023 through May 2028. The balance of equipment financing notes payable was approximately $1,052,000 and

$1,351,000 as of September 30, 2023 and December 31, 2022, respectively.

NOTE 8: LEASES

Operating Leases

The Company has active operating lease arrangements

for office space and production facilities. The Company is typically required to make fixed minimum rent payments relating to its right

to use the underlying leased asset. In accordance with the adoption of ASC 842, the Company recorded right-of-use assets and related lease

liabilities for these leases as of January 1, 2022.

The Company has lease agreements which contain

both lease and non-lease components, which it has elected to account for as a single lease component when the payments are fixed. As such,

variable lease payments not dependent on an index or rate, such as real estate taxes, common area maintenance, and other costs that are

subject to fluctuation from period to period are not included in lease measurement. The Company includes extensions in the determination

of the lease term when it is reasonably certain that such options will be exercised.

The Company’s lease agreements do not provide

an implicit borrowing rate. Therefore, the Company used a benchmark approach to derive an appropriate incremental borrowing rate. The

Company benchmarked itself against other companies of similar credit ratings and comparable credit quality and derived an incremental

borrowing rate to discount each of its lease liabilities based on the remaining lease term.

The components of operating lease expense recorded

in the condensed consolidated statements of operations were as follows:

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating lease cost | |

$ | 167,517 | | |

$ | 193,018 | | |

$ | 559,133 | | |

$ | 548,997 | |

| Short-term lease cost | |

| 4,265 | | |

| 52,631 | | |

| 71,762 | | |

| 104,882 | |

| Total lease cost | |

$ | 171,782 | | |

$ | 245,649 | | |

$ | 630,895 | | |

$ | 653,879 | |

Variable lease cost for the three and nine months

ended September 30, 2023 and 2022 was not material.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

Right of use assets and lease liabilities for

operating leases were recorded in the condensed consolidated balance sheets as follows:

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Operating lease right-of-use assets | |

$ | 821,065 | | |

$ | 1,336,826 | |

| | |

| | | |

| | |

| Operating lease liabilities, current | |

$ | 505,548 | | |

$ | 666,542 | |

| Operating lease liabilities, long-term | |

| 366,871 | | |

| 744,142 | |

| Total operating lease liabilities | |

$ | 872,419 | | |

$ | 1,410,684 | |

The weighted-average remaining lease term for

operating leases was 1.92 years and the weighted-average incremental borrowing rate was 8.8% as of September 30, 2023.

Supplemental cash flow information related to

the Company’s operating leases was as follows:

| | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Cash paid for amounts included in the measurement of operating lease liabilities | |

$ | 605,495 | | |

$ | 554,751 | |

As of September 30, 2023, future minimum

lease payments required under operating leases are as follows:

| 2023 (Remainder) | |

$ | 150,793 | |

| 2024 | |

| 511,786 | |

| 2025 | |

| 230,858 | |

| 2026 | |

| 58,433 | |

| Thereafter | |

| — | |

| Total minimum lease payments | |

| 951,870 | |

| Less: imputed interest | |

| (79,451 | ) |

| Total | |

$ | 872,419 | |

Finance Leases

As of September 30, 2023, the Company has

financed through lease agreements a total of approximately $1,867,000 of its capital equipment purchases with monthly payments ranging

from approximately $1,600 to $14,000, repayment terms ranging from 48 to 60 months, and effective interest rates ranging from 2.67% to

7.44%. Monthly lease payments for all finance leases as of September 30, 2023 are approximately $39,000. These lease obligations

mature ranging from May 2026 through February 2028 and are secured by approximately $3,901,000 in underlying assets which have approximately

$964,000 in accumulated depreciation as of September 30, 2023. The balance of finance lease obligations was approximately $1,354,995

and $1,300,011 as of September 30, 2023 and December 31, 2022, respectively.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

Right of use assets and lease liabilities for

finance leases were recorded in the condensed consolidated balance sheets as follows:

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Property and equipment, net | |

$ | 2,937,313 | | |

$ | 2,672,177 | |

| | |

| | | |

| | |

| Finance lease liabilities, current | |

$ | 394,157 | | |

$ | 441,523 | |

| Finance lease liabilities, long-term | |

| 960,838 | | |

| 858,488 | |

| Total finance lease liabilities | |

$ | 1,354,995 | | |

$ | 1,300,011 | |

The weighted-average remaining lease term for

finance leases was 3.35 years and the weighted-average incremental borrowing rate was 4.51% as of September 30, 2023.

Supplemental cash flow information related to

the Company’s finance leases was as follows:

| | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Operating cash flows from finance leases | |

$ | (63,395 | ) | |

$ | (46,127 | ) |

| Financing cash flows from finance leases | |

$ | (412,007 | ) | |

$ | (305,296 | ) |

Amortization and interest expense information

related to the Company’s finance leases was as follows:

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Amortization expense | |

$ | 84,615 | | |

$ | 57,403 | | |

$ | 242,270 | | |

$ | 152,508 | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

$ | 20,921 | | |

$ | 16,148 | | |

$ | 63,395 | | |

$ | 46,127 | |

As of September 30, 2023, future minimum

lease payments required under finance leases are as follows:

| 2023 (Remainder) | |

$ | 115,887 | |

| 2024 | |

| 463,547 | |

| 2025 | |

| 463,547 | |

| 2026 | |

| 327,444 | |

| 2027 | |

| 110,937 | |

| Thereafter | |

| 18,490 | |

| Total minimum lease payments | |

$ | 1,499,852 | |

| Less: imputed interest | |

| (144,857 | ) |

| Total | |

$ | 1,354,995 | |

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

NOTE 9: CONVERTIBLE NOTES

$4,500,000 Convertible Promissory Note (“April

2022 Note”)

On April 25, 2022, the Company (“Debtor”)

entered into a $4,500,000 convertible promissory note agreement with Ducera Investments LLC - 2022 Series A (“Creditor”) whereby

the Debtor agrees to pay the Creditor the amount borrowed plus interest accrued at an annual rate of 10% compounded quarterly. Subject

to certain conditions, interest on the promissory note accrues as additional principal. The term of the April 2022 Note is five years

unless conversion privileges are exercised. Conversion can occur at the option of the Creditor, the Debtor or upon maturity and is described

below:

(i) The Creditor has the option to convert the

promissory note at any time prior to the maturity date, in full or in part, into the number of shares of common stock (“Common Stock”),

no par value, of the Company equal to the amount determined by dividing the principal amount of this note plus the accrued interest by

$140.00 ($7.00 - pre reverse split), subject to adjustment (as adjusted, the “Conversion Price”); (ii) at any time prior to

the maturity date, the Debtor may convert the note, in full or in part, at the Conversion Price provided that, in order to exercise the

conversion, the closing share price of the Common Stock on the Nasdaq Stock Market LLC (the “Closing Share Price”) for the

thirty (30) consecutive trading days prior to, and including, the conversion date exceeds the per share price required to provide the

Creditor with shares having a market value of at least 4.5 times $4,500,000 upon conversion; and (iii) if none of a Creditor’s election

to convert shares or the Company’s election to convert shares has occurred, then upon the maturity date, the outstanding principal

plus accrued interest on the note shall convert into shares of the common stock at the lesser of the Conversion Price and the greater

of (x) the per share price required to provide the Creditor with shares having a market value of at least 4 times $4,500,000, and (y)

$86.60 (the “Floor Conversion Price”) ($4.33 pre reverse split). In the event that the notes are converted at the Floor Conversion

Price, the Company shall also pay to the Creditor on the maturity date a cash payment equal to (x) the principal amount of the note at

the maturity date minus (y) the Converted Equity Market Value (as defined below) divided by 4. “Converted Equity Market Value”

means the value of the shares of common stock delivered to the Creditor based on a share price equal to the lower of: (i) 10-day volume

weighted average price of the common stock for the 10-days immediately prior to, but excluding, the maturity date and (ii) the Closing

Share Price on the day immediately prior to the maturity date.

Arcimoto has elected to measure the note at fair

value. In estimating the fair value of this debt, a binomial lattice model was used. The required inputs include the estimated term of

3.57 years, risk-free rate of 4.69%, the Company’s stock volatility of 111.91%, stock price on valuation date of $0.84, and a risk

premium of 9.48%. The note’s fair value measurement is classified as Level 2 under the fair value hierarchy as provided by ASC 820,

“Fair Value Measurement.” The fair valuation of this convertible note uses inputs other than quoted prices that are observable

either directly or indirectly. Under this option, changes in fair value of the convertible debt are recorded as an unrealized gain or

loss on convertible note fair value in the Unaudited Condensed Consolidated Statements of Operations. See Note 15 “Fair Value Measurements”

for further details. As a result, the Company recorded an unrealized gain (loss) of $80,550 and $364,110 for the three and nine months

ended September 30, 2023, and $1,925,190 and $(220,350) for the three and nine months ended September 30, 2022, respectively. The balance

on this note is $4,523,580 and $4,887,690 at September 30, 2023 and December 31, 2022, respectively, and is classified as a

long-term liability on the Company’s Condensed Consolidated Balance Sheets.

ARCIMOTO, INC.

CONDENSED CONSOLIDATED NOTES TO FINANCIAL STATEMENTS

(Unaudited)

$10,000,000 Senior Secured Convertible Note

(“September 2022 Note”)

On August 31, 2022, the Company entered into a

Securities Purchase Agreement (the “SPA”) with a third-party investor (the “Buyer” or the “Holder”).

Under the terms of the SPA, the Company issued to the Buyer the notes and warrants pursuant to a then currently effective shelf registration

statement on Form S-3, which had sufficient availability for the issuance of the securities on each closing date.

Under the SPA, the Company authorized the issuance

of one or more series of senior secured convertible notes of the Company, in the aggregate original principal amount of $20,000,000. Such

notes shall be convertible into shares of common stock, no par value per share, of the Company. Further, the Company authorized the issuance

of warrants to acquire up to an aggregate of 25,000 shares of common stock. The notes ranked senior to all outstanding and future indebtedness

of the Company and its subsidiaries and was secured by a second priority perfected security interest in all of the existing and future

assets of the Company and its direct and indirect subsidiaries, if any, including a pledge of all of the capital stock of each of the

subsidiaries.

On September 1, 2022 (the “Issuance Date”),

one note (the “September 2022 Note”) in the amount of $10,000,000 with 25,000 accompanying warrants (the “Warrants”)

were issued to the Buyer. The September 2022 Note was issued with a principal amount of $10,000,000 and an original issue discount of

$600,000, payable in 24 periodic installments with a coupon rate of 6%, and with a maturity date of September 1, 2024. At the option of

the Company, periodic installments can be paid in either cash or common stock (at an 8% discount) to the Holder. Payments in cash were

subject to an additional premium and are recorded as additional interest expense. In the event of a default, the interest rate is increased

to 15%, which is the default rate. At any time on or after the Issuance Date, the Holder is entitled to convert any unpaid principal plus

accrued interest at a conversion price of $5.00 per share. The SPA also provided for the Holder to require payment of principal and unpaid

interest up to four times per period. This provision allowed the September 2022 Note to be settled in full over a six-month period at

the Holder’s option. In addition, a certain percentage of cash received from issuances of shares in conjunction with the ATM discussed

in Note 2 - Summary of Significant Accounting Policies was used to pay down the principal of the September 2022 Note.

The Warrants are exercisable at any time or times

on or after the six month and one day anniversary of the Issuance Date. The Warrants expire on the fifth anniversary of the Issuance Date.

The exercise price of each Warrant which is convertible to a share of common stock is $200.00. As a result of the issuance of the Series

D Convertible Preferred Share in August 2023 the warrants associated with this convertible note were canceled and replaced with new warrants

for 650,000 shares at an exercise price of $1.50.

The net proceeds of $9,400,000 (after discount)

are bifurcated between the Warrants and the September 2022 Note. The amount allocated to the Warrants is $598,670, which is the fair value

on the Issuance Date. The remaining amount (before debt issuance costs) of $8,801,330 was allocated to the September 2022 Note on the

Issuance Date. The Company has elected to measure the note at fair value. In estimating the fair value of this debt, a binomial lattice