Earnings Preview: Analog Devices - Analyst Blog

18 Mai 2012 - 12:15PM

Zacks

Analog Devices, Inc. (ADI) is scheduled to

announce its fiscal second-quarter 2012 results on May 22. We

witness only one downward movement in analyst estimates in the

build-up to the release.

Prior-Quarter Synopsis

Analog’sfirst quarter 2012 pro forma earnings missed the Zacks

Consensus Estimate by a couple of cents due to weaker-than-expected

revenue and margins.

Revenue in the quarter was $648.1 million, down 9.5%

sequentially and 11.0% year over year, particularly due to the

weakness in the consumer, communications and industrial end

markets. However, the automotive segment performed well in the

quarter on account of increased use of electronic content in

automobiles, growing dollar content per vehicle for Analog and

higher sales of vehicles.

Gross margin of 63.2% was down both sequentially and year over

year, impacted by lower utilization rates, as Analog tried to keep

internal inventories under control.

Second Quarter Guidance

Management expects second quarter revenue of $655-$675 million

(a 1-4% sequential increase) with the gross margin at 64-64.5%,

operating expenses of around $226 million and diluted EPS of 48-53

cents. For the second quarter, the Zacks Consensus Estimate is

pegged at 51 cents, at the high end of the guided range.

(Detailed earnings results can be viewed in the blog titled:

Analog Devices Optimistic Despite Miss

Agreement of Analysts

Out of the 18 analysts providing estimates for the second

quarter, none made any revision in the last 30 days. For fiscal

2012, only 1 analyst made a downward revision over the same 30-day

time period.

The majority of analysts expect a decent second quarter with

revenue and non-GAAP EPS (including options) in line with the

Street consensus estimates of $666 million and $0.51,

respectively.

The analysts expect to see strength in the automotive end market

and stabilization in industrial and communications (driven by 3G

deployments in China), which have remained weak thus far. They

contend that 3G deployments and growing semiconductor content in

automobiles will drive the company’s future revenue growth. They

also believe that wireless infrastructure is another area of

revenue growth with strength in wireless base station build-outs

owing to continued expansion into China, Europeand North

America.

However, a handful of analysts do not expect a strong quarter

due to some softness in the end markets and uncertainty in the

current environment. They state that demand uncertainty has

continued, particularly, in industrial and communications end

markets, which together comprise roughly 65% of Analog’s total

revenue.

Magnitude of Estimate Revisions

In the past 30 days, there was no change to the Zacks Consensus

Estimate for the second quarter but the estimate for fiscal 2012

dropped a penny to $2.18.

Over the 90-day period, the Zacks Consensus Estimate fell 3

cents to 51 cents for the second quarter and 10 cents to $2.18 for

fiscal 2012.

The weak demand environment and lower-than-expected guidance

announced by management during the first quarter earnings call,

might have prompted the reduction in estimates.

Our Recommendation

Analog Devices is a leading supplier of analog and DSP

integrated circuits. We remain encouraged by the company’s dominant

position in many of its product segments, and meaningfully improved

gross and operating margin structures.

However, we do not expect Analog Devices to see a strong second

quarter due to a tough macroeconomic environment and softness

within the communications and industrial infrastructure

markets.

Analog, which competes with other large analog players, such as

Intersil Corporation, Linear Technology

Corp(LLTC), Maxim Integrated Products

(MXIM) and Texas Instruments (TXN),holds a Zacks

#4 Rank that translates into a short-term ‘Sell’ rating.

ANALOG DEVICES (ADI): Free Stock Analysis Report

LINEAR TEC CORP (LLTC): Free Stock Analysis Report

MAXIM INTG PDTS (MXIM): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

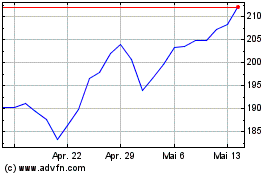

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024