Crown Place VCT PLC Agm Statement

29 November 2018 - 2:45PM

UK Regulatory

TIDMCRWN

At an Annual General Meeting of Crown Place VCT PLC, duly convened at

The City of London Club, 19 Old Broad Street, London EC2N 1DS on 29

November 2018 at 11:00 a.m. the following resolutions were passed:

Ordinary resolutions numbers 1 to 5 were passed.

The following items of Special Business were passed of which resolution

6 and 7 were passed as ordinary resolutions and 8 to 10 were passed as

special resolutions.

Special business

6. Change to investment policy

That the Company's investment policy be amended by replacing the wording

under the heading "Investment policy" in the current policy with the

following:

"The Company will invest in a broad portfolio of smaller, unquoted

growth businesses across a variety of sectors including higher risk

technology companies. Investments may take the form of equity or a

mixture of equity and loans.

Whilst allocation of funds will be determined by the investment

opportunities which become available, efforts will be made to ensure

that the portfolio is diversified both in terms of sector and stage of

maturity of investee businesses. Funds held pending investment, or for

liquidity purposes, will be held principally as cash on deposit."

7. Authority to allot shares

That the Directors be generally and unconditionally authorised in

accordance with section 551 of the Companies Act 2006 (the "Act") to

allot shares in the Company up to an aggregate nominal amount of

GBP365,732 for Ordinary shares provided that this authority shall expire

15 months from the date that this resolution is passed, or, if earlier,

the conclusion of the next Annual General Meeting of the Company but so

that the Company may, before such expiry, make an offer or agreement

which would or might require shares to be allotted or rights to

subscribe for or convert securities into shares to be granted after such

expiry and the Directors may allot shares or grant rights to subscribe

for or convert securities into shares pursuant to such an offer or

agreement as if this authority had not expired.

8. Authority for the disapplication of pre-emption rights

That the Directors be empowered, pursuant to section 570 of the Act, to

allot equity securities (within the meaning of section 560 of the Act)

for cash pursuant to the authority conferred by resolution number 7

and/or sell Ordinary shares held by the Company as treasury shares for

cash as if section 561(1) of the Act did not apply to any such allotment

or sale.

Under this power the Directors may impose any limits or restrictions and

make any arrangements which they deem necessary or expedient to deal

with any treasury shares, fractional entitlements, record dates, legal,

regulatory or practical problems in, or laws of, any territory or other

matter, arising under the laws of, or the requirements of any recognised

regulatory body or any stock exchange in, any territory or any other

matter.

This power shall expire 15 months from the date that this resolution is

passed or, if earlier, the conclusion of the next Annual General Meeting

of the Company, save that the Company may, before such expiry, make an

offer or agreement which would or might require equity securities to be

allotted after such expiry and the Directors may allot equity securities

in pursuance of any such offer or agreement as if this power had not

expired

9. Authority to purchase own shares

That, the Company be generally and unconditionally authorised to make

market purchases (within the meaning of Section 693(4) of the Act) of

Ordinary shares of 1 penny each in the capital of the Company, on such

terms as the Directors think fit, provided always that:

(a) the maximum number of shares hereby authorised to be

purchased is 27,411,637 representing 14.99 per cent. of the issued

Ordinary share capital of the Company as at the date of this Notice;

(b) the minimum price, exclusive of any expenses, which may be

paid for an Ordinary share is 1 penny;

(c) the maximum price, exclusive of any expenses, which may be

paid for each Ordinary share is an amount equal to the higher of (a) 105

per cent. of the average of the middle market quotations for an Ordinary

share, as derived from the London Stock Exchange Daily Official List,

for the five business days immediately preceding the day on which the

Ordinary share is purchased; and (b) the amount stipulated by Article

5(1) of the Buy-back and Stabilisation Regulation 2003;

(d) the authority hereby conferred shall, unless previously

revoked, varied or renewed, expire 15 months from the date that this

resolution is passed or, if earlier, at the conclusion of the next

Annual General Meeting; and

(e) the Company may make a contract or contracts to purchase

Ordinary shares under this authority before the expiry of the authority

which will or may be executed wholly or partly after the expiry of the

authority, and may make a purchase of shares in pursuance of any such

contract or contracts as if the authority conferred hereby had not

expired.

10. Authority to sell treasury shares

That the Directors be empowered to sell treasury shares at the higher of

the prevailing current share price and the price at which they were

bought in.

For further information please contact:

Albion Capital Group LLP

Tel: 020 601 1850

29 November 2018

LEI No 213800SYIQPA3L3T1Q68

(END) Dow Jones Newswires

November 29, 2018 08:45 ET (13:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

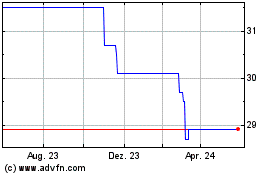

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024