U.S. Dollar Climbs Further Off Recent Lows

24 März 2023 - 5:30PM

RTTF2

Following the rebound seen during yesterday's trading, the value

of the U.S. dollar has seen further upside during trading on

Friday.

The U.S. dollar index is climbing 0.57 points or 0.6 percent to

103.10, bouncing further off its lowest levels in over a month.

The greenback is trading at 130.75 yen versus the 130.85 yen it

fetched at the close of New York trading on Thursday. Against the

euro, the dollar is valued at $1.0761 compared to yesterday's

$1.0831.

The extended recovery by the dollar comes as the currency has

benefited from its appeal as a safe haven amid renewed concerns

about the health of the banking sector.

U.S.-listed shares of Deutsche Bank (DB) moved sharply lower in

early trading amid a spike by the German lender's credit default

swaps.

Credit Suisse (CS) and UBS Group (UBS) also came under pressure

after a report from Bloomberg said they are among banks under

scrutiny in a Justice Department probe into whether financial

professionals helped Russian oligarchs evade sanctions.

UBS' state-backed acquisition of troubled rival Credit Suisse

for 3 billion Swiss francs, or $3.2 billion, helped ease concerns

about recent banking industry turmoil earlier in the week.

While stocks on Wall Street managed to recover from early

weakness, the dollar has seen continued strength throughout the

day.

On the U.S. economic front, the Commerce Department released a

report showing a continued slump in orders for transportation

equipment led to an unexpected decrease in new orders for U.S.

manufactured durable goods in the month of February.

The Commerce Department said durable goods orders slid by 1.0

percent in February after plummeting by a revised 5.0 percent in

January.

Economists had expected durable goods orders to increase by 0.6

percent compared to the 4.5 percent plunge that had been reported

for the previous month.

Excluding the steep drop in orders for transportation equipment,

durable goods orders were unchanged in February after rising by 0.4

percent in January. Ex-transportation orders were expected to inch

up by 0.2 percent.

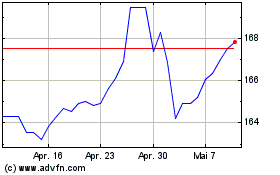

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

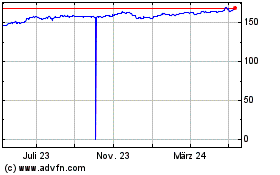

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024