Up sharply

relative to H1 2020/2021 (x3.6) and more than 7.5% higher than in

H1 2018/2019

Regulatory News:

PIERRE ET VACANCES (Paris:VAC):

1]

Revenue

Under IFRS accounting, revenue in the first half of 2021/2022

totalled €636.7 million.

The Group nevertheless continues to comment on its revenue and

the associated financial indicators, in compliance with its

operating reporting namely:

- with the presentation of joint undertakings in proportional

consolidation,

- excluding the impact of IFRS16 application.

A reconciliation table presenting revenue stemming from

operating reporting and revenue under IFRS accounting is presented

at the end of the press release.

Revenue is also presented according to the following operating

segments, as defined under IFRS 81, i.e.:

- the Center Parcs operating segment covering both

operation of the domains marketed under the Center Parcs, Sunparks

and Villages Nature brands, and the building/renovation activities

for tourism assets and property marketing in the Netherlands,

Germany and Belgium;

- the Pierre & Vacances operating segment covering

the tourism businesses operated in France and Spain under the

Pierre & Vacances and maeva.com brands, the property

development business in Spain and the asset management business

line (responsible in particular for relations with individual and

institutional lessors);

- the Adagio operating segment covering operation of the

city residences leased by the Pierre & Vacances-Center Parcs

Group and entrusted to the Adagio SAS joint venture under

management mandates, as well as operation of the sites directly

leased by the joint venture;

- the operating segment covering Major Projects

(construction and development of new assets on behalf of the Group

in France) and Senioriales, the subsidiary specialised in

property development and operation of non-medicalised residences

for independent elderly people;

- the Others operating segment covering primarily the

holding company activities.

Finally, the Group has changed its operational reporting to

comply with the presentation chosen by the majority of tourism

players concerning holiday marketing fees. Revenue from

accommodation rental is therefore presented in gross terms before

these fees, whereas it was previously presented net of these

commission fees. This change in presentation has no impact on the

overall amount of revenue from the tourism businesses.

Accommodation revenue in 2018/2019 and 2020/2021 has been

adjusted accordingly in the following table.

€m

2021/2022 operational

reporting

2020/2021 proforma operational

reporting*

Change vs.2020/2021

2018/2019 pro-forma

operational

reporting*

Change vs.2018/2019

Center Parcs

185.2

61.4

202%

o/w Accommodation revenue

121.1

17.2

605%

109.1

11.1%

Pierre & Vacances

113.2

28.9

291%

o/w Accommodation revenue

81.2

18.0

352%

87.8

-7.6%

Adagio

30.3

12.0

152%

o/w Accommodation revenue

26.9

9.9

171%

33.8

-20.4%

Major Projects & Senioriales

30.1

26.8

12%

Holding Company

1.0

0.9

9%

GROUP REVENUE Q2

359.8

130.1

177%

Accommodation revenue

229.2

45.0

409%

230.7

-0.6%

Supplementary income

71.0

17.2

312%

Other revenue

59.6

67.8

-12%

Center Parcs

422.8

161.8

161%

o/w Accommodation revenue

280.2

76.2

268%

228.8

22.4%

Pierre & Vacances

165.6

48.6

240%

o/w Accommodation revenue

116.9

29.0

304%

121.0

-3.4%

Adagio

67.1

25.5

163%

o/w Accommodation revenue

59.9

21.4

180%

75.2

-20.4%

Major Projects & Senioriales

58.7

59.3

-1%

Holding Company

1.2

2.0

-41%

GROUP REVENUE H1

715.3

297.2

141%

Accommodation revenue

457.0

126.5

261%

425.1

7.5%

Supplementary income

131.0

38.5

240%

Other revenue

127.4

132.2

-4%

* Accommodation revenue expressed in gross terms including

marketing fees

After an excellent summer season and revenue up 113% in the

first quarter of 2021/2022 (vs. Q1 2020/2021), growth momentum

continued during the second quarter of the year (+177% relative to

the year-earlier period). In all, the Group’s first half revenue

totalled €715.3 million, up 141% relative to 2020/2021.

Accommodation revenue:

Accommodation revenue totalled €457.0 million in H1

2021/2022, representing more than 3.5x the revenue recorded in the

first half of the previous year.

Compared with the first half of 2018/2019 (the reference

period not affected by the pandemic), the Group recorded an

increase in accommodation revenue 7.5% higher than the

pre-crisis level, with:

- robust revenue growth at Center Parcs: +22.4% over H1,

including +11.1% in Q2, primarily driven by the rise in average

letting rates stemming from the premiumisation of renovated

domains, and benefiting all destinations (+25.1% for the French

domains, o/w +9.4% in Q2, and +21.0% for the domains located in

BNG2, o/w +12.1% in Q2).

- revenue down 3.4% for Pierre & Vacances (-7.6% in the

second quarter), related to the decline in the stock of

accommodation marketed (non-renewal of leases or withdrawals from

loss-making sites), with:

- slight growth in the residences business in France (+0.6%) in

the first half, despite the 7.8% decline in the supply of

accommodation. Q2 accommodation revenue was down 4.5%, due to 10.6%

decline in the number of nights offered vs. 2018/2019. On a

same-structure basis, revenue over the quarter was higher, driven

by healthy performances at the mountain destinations (average

letting rates up by almost 13% and occupancy rate of 92%, close to

the level in Q2 2018/2019.

- Non-significant revenue in Spain, accounting for just 6% of

accommodation revenue in the P&V scope over the first half and

just 3.5% during Q2.

- Revenue from the Adagio city residences up 180% relative to

the first half of 2020/2021 but still down 20.4% relative to the

first half of 2018/2019, although this was a lesser decline than in

the previous year and due to the lack of international and

corporate guests.

Supplementary income:

First half supplementary income jumped by 240% to €131.0 million

relative to the year-earlier period, and by 10.6% relative to the

same period in 2018/2019. It was driven especially by outstanding

performances at maeva.com (whose revenue more than doubled compared

to the first half of 2018/2019) and higher revenue from on-site

activities at Center Parcs domains.

Other revenue:

The Group recorded €127.4 million in revenue from its other

activities stemming mainly from:

- Seniorales residences for €31.3 million (vs. €33.6 million in

H1 2020/2021);

- The Major Projects property development division for €27.4

million (primarily Center Parcs Landes de Gascogne in the

Lot-et-Garonne region for €21.2 million), compared with €25.7

million in H1 2020/2021 (of which €16.9 million relative to Center

Parcs Landes de Gascogne);

- Renovation operations at Center Parcs domains in BNG million

for €66.8 million vs. €68.5 million in 2020/2021.

2] Outlook

Tourism businesses:

In view of tourism reservations to date for the third quarter

2021/2022 and compared to Q3 of 2018/2019 (pre-Covid), the Group is

currently expecting:

- further growth in performances by Center Parcs Europe, with

revenue growth likely to exceed the level seen in Q2,

- growth in revenue at Pierre & Vacances, adjusted for the

decline in the supply of accommodation (around 20% lower than in

2018/2019).

- a decline in revenue at Adagio, albeit far less so than in the

first half of the year, with the recovery in business taking shape

as the weeks go by.

Financial targets of the Reinvention

plan:

In line with previous announcements, the Group and investors who

signed the restructuring agreement on 10 March 2022 are currently

working on updating the financial targets of the Reinvention 2025

plan, which will be communicated in coming days.

3] Reconciliation tables – Revenue

€ millions

2021/2022

According to operational

reporting

Adjustment for IFRS 11

Adjustment for IFRS 16

2021/2022 IFRS

Center Parcs

185.2

-4.7

-14.5

166.0

Pierre & Vacances

113.2

113.2

Adagio

30.3

-6.8

23.5

Grands Projets & Senioriales

30.1

-6.3

-5.1

18.7

Holding company

1.0

1.0

Total Q2 2021/2022 revenue

359.8

-17.8

-19.6

322.5

€ millions

2021/2022

According to operational

reporting

Adjustment for IFRS 11

Adjustment for IFRS 16

2021/2022 IFRS

Center Parcs

422.8

-12.1

-33.3

377.4

Pierre & Vacances

165.6

165.6

Adagio

67.1

-15.5

51.6

Major Projects & Senioriales

58.7

-8.0

-9.8

40.9

Holding

1.2

1.2

Total H1 2021/2022 revenue

715.3

-35.6

-43.0

636.7

IFRS11 adjustments: for

its operational reporting, the Group continues to integrate joint

operations under the proportional integration method, considering

that this presentation is a better reflection of its performance.

In contrast, joint ventures are consolidated under equity

associates in the consolidated IFRS accounts.

IFRS16 adjustments: The

application of IFRS16 as of 1 October 2019 leads to the

cancellation in the financial statements, of a share of revenue and

the capital gain for disposals undertaken as part of property

operations with third-parties (given the Group’s right-of-use

rights). See above for the impact on H1 revenue.

1 See pages 181-182 of the Universal Registration Document,

filed with the AMF on 17 March 2022 and available on the Group’s

website: www.groupepvcp.com 2 Belgium, the Netherlands, Germany

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220419005819/en/

For further information: Investor Relations and

Strategic Operations Emeline Lauté +33 (0) 1 58 21 54 76

info.fin@groupepvcp.com

Press Relations Valérie Lauthier +33 (0) 1 58 21 54 61

valerie.lauthier@groupepvcp.com

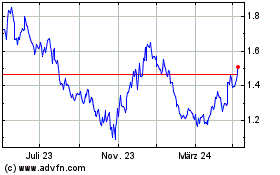

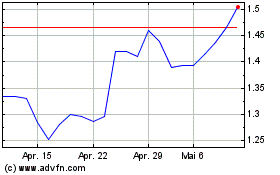

Pierre & Vacances (EU:VAC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Pierre & Vacances (EU:VAC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024