Schneider Electric 2022 Earnings Rose on Strong Demand

16 Februar 2023 - 7:59AM

Dow Jones News

By Pierre Bertrand

Schneider Electric SE reported an increase in full-year earnings

Thursday amid strong demand and customer focus on electrification,

digitization and sustainability.

The French energy management company achieved 3.48 billion euros

($3.72 billion) in net profit compared with EUR3.20 billion in 2021

on revenue that grew 12% organically to EUR34.18 billion.

The result compares with expectations of net profit of EUR3.52

billion and revenue of EUR33.63 billion, according to a

company-provided consensus.

Adjusted earnings before interest, taxes and amortization

exceeded analysts' expectations, amounting to EUR6.02 billion, a

14% organic rise compared to 2021.

The Paris-based company said its result was driven by dynamic

demand in all of its four end-markets which were supported by

customers focusing on electrification, digitization and

sustainability. That said, consumer-linked segments including

residential buildings and distributed IT remained weak as softening

demand trends seen in the third quarter carried over.

Analysts had expected Schneider Electric to post EUR5.95 billion

in adjusted Ebita, according to the consensus.

The company said that it would propose a dividend of EUR3.15 a

share compared with EUR2.90 for 2021.

Schneider Electric said that it is targeting organic adjusted

Ebita growth of between 12% and 16% in 2023 and expects organic

revenue growth of 9% to 11% with an Ebita margin of around 17.4% to

17.7%.

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

February 16, 2023 01:44 ET (06:44 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

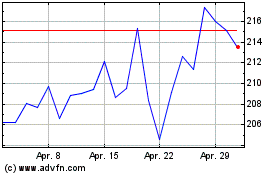

Schneider Electric (EU:SU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Schneider Electric (EU:SU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024