- CHANGES TO THE BOARD OF DIRECTORS

- SUMMARY OF VOTING RESULTS

Regulatory News:

ORPEA (Paris:ORP):

Guillaume Pepy, Chairman of the Board of Directors:

"ORPEA can now look to the future with a largely new Board of

Directors, reflecting the arrival of its new shareholders. I am

delighted with this new governance structure. The skills of the new

Board of Directors, combined with the long-term vision of our new

shareholders, will give the Group the resources it needs to achieve

its ambitions. Since summer 2022, the Group has been supported by a

Board of Directors working closely with Laurent Guillot and his

team to successfully implement the Refoundation Plan and the

financial restructuring. Once again, I would like to thank the

outgoing directors for their commitment, and on behalf of us all, I

would like to congratulate Laurent Guillot and his team for their

dedication to serving patients, residents and staff. I would also

like to thank the newly appointed members of the Board for their

renewed support and I shall continue to fulfil my role as Chairman

of the Board with commitment and determination, serving all ORPEA's

stakeholders and pursuing the Refoundation work that began over a

year ago".

Laurent Guillot, Chief Executive Officer: "This General

Meeting is a major step in the Refounding of the company. The

arrival of Caisse des Dépôts, CNP, MAIF and MACSF as shareholders

represented on the Board of Directors, is a sign of confidence in

the company, its responsibilities and its vital role in serving the

most vulnerable, and above all in the men and women who serve them

in the field each day. I'm very pleased with this new governance

structure and with the appointment to our Board of Directors of

individuals with recognised experience. I would also like to thank

the outgoing directors for their commitment and support throughout

their tenure, alongside Guillaume Pepy, Chairman of the Board. The

ORPEA Group is today starting a new chapter. Since 15 November

2022, we have been transforming ORPEA with our Refoundation Plan.

We successfully restored the Company's financial balance, with the

Group undergoing profound changes in one year. To improve the

working conditions in our facilities and the care we provide to our

residents, patients and beneficiary, we embarked on a

transformation process and are achieving the first results, but we

need to continue and accelerate. Thanks to the support of the

Board, the commitment of its Chairman Guillaume Pepy, and the

determination of all the Group's team, which I commend, we can

embark on this new phase with confidence and ambition to become a

company with a mission, serving the common interest".

Changes to the Board of Directors of ORPEA

Today's Combined General Meeting of ORPEA (the “Meeting”)

approved the major changes to the Board of Directors of ORPEA

proposed in connection with its financial restructuring, and in

accordance with (i) the Lock-Up agreement, entered into on 14

February 2023 between the Company and, firstly, Caisse des Dépôts

et Consignations, CNP Assurances, MAIF and MACSF (the

“Groupement") and, secondly, five institutions holding the

Company's unsecured debt and (ii) the Company’s accelerated

safeguard plan approved by the specialised commercial court of

Nanterre on 24 July 2023.

Additionally the new Board of Directors, which met immediately

after the Meeting, appointed two non-voting advisors.

Finally, May Antoun was appointed as director representing

employees by the European Works Council of ORPEA at its plenary

meeting of 13 December 2023.

Having regard to the expiry announced on 13 November 2023 of the

terms of office of certain directors who were previously acting,

and to these appointments, the Board of Directors of ORPEA is now

composed of 13 directors and two non-voting advisors,

including:

- seven non-independent directors, namely Caisse des Dépôts et

Consignations (represented by Audrey Girard), CNP Assurances

(represented by Stéphane Dedeyan), MAIF (represented by Pascal

Demurger), MACSF Epargne Retraite (represented by Stéphane

Dessirier), Philippe Grangeon, Sibylle Le Maire and Frédérique

Mozziconacci,

- three independent directors, namely Guillaume Pepy, Mireille

Faugère and Méka Brunel,

- the Chief Executive Officer, namely Laurent Guillot, and

- two directors representing employees, namely Sophie Kalaidjian

and May Antoun.

Three directors on the Board are independent, giving a

proportion of independent directors of 27% (excluding directors

representing employees and non-voting advisors). The composition of

the Board of Directors is not compliant with recommendation 10.3 of

the AFEP-MEDEF Code providing that, in controlled companies, the

proportion of independent directors must be at least one third.

Appendix contains a table providing details and

information about the members of the new Board of Directors.

At its first meeting, the new Board of Directors decided (i) to

create an Investment Committee, (ii) to change the duties of its

four Board Committees and (iii) to determine the new composition of

those Committees.

As of 22 December 2023:

- the Audit and Risks Committee is composed of five

directors: Méka Brunel (Chair), Caisse des Dépôts et Consignations

(represented by Audrey Girard), CNP Assurances (represented by

Stéphane Dedeyan), MAIF (represented by Pascal Demurger) and

Mireille Faugère. Laurent David, non-voting advisor, also attends

this Committee.

Two directors on this Committee are independent, giving a

proportion of independent directors of 40% (excluding non-voting

advisors). The composition of the Audit and Risks Committee is not

compliant with recommendation 17.1 of the AFEP-MEDEF Code providing

that the proportion of independent directors must be at least two

thirds;

- the Appointments and Remuneration Committee is composed

of six directors: Guillaume Pepy (Chair), Caisse des Dépôts et

Consignations (represented by Audrey Girard), MACSF Epargne

Retraite (represented by Stéphane Dessirier), Philippe Grangeon,

Méka Brunel and Sophie Kalaidjian.

Two directors on this Committee are independent, giving a

proportion of independent directors of 40% (excluding the director

representing employees). The composition of the Appointments and

Remuneration Committee is not compliant with recommendations 18.1

and 19.1 of the AFEP-MEDEF Code providing that the committee

responsible for appointments and the committee responsible for

remuneration must be composed of a majority of independent

directors;

- the Ethics, Quality and CSR Committee is composed of

five directors: Mireille Faugère (Chair), Philippe Grangeon,

Sibylle Le Maire, Frédérique Mozziconacci and May Antoun. Pascale

Pradat, non-voting advisor, also attends this Committee.

The AFEP-MEDEF Code does not provide any recommendations

regarding the composition of this Committee;

- the Investment Committee is composed of three

directors: Caisse des Dépôts et Consignations (represented by

Audrey Girard) (Chair), CNP Assurances (represented by Stéphane

Dedeyan) and Philippe Grangeon. Laurent David, non-voting advisor,

also attends this Committee.

The AFEP-MEDEF Code does not provide any recommendations

regarding the composition of this Committee.

The duties of the Board Committees are set out in the Internal

Rules of the Board of Directors, as amended on 22 December 2023,

which are available on ORPEA's website at the following address:

www.orpea-group.com/en/the-group/gouvernance

The failure to comply with the recommendations of the AFEP-MEDEF

Code relating to the proportion of independent directors on the

Board of Directors, the Audit and Risks Committee and the

Appointments and Remuneration Committee is due to the governance

agreed in relation to the Groupement's stake in the Company’s share

capital, having regard to its acquisition of a majority

shareholding, which is set out in the Company's accelerated

safeguard plan approved by the specialised commercial court of

Nanterre on 24 July 2023.

Summary of voting results for other resolutions

During this Meeting, the required majority of Company

shareholders approved the resolutions relating to:

- the approval of the 2022 financial statements, the

appropriation of profit and the approval of the Auditors’ report on

regulated agreements;

- the approval of the co-option of two directors;

- the appointment of new directors;

- the remuneration and benefits of corporate officers for the

2022 financial year (except Yves Le Masne’s remuneration and

benefits1);

- the remuneration policy for corporate officers for the 2023

financial year;

- the renewal or grant of financial delegations and

authorisations to the Board of Directors (except the authorization

to issue share warrants to the Groupement1);

- the amendment of the Articles of Association;

- the powers for formalities.

It should be noted that the shares of the beneficiaries of the

issuance of share warrants without pre-emption rights for

shareholders under the 27th and 28th resolutions were excluded from

the vote on the corresponding resolutions pursuant to applicable

regulations.

Detailed results of the votes may be consulted at this following

address:

www.orpea-group.com/en/shareholders-investors/shareholders/shareholder-meeting

About ORPEA

ORPEA is a leading global player, expert in the care of all

types of frailty. The Group operates in 20 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living, home care), post-acute and rehabilitation care and

mental health care (specialized clinics). It has more than 76,000

employees and welcomes more than 267,000 patients and residents

each year.

https://www.orpea-group.com/en

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and a

member of the SBF 120 and CAC Mid 60 indices.

Appendix

Personal information

Experience

Position on the Board

Membership of

Committees

Director

Age2

Gender

Nationality/Nationalities

Number of shares

Number of offices held in

listed companies

Independence

First date of

appointment

Term of office3

Length of service on the

Board

(C = Chair /

M = Member)

Guillaume Pepy

65

M

French

1

2

Yes

28/07/2022

AGM 2026

2

Appointments and Remuneration

Committee (C)

Laurent Guillot

54

M

French

1

2

No

28/07/2022

AGM 2026

1

-

Audrey Girard4

48

F

French

-

0

No

22/12/2023

AGM 2026

0

Investment Committee (C)

Audit and Risk Committee (M)

Appointments and Remuneration Committee (M)

Stéphane Dedeyan5

58

M

French

-

3

No

22/12/2023

AGM 2027

0

Audit and Risk Committee (M)

Investment Committee (M)

Pascal Demurger6

59

M

French

-

0

No

22/12/2023

AGM 2027

0

Audit and Risk Committee (M)

Stéphane Dessirier7

63

M

French

-

0

No

22/12/2023

AGM 2026

0

Appointments and Remuneration

Committee (M)

Philippe Grangeon8

66

M

French

-

1

No

22/12/2023

AGM 2027

0

Ethics, Quality and CSR Committee

(M) Appointments and Remuneration Committee (M)

Investment Committee (M)

Sibylle Le Maire8

49

F

French

-

1

No

22/12/2023

AGM 2027

0

Ethics, Quality and CSR Committee

(M)

Frédérique Mozziconacci9

51

F

French

-

1

No

22/12/2023

AGM 2026

0

Ethics, Quality and CSR Committee

(M)

Méka Brunel

67

F

French

70,000

1

Yes

22/12/2023

AGM 2027

0

Audit and Risk Committee (C)

Appointments and Remuneration

Committee (M)

Mireille Faugère

67

F

French

1

1

Yes

01/10/2022

AGM 2024

1

Audit and Risk Committee (M)

Ethics, Quality and CSR Committee (C)

Sophie Kalaidjian

45

F

French

20

1

No

15/01/2015

AGM 2024

8

Appointments and Remuneration

Committee (M)

May Antoun

63

F

French

-

0

No

13/12/2023

AGM 2026

0

Ethics, Quality and CSR Committee

(M)

Non-voting members

Age2

Gender

Nationality/Nationalities

Number of shares

Number of offices held in

listed companies

Independence

First date of

appointment

Expiry date of term of

office

Length of service on the

Board

Chairman (C) / Member

(M)

Laurent David

36

M

French and British

-

0

-

22/12/2023

AGM 2027

0

Audit and Risk Committee (M)

Investment Committee (M)

Pascale Pradat

64

F

French

-

0

-

22/12/2023

AGM 2027

0

Ethics, Quality and CSR Committee

(M)

__________________

1 The 17 resolution relating to the 2022 remuneration for Yves

Le Masne and the 27th resolution relating to the delegation of

powers to the Board of Directors to issue and allocate share

warrants to the Groupement were rejected, with 11.19% of favorable

votes and 65.55% of favorable votes respectively. 2On the date of

publication of the 2023 notice of meeting brochure. 3General

Meeting ruling on the financial statements for the previous

financial year. 4Permanent representative of the Caisse des Dépôts

et Consignations. 5Permanent representative of CNP Assurances.

6Permanent representative of MAIF. 7Permanent representative of

MACSF Epargne Retraite. 8Candidate proposed by Caisse des Dépôts et

Consignations. 9 Candidate proposed by MAIF.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231222627505/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Toll-free number for shareholders: 0 805 480 480

Investor Relations NewCap Dusan Oresansky 01 44 71

94 94 ORPEA@newcap.eu

Press Relations ORPEA Isabelle Herrier-Naufle

Press Relations Director 07 70 29 53 74 i.herrier-naufle@orpea.net

Image7 Charlotte Le Barbier // Laurence Heilbronn 06 78

37 27 60 - 06 89 87 61 37 clebarbier@image7.fr lheilbronn@image7.fr

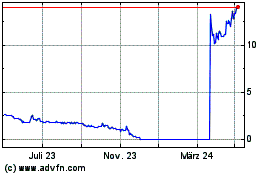

Orpea (EU:ORP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

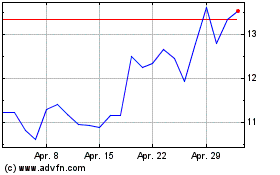

Orpea (EU:ORP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024