LUMIBIRD: FIRST-HALF RESULTS FOR 2024 UP IN THE MEDICAL DIVISION,

LOWER IN THE PHOTONICS DIVISION

Lannion, September 24, 2024 – 17:45 pm

FIRST-HALF RESULTS FOR 2024 UP IN THE

MEDICAL DIVISION, LOWER IN THE PHOTONICS DIVISION

- EBITDA1 of

€10.9m on a reported basis, compared with €13.8m in H1

2023

- Medical Division: EBITDA as a percentage of sales

revenue up to 17.6% (vs. 15.4% in H1 2023)

- Photonics division: EBITDA

as a percentage of sales revenue down to 4.3% (vs 12.9% in H1 2023)

and 7.9% excluding Convergent

- Lumibird expects to achieve

sales revenue growth of over 5% and an EBITDA as a percentage of

sales revenue of over 16% in 2024

- 3-year objectives of 2024-2026 plan

maintained

The Lumibird Group, the European leader

in laser technologies, has published lower results for the first

half of 2024, due to a fall in profitability in the Photonics

division, mainly because of lower-than-expected sales, an

unfavourable product mix impacting the gross margin percentage and

the integration of the Convergent business, loss-making over the

period. The Medical division significantly improved its

profitability by increasing its gross margin percentage and

controlling operating costs. For FY 2024, Lumibird anticipates

sales growth of over 5% and EBITDA as a percentage of sales revenue

of over 16%. In addition, the Group is confident in the momentum of

its markets and its capacity for innovation and remains focused on

achieving its 3-year objectives: a compound annual growth rate

(CAGR) in sales revenue of over 8% and EBITDA as a percentage of

sales revenue up by at least 500 basis points compared with 2023

(17%).

Extract from the condensed consolidated

interim financial statements approved by the Board of Directors on

24 September 2024

30 June (in €m)

|

H1 2024 reported

|

H1 2024 excluding

Convergent2

|

H1 2023

|

Restated change |

|

Value |

% |

|

Revenues |

98.0 |

94.2 |

97.2 |

(3.0) |

-3% |

|

EBITDA 1 |

10.9 |

12.3 |

13.8 |

(1.5) |

-11% |

|

% revenues |

11.2% |

13.1% |

14.2% |

|

|

|

Profit from recurring operations |

1.6 |

4.2 |

6.0 |

(1.7) |

-29% |

|

% revenues |

1.7% |

4.5% |

6.2% |

|

|

|

Operating profit |

2.2 |

|

2.7 |

|

|

|

Net income |

(0.1) |

|

0.5 |

|

|

Stable sales revenue in the first half of

2024

In the first half of 2024, the Group recorded 1%

growth in consolidated sales revenue, to €98.0m on a reported basis

and €94.2m excluding Convergent, down slightly (-3%).

- The Medical

Division posted sales revenue of €50.8m in the first half, down

slightly (-1%) on the previous year, and up 0.4% at constant

exchange rates. The 1st half saw a gradual recovery in

Asian markets, mainly China and Korea, and slight growth in EMEA

and the Americas. The regulatory and administrative obstacles

identified at the end of 2023 are gradually being overcome, for

example by obtaining CE marking for C-DIAG (dry eye) in May 2024

and authorization for our distributor in Brazil to re-import

Optotek brand products.

- The Photonics

division, with revenues of €47.2m on a reported basis, up 3% and

down 4% on a like-for-like basis, had a mixed performance in the

first half of 2024. Strong growth in Europe was driven by the

buoyancy of the Defence/Space segment, while the decline in

business in the Americas and Asia-Pacific was mainly due to the ETS

(Environment, Topography and Security) segment. The Lidar Systems

business was severely impacted by a commercial and industrial

reorganization that took longer than expected. The division also

suffered from order backlogs, adding to the unfavourable base

effect for the H1 2023 comparison.

Contribution for both divisions

Summary of results by division

in €m

|

Photonics |

Medical |

|

2023-H1 (reported) |

2024-H1

(reported) |

2024-H1

(excluding Convergent) |

Chg 24-23(%) (excl. Convergent) |

2023–H1 |

2024-h1 |

Chg (%) |

|

Revenues |

45.9 |

47.2 |

43.4 |

-5.5% |

51.3 |

50.8 |

-0.9% |

|

Gross margin |

29.9 |

28.3 |

26.8 |

-10.5% |

30.9 |

31.2 |

+0.9% |

|

% |

65.2% |

59.9% |

61.7% |

|

60.3% |

61.4% |

|

|

EBITDA |

5.9 |

2.0 |

3.4 |

-42.2% |

7.9 |

8.9 |

+12.7% |

|

% |

12.9% |

4.3% |

7.9% |

|

15.4% |

17.6% |

|

|

Profit from recurring operations |

0.7 |

(4.8) |

(2.2) |

-396.4% |

5.2 |

6.4 |

+22.5% |

|

% |

1.6% |

-10.2% |

-5% |

|

10.2% |

12.6% |

|

Gross margin rate for the Photonics division was

59.9% on a reported basis, down 530 bps, impacted in particular by

the integration of Convergent. Excluding Convergent, the decline

was just 350 bps, due to a sharp 50% fall in business in the ETS

market and a less favourable product mix than in H1 2023 (fewer

sales of high-margin Lidar systems). For the Medical division,

gross margin is up, despite the slight fall in sales revenue,

reflecting the return to a gross margin rate (61.4%) at the 2022

level.

EBITDA for the first half of 2024 was €10.9m on

a reported basis, or 11.1% of revenues, compared with 14.2% in the

first half of 2023. Excluding Convergent, EBITDA for the first half

of 2024 was €12.3m, representing a margin of 13.1% of sales. The

increase in EBITDA for the Medical division, due to an improved

gross margin and tight control of operating costs, was not enough

to offset the decline in EBITDA for the Photonics division, which

was mainly due to a lower gross margin, despite a reduction in

operating costs.

In accordance with IFRS, reported EBITDA has

been restated for development costs capitalised during the period,

and operating income before non-recurring items has been restated

for depreciation charges relating to the capitalisation of

projects:

- Over the period, direct expenditure

on development projects, whether self-financed, subsidised or

eligible for the research tax credit, totalled €11.1m, compared

with €9.1m a year earlier. The portion capitalised during the

period as investment (and -excluded from EBITDA) amounted to €6.1m,

compared with €6.2m a year earlier.

- Depreciation and amortisation of

R&D investments (recognised in current EBIT) totalled €4.1m,

compared with €3.9m a year earlier.

Profit from recurring operations for the first

half of the year was therefore €1.6m on a reported basis and €4.2m

excluding Convergent, compared with €6.0m in the first half of

2023.

After net financial expenses of €2.2m (vs. €2.8m

in H1 2023) and tax of €0.1m (vs. €0.6m in H1 2023), net profit was

€0.1m, compared with €0.5m in H1 2023.

Cash flow: solid generation of operating cash

flow

| in

€m |

30/06/2023 |

30/06/2024 |

| Cash

flow from operating activities |

6.4 |

14.8 |

|

Of which cash flow from operations before tax and finance

costs |

10.5 |

11.2 |

|

Of which Change in WCR |

(2.9) |

5.3 |

|

Of which tax paid |

(1.2) |

(1.8) |

|

Cash flow from investing activities |

(15.1) |

(9.0) |

|

Of which Industrial investment |

(14.0) |

(9.0) |

|

Of which external growth |

(1.1) |

- |

|

Of which other financial assets |

- |

- |

|

Cash flow from financing activities |

(3.2) |

1.9 |

|

Of which capital increase |

- |

- |

|

Of which net new financing |

0.7 |

5.5 |

|

Of which debt servicing |

(1.6) |

(2.7) |

|

Of which other changes |

(2.4) |

(0.9) |

| CHANGE

IN CASH AND CASH EQUIVALENTS

3 |

(11.9) |

7.7 |

The change in working capital requirements made

a positive contribution (+€5.3m) to the change in cash and cash

equivalents over the first half of 2024, mainly due to the

reduction in trade receivables.

After several years of heavy investment in new

production capacity, investment flows in the first half of 2024 are

down. Capitalised development costs amounted to €6.1m (€6.2m at

end-June 2023) and capital expenditure to improve production

facilities to €2.9m (€7.9m at end-June 2023).

Balance sheet position

| Extract

from the consolidated balance sheet (in €m) |

31/12/2023 |

30/06/2024 |

|

Goodwill |

72.6 |

73.1 |

|

Non-current assets (excluding goodwill) |

135.3 |

140.7 |

|

Current assets (excluding cash) |

141.1 |

137.1 |

|

Cash and cash equivalents |

56.2 |

63.9 |

| TOTAL

ASSETS |

405.2 |

414.8 |

|

Equity (including minority interests) |

193.3 |

193.5 |

|

Financial liabilities4 non current |

128.6 |

136.4 |

|

Other non-current liabilities |

9.2 |

9.8 |

|

Current financial liabilities |

16.5 |

17.5 |

|

Current liabilities |

57.6 |

57.6 |

| TOTAL

LIABILITIES |

405.2 |

414.8 |

Net financial debt stood at €90.0m at 30 June

2024, compared with €88.9m at 31 December 2023. It is made up of

€153.9m in gross financial debt and €63.9m in cash and cash

equivalents.

Lumibird retains a solid financial position,

with gearing of 47% and a leverage ratio (12 months rolling) of

2.9.

Outlook

After a mixed first half, Lumibird expects to

achieve the following in 2024:

- Sales revenue

growth rate of over 5% and EBITDA as a percentage of sales revenue

of over 16% (17% in 2023),

- For the Medical

division, revenue growth rate of over 8% and a significant

improvement in EBITDA as a percentage of sales revenue compared

with 2023 (18.1%),

- For the

Photonics division, revenue growth of over 2%, with the integration

of Convergent. Photonics revenues (excluding Convergent) are

expected to be stable. EBITDA as a percentage of sales revenue for

the Photonics division is expected to be lower than in 2023

(15.8%). The acquisition of Convergent represents a long-term

investment in technology and product development. The time taken to

bring new products to market will be more gradual than expected. In

addition, sales of OEM5 products are expected to fall in

H2 2024, with a negative impact on H2 2024 EBITDA for Convergent.

Convergent sales revenue for 2024 are expected to be between €5.5m

and €6.0m.

Lumibird remains confident in the momentum of

its markets and its capacity for innovation, and confirms the

objectives of its 2024-2026 plan, namely:

- A compound

annual growth rate (CAGR) in sales of over 8%, driven by the launch

of new products and the order book secured by multi-year

contracts,

- EBITDA as a % of

sales up by at least 500 basis points compared with 2023 (17%). The

improvement in EBITDA will be driven by the Group's verticalisation

strategy, productivity gains and the optimisation of its operating

cost structure as a result of recent investments.

Next date : Q3 2024 revenues,

21/10/2024 after close of trading

LUMIBIRD is one of the world's leading laser

specialists. With 50 years' experience and expertise in

solid-state, diode and fibre laser technologies, the Group designs,

manufactures and distributes high-performance laser solutions via

two divisions: Photonics and Medical. The Photonics Division

designs and produces components, lasers and systems for the defence

and space, environment, topography and safety, industrial and

scientific, and medtech markets. The Medical branch designs and

produces medical diagnostic and treatment systems for

ophthalmology.

The result of the merger in October 2017 between the Keopsys and

Quantel Groups, LUMIBIRD, with more than 1,000 employees and over

€203.6m in sales in 2023 is present in Europe, America and

Asia.

LUMIBIRD shares are listed in compartment B of Euronext

Paris. FR0000038242 -

LBIRD www.lumibird.com

LUMIBIRD has been a member of Euronext

Tech Leaders since

2022.

Contacts

LUMIBIRD

Marc Le Flohic

Chairman and Chief Executive Officer

Tel. +33(0) 1 69 29 17 00

info@lumibird.com |

LUMIBIRD

Sonia Rutnam

Chief Financial and Transformation Officer

Tel. +33(0) 1 69 29 17 00

info@lumibird.com |

Calyptus

Mathieu Calleux

Investor Relations

Tel. +33(0) 1 53 65 37 91

lumibird@calyptus.net |

This press release contains forward-looking

statements. These forward-looking statements represent trends or

objectives, as the case may be, and should not be construed as

forecasts of the Company's results or any other performance

indicator. These statements are by their nature subject to risks

and uncertainties as described in the Company's URD filed with the

Autorité des Marchés Financiers (under number D24-0239). These

statements do not therefore reflect the Company's future

performance, which may differ materially.

1 EBITDA (corresponding to EBE disclosed in the financial

statements) to recurring operating income adjusted for charges to

provisions and depreciation, net of reversals, and expenses covered

by such reversals.

2 Excluding Convergent, included in the scope of

consolidation on 31.08.2023, unaudited data

3 Cash corresponds to "cash and cash equivalents" on the assets

side of the balance sheet, net of bank overdrafts included in

current financial liabilities on the liabilities side. It is

presented before currency change impact.

4 Financial liabilities (current and non-current) correspond to

financial debts and include lease debts in accordance with IFRS16

(11.5M€ for 30th June 2024 and 9.8M€ for 31 December

2023)

5 Original Equipment Manufacturer

- 240924LUMIBIRD_RS_2024_EN (1)

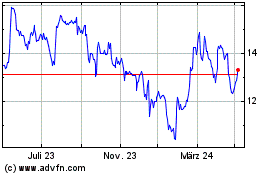

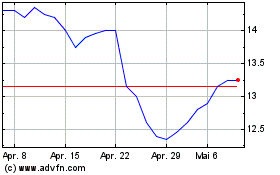

Lumibird (EU:LBIRD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Lumibird (EU:LBIRD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024