Brunel’s Momentum: Strategy update for post-Covid profitable growth acceleration and the next phase of development

31 März 2021 - 8:30AM

Brunel’s Momentum: Strategy update for post-Covid profitable growth

acceleration and the next phase of development

Amsterdam, 31 March 2021 – Today at its first-ever Capital

Markets Event, Brunel International N.V. (Brunel; BRNL), a global

provider of flexible specialist workforce solutions, will present

an update on its strategy and growth plans for the period 2021 -

2025.

Highlights Strategy Update 2021 – 2025

- Brunel enters the next phase of development with a leaner and

more disciplined organization providing for enhanced operating

leverage

- Well-positioned to take advantage of post-Covid market momentum

with increased demand for specialists and engineering solutions for

a more sustainable world

- New growth strategy based on four value drivers: (i)

Diversification; (ii) Specialization; (iii) Capability

building; (iv) Disciplined execution; enabled by a global

operational steering model and further accelerated through

M&A

- Matched capital allocation plan with a dividend policy revised

upwards to 60-100% pay-out

- New set of medium term objectives and key metrics introduced to

underline ambition, track strategic progress and performance

delivery

Jilko Andringa, CEO of Brunel

International N.V.: “For Brunel we now see several things

coming together at the same time. There will be a post-Covid market

recovery and new momentum for change with the digital and energy

transition significantly gaining traction across many of the global

industries we serve. Investment planning by clients in key markets

such as renewables, future mobility, oil & gas and life

sciences is starting to ramp up again. All these developments imply

an ever greater need for engineers and engineering solutions in the

years to come. Given our pool of more than 12,000 skilled

specialists combined with our global network, we are uniquely

positioned to benefit from these trends as we are on the verge of

our next phase of development.

Over the past few years, our team has worked

hard to lay the foundation for this next phase. We have established

a leaner, more agile and disciplined organization. 2020 was in fact

an unexpected but successfully passed test for this. It

demonstrated our enhanced operating leverage and showed that we

were able to protect our margins by trimming down our cost base

faster than our revenue decline.

With the fundamental and ongoing shift to a more

sustainable world, the new market momentum and our more agile

organization in place, this is the right time for us to gear up our

strategy, accelerate our growth and margin expansion. We believe

our prospects for the years to come are better than ever. Our new

medium term objectives underline our ambitions to create a better

and more sustainable future for our clients and our professionals

and demonstrate the potential of Brunel’s unique and future-proof

business model.”

Upward revision dividend

policyIn line with our updated strategy and capital

allocation plan, the dividend policy has been revised upward with

the intention to distribute 60%-100% (prior: 30%-100%) of earnings

per share as dividend.

New medium term objectives and key

metricsWe have set new financial and non-financial

objectives and will apply the following key metrics to track our

performance in this next phase of development:

| Financial

objectives |

|

- Revenue:

- Gross margin:

- Revenue per FTE:

- EBIT as % of gross profit:

- EBIT margin:

|

high single-digit year-on-year

growth (as of 2022)year-on-year increase in each (reporting)

regionyear-on-year increase of billing ratesconversation rate of

30% or higher in 2025group EBIT >6% in 2025 |

| Non-financial

objectives |

|

- Specialist pool:

- Engagement:

- Specialist retention:

- Carbon footprint:

- SDG’s:

|

>15,000 connected specialists

in 2025client, contractor and staff NPS score of >

+25year-on-year average retention rate improvement of 1

monthcommitted to deliver on UN’s zero emission plancontinued

commitment to UN SDG’s 4, 5, 7, 10, 12 and 14 |

GuidanceThe outlook for Q1 2021

as provided at the publication of our full year results 2020 in

February remains unchanged: year on year a lower revenue, at

slightly higher gross margins (%) and significantly lower cost,

resulting in an EBIT similar to Q1 2020.

Supervisory BoardJust Spee will

become chairman of the Supervisory Board, succeeding Aat

Schouwenaar.

Capital Markets Event and Live

WebcastToday at 15:00 CET Brunel will host a Capital

Markets Event at which it will present and discuss the strategy

update. You can watch the event through a real-time webcast. The

presentations and a replay of the webcast will be made available on

our website: www.brunelinternational.net

Attachment

Press Release - CMD and strategy update

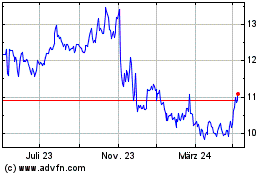

Brunel International NV (EU:BRNL)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Brunel International NV (EU:BRNL)

Historical Stock Chart

Von Apr 2024 bis Apr 2025