Crypto Firms’ Plans To Leave The US Speak Imminent Doom, Says Tim Draper

07 Mai 2023 - 10:00AM

NEWSBTC

The United States is gradually becoming too hot for crypto firms to

operate due to unclear and stringent regulatory approaches. For

instance, a recent development that sparked an outcry was the

proposal to impose a 30% excise tax on crypto-mining facilities. US

President Joe Biden’s budget proposal presented a phased-in tax on

the electricity used by crypto mining firms. This tax and the

Securities and Exchange Commission’s enforcement actions may push

many top crypto firms and startups to consider offshore operations.

As such, Tim Draper foresees a massive departure from the US that

might crash its economy. US Unclear Regulatory Environment Is

Leading To Massive Crypto Exodus In a Twitter post, the founder of

DFJvc, Draper mentioned that Silicon Valley startups are relocating

operations to Asia, Europe, and the Middle East. Related Reading:

Bitcoin Miners Reap Profits As Mining Difficulty Hits 3-Month Low

He further stated that Gemini and Coinbase are moving out of the US

due to the regulatory pressure on their operations. Coinbase CEO

Brian Armstrong hinted at the same outcome in an April conference

organized by the Innovative Finance industry body. While

speaking, Armstrong stated that the Bahamas-based FTX exchange that

crashed in 2022 shows the need for clear crypto regulations. As

such, the industry needs clear regulations in the US and UK, or

more firms will establish operations in “offshore havens.” New York

Is Losing Blockchain Development Leadership Draper also pointed out

that countries like Singapore, Dubai, and London gradually overtake

New York in blockchain development. A report by Global Media

Insight on March 29, 2023, pitched the UAE as the most

digital-friendly country in the world. The report revealed that

Dubai has many policies that support blockchain technology. As

such, it is emerging as one of the best crypto trading markets

worldwide. In April, Binance also shared many reasons Dubai

is crypto-friendly, mentioning tax-free zone, government support,

high-tech infrastructure, etc. Related Reading: PEPE Market Cap

Crosses $1 Billion As Gemini Listing Rumors Spread Apart from the

UAE, London, and Singapore also has a more crypto-friendly

environment than the US. According to Draper, these countries have

positioned themselves to accommodate crypto firms, thereby

attracting more investments gradually. In conclusion, Draper

believes that such an outflow of investment and development might

leave the US economy in bad shape, increase homelessness and lead

to a massive loss of jobs. -Featured image from CNBC and chart from

Tradingview

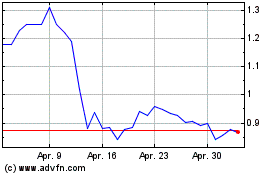

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024