Solana Set For Explosive Growth: Expert Predicts 1650% Price Increase Based On This Pattern

12 Dezember 2024 - 12:30PM

NEWSBTC

As the broader crypto market rebounds following Donald Trump’s

election on 5 November, Solana (SOL), currently the sixth largest

token by market capitalization, has resumed its bullish trajectory,

recently reclaiming the $230 price level. On Wednesday, the Solana

price surged nearly 7%, reaching $232 after a two-week correction

period that followed its current all-time high achievement of $263

on November 23. Could The Solana Price Soar To $4,000? The recent

price action suggests that Solana may be on track to not only

retest its previous peak but potentially exceed it

significantly. Crypto analyst Ali Martinez highlighted a

bullish “cup and handle” pattern forming on Solana’s one-month

chart, indicating the potential for a remarkable uptrend.

Martinez forecasts that if this pattern plays out, Solana could see

gains exceeding 1,650%, resulting in a new record price of $4,000

per token. Related Reading: XRP Price Defies Bearish Crypto Trend,

Rallies 6%: Key Drivers Revealed However, perspectives among

analysts vary regarding the future trajectory of Solana. While

some, like Cryptorangutan, emphasize the current momentum

indicators and established buying pressure, predicting a surge

toward the $300 mark, others urge caution. Analyst

MoreCryptoonl on the other hand, points out a completed pullback

structure, indicating a clear five-wave move downward. This

analysis suggests that while the recovery rally is underway, it

remains uncertain whether it will develop into a bullish pattern or

an ABC corrective structure. Total Value Locked Hits $9.198 Billion

Despite the mixed technical signals, key financial metrics paint a

largely positive picture for Solana. According to CoinMarketCap,

the market capitalization stands at approximately $112.73 billion,

positioning Solana as the sixth-largest cryptocurrency.

Additionally, its Total Value Locked (TVL) has reached $9.198

billion, reflecting continued interest in its decentralized finance

(DeFi) ecosystem. However, decentralized exchange (DEX) volumes

have fallen by 25% to $28 billion, indicating some volatility in

trading activity. The narrative surrounding Solana has been further

fueled by recent developments in the market. Grayscale’s filing for

a spot Solana ETF in the US has generated buzz, as the

cryptocurrency community anticipates the potential for increased

institutional investment. Additionally, the project Jupiter

has revised its $1.6 billion airdrop after a failed vote, while the

platform Pump.fun reported record revenue of $93 million for

November, despite experiencing a 66% weekly drop. Related Reading:

Bitcoin CME Chart Shows Striking Similarities To 2023, Here’s What

Happened Last Time In the DeFi landscape, Solana has slipped to

third place as Tron’s TVL surged 78% to $13 billion, yet it

maintains a strong lead with 5.56 million active addresses.

However, the recent decline in DEX revenue and volume, particularly

with Raydium experiencing an 8.22% drop, indicates a need for

stability in trading activities within the ecosystem. Featured

image from DALL-E, chart from TradingView.com

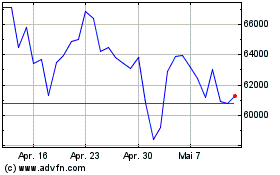

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024