Ethereum Analyst Shares Correlation With S&P500 – Last Dip Before It Hits $10,000?

06 November 2024 - 9:30AM

NEWSBTC

Ethereum (ETH) stands at a critical turning point, with opinions

split on its future performance this cycle. Some analysts argue

that ETH will continue to lag, possibly underperforming against

other assets like Bitcoin, which has shown strong momentum.

However, others are optimistic, believing Ethereum is poised for an

aggressive rally, especially if it can establish a solid bounce

from current lows. Related Reading: Bitcoin Open Interest Dropped

Significantly – Investors Cautions Amid US Election Week? Renowned

crypto analyst Ali Martinez has shared a compelling technical

analysis, highlighting a correlation between ETH and the S&P

500. According to Martinez, this relationship could signal a

substantial upward move for Ethereum, aligning with broader market

trends in traditional finance. Martinez’s analysis suggests that

Ethereum could be on track for a major breakout if the current

setup holds, with a target around the $10,000 mark. As Ethereum

trades near a crucial support level, the coming days will be

pivotal in determining its direction. With significant upside

potential, if a bullish trend takes hold, this moment may define

ETH’s trajectory for the remainder of the cycle. Investors are now

watching closely, weighing ETH’s next moves against crypto and

traditional market cues. Is Ethereum Preparing To Rally? Ethereum

(ETH) has been trading precariously around the $2,400 level, with

recent dips below this threshold sparking concern among investors

hoping for a bullish breakout. This uncertainty has heightened as

traders navigate a market riddled with fear, wondering if ETH is

about to embark on a long-awaited rally or fall to new lows. Top

analyst and investor Ali Martinez has provided an optimistic

outlook, sharing a technical analysis on X that suggests Ethereum’s

price movements closely mirror those of the S&P 500. According

to Martinez, this dip could be the final one before Ethereum

experiences a massive upswing, potentially tripling in value to hit

the ambitious $10,000 target. Martinez’s analysis taps into

broader market sentiment, noting that ETH has shown resilience at

key levels and that this correlation with the S&P 500 could

indicate strength and stability shortly. As the U.S. election

results unfold and the Federal Reserve’s upcoming interest rate

decision looms, the potential for volatility remains high. These

factors could introduce sharp price swings, driving ETH lower

temporarily before it rebounds and gains momentum for a sustained

rally. Related Reading: Solana Likely To Target $200 ‘If It

Holds Current Support’ – What To Expect The combination of market

catalysts and Martinez’s analysis has sparked cautious optimism,

suggesting that while the near-term risk is high, Ethereum could be

on the verge of a significant breakout if it holds its ground

through the coming turbulence. ETH Testing Crucial Demand

Ethereum briefly dipped below the $2,400 mark, a key support level,

before rebounding to $2,440. This bounce has given bulls hope, but

to maintain upward momentum and challenge the prevailing bearish

outlook, ETH must keep rising and target higher supply zones.

Critical to this effort will be breaking above the 200-day

exponential moving average (EMA) at $2,758—a level that has

consistently pushed down price action and acted as a significant

resistance since early August. If bulls succeed in reclaiming this

EMA, it could mark a shift in momentum, potentially setting up ETH

for a stronger bullish trend. However, if ETH fails to hold above

$2,400 in the coming days, it risks a deeper retracement. Analysts

have identified the $2,220 level as a crucial line of

defense. Related Reading: Dogecoin Analyst Reveals Buying

Opportunities At Lower Prices – Details This lower demand zone

could provide the final support necessary to prevent further

losses, but if breached, it would likely deepen the bearish

sentiment surrounding Ethereum’s current price action. This week

will be pivotal, as holding above these key levels could provide

ETH with the stability it needs to stage a more aggressive push

upwards. Featured image from Dall-E, chart from TradingView

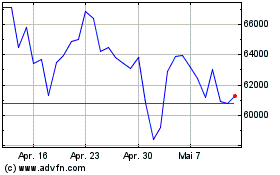

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024