Bitcoin Price Surge In 2024 Not Enough To Beat Gold’s Risk-Adjusted Returns – Details Here

09 Oktober 2024 - 1:00PM

NEWSBTC

According to Goldman Sachs, Bitcoin (BTC) price appreciation in

2024 failed to compensate for its price volatility risks.

Meanwhile, gold’s higher risk-adjusted returns reaffirmed its “safe

haven” narrative. Despite The Gains, Bitcoin Fails To Outshine Gold

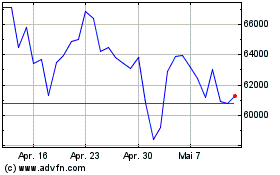

The leading digital asset by reported market cap surged from

roughly $42,000 at the beginning of the year to as high as $73,000

in March 2024, recording more than 73% gains. At its current market

price of $62,790, BTC is still more than 40% up from its price in

January 2024. Related Reading: Bitcoin Correlation With Gold Now At

Highest Level Since March Notably, throughout 2024, Bitcoin has

consistently outperformed major equity indices, fixed-income

instruments, gold, and crude oil. However, according to

data tracked by Goldman Sachs, despite BTC’s impressive gains, its

price performance in absolute terms fails to compensate for its

volatility. The analysis by Goldman Sachs puts BTC’s year-to-date

(YTD) volatility ratio at just under 2%. In comparison, gold gave a

risk-adjusted return of 3%, posting strong 28% gains in absolute

terms. For the uninitiated, the volatility ratio measures the

return an asset generates for each unit of risk or volatility it

carries. A higher ratio indicates that an asset provides better

returns relative to the risk taken, while a lower ratio suggests

less efficient performance. The analysis notes that Bitcoin’s

volatility ratio was only better than Ethereum’s native ETH token,

S&P GSCI Energy Index, and Japan’s TOPIX index among the

non-fixed income growth-sensitive investments. Bitcoin’s low

volatility ratio compared to gold cements the latter’s claim as a

“safe haven asset.” This came under the limelight last week when

BTC slumped, and gold surged following Iran’s offensive against

Israel. Still A Long Way To Go For Bitcoin Since its inception

following the 2008 financial crisis, Bitcoin’s ascent to a

trillion-dollar market cap asset has been remarkable. The

fixed supply of 21 million, decentralized network architecture, and

halving every four years make BTC an appealing asset. However, the

market cap gap between Bitcoin and gold remains vast. That said,

several crypto analysts are confident that Bitcoin will outperform

the shining metal in the coming years. For instance, seasoned

analyst Peter Brandt recently made an ambitious prediction that by

2025, BTC could see its price jump 400% relative to gold. Related

Reading: Bitcoin On Brink Of Massive Breakout Like Gold In 2008:

Hedge Fund CEO Similarly, in August 2024, VanEck CEO Jan van Eck

stated that BTC could surge to $350,000 on the back of greater

adoption. Most recently, investment management firm BlackRock

declared Bitcoin a “gold alternative” due to its fixed supply and

increasing investor confidence in its ability to tackle inflation

and avoid value erosion during uncertain times. On the contrary,

billionaire Ray Dalio has expressed his opinion on the Bitcoin vs.

gold narrative, saying that BTC will never fully replace gold. BTC

trades at $62,790 at press time, down 2.3% in the last 24 hours.

Featured image from Unsplash, charts from ingoldwetrust.report and

Tradingview.com

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Mär 2024 bis Mär 2025