Technical Indicators Show Strong Bitcoin Bullishness – New ATH On The Horizon?

28 Juli 2024 - 6:00PM

NEWSBTC

Bitcoin has definitely performed on the bullish side for the past

three weeks. Many investors are now convinced of the full return of

bullish price actions, and various technical indicators support

this surge in optimism. One such indicator is the hash ribbon,

which highlights a positive price momentum for Bitcoin. Related

Reading: Solana Set For 900% Rally With Breakout From This Pattern

— Analyst The hash ribbon provides a compelling view of on-chain

activity by tracking the behavior of miners, who are known to have

a direct influence on the cryptocurrency’s price. Price Momentum

Flips Positive Crypto analyst Ali Martinez highlighted an

intriguing phenomenon with the hash ribbon indicator on social

media platform X. As noted by the analyst, the hash ribbon is

signaling the end of miner capitulation, which suggests that the

BTC price momentum has shifted from negative to positive. The

hash ribbon indicator analyzes Bitcoin’s hash rate using the 30-day

and 60-day moving averages to gauge miner activity and network

health. When the 30-day moving average drops below the 60-day, it

indicates miner capitulation; when it crosses back above, it

signals recovery and potential bullish price action. As shown by

the price chart below, the last miner capitulation began on June 17

after the 30-day moving average crossed below the 60-day moving

average. Recent market dynamics have seen the 30-day moving average

crossing back up, suggesting that miners are now at a bullish

outlook. Bitcoin miners have faced challenges since the April

2024 halving, which reduced their daily revenue from an average of

$70 million pre-halving to $30 million post-halving. This revenue

drop forced many miners to sell their BTC holdings to cover

operational costs. However, recent data indicates that miner

capitulation may be nearing its end, as increased activity on the

Bitcoin network pushed daily miner revenue back above $40 million.

Positive Bitcoin Comments Reach Highest Level In 16 Months Still in

the spirit of bullishness, crypto on-chain intelligence platform

Santiment noted Bitcoin’s bullishness among market participants is

now at its peak. Santiment’s data reveals that the ratio of

positive versus negative comments about BTC on social media has

surged to its highest level since March 2023 as investors become

increasingly optimistic about a new all-time high. This surge in

positive sentiment can be attributed mainly to the favorable

mentions of Bitcoin at the recently concluded Bitcoin conference.

During the conference, Republican presidential candidate Robert F.

Kennedy Jr. reiterated his bullish stance on Bitcoin. Related

Reading: Bitcoin Supply Drop Signals Upbeat Price Movement, Analyst

Says Additionally, former president and current Republican nominee

Donald Trump altered his previous stance on Bitcoin and expressed

support for the cryptocurrency. Trump also promised to fire SEC

Chairman Gary Gensler, who is known for his very strict approach

towards Bitcoin and other cryptocurrencies, if elected

president. The combination of political support

and positive sentiment on social media has fueled mentions of

Bitcoin reaching a new all-time high in August. At the time of

writing, Bitcoin is trading at $67,500. Featured image from

Vecteezy, chart from TradingView

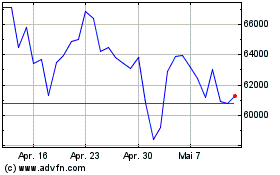

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024