Ethereum Oversold? Researcher Predicts Speculative Surge Could Spark Market Revival

08 November 2024 - 9:00PM

NEWSBTC

Ethereum has had a rough year, but recent insights from industry

insiders indicate a possible comeback. Matthew Sigel, VanEck’s Head

of Digital Assets Research, recently indicated that Ethereum is

oversold. He thinks that raising speculative interest in the

altcoin will enable its comeback. This comes as Ether tries to

catch up with rivals such as Bitcoin and Solana, which far exceeded

it in 2024. Related Reading: Binance Coin Breaks $600! Is There

More Upside Ahead For BNB? A Shift In Market Sentiment Sigel spoke

on The Tie’s latest episode in which he hopes Ethereum will go in

the right direction. He also noted that, although Ethereum faces

problems, particularly regarding EIP-4844 in which it changes its

economic model, opportunities can still emerge for a “bottom.”

.@matthew_sigel “I think ETH is oversold…Speculation will come back

to this market and I don’t think it’s going to ignore Ethereum.”

https://t.co/5pMcZBLzfi — VanEck (@vaneck_us) November 7, 2024 The

market is now a little conservative, but Sigel sees the commodity

drifting back into speculation, bringing price back up and

advocates to the trade again. That also places it in line with

larger Ethereum expectations. Analysts are even expecting ETH to

trade between $2,199 and $3,019 in 2024, with some expecting a

spike to above $5,000 by 2025. Excitement generated earlier this

year by acceptance of spot Ethereum ETFs has brought a regulated

gateway to investors for entering the market, both retail and

institutional investors. This development may cause massive inflows

into Ethereum with enormous financial inflows, further buttressing

its price. Technical Analysis And Price Predictions According to

the latest technical analysis, Ethereum must break above $3,000 to

sustain its bullish sentiment, and many analysts believe this may

well open roads for a new record high. According to the Ethereum

Rainbow Chart, we can see all sorts of possible prices for the

following years, with estimates reaching as high as $12,000 by

2030. However, some are concerned about Ethereum’s long-term

economic strategy. Sigel said that Layer-2 networks have started to

claim more of Ethereum’s blockspace, resulting in lower transaction

fees and income. This development has led some investors to lose

faith in Ethereum as a deflationary asset. If this trend continues

without changes to link Layer-2 networks more closely with

Ethereum’s ecosystem, VanEck’s long-term price targets may be

jeopardized. Related Reading: Solana Rockets Past BNB To Claim

Coveted 4th Spot In Crypto Ranks The Road Ahead For Ethereum

Despite these problems, commentators express a genuine feeling of

optimism about Ethereum’s future. The prospect of fresh speculative

activity, along with the regulatory certainty given by ETF

approvals, could be exactly the spark for a significant comeback.

As the market evolves and reacts to these developments, investors

are looking for signals that a positive trend will return to

Ethereum. While Ethereum confronts challenges, experts believe that

a combination of increasing interest and good market conditions

might pave the way for a resurgence in 2024 and beyond. Featured

image from DALL-E, chart from TradingView

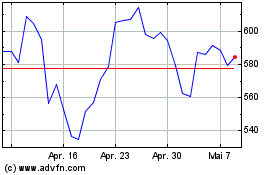

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024