Developer Hails ETH Burning, Will Ethereum Break $3,000?

17 Januar 2024 - 10:00PM

NEWSBTC

Péter Szilágyi, an Ethereum (ETH) developer, has lauded EIP-1559

and its ETH burning mechanism as “the great equalizer.” Taking to X

on January 16, Szilágyi admired EIP-1559’s ability to “level

the playing field between validators and regular users.” Developer:

EIP-1559 Is A “Great Equalizer” Since the implementation of

EIP-1559, Ethereum adjusted how users bid gas fees, introducing the

“base fee,” which was burned or sent to an irretrievable wallet. So

far, data from Ultrasound Money shows that over 3.9 million

ETH have been destroyed. In the last week alone, the Ethereum

network automatically sent more than 21,100 ETH out of circulation,

“burning” ETH’s supply. Specifically, Szilágyi mentioned the

advantage regular users have with EIP-1559. Through this

implementation, validators (previously miners before Ethereum

shifted to a proof-of-stake blockchain) no longer have the

privilege of arbitrarily adjusting gas limits and transaction

fees. Related Reading: Bitcoin ETF Makes Waves: Volumes Surge

$10 Billion 3 Days Earlier, that leeway created what the developer

described as an “imbalance,” which made it tough for “regular users

to compete.” However, following this implementation, everyone must

adhere regardless of status as a validator, founder, or user.

With EIP-1559, the “base fee” adjustment is set at the protocol

level. It is this base fee that the network burns, gradually making

ETH deflationary, reading from the number of coins taken out of

circulation since EIP-1559 went live in early August 2021. Even so,

a sender can “tip” the validator, incentivizing them to prioritize

validating a transaction. Stability And Predictability Achieved,

Ethereum Upsides Capped At $3,000 Szilágyi’s comments reflect a

growing consensus among Ethereum supporters regarding the positive

impact of EIP-1559. Though a big percentage of EIP-1559 is fixated

on the price impact of the proposal, there is more that it

achieves. Related Reading: SUI Overtakes Bitcoin, Aptos To

Become 13th-Largest DeFi Network Most importantly, from a user

experience perspective, it is now easier for senders to predict how

much they will pay for a transaction. This is crucial, especially

when the network is congested. Additionally, though the Ethereum

gas fee remains relatively high, EIP-1559, though considered a “bad

idea” by Szilágyi, has stabilized the network. ETH burning is

attributed to reducing inflation in Ethereum, a network whose total

supply is not capped like Bitcoin. Over the long term, prices might

benefit from this proposal. However, prices are bullish in the

short to medium term. Still, upsides are limited to around the

$3,000 psychological round number. Feature image from Canva, chart

from TradingView

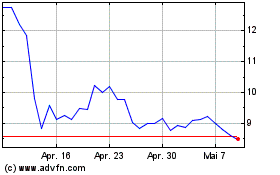

Aptos (COIN:APTUSD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Aptos (COIN:APTUSD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024