ApeCoin Crashes 7% Following SEC Probe Against Yuga Labs

11 Oktober 2022 - 7:52PM

NEWSBTC

ApeCoin (APE) is trending to the downside as the U.S. Securities

and Exchange Commission (SEC) announces an investigation against

its parent company, Yuga Labs. The creators of popular non-fungible

token (NFT) collections, including Bored Ape Yacht Club (BAYC), the

regulator will look into a potential violation of their securities

laws. Related Reading: Here’s Why SUSHI Is Down More Than 10% In

The Last 24 Hours According to a report from Bloomberg, the

Commission will investigate the “affinity” of the digital assets

minted and promoted by Yuga Labs and the possibility that these

NFTs are “more akin to stocks”. This would place the crypto company

in an alleged violation of U.S. federal law. The report quotes a

source familiar with the matter, this individual also claims that

the investigation will extend to ApeCoin, the native token that

supports ApeCoin DAO governance model offering its users access to

a staking mechanism. Via this token, holders can make decisions

related to the project. APE was launched as part of an initiative

to provide BAYC investors with more voice and power over the

project via the ApeCoin DAO. Via social media, many users are

expressing concern about the future of the DAO and its staking

mechanism leading to the crash in the price of the token. In a

statement to Bloomberg, a representative for Yuga Labs stated: It’s

well-known that policymakers and regulators have sought to learn

more about the novel world of web3. We hope to partner with the

rest of the industry and regulators to define and shape the

burgeoning ecosystem. As a leader in the space, Yuga is committed

to fully cooperating with any inquiries along the way. ApeCoin And

Yuga Labs Fall Into SEC Scrutiny A probe can escalate from the

Commission against Yuga Labs, such as pursuing a legal case.

However, not every probe leads to legal action. Under the

leadership of Gary Gensler, the SEC has been targeting

crypto-related activity. On several occasions, the current SEC

Chair has compared crypto with the “Wild West” and has classified

“most of the crypto” as potential securities. Bitcoin is the only

exception that Gensler seems willing to admit publicly. Over the

past months, SEC enforcement actions against crypto projects have

increased. The Commission seems to be targeting major and very well

know entities, such as Yuga Labs and their projects BAYC and

ApeCoin, socialite Kim Kardashian, and others. Their current

biggest case involves payment company Ripple and the alleged

offering of an unregulated security, XRP. According to a report

from FOX, some SEC staff believe the Commission is pushing this

lawsuit for the personal benefit of Gary Gensler and his desire to

be nominated for Secretary of Treasury. Related Reading: No Pivot

In Sight: Why Bitcoin Could See More Pain As Inflation Strengthens

The Commission is allegedly understaffed and pushing many to seek

employment elsewhere as they disagree with Gensler’s management

style and complaint about long working hours. At the time of

writing, there is no statement from Yuga Labs regarding the probe.

SCOOP (1/3): @SEC_Enforcement staffers are complaining @GaryGensler

violated protocol by hyping @KimKardashian settlement, appearing on

@CNBC within minutes of the case being announced, people w direct

knowledge tell @FoxBusiness. They are calling it a “publicity

stunt” — Charles Gasparino (@CGasparino) October 5, 2022

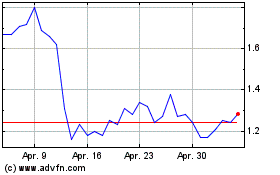

ApeCoin (COIN:APEUSD)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

ApeCoin (COIN:APEUSD)

Historical Stock Chart

Von Mär 2024 bis Mär 2025