ProShares Files for S&P 500 Aristocrats ETF - ETF News And Commentary

26 Juli 2013 - 8:55PM

Zacks

ProShares has long been a leader in the leverage and inverse ETF

market. The company is probably best known for its S&P

500-focused funds—such as SH, SDS

and SSO—although it has more than one billion in

assets in some of its bond (TBT) and small cap

products (UWM) as well.

Yet while the firm has made its name in these levered products,

it is apparently looking to branch out into the ‘regular’ ETF

market too. The firm has launched several of these products in the

past few months such as a private equity fund

(PEX) and a merger arbitrage ETF (MRGR),

and has recently put another into the pipeline (also see Coming

Soon: Rising Rates ETF).

This proposed ETF looks to continue ProShares’ recent trend into

the unlevered market, focusing on domestic stocks. While the filing

was just an initial one, and thus some key details were not

released such as expense ratio or ticker symbol, we have

highlighted a few of the important points that were revealed in the

document below:

New ProShares Filing in Focus

The proposed fund looks to be for the S&P 500 Aristocrats

ETF, which looks to track, before fees and expenses, the

performance of the S&P 500 Dividend Aristocrats ETF. This

benchmark seeks to give exposure to S&P 500 companies that have

increased dividend payments each year for at least the past 25

years (see 3 Red Hot Dividend ETFs).

In total, the index contains a minimum of 40 stocks in its

basket, equally weighting among all of the securities. However, it

should be noted that no single sector is allowed to make up more

than 30% of the index weight, and that rebalancings are done on a

quarterly basis, while annual index reconstruction is done in the

January rebalance period.

This could result in a relatively safe portfolio of dividend

payers who have been very prudent with their cash reserves.

However, the yield may not actually be that high for this fund, as

the index only intends to look at firms that are consistently

increasing dividends, not necessarily those that have a robust

yield.

ETF Competition

While dividend-focused ETFs are usually pretty popular, it is

worth noting that this won’t exactly be the first product to target

the dividend aristocrat space. In fact, there are several other

products out there already that have a similar focus, and billions

of AUM to boot (see Buy These 3 ETFs for Excellent Dividend

Growth).

Particularly, this is the case for the SPDR S&P

Dividend ETF (SDY) and the Vanguard Dividend

Appreciation ETF (VIG). These two both focus in on stocks

that have a history of increasing dividends over long time periods,

and thus could be top competitors for any future ProShares product.

Plus, the two combine to hold more than $25 billion in AUM, so they

will definitely be difficult to unseat.

Given this huge following, ProShares will either have to offer a

very low expense ratio, or be able to show some outperformance with

its equal-weight methodology in order to attract new investors to

the space (also see 3 New ETFs You Should Not Ignore).

If either of these points come to pass, a new ProShares

aristocrat ETF could see some interest, as after all, there is

clearly a ton of interest in both the dividend space, and the idea

of tracking companies that raise dividends year after year for

exposure.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

PRO-MERGER (MRGR): ETF Research Reports

PRO-GLBL LPE (PEX): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

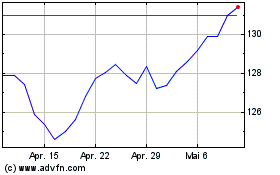

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

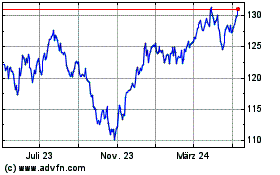

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Mai 2023 bis Mai 2024