Huawei procures 5G telecom gear from Japan as Beijing pushes for

global edge

By River Davis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 30, 2020).

TOKYO -- The U.S. is making it tougher for American companies to

help China roll out superfast cellular networks. But companies in

Japan, a U.S. ally, are fueling China's leap ahead and making money

doing it.

By the end of the year, China plans to deploy more than a

half-million base stations in its $150 billion push to blanket the

nation with fifth-generation cellular service, often with equipment

from national champion Huawei Technologies Co.

"The Chinese government is enthusiastically promoting the spread

of 5G. It's a very promising market for our parts," said Tsuneo

Murata, chairman of electronic-component maker Murata Manufacturing

Co.

Supplying parts and materials to global technology companies is

bread-and-butter business for Japan since most of its

consumer-electronics brands have faded.

With the U.S. and China battling over tech hegemony and the U.S.

government weighing intervention in the private sector to block

Huawei, Japan is trying to supply both sides, while avoiding

political land mines. The question is how long Japan, whose

territory is protected by U.S. forces, and other U.S. allies such

as Germany and South Korea can keep up the business.

"When the U.S. first went forward with export controls, its

regulations mostly affected U.S. companies. But over the past year,

the U.S. has started to recognize that companies like Huawei are

still getting all of this technology," said Wendy Cutler, a former

top U.S. trade negotiator now at the Asia Society.

The "drumbeat of export controls" could soon reach U.S. allies,

she said. "If you look at the announcements holistically, it's

clear where we're going."

In May, the Trump administration said it would impose export

restrictions designed to cut off Huawei from overseas suppliers,

largely targeting Taiwan Semiconductor Manufacturing Co.'s sale of

semiconductors to Huawei's HiSilicon unit.

For now, China remains one of the few healthy sources of profit

for Japanese companies suffering from the impact of the

coronavirus. Anritsu Corp., whose machines measure whether 5G

equipment such as base stations are functioning properly, saw its

operating profit rise 75% in the latest quarter compared with a

year earlier, thanks to strong 5G-related demand in China and the

greater Asia region.

"For us, demand from China has been increasing as China's

smartphone suppliers sell products to a larger and larger global

audience," said Takeshi Shima, an Anritsu senior vice

president.

Although Beijing has promoted a "buy China" policy with the goal

of strengthening manufacturing in the country, many Japanese parts

suppliers have embedded themselves in the Chinese supply chain for

years and steadily make money.

Chinese companies still rely on Japanese suppliers that also do

business in the U.S., Jefferies analyst Sho Fukuhara said. "With

the U.S. not wanting Chinese goods and China not wanting U.S.

goods, that leaves Japan to benefit from both sides," he said.

Murata produces a speck-sized component called a multilayer

ceramic capacitor that helps control the flow of electricity and

stores power for semiconductors. It is used in everything from

smartphones to cars. A typical 5G base station would require about

15,000 of the parts, according to capacitor makers.

Murata said its orders for capacitors rose by nearly 50% in the

January-March quarter compared with a year earlier, thanks to 5G

gear.

Many of those obscure-but-critical parts are going to Huawei,

China's top maker of smartphones and 5G equipment. Huawei Chairman

Liang Hua said last November that the company was on track to

procure about $10 billion in parts from Japan in 2019. With such

procurement, "currently we can ship core products to our customers

in a timely manner, without relying on U.S. components," he

said.

Washington policy makers fear that if China seizes the lead in

building out a large, reliable 5G network, it could export more of

its gear to other countries, which could become dependent on China.

Beijing could also get a head start in new technologies powered by

faster wireless speeds such as driverless cars.

A congressionally mandated report early this year by the Center

for a New American Security said the U.S. should expand curbs on

sales to Huawei's 5G systems to cover sales by foreign companies.

"Choking off Huawei's ability to purchase international parts and

not just U.S.-origin equipment for 5G network equipment would

create significant operational challenges to Huawei's efforts to

build such networks," the report said.

One tool the U.S. is considering is to make it even harder for

companies outside the U.S. to use American parts when supplying

Huawei, said Martin Chorzempa, research fellow at the Peterson

Institute for International Economics.

The risk, he said, is a "de-Americanization" of global supply

chains in which foreign companies avoid American technology

altogether so as not to trip U.S. export controls.

That is why the Trump administration, when it announced

Huawei-related restrictions in May, went with a narrower rule

change targeted at chips, Mr. Chorzempa said. Semiconductors were

seen as the best choke point to hit Huawei's development, he said,

but for now, the rules leave room for suppliers of other parts to

keep selling to Huawei.

Panasonic Corp., for one, is expanding its factory in the

southern Chinese city of Guangzhou, where it produces materials for

circuit boards used in devices such as 5G routers.

At the same time, companies are bracing for tighter regulation.

At Anritsu, the measuring-instrument maker, Mr. Shima said he was

trying to figure out how much the company would be affected by U.S.

rules. "Japanese companies are going to have to look carefully at

what exactly is being said," he said.

Write to River Davis at River.Davis@wsj.com

(END) Dow Jones Newswires

June 30, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

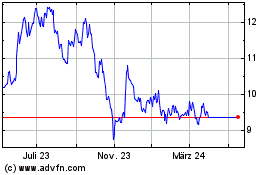

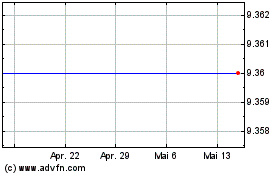

Panasonic (PK) (USOTC:PCRFY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Panasonic (PK) (USOTC:PCRFY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024