Acceleware® Ltd. (“Acceleware” or the “Company”) (TSX-V: AXE), a

leading innovator of transformative technologies targeting the

decarbonization of industrial heating, today announced its

financial and operating results for the three months ended March

31, 2024 (all figures are in Canadian dollars unless otherwise

noted). Acceleware’s results reflect contributions from the

Company’s two business units, radio frequency (“RF”) heating for

industrial applications using the Company’s proprietary Clean Tech

Inverter (“CTI”) including enhanced oil recovery (“RF XL”), and

high-performance computing ("HPC”) scientific software. This news

release should be read in conjunction with the Company’s unaudited

interim condensed financial statements and the accompanying notes

for the three months ended March 31, 2024 and management’s

discussion and analysis (“MDA”) thereto, together with the audited

financial statements for the year ended December 31, 2023, notes

and MDA thereto, all of which are available on Acceleware’s website

at www.acceleware.com or on www.sedarplus.ca.

HIGHLIGHTS

Financial highlights for the three months ended

March 31, 2024:

|

|

|

|

Three Months Ended |

|

|

|

|

|

Mar 31, 2024 |

|

Mar 31, 2023 |

|

|

Revenue |

|

|

|

43,594 |

|

103,547 |

|

|

Comprehensive income/ (loss) |

|

|

|

(969,971) |

|

(255,617) |

|

|

Gross R&D expenditures |

|

|

|

501,115 |

|

752,368 |

|

|

Government assistance |

|

|

|

- |

|

434,023 |

|

|

|

|

|

|

|

|

|

|

Encouraged by positive results to date, the

Company worked closely with industry partners to determine the most

appropriate next steps in the RF XL Pilot. It was determined that

the most practical path forward involves a redeployment of all

subsurface components incorporating the multiple improvements and

upgrades that Acceleware has made to the RF XL downhole system.

Acceleware is actively sourcing an additional $5 million of funding

to complete the redeployment. The redeployment is expected to

enable higher power to be distributed in the reservoir for a

sustained period in a second phase of heating. Please refer to the

MDA for a complete RF XL Pilot update.

On April 11, 2024 Acceleware announced that is

had been awarded Phase 2 of a potash ore drying project by the

International Minerals Innovation Institute (“IMII”). The new

project phase will advance Phase 1 work and is intended to further

validate the use of radio frequency energy from Acceleware's CTI to

dry potash ore and other minerals. Phase 2 work will include the

construction and testing of a lab-scale prototype dryer, and on a

stage gate basis, the design, construction and testing of larger

shop-scale prototype. IMII is a non-profit organization jointly

funded by industry and government that is committed to developing

and implementing innovative education, training, research and

development partnerships for supporting a world-class minerals

industry. IMII's minerals industry members include BHP, Cameco

Corporation, Fission Uranium Corp., The Mosaic Company and Nutrien

Ltd.

Acceleware continued to invest in developing and

protecting new intellectual property with the total number of

patents issued, allowed, applied for, or in development growing to

a total of 61.

QUARTER IN REVIEW

Revenue of $0.04 million was generated in the

three months ended March 31, 2024 compared to $0.1 million in the

three months ended March 31, 2023 (“Q1 2023”) and $0.04 million in

the previous quarter ended December 31, 2023 (“Q4 2023”). Revenue

in Q1 2024 included software and maintenance revenue. Revenue was

lower in Q1 2024 and Q4 2023 due the variability in revenue earned

in the RF Heating segment for technology evaluation services in

applying CTI to industrial heating. While interest has increased in

EM Powered Heat and the CTI (see IMII project discussed above),

there was no revenue recognised in Q1 2024 or Q4 2023.

Total comprehensive loss for Q1 2024 was $1.0

million compared to a comprehensive loss of $0.3 million for Q1

2023 and a comprehensive income of $0.6 million for Q4 2023.

Comprehensive income in Q4 2023 was due to the receipt of

government assistance from CRIN relating to costs incurred from

January 1, 2022 to June 30, 2023. Offsetting lower spending in Q1

2024 and Q4 2023 were higher interest costs related to notes

payable funding the Company’s working capital. Comprehensive

income/(loss) in all periods was impacted by changes in value of

the derivative financial instruments embedded within the

convertible debenture. The changes in derivative value are driven

primarily by fluctuations in the Company’s share price.

Gross R&D expenses incurred in Q1 2024 were

$0.5 million compared to $0.8 million in Q1 2023 and $.07 million

in Q4 2023. R&D spending was lower in Q1 2024 and Q4 2023

compared to Q1 2023 due to a change in the nature of RF XL Pilot

activities. Most R&D activity in Q1 2024 was related to lab

engineering, designing and testing, data analysis, and partner

consultations. There was no government assistance received in Q1

2024 compared to $0.4 million in Q1 2023 and $2.1 million in Q4

2023, the latter constituting the first CRIN payment. Meanwhile,

the Government of Alberta’s Innovation Employment Grant (“IEG”) to

support research and development was effective January 1, 2021 and

provides a grant of up to 20% of eligible R&D expenses incurred

in Alberta. This new grant effectively replaced Alberta’s 10%

scientific research and experimental development refundable tax

credit that was eliminated as at December 31, 2019. The Company met

the eligibility criteria, claimed eligible R&D expenditures and

received $0.4 million in Q1 2023 related to 2021 eligible

expenditures and $0.1 million in Q3 2023 related to 2022 eligible

expenditures and $nil in Q4 2023. As at March 31, 2024 there was

$nil million government assistance receivable however a claim for

2023 expenditures is in process. Government assistance offsets

gross R&D costs.

G&A expenses incurred in Q1 2024 were $0.5

million compared to $0.3 million in Q1 2023 and $0.6 million in Q4

2023. There were higher non-cash payroll related costs incurred in

Q1 2024 and Q4 2023 due to the timing of option grants, higher

professional fees and lower salaries as the Company continues to

prioritize cost control given uncertain economic conditions.

At March 31, 2024, Acceleware had negative

working capital of $2,799,757 (December 31, 2023 – negative working

capital of $1,985,372) including $126,895 in cash and cash

equivalents (December 31, 2023 - $951,569) and $852,069 in

short-term notes payable (December 31, 2023 - $944,010). As of

March 31, 2024, Acceleware also had $2,215,000 in long-term 10%,

semi-annual interest, convertible debentures outstanding, the

principal amount of which is owing four years from the date of

issue or approximately Q1 2026. Fluctuations in non-cash working

capital were attributable to the timing of receipt and recognition

of government and partner funding and related R&D spending.

During Q4 2023, Acceleware received the first claim for

reimbursement under the new $3 million CRIN grant funding

arrangement noted above. There was $2,064,434 received in Q4 2023.

Cash and cash equivalents decreased in Q1 2024 due to timing of

payments of trade payables. Increasing the deficit is deferred

revenue of $4,350,000 as at March 31, 2024 (December 31, 2022 –

$4,350,000). Despite receiving non-refundable cash payments for

these amounts, the milestone payments have not met all requirements

for revenue recognition under IFRS 15 Revenue from Contracts with

Customers. These amounts will be recognized as revenue and increase

shareholders’ equity when RF XL Pilot heating is complete or the

data revenue contracts are terminated, whichever is earlier.

ABOUT ACCELEWARE:

Acceleware is an innovator of clean-tech

decarbonization technologies comprised of two business units: Radio

Frequency Heating Technology and Seismic Imaging Software.

Acceleware is piloting RF XL, its patented

low-cost, low-carbon production technology for heavy oil and oil

sands that is materially different from any heavy oil recovery

technique used today. Acceleware's vision is that electrification

of heavy oil and oil sands production can be made possible through

RF XL, supporting a transition to much cleaner energy production

that can quickly bend the emissions curve downward. With clean

electricity, Acceleware’s RF XL technology could eliminate

greenhouse gas (GHG) emissions associated with heavy oil and oil

sands production. RF XL uses no water, requires no solvent, has a

small physical footprint, can be redeployed from site to site, and

can be applied to a multitude of reservoir types. Acceleware is

also actively developing partnerships for RF heating of other

industrial applications using the Company’s proprietary CTI.

Acceleware and Saa Dene Group (co-founded by Jim

Boucher) have created Acceleware | Kisâstwêw to raise the profile,

adoption, and value of Acceleware technologies. The shared vision

of the partnership is to improve the environmental and economic

performance of the energy sector by supporting ideals that are

important to Indigenous peoples, including respect for land, water,

and clean air.

The Company’s seismic imaging software solutions

are state-of-the-art for high fidelity imaging, providing the most

accurate and advanced imaging available for oil exploration in

complex geologies. Acceleware is a public company listed on

Canada’s TSX Venture Exchange under the trading symbol “AXE”.

NOTE REGARDING FORWARD-LOOKING

INFORMATION AND OTHER ADVISORIES

This news release contains “forward-looking

information” within the meaning of Canadian securities legislation.

Forward-looking information generally means information about an

issuer’s business, capital, or operations that are prospective in

nature, and includes disclosure about the issuer’s prospective

financial performance or financial position.

The forward-looking information in this press

release can be identified by terms such as “believes”, “estimates”,

“plans”, “potential”, and “will”, and includes information about,

the expected commercialization of RF XL, the expected cost of

the RF XL Pilot, the timing of the execution of the

RF XL Pilot and the redeployment, expected financing required

for the RF XL Pilot redeployment, and the anticipated

economic and societal benefits of the RF XL technology. Acceleware

assumes that current cost estimates are accurate, current

timelines will not be delayed by either internal or external

causes, that research and development effort including the

commercial-scale test plans will result in commercial-ready

products, and that future capital raising efforts will be

successful.

Actual results may vary from the forward-looking

information in this press release due to certain material risk

factors. These risk factors are described in detail in Acceleware’s

continuous disclosure documents, which are filed on SEDAR at

www.sedar.com.

Acceleware assumes no obligation to update or

revise the forward-looking information in this press release,

unless it is required to do so under Canadian securities

legislation.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this release in the United States. The securities have

not been and will not be registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”), or

any state securities laws and may not be offered or sold within the

United States or to U.S. persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

DISCLAIMER

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For more information:Geoff ClarkTel: +1 (403)

249-9099geoff.clark@acceleware.com

Acceleware Ltd.435 10th Avenue SECalgary, AB,

T2G 0W3CanadaTel: +1 (403) 249-9099www.acceleware.com

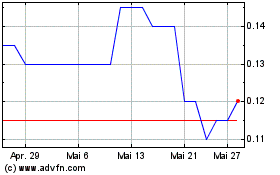

Acceleware (TSXV:AXE)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Acceleware (TSXV:AXE)

Historical Stock Chart

Von Apr 2024 bis Apr 2025