Acceleware® Ltd. (“Acceleware” or the “Company”) (TSX-V: AXE), a

leading innovator of transformative technologies targeting the

decarbonization of industrial process heat, today announced its

financial and operating results for the nine months ended September

30, 2024 (all figures are in Canadian dollars unless otherwise

noted). Acceleware’s results reflect contributions from the

Company’s two business units, radio frequency (“RF”) heating for

industrial applications using the Company’s proprietary Clean Tech

Inverter (“CTI”) including enhanced oil recovery (“RF XL”),

and high-performance computing ("HPC”) scientific software. This

news release should be read in conjunction with the Company’s

unaudited interim condensed financial statements and the

accompanying notes for the nine months ended September 30, 2024 and

management’s discussion and analysis (“MDA”) thereto, together with

the audited financial statements for the year ended December 31,

2023, notes and MDA thereto, all of which are available on

Acceleware’s website at www.acceleware.com or on www.sedarplus.ca.

HIGHLIGHTS

Financial highlights for the three and nine

months ended September 30, 2024:

|

|

|

Three Months Ended |

Nine Months Ended |

|

|

|

Sept 30, 2024 |

Sept 30, 2023 |

Sept 30, 2024 |

Sept 30, 2023 |

|

Revenue |

$ |

1,259,315 |

62,467 |

3,314,956 |

235,421 |

| Comprehensive income/

(loss) |

|

856,500 |

(1,272,006) |

1,150,443 |

(2,663,121) |

|

Gross R&D expenditures |

|

408,356 |

798,544 |

1,672,439 |

2,188,545 |

|

Government assistance |

$ |

(650,165) |

(119,785) |

(1,227,928) |

(553,808) |

In the nine months ended September 30, 2024, the

Company worked closely with industry partners to progress next

steps in the RF XL Pilot. An output of this work is the

determination that the most practical path forward is to redeploy

all subsurface components incorporating the multiple improvements

and upgrades that Acceleware has made to the RF XL downhole

system. During Q3, 2024, the Company continued to refine

redeployment and test plans, confirming the $5 million cost

estimate, which Acceleware is now actively sourcing. Since the end

of Q2 2024, the Company has increased the total non-dilutive

funding amount secured for the next phase of the RF XL Pilot,

contingent on receiving the remainder of the $5 million. The

Company has also secured RF XL consulting revenue from a

confidential oil and gas operator, the net proceeds of which will

be applied to the costs in the next phase of the RF XL Pilot.

Additional RF XL consulting revenue from this operator may be

available in 2025, the net proceeds of which will also be applied

to the RF XL Pilot. The Company has identified several additional

industry and government potential funders and is actively

discussing the project with them. The primary outreach message is

that the next phase of the RF XL Pilot is expected to enable higher

power to be distributed in the reservoir for a sustained period,

resulting in higher temperatures in the reservoir, and potentially

greater oil production with the ultimate goal of further validating

the commercial viability of RF XL. Please refer to the MDA for a

complete RF XL Pilot update.

In the three months ended September 30, 2024

(“Q3 2024”), a Test Data Purchase Agreement with a second oil-sands

producer was concluded and as such the Company recognized $900,000

revenue, the payment of which was received in past quarters. The

remaining revenue of $1,900,000 from the third oil-sands producer

will be recognized when all milestones have been met (expected in

2024), or the contract is terminated, whichever is earlier.

Other recent highlights include:

- On August 20, 2024, Acceleware

announced that it was one of 50 companies selected to pitch at the

21st Annual Rice Alliance Energy Tech Venture Forum, an anchor

event for the Inaugural Energy and Climate Startup Week in Houston,

Texas, September 9-13, 2024.

- In September 2024, Acceleware

joined the Renewable Thermal Collaborative (RTC), and attended the

RTC Summit in Washington, D.C., on September 30-October 1, 2024.

The RTC is the global coalition for companies, institutions, and

governments committed to scaling up renewable heating and cooling

at their facilities, dramatically cutting carbon emissions.

- On October 22, 2024, Acceleware

announced that it was one of ten companies selected by The Mining

Innovation Commercialization Accelerator (MICA) and by Chilean

mining operators to attend the Chile-Canada Mining Innovation

Summit (CCMIS) on October 24, 2024 in Santiago, Chile. In addition,

Acceleware participated in the Global Mining Group’s (GMG) Santiago

Forum, “Igniting Action: Building the Mines of The Future Today” on

October 22- 23, 2024.

- Acceleware continues to work toward

Phase 3 of a potash ore drying project by the International

Minerals Innovation Institute (“IMII”). Phase 2 findings were

presented to IMII in July 2024. Phase 3 of the project includes the

design, construction and testing of a larger shop-scale

demonstration dryer. IMII, a non-profit organization jointly funded

by industry and government, is committed to developing and

implementing innovative education, training, research and

development partnerships to support a world-class minerals

industry. IMII's minerals industry members include BHP, Cameco

Corporation, Fission Uranium Corp., The Mosaic Company and Nutrien

Ltd.

- Acceleware continued to invest in

developing and protecting new intellectual property with the number

of patents issued, allowed, applied for, or in development

totalling 60 as at September 30, 2024.

QUARTER IN REVIEW

Revenue of $1.3 million was recorded in the

three months ended September 30, 2024 compared to $0.1 million in

the three months ended September 30, 2023 (“Q3 2023”) and $2.0

million in the previous quarter ended June 30, 2024 (“Q2 2024”).

Revenue in Q3 2024 included $0.9 million in revenue related to the

RF XL Pilot as a contract for one oil-sands producer was terminated

triggering revenue recognition of previously received milestone

payments and $0.3 million services revenue upon completion of the

first potash ore drying prototype.

Total comprehensive income for Q3 2024 was $0.9

million compared to a comprehensive loss of $1.3 million for Q3

2023 and a comprehensive loss of $1.3 million for Q2 2024.

Comprehensive income in Q3 2024 was high due to revenue related to

the RF XL Pilot and receipt of government assistance from CRIN

relating to costs incurred from January 1, 2024 to March 31, 2024.

Finance expenses in Q3 2024 and Q3 2023 include interest expense on

notes payable which are funding the Company’s working capital.

Comprehensive income or loss in all periods was impacted by changes

in value of the derivative financial instruments embedded within

the convertible debenture. The changes in derivative value are

driven primarily by the fluctuation in the Company’s share

price.

Gross R&D expenses incurred in Q3 2024 were

$0.8 million compared to $0.8 million in Q3 2023 and $0.7 million

in Q2 2024. R&D spending in 2024 was related to development of

the IMII dryer for potash ore and included lab engineering,

designing and testing, data analysis, and partner consultations.

R&D spending in Q3 2023 was related to the RF XL Pilot. There

was $0.7 million government assistance received in Q3 2024 and $0.1

in Q3 2023 and $0.6 in Q2 2024. The Company received the final CRIN

payment of $0.3 million in Q3 2024 and the final ERA holdback

payment of $0.2 million. The Government of Alberta’s Innovation

Employment Grant (“IEG”) to support research and development was

effective January 1, 2021 and provides a grant of up to 20% of

eligible R&D expenses incurred in Alberta. This new grant

effectively replaced Alberta’s 10% scientific research and

experimental development refundable tax credit that was eliminated

as at December 31, 2019. The Company met the eligibility criteria,

claimed eligible R&D expenditures and received $0.3 million in

Q3 2024 related to 2023 eligible expenditures, received $0.1

million in the three months ended September 30, 2023 related to

2022 eligible expenditures, and $0.4 million in the three months

ended March 31, 2023 related to 2021 eligible expenditures.

Government assistance is recorded as a reduction of R&D

expenses.

G&A expenses incurred in Q3 2024 were $0.4

million compared to $0.6 million in Q3 2023 and $0.4 million in Q2

2024. There were lower non-cash payroll related costs incurred in

Q3 2024 due to the timing of option grants and lower salaries as

the Company continues to prioritize cost control given uncertain

economic conditions.

As at September 30, 2024, Acceleware had

negative working capital of $2.6 million (December 31, 2023 –

negative working capital of $2.0 million) including cash and cash

equivalents of $0.5 million (December 31, 2023 – $1.0 million). The

increase in negative working capital is attributable to the timing

of receipt and recognition of government and partner funding and

related R&D spending. Increasing the deficit is deferred

revenue of $1.9 million as at September 30, 2024 (December 31, 2023

– $4,350,000). Despite receiving non-refundable cash payments for

these amounts, the milestone payments have not met all requirements

for revenue recognition under IFRS 15 Revenue from Contracts with

Customers. These amounts will be recognized as revenue and increase

shareholders’ equity when RF XL Pilot heating is complete or the

data contracts are terminated, whichever is earlier.

YEAR TO DATE IN REVIEW

Revenue of $3.3 million was recorded in the nine

months ended September 30, 2024 compared to $0.2 million for the

nine months ended September 30, 2023. Revenue for the nine months

ended September 30, 2024 included $2.85 million services revenue

related to the RF XL Pilot and $0.3 million in services revenue

related to the potash drying project. Revenue was recognized for

the RF XL Pilot as all milestones were completed under contract for

one oil-sands producer and the other oil-sands producer terminated

its contract triggering revenue recognition of previously received

milestone payments.

Total comprehensive income for the nine months

ended September 30, 2024 was $1.2 million compared to comprehensive

loss of $2.7 million for the nine months ended September 30, 2023

due to higher revenue as noted above and higher government

assistance. There are fluctuations in both periods related to

changes in fair value of the derivative financial instruments

embedded in the convertible debentures.

Gross R&D expenses for the nine months ended

September 30, 2024 were $1.7 million compared to $2.2 million

incurred during the nine months ended September 30, 2023 due to

higher R&D activity in the first half of 2023 related to the

final steps of the RF XL Pilot workover. Federal and provincial

government assistance of $1.2 million was recognized in the nine

months ended September 30, 2024 compared to $0.6 million for the

nine months ended September 30, 2023 as the RF XL Pilot nears

completion.

G&A expenses incurred during the nine months

ended September 30, 2024 were $1.3 million compared to $1.4 million

for the nine months ended September 30, 2023. The Company continues

to prioritize cost management.

ABOUT ACCELEWARE:

Acceleware is an innovator of clean-tech

decarbonization technologies comprised of two business units: Radio

Frequency Heating Technology and Seismic Imaging Software.

Acceleware is piloting RF XL, its patented

low-cost, low-carbon production technology for heavy oil and oil

sands that is materially different from any heavy oil recovery

technique used today. Acceleware's vision is that electrification

of heavy oil and oil sands production can be made possible through

RF XL, supporting a transition to much cleaner energy

production that can quickly bend the emissions curve downward. With

clean electricity, Acceleware’s RF XL technology could

eliminate greenhouse gas (GHG) emissions associated with heavy oil

and oil sands production. RF XL uses no water, requires no

solvent, has a small physical footprint, can be redeployed from

site to site, and can be applied to a multitude of reservoir types.

Acceleware is also working on the decarbonization of other

industrial process heat applications through its EM Powered Heat

technology, which uses the Company’s proprietary CTI. These include

a multi-phase EM Powered Heat potash dryer project currently

underway with the International Minerals Innovations Institute in

Saskatchewan, Canada.

Acceleware and Saa Dene Group (co-founded by Jim

Boucher) have created Acceleware | Kisâstwêw to raise the profile,

adoption, and value of Acceleware technologies. The shared vision

of the partnership is to improve the environmental and economic

performance of the energy sector by supporting ideals that are

important to Indigenous peoples, including respect for land, water,

and clean air.

The Company’s seismic imaging software solutions

are state-of-the-art for high fidelity imaging, providing the most

accurate and advanced imaging available for oil exploration in

complex geologies. Acceleware is a public company listed on

Canada’s TSX Venture Exchange under the trading symbol “AXE”.

NOTE REGARDING FORWARD-LOOKING

INFORMATION AND OTHER ADVISORIES

This news release contains “forward-looking

information” within the meaning of Canadian securities legislation.

Forward-looking information generally means information about an

issuer’s business, capital, or operations that are prospective in

nature, and includes disclosure about the issuer’s prospective

financial performance or financial position.

The forward-looking information in this press

release can be identified by terms such as “believes”, “estimates”,

“plans”, “potential”, and “will”, and includes information about,

the expected commercialization of RF XL, the expected

cost of the RF XL Pilot, the timing of the

execution of the RF XL Pilot and the redeployment,

expected financing required for the RF XL Pilot redeployment,

and the anticipated economic and societal benefits of the

RF XL technology. Acceleware assumes that current cost

estimates are accurate, current timelines will not be delayed by

either internal or external causes, that research and

development effort including the commercial-scale test plans will

result in commercial-ready products, and that future capital

raising efforts will be successful.

Actual results may vary from the forward-looking

information in this press release due to certain material risk

factors. These risk factors are described in detail in Acceleware’s

continuous disclosure documents, which are filed on SEDAR at

www.sedar.com.

Acceleware assumes no obligation to update or

revise the forward-looking information in this press release,

unless it is required to do so under Canadian securities

legislation.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this release in the United States. The securities have

not been and will not be registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”), or

any state securities laws and may not be offered or sold within the

United States or to U.S. persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

DISCLAIMER

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For more information:Geoff ClarkTel: +1 (403)

249-9099geoff.clark@acceleware.com

Acceleware Ltd.435 10ᵗʰ Avenue SECalgary,

AB, T2G 0W3CanadaTel: +1 (403) 249-9099www.acceleware.com

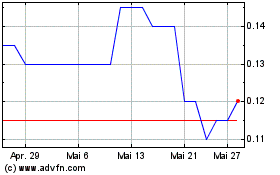

Acceleware (TSXV:AXE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Acceleware (TSXV:AXE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024