OverActive Media (“OverActive” or the “Company”) (TSXV:OAM), a

global sports, media and entertainment company for today’s

generation of fans, is pleased to announce its financial

results for the three and six-month period ended June 30, 2021. The

condensed consolidated interim financial statements, notes to

financial statements, and Management’s Discussion and Analysis for

the three and six-month period ended June 30, 2021, are available

on the Company’s website at www.overactivemedia.com and under the

Company's SEDAR website at www.sedar.com. All financial

figures are denominated in $000s CAD unless otherwise stated.

Q2 2021 Financial

Highlights

- Total revenue for the three months

ended June 30, 2021 increased by 71% to $2,104, compared to $1,227

for the same period in 2020. In 2020, total revenue for the three

months ended June 20, 2020 of $1,227 represented only 15% of 2020

FYE total revenue. We expect that a similar seasonality pattern

will continue in 2021.

- Total revenue for the six months

ended June 30, 2021 increased by 56%, to $3,402, compared to $2,179

for the same period in 2020. In 2020, total revenue for the six

months ended June 30, 2020 of $2,179 represented only 26% of 2020

FYE revenue. We expect that a similar seasonality pattern will

continue in 2021.

- Adjusted EBITDA1 for the three

months ended June 30, 2021 improved by 28% to ($1,851), compared to

($2,561) for the same period in 2020, as a result of strong revenue

growth.

- Adjusted EBITDA for the six months

ended June 30, 2021 increased by 36% to ($4,282) compared to

($6,678) for the same period in 2020, a 36% improvement as a result

of strong revenue growth.

- As at June 30, 2021, the Company

had cash and cash equivalents of $15,660 compared to $5,585 as at

December 31, 2020. Subsequent to the quarter, the Company secured

an additional $23,034 as a result of its receipt of the gross

proceeds of the brokered subscription receipt financing that was

completed in connection with its qualifying transaction.

“We are delivering significant year-over-year

revenue growth and generating a strong recurring revenue base from

our sponsorship partners, who recognize the appeal of our team

franchises to today’s generation of fans,” said Chris Overholt, CEO

of OverActive Media. “Our franchise agreements with global gaming

publishers entitle us to a revenue share from each league, which we

typically recognize in the back half of the year. We expect solid

revenue growth for the rest of the year, with a continued focus on

adding globally recognized brands as long-term partners and

competing at the highest level in our respective leagues.”

Mr. Overholt continued, “Subsequent to the end

of this quarter, we completed our public listing on the Toronto

Venture Exchange and received over $23 million in aggregate gross

proceeds from a brokered subscription receipt. This, alongside a

$16.9 million non-brokered financing that we completed in late

March and early April, which included investments from BCE Inc.

(TSX:BCE) and the National Hockey League's Montreal Canadiens,

gives us a strong balance sheet to pursue our growth strategy. We

are also making important strides on our plan to build the premier

sports and entertainment venue in North America, offering

state-of-the-art technology and one of the most unique fan

experiences in the world.”

Operational Highlights

- Team BDS acquired the League of

Legends European Championship (LEC) franchise slot from Schalke 04

for a reported $40 million (€26.5 million). OverActive Media

acquired an LEC franchise in 2019 that operates under the MAD Lions

brand for $12 million (€8 million).

- MAD Lions won the Spring 2021

League of Legends European Championship and became the “New Kings

of Europe.”

- The Toronto Ultra won the Call of

Duty League Stage II Major Championship. Toronto Ultra also reached

a milestone of 500,000 social media followers and was highlighted

by Twitter as one of the most popular esports brands in

Canada.

- Flashpoint 3, the CS:GO tournament

operated by B Site Inc. (a company in which OverActive holds a

minority interest), realized the highest viewership to date and was

held on behalf of Valve Inc. as a Major Regional Tournament in

Europe.

- Toronto Defiant, our Overwatch

League franchise, is set to complete its third season while

delivering our best results. The team is currently participating in

the Countdown Cup and has qualified for the 2021 Championship

Play-In Tournament.

- TD Bank (TSX:TD) became an official

sponsor of Toronto Ultra and OverActive in Canada.

- Crave Meals, a Kraft Heinz brand

(NASDAQ:KHC), became the official meal partner of the Toronto

Ultra.

- Bud Light (NYSE:BUD) became the

official beer sponsor of the Toronto Ultra.

- Warner Music Spain, part of leading

record label Warner Music Group (NASDAQ:WMG) partnered with MAD

Lions to enhance the fan experience across music, esports and video

games.

- OverActive and H4X announced a

multi-year partnership, making H4X the Lead Apparel Partner of the

Toronto Ultra and the Toronto Defiant.

- OverActive unveiled its new 15,000

sq. ft. headquarters that includes a Red Bull Gaming Studio, Bell

Fibe Zone, TD Player Lounge and Canon Creator Lab.

1 Adjusted EBITDA is a non-IFRS measure. Refer to “Non-IFRS

Measures” at the end of this press release.

ABOUT OVERACTIVE MEDIA

OverActive Media (TSXV:OAM) is headquartered in

Toronto, Ontario, with operations in Madrid, Spain and Berlin,

Germany. OverActive’s mandate is to build an integrated global

company delivering sports, media and entertainment products for

today’s generation of fans with a focus on esports, videogames,

content creation and distribution, culture, and live and online

events. OverActive owns team franchises in (i) the Overwatch

League, operating as the Toronto Defiant, (ii) the Call of Duty

League, operating as the Toronto Ultra, (iii) the League of Legends

European Championship (“LEC”), operating as the MAD Lions, (iv) the

Superliga, operating as the MAD Lions Madrid, and (v) Flashpoint,

operating as MAD Lions Counter Strike:Global Offensive (a

franchised league operated by B Site Inc., a company in which

OverActive holds a minority interest), as well as other

non-affiliated CS:GO tournaments and leagues. OverActive also

operates both live and online events, operating as OAM Live and

maintains an active social media presence with its fans and

community members, operates fan clubs, and other fan related

activities that increase the reach of its brands.

For more information, please contact:

Babak Pedram, Investor RelationsVirtus Advisory Group Inc. (416)

995-8651bpedram@virtusadvisory.com

Leah Gaucher, Director of PR & CommunicationsOverActive

Media(647) 924-2614lgaucher@oam.gg

Cautionary Note Regarding

Forward-Looking Information

This press release contains statements which

constitute “forward-looking statements” and “forward-looking

information” within the meaning of applicable securities laws

(collectively, “forward-looking statements”), including statements

regarding the plans, intentions, beliefs and current expectations

of OverActive with respect to future business activities and

operating performance. Forward-looking statements are often

identified by the words “may”, “would”, “could”, “should”, “will”,

“intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or

similar expressions and includes information regarding the

anticipated financial and operating results of OverActive in the

future.

Investors are cautioned that forward-looking

statements are not based on historical facts but instead OverActive

management’s expectations, estimates or projections concerning

future results or events based on the opinions, assumptions and

estimates of management considered reasonable at the date the

statements are made. Although OverActive believes that the

expectations reflected in such forward-looking statements are

reasonable, such statements involve risks and uncertainties, and

undue reliance should not be placed thereon, as unknown or

unpredictable factors could have material adverse effects on future

results, performance or achievements of the OverActive. Among the

key factors that could cause actual results to differ materially

from those projected in the forward-looking statements include the

following: the potential impact of OverActive’s qualifying

transaction on relationships, including with regulatory bodies,

employees, suppliers, customers and competitors; changes in general

economic, business and political conditions, including changes in

the financial markets; changes in applicable laws and regulations

both locally and in foreign jurisdictions; compliance with

extensive government regulation; the risks and uncertainties

associated with foreign markets; and other risk factors set out in

OverActive’s filing statement dated July 2, 2021, a copy of which

may be found under OverActive’s profile at www.sedar.com. These

forward-looking statements may be affected by risks and

uncertainties in the business of OverActive and general market

conditions, including COVID-19.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking statements prove incorrect, actual results may vary

materially from those described herein as intended, planned,

anticipated, believed, estimated or expected. Although OverActive

has attempted to identify important risks, uncertainties and

factors which could cause actual results to differ materially,

there may be others that cause results not to be as anticipated,

estimated or intended and such changes could be material.

OverActive does not intend and do not assume any obligation, to

update the forward-looking statements except as otherwise required

by applicable law.

Non-IFRS Measures

This press release includes references to

adjusted EBITDA. Adjusted EBITDA is a non-IFRS financial measure

and is defined by the Company as net income or loss before income

taxes, finance costs, depreciation and amortization,

decrease/increase in net present value of franchise obligations,

foreign exchange gains/loss, assistance payments from Franchise

League and government assistance, restructuring costs, intangibles

assets impairment charge and share-based compensation. We believe

that adjusted EBITDA is a useful measure of financial performance

because it provides an indication of the Company’s ability to

capitalize on growth opportunities in a cost-effective manner,

finance its ongoing operations and service its financial

obligations.

This non-IFRS financial measure is not an

earnings or cash flow measure recognized by IFRS and does not have

a standardized meaning prescribed by IFRS. Our method of

calculating such a financial measure may differ from the methods

used by other issuers and, accordingly, our definition of this

non-IFRS financial measure may not be comparable to similar

measures presented by other issuers. Investors are cautioned that

non-IFRS financial measures should not be construed as an

alternative to net income determined in accordance with IFRS as

indicators of our performance or to cash flows from operating

activities as measures of liquidity and cash flows.

For a reconciliation of adjusted EBITDA to net

loss, please refer to Management’s Discussion and Analysis.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

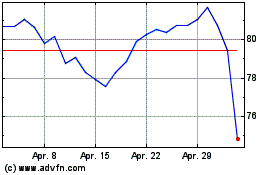

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025