Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF)

(“Calibre” or the “Company”) announces financial and operating

results for the three (“Q2 2024”) and six months (“YTD 2024”) ended

June 30, 2024. Consolidated Q2 and YTD 2024 filings can be found at

www.sedarplus.ca and on the Company’s website at

www.calibremining.com. All figures are expressed

in U.S. dollars unless otherwise stated.

Darren Hall, President and Chief

Executive Officer of Calibre, stated: “Calibre continues

to generate strong operating cash flow, while the fully funded

Valentine Gold Mine progresses to construction completion. With the

recent approvals for the Volcan open pit and subsequent ore

deliveries into the Libertad mill we, as planned, expect a stronger

H2 and remain on track to deliver into our 2024 gold production

guidance of 275,000 - 300,000 ounces.

During the quarter we made excellent progress

advancing the construction of the Valentine Gold Mine with SAG

mill, ball mill and primary crusher installation well underway.

Pleasingly the team have recently surpassed 2 million hours worked

without a lost time injury. A key development recently announced

was the receipt of the Federal Environment approval and issuance of

Provincial mine and surface leases for development of the Berry

deposit and associated infrastructure. With this approval we now

have all the major approvals for the current life of mine plan,

providing certainty as well as flexibility to optimize for near

term cash flow.

We have extensive exploration drilling underway

across all our assets. Previously disclosed results at the

Valentine Gold Mine indicate robust growth potential below and

adjacent to existing Mineral Resources. Consequently, we have

expanded the current drill program with 100,000 metres of

additional drilling as we begin to unlock the incredible

opportunity of resource expansion and discovery potential across

the 32 kilometre long Valentine Lake Shear Zone.”

Q2 2024 Highlights

- Construction of the

multi-million-ounce Valentine Gold Mine surpasses 77%

construction as of July 31, 2024, with a cost to complete of C$211

million and remains on track for gold production in Q2

2025;

- Operations leadership team

employed;

- Onsite assay lab construction

completed and operating;

- Primary crusher installation

underway;

- Primary conveyor from crusher to

grinding building onsite;

- Reclaim tunnel and coarse ore

stockpile construction progressing;

- SAG mill and ball mill installation

underway;

- CIL leaching tanks construction

well underway; and

- Tailings Management Facility

progressing, embankment liner at 96%;

- Received Federal

Environmental approval for the development of the Berry open

pit at the Valentine Gold Mine, with this, the major

approvals are in place for the three-pit mine plan;

- Continuous gold

mineralization discovery at the Valentine Gold Mine

reinforces the vast upside potential;

- Commenced the largest pure

exploration drilling campaign in Valentine’s history

following up on recent results and providing new discovery

opportunities along multiple kilometres of identified shear

zones;

- Valentine Gold Mine achieves 2

million hours worked with no lost time injury a significant

milestone;

- Achieved another significant

milestone with receipt of the Environmental approval for

operation of the Volcan Gold deposit in

Nicaragua and within a month delivered first ore

to the Libertad mill located 5km away, demonstrating the

value of the Company’s hub and spoke operating strategy as it

organically grows gold production;

- Consolidated production is expected

to be weighted to the second half of 2024 with Q4 2024 anticipated

to be the strongest quarter of the year while Total Cash Cost

(“TCC”) and All-In Sustaining Costs (“AISC”) are forecast to be

lower;

- Gold and silver drill

results from Eastern Borosi (“EBP”) reinforce the

significant mineral endowment and potential for discovery and

resource expansion within the 176 km2 EBP land package;

- Included in the S&P/TSX

Composite Index, reflecting Calibre’s

growth and value generation for shareholders;

- Consolidated gold sales of 58,345

ounces grossing $137.3 million in revenue at an average realized

gold price1 of $2,302/oz;

- Consolidated TCC1 of $1,264/oz;

Nicaragua $1,232/oz and Nevada $1,435/oz;

- Consolidated AISC1 of $1,533/oz;

Nicaragua $1,407/oz and Nevada $1,766/oz; and

- Cash and restricted cash of $127.6

million and $125.0 million, respectively, as at June 30, 2024.

YTD 2024 Highlights

- Consolidated gold sales of 120,122

ounces grossing $269.2 million in revenue, at an average realized

gold price1 of $2,194/oz;

- Consolidated TCC1 of $1,302/oz;

Nicaragua $1,276/oz and Nevada $1,468/oz;

- Consolidated AISC1 of $1,545/oz;

Nicaragua $1,441/oz and Nevada $1,685/oz; and

- Cash provided by operating

activities of $106.6 million including the proceeds from the gold

prepay net of the deferred revenue recognized in Q2 2024.

CONSOLIDATED RESULTS: Q2 and YTD 2024

Consolidated Financial

Results2

|

$'000 (except per share and per ounce amounts) |

|

Q2 2024 |

|

|

Q2 2023 |

|

|

YTD 2024 |

|

|

YTD 2023 |

|

|

Revenue |

$ |

137,325 |

|

$ |

139,310 |

|

$ |

269,213 |

|

$ |

266,223 |

|

|

Cost of sales, including depreciation and amortization |

$ |

(94,685 |

) |

$ |

(85,769 |

) |

$ |

(197,316 |

) |

$ |

(180,429 |

) |

|

Mine operating income |

$ |

42,640 |

|

$ |

53,541 |

|

$ |

71,897 |

|

$ |

85,794 |

|

|

Net income |

$ |

20,762 |

|

$ |

33,203 |

|

$ |

17,126 |

|

$ |

49,612 |

|

|

Net income per share (basic) |

$ |

0.03 |

|

$ |

0.07 |

|

$ |

0.02 |

|

$ |

0.11 |

|

|

Net income per share (fully diluted) |

$ |

0.03 |

|

$ |

0.07 |

|

$ |

0.02 |

|

$ |

0.10 |

|

|

Adjusted net income1,3 |

$ |

19,035 |

|

$ |

33,633 |

|

$ |

24,345 |

|

$ |

49,831 |

|

|

Adjusted net income per share (basic) |

$ |

0.02 |

|

$ |

0.07 |

|

$ |

0.03 |

|

$ |

0.11 |

|

|

Cash provided by operating activities |

$ |

60,826 |

|

$ |

59,803 |

|

$ |

106,641 |

|

$ |

86,550 |

|

|

Capital investment in mine development and PPE |

$ |

107,939 |

|

$ |

35,719 |

|

$ |

183,796 |

|

$ |

56,759 |

|

|

Capital investment in exploration |

$ |

8,967 |

|

$ |

8,181 |

|

$ |

16,604 |

|

$ |

13,743 |

|

|

Gold ounces produced |

|

58,754 |

|

|

68,776 |

|

|

120,521 |

|

|

134,526 |

|

|

Gold ounces sold |

|

58,345 |

|

|

69,009 |

|

|

120,122 |

|

|

134,779 |

|

|

Average realized gold price1 ($/oz) |

$ |

2,302 |

|

$ |

1,974 |

|

$ |

2,194 |

|

$ |

1,933 |

|

|

TCC ($/oz)1 |

$ |

1,264 |

|

$ |

977 |

|

$ |

1,302 |

|

$ |

1,068 |

|

|

AISC ($/oz)1 |

$ |

1,533 |

|

$ |

1,178 |

|

$ |

1,545 |

|

$ |

1,239 |

|

Operating Results

|

NICARAGUA |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

|

Ore mined (t) |

359,295 |

613,536 |

894,082 |

1,096,797 |

|

Ore milled (t) |

455,616 |

515,478 |

986,626 |

998,567 |

|

Grade (g/t Au) |

3.48 |

4.06 |

3.40 |

3.85 |

|

Recovery (%) |

92.5 |

92.4 |

92.0 |

92.7 |

|

Gold produced (ounces) |

49,208 |

58,392 |

104,215 |

113,389 |

|

Gold sold (ounces) |

49,210 |

58,588 |

104,217 |

113,583 |

|

|

|

|

|

|

|

NEVADA |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

|

Ore mined (t) |

1,080,242 |

1,096,313 |

2,068,936 |

2,384,906 |

|

Ore placed on leach pad (t) |

1,062,001 |

1,072,046 |

2,037,355 |

2,375,878 |

|

Grade (g/t Au) |

0.44 |

0.39 |

0.41 |

0.38 |

|

Gold produced (ounces) |

9,546 |

10,384 |

16,306 |

21,137 |

|

Gold sold (ounces) |

9,135 |

10,420 |

15,905 |

21,195 |

|

|

|

|

|

|

CONSOLIDATED Q2 and YTD 2024 FINANCIAL

REVIEW

TCC and AISC for Q2 2024 were $1,264 per ounce

and $1,533 per ounce, respectively. The higher cash costs and AISC

were due to lower gold production and sales tied to the sequencing

of mining different orebodies with lower ore grades, along with

higher tonnes moved and higher strip ratios. Q2 2024 gold

production was impacted by the geotechnical issue at Limon Norte.

The ore tonnes that were not mined in Q2 from Limon Norte are

expected to be mined in the second half of 2024.

Net Income

The net income per share in Q2 2024 was $0.03

for both basic and diluted shares (Q2 2023: $0.07 for both basic

and diluted). YTD 2024 net income per share was $0.02 for both

basic and diluted shares (YTD 2023: $0.11 for basic shares and

$0.10 for diluted shares). As a result of the Marathon Gold

transaction and C$115 million bought deal financing, the shares

outstanding in 2024 increased resulting in the lower net income per

share metric.

2024 GUIDANCE

|

|

CONSOLIDATED |

NICARAGUA |

NEVADA |

|

Gold Production/Sales (ounces) |

275,000 – 300,000 |

235,000 - 255,000 |

40,000 - 45,000 |

|

TCC ($/ounce)1 |

$1,075 - $1,175 |

$1,000 - $1,100 |

$1,400 - $1,500 |

|

AISC ($/ounce)1 |

$1,275 - $1,375 |

$1,175 - $1,275 |

$1,650 - $1,750 |

|

Growth Capital ($ million)* |

$45 - $55 |

|

Updated Exploration Capital ($ million) |

$40 - $45 |

* Growth capital excludes the capital being

invested in the construction of Valentine Gold Mine

Calibre’s 2024 guidance reflects, what is

expected to be, the fifth consecutive year of annual production

growth. Given its proven track record, Calibre will continue to

reinvest into exploration and growth with over 160,000 metres of

drilling and development of new satellite deposits across its asset

portfolio expected in 2024.

Consolidated production is expected to be

weighted to the second half of 2024 with Q4 2024 anticipated to be

the strongest quarter of the year while TCC and AISC are forecasted

to be lower. Production in H2 2024 and Q4 2024 will benefit from

the open pit Volcan mine expected to reach commercial production in

Q3 2024, higher production from Guapinol and higher Limon and Tigra

open pit ore production. Growth capital includes underground

development at Panteon Norte, Volcan mine development, waste

stripping and land acquisition.

Since acquiring the Nicaraguan assets from

B2Gold in October 2019, the Nevada assets from Fiore Gold in 2022,

and the Newfoundland and Labrador assets from Marathon Gold in

2024, Calibre has consistently reinvested in mine development and

exploration programs. These investments have led to the discovery

of new deposits and growth in both production and Reserves. This

progress positions Calibre to fulfill its commitments and enhance

profitability as it expands its operations in Canada with the

Valentine Gold Mine anticipated to deliver first gold during Q2

2025.

The Company's mineral endowment includes 4.1

million ounces of Reserves, 8.6 million ounces of Measured and

Indicated Resources (inclusive of Reserves), and 3.6 million ounces

of Inferred Resources, as detailed in the press release

dated March 12, 2024.

Q2 and YTD 2024 FINANCIAL RESULTS AND

CONFERENCE CALL DETAILS

Second quarter and YTD 2024 financial results

will be released after market close on Monday, August 12, 2024, and

management will be hosting a conference call on Tuesday, August 13,

2024, to discuss the results and outlook in more detail.

|

Date: |

Tuesday, August 13, 2024 |

| Time: |

10:00 am ET |

| Webcast Link: |

https://edge.media-server.com/mmc/p/vmftefqy |

| |

|

Instructions for obtaining conference call

dial-in number:

- All parties must register at the link below to participate in

Calibre’s Q2 and YTD 2024 conference call.

- Register by clicking

https://dpregister.com/sreg/10189865/fcb2dee667

and completing the online registration form.

- Once registered you will receive

the dial-in numbers and PIN number for input at the time of the

call.

The live webcast and registration link can be

accessed here and at www.calibremining.com under

the Events and Media section under the investors tab. The live

audio webcast will be archived and available for replay for 12

months after the event at www.calibremining.com.

Presentation slides that will accompany the conference call will be

made available in the investors section of the Calibre website

under Presentations prior to the conference call.

Qualified Person

The scientific and technical information

contained in this news release was approved by David Schonfeldt

P.GEO, Calibre Mining’s Corporate Chief Geologist and a "Qualified

Person" under National Instrument 43-101.

About Calibre

Calibre is a Canadian-listed, Americas focused,

growing mid-tier gold producer with a strong pipeline of

development and exploration opportunities across Newfoundland &

Labrador in Canada, Nevada and Washington in the USA, and

Nicaragua. Calibre is focused on delivering sustainable value for

shareholders, local communities and all stakeholders through

responsible operations and a disciplined approach to growth. With a

strong balance sheet, a proven management team, strong operating

cash flow, accretive development projects and district-scale

exploration opportunities Calibre will unlock significant

value.

ON BEHALF OF THE BOARD

“Darren Hall”

Darren Hall, President & Chief Executive Officer

For further information, please contact:

Ryan KingSenior Vice President, Corporate

Development & IRT: 604.628.1010E: calibre@calibremining.comW:

www.calibremining.com

Calibre’s head office is located at Suite 1560, 200 Burrard St.,

Vancouver, British Columbia, V6C 3L6.

X / Facebook / LinkedIn / YouTube

The Toronto Stock Exchange has neither reviewed nor accepts

responsibility for the adequacy or accuracy of this news

release.

Notes

(1) NON-IFRS

FINANCIAL MEASURES

The Company believes that investors use certain

non-IFRS measures as indicators to assess gold mining companies,

specifically TCC per Ounce and AISC per Ounce. In the gold mining

industry, these are common performance measures but do not have any

standardized meaning. The Company believes that, in addition to

conventional measures prepared in accordance with IFRS, certain

investors use this information to evaluate the Company’s

performance and ability to generate cash flow. Accordingly, it is

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS.

TCC per Ounce

of Gold: TCC include mine site operating

costs such as mining, processing, and local administrative costs

(including stock-based compensation related to mine operations),

royalties, production taxes, mine standby costs and current

inventory write downs, if any. Production costs are exclusive of

depreciation and depletion, reclamation, capital, and exploration

costs. TCC per gold ounce are net of by-product silver sales and

are divided by gold ounces sold to arrive at a per ounce

figure.

AISC per

Ounce of Gold: A performance measure that

reflects all of the expenditures that are required to produce an

ounce of gold from current operations. While there is no

standardized meaning of the measure across the industry, the

Company’s definition is derived from the AISC definition as set out

by the World Gold Council in its guidance dated June 27, 2013, and

November 16, 2018. The World Gold Council is a non-regulatory,

non-profit organization established in 1987 whose members include

global senior mining companies. The Company believes that this

measure will be useful to external users in assessing operating

performance and the ability to generate free cash flow from current

operations. The Company defines AISC as the sum of TCC (per above),

sustaining capital (capital required to maintain current operations

at existing levels), capital lease repayments, corporate general

and administrative expenses, exploration expenditures designed to

increase resource confidence at producing mines, amortization of

asset retirement costs and rehabilitation accretion related to

current operations. AISC excludes capital expenditures for

significant improvements at existing operations deemed to be

expansionary in nature, exploration and evaluation related to

resource growth, rehabilitation accretion and amortization not

related to current operations, financing costs, debt repayments,

and taxes. Total all-in sustaining costs are divided by gold ounces

sold to arrive at a per ounce figure.

Average

Realized Price per Ounce SoldAverage realized price per

ounce sold is a common performance measure that does not have any

standardized meaning. The most directly comparable measure prepared

in accordance with IFRS is revenue from gold sales.

TCC and AISC per Ounce of Gold Sold

Reconciliations

The tables below reconcile TCC and AISC for the

three months ended June 30, 2024 and 2023.

1. Sustaining capital expenditures are shown in

the Growth and Sustaining Capital Table in the Q2 2024 MD&A

dated June 30, 2024.

1. Sustaining capital expenditures are shown in

the Growth and Sustaining Capital Table in the Q2 2024 MD&A

dated June 30, 2024.

The tables below reconcile TCC and AISC for the

six months ended June 30, 2024 and 2023.

1. Sustaining capital expenditures are shown in

the Growth and Sustaining Capital Table in the Q2 2024 MD&A

dated June 30, 2024.

1. Production costs include a $0.7 million net

realizable value reversal for the Pan mine.2. Sustaining capital

expenditures are shown in the Growth and Sustaining Capital Table

in the Q2 2024 MD&A dated June 30, 2024.

(2) CONSOLIDATED

FINANCIAL AND OPERATIONAL RESULTS FOR 2024 INCLUDE THE RESULTS FROM

MARATHON SINCE ITS ACQUISITION, FROM THE PERIOD OF JANUARY 25, 2024

TO JUNE 30, 2024.

(3) ADJUSTED NET

INCOME

Adjusted net income and adjusted earnings per

share – basic exclude a number of temporary or one-time items

described in the following table, which provides a reconciliation

of adjusted net income to the consolidated financial

statements:

|

(in thousands – except per share amounts) |

|

Q2 2024 |

|

Q2 2023 |

YTD 2024 |

|

YTD 2023 |

|

|

Net income |

$ |

20,762 |

|

$ |

33,203 |

$ |

17,126 |

$ |

49,612 |

|

|

Addbacks (net of tax impacts): |

|

|

|

|

|

Other corporate expenses |

|

(1,727 |

) |

|

430 |

|

7,206 |

|

512 |

|

|

Nevada inventory write-down |

|

- |

|

|

- |

|

- |

|

(616 |

) |

|

Mineral property write-off |

|

- |

|

|

- |

|

13 |

|

323 |

|

|

Adjusted net income |

$ |

19,035 |

|

$ |

33,633 |

$ |

24,345 |

$ |

49,831 |

|

|

Weighted average number of shares outstanding |

|

776,801 |

|

|

454,978 |

|

715,328 |

|

453,005 |

|

|

Adjusted net income (loss) per share – basic |

$ |

0.02 |

|

$ |

0.07 |

$ |

0.03 |

$ |

0.11 |

|

Cautionary Note Regarding Forward Looking

Information

This news release includes certain

"forward-looking information" and "forward-looking statements"

(collectively "forward-looking statements") within the meaning of

applicable Canadian securities legislation. All statements in this

news release that address events or developments that we expect to

occur in the future are forward-looking statements. Forward-looking

statements are statements that are not historical facts and are

identified by words such as "expect", "plan", "anticipate",

"project", "target", "potential", "schedule", "forecast", "budget",

"estimate", “assume”, "intend", “strategy”, “goal”, “objective”,

“possible” or "believe" and similar expressions or their negative

connotations, or that events or conditions "will", "would", "may",

"could", "should" or "might" occur. Forward-looking statements in

this news release include but are not limited to the Company’s

expectations of gold production and production growth; the upside

potential of the Valentine Gold Mine; the Valentine Gold Mine

achieving first gold production during the second quarter of 2025,

the Volcan mine reaching commercial production in the third quarter

of 2024; commencement of construction activities for the Berry

deposit during the third quarter of 2024; the Company’s

reinvestment into its existing portfolio of properties for further

exploration and growth; statements relating to the Company’s 2024

priority resource expansion opportunities; the Company’s metal

price and cut-off grade assumptions. Forward-looking statements

necessarily involve assumptions, risks and uncertainties, certain

of which are beyond Calibre's control. For a listing of risk

factors applicable to the Company, please refer to Calibre's annual

information form (“AIF”) for the year ended December 31, 2023, its

management discussion and analysis for the year ended December 31,

2023 and other disclosure documents of the Company filed on the

Company’s SEDAR+ profile at www.sedarplus.com.

For a listing of risk factors applicable to the

Company, please refer to Calibre's annual information form (“AIF”)

for the year ended December 31, 2023, its management discussion and

analysis for the year ended December 31, 2023 and other disclosure

documents of the Company filed on the Company’s SEDAR+ profile at

www.sedarplus.comCalibre's forward-looking statements are based on

the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management at such time. Calibre does not assume any

obligation to update forward-looking statements if circumstances or

management's beliefs, expectations or opinions should change other

than as required by applicable securities laws. There can be no

assurance that forward-looking statements will prove to be

accurate, and actual results, performance or achievements could

differ materially from those expressed in, or implied by, these

forward-looking statements. Accordingly, undue reliance should not

be placed on forward-looking statements.

Infographics accompanying this announcement are

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0965dc85-e5b5-47cf-a3e9-3e1aa1a862ae

https://www.globenewswire.com/NewsRoom/AttachmentNg/3a24ddce-e5fb-4c18-bcf9-25b813ce11ce

https://www.globenewswire.com/NewsRoom/AttachmentNg/39090241-ca1a-4bdc-9ec7-088d265a7011

https://www.globenewswire.com/NewsRoom/AttachmentNg/379e8008-a1ad-4856-9f94-ebad7f9e6f27

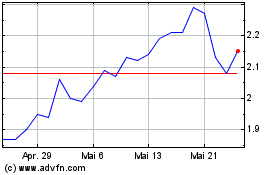

Calibre Mining (TSX:CXB)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Calibre Mining (TSX:CXB)

Historical Stock Chart

Von Nov 2023 bis Nov 2024