FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of January 2024

Commission File Number: 001-38757

TAKEDA PHARMACEUTICAL COMPANY LIMITED

(Translation of registrant’s name into English)

1-1, Nihonbashi-Honcho 2-Chome

Chuo-ku, Tokyo 103-8668

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Information furnished on this form:

EXHIBIT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | TAKEDA PHARMACEUTICAL COMPANY LIMITED |

| | | |

| Date: January 16, 2024 | | By: | /s/ Norimasa Takeda |

| | | Norimasa Takeda Chief Accounting Officer and Corporate Controller |

News Release

Announcement of a company split (simplified absorption-type company split/short-form company split) with a wholly-owned subsidiary

Osaka, Japan, January 15, 2024 --- Takeda Pharmaceutical Company Limited (Head Office: Chuo-ku, Osaka; (TSE:4502/NYSE:TAK), “Takeda”) decided today to succeed to the rights and obligations of the pharmaceutical manufacturing support operational businesses of Takeda Giken Service, Ltd. (“Takeda Giken”), a wholly-owned subsidiary of Takeda, relating to test analysis, logistics management, and other Good Manufacturing Practice (“GMP”)-based pharmaceutical manufacturing support for Takeda and its subsidiaries and associates, through an absorption-type company split (the “Company Split”).

Please note that because the Company Split falls within the category of an absorption-type company split (simplified absorption-type company split/short-form absorption-type company split), with the splitting company being Takeda’s wholly-owned subsidiary, this release is made in a simplified format. Takeda Giken is planning to dissolve after completion of the Company Split.

Note

1. Purpose of the Company Split

The Company Split is part of Takeda’s strategy to streamline the ownership structure of its subsidiaries and create a more adaptable and robust product supply model. This initiative aligns with the reinforced quality assurance system for pharmaceutical products in the industry. We are committed to ensuring sustainable growth by delivering a stable supply of the high-quality medicines on which our patients rely.

2. Outline of the Company Split

(i) Company Split schedule

Date of decision by the director delegated by the board of directors’ meeting

January 15, 2024

Date of execution of the absorption-type company split agreement

January 15, 2024

Scheduled company split date (effective date)

April 1, 2024

*Please note that because, for Takeda, the Company Split falls within the category of a simplified absorption-type company split in Article 796 paragraph (2) of the Companies Act; and, for Takeda Giken, it falls within the category of a short-form absorption-type company split under Article 784 paragraph (1) of the Companies Act, the Company Split is being executed without obtaining approval by resolution of a general meeting of shareholders of both Takeda and Takeda Giken.

(ii) Method of Company Split

The Company Split will be performed as an absorption-type company split, with the succeeding company being Takeda, and the splitting company being Takeda Giken.

(iii) Allotment upon Company Split

Since the Company Split is an absorption-type company split with Takeda’s wholly-owned subsidiary, no allotment of new shares, monies or other properties will be performed upon the Company Split.

(iv) Handling of the splitting company’s share options and bonds with share options

Not applicable.

(v) Increase or decrease in stated capital as a result of the Company Split

There will be no increase or decrease in the stated capital of Takeda as a result of the Company Split.

(vi) Rights and obligations to which Takeda will succeed

Takeda will succeed to the rights and obligations of the pharmaceutical manufacturing support operational businesses of Takeda Giken relating to test analysis, logistics management, and other GMP-based pharmaceutical manufacturing support for Takeda and its subsidiaries and associates as of the effective date of the Company Split within the scope provided for in the absorption-type company split agreement.

(vii) Prospects for performance of obligations

Takeda and Takeda Giken foresee no problems in fulfilment of the obligations to be performed by each company on and after the effective date of the Company Split.

3. Overview of the Parties to the Company Split

| | | | | | | | |

| Successor Company (as of March 31, 2023) | Splitting Company (as of March 31, 2023) |

| (1) Name | Takeda Pharmaceutical Company Limited | Takeda Giken Service, Ltd. |

| (2) Address | 1-1, Doshomachi 4-chome, Chuo-ku, Osaka-shi, Osaka, Japan | 17-85, Jusohommachi 2-chome, Yodogawa-ku, Osaka-shi, Osaka, Japan |

| (3) Title and name of the representative person | Representative Director, President & CEO: Christophe Weber | Representative Director, President: Daisuke Izutsu |

| (4) Business description | Research and development, manufacturing, sale, and marketing of pharmaceutical drugs | Support for manufacturing and research of pharmaceutical drugs and clinical trial drugs (analysis, warehousing, manufacturing support, and quality assurance) |

| (5) Capital amount | 1,676,345 million yen | 50 million yen |

| | | | | | | | |

| (6) Date of foundation / incorporation | January 12, 1925 | April 1, 1986 |

| (7) Number of outstanding shares | 1,582,296,025 shares | 600 shares |

| (8) Fiscal year end | March 31 | March 31 |

| (9) Major shareholders and their shareholding percentages | The Master Trust Bank of Japan, Ltd.

(Trust account) 16.76%

Custody Bank of Japan, Ltd. (Trust account)

5.62%

The Bank Of New York Mellon as Depositary Bank for Depositary Receipt Holders 4.47%

JP Morgan Chase Bank 385632 3.75%

State Street Bank West Client-Treaty 505234

1.83%

Nippon Life Insurance Company 1.81%

JPMorgan Securities Japan Co., Ltd. 1.64%

SSBTC Client Omnibus Account 1.40%

JP Morgan Chase Bank 385781 1.29%

Takeda Science Foundation 1.15% | ・Takeda 100% |

| (10) Result of operations and financial condition for the immediately preceding fiscal year | March 2023 (Consolidated, IFRS) (in million yen unless otherwise specified) | March 2023 (Non-consolidated, JGAAP) (in million yen unless otherwise specified) |

Equity attributable to owners of the parent company / Net assets | 6,354,122 | 336 |

| Total assets | 13,957,750 | 598 |

Equity attributable to owners of the parent company per share / Net assets per share | 4,087.49 yen | 559,327.09 yen |

| Total revenue | 4,027,478 | 1,299 |

| Operating profit | 490,505 | 173 |

| Profit before tax | 375,090 | 173 |

| | | | | | | | |

Net profit attributable to owners of the parent company / Net profit | 317,017 | 131 |

| Basic earnings per share / Net profit per share | 204.29 yen | 218,512.57 yen |

4. Outline of the business of the divisions to which Takeda will succeed

(1) Details of the business of the divisions to be transferred

The pharmaceutical manufacturing support operational businesses of Takeda Giken relating to test analysis, logistics management, and other GMP-based pharmaceutical manufacturing support for Takeda and its subsidiaries and associates.

(2) Operating results of the businesses to which Takeda will succeed

Net sales :1,249 million yen

(3) Assets and liabilities to be transferred, and the amounts thereof

| | | | | | | | | | | |

| Assets | Liabilities |

| Item | Amount | Item | Amount |

| Current assets | 536 million yen | Current liabilities | 158 million yen |

| Non-current assets | 49 million yen | Non-current liabilities | 80 million yen |

*As the above figures are calculated based on the balance sheet as of March 31, 2023, the actual values to be succeeded may differ from the above amounts.

5. Status after the Company Split

There will be no change in the name, address, title and name of the representative, business description, stated capital, or fiscal year-end of Takeda after the Company Split.

6. Business Outlook

Since the Company Split is a company split with Takeda’s wholly-owned subsidiary, there will be no financial impact on consolidated earnings for the current fiscal year.

About Takeda

Takeda is focused on creating better health for people and a brighter future for the world. We aim to discover and deliver life-transforming treatments in our core therapeutic and business areas, including gastrointestinal and inflammation, rare diseases, plasma-derived therapies, oncology, neuroscience and vaccines. Together with our partners, we aim to improve the patient experience and advance a new frontier of treatment options through our dynamic and diverse pipeline. As a leading values-based, R&D-driven biopharmaceutical company headquartered in Japan, we are guided by our commitment to patients, our people and the planet. Our employees in approximately 80 countries and regions are driven by our purpose and are grounded in the values that have defined us for more than two centuries. For more information, visit https://www.takeda.com.

Media Contacts:

| | |

Kumi Iiyama kumi.iiyama@takeda.com +81 (80) -5789-7742 |

Important Notice

For the purposes of this notice, “press release” means this document, any oral presentation, any question and answer session and any written or oral material discussed or distributed by Takeda Pharmaceutical Company Limited (“Takeda”) regarding this release. This press release (including any oral briefing and any question-and-answer in connection with it) is not intended to, and does not constitute, represent or form part of any offer, invitation or solicitation of any offer to purchase, otherwise acquire, subscribe for, exchange, sell or otherwise dispose of, any securities or the solicitation of any vote or approval in any jurisdiction. No shares or other securities are being offered to the public by means of this press release. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. This press release is being given (together with any further information which may be provided to the recipient) on the condition that it is for use by the recipient for information purposes only (and not for the evaluation of any investment, acquisition, disposal or any other transaction). Any failure to comply with these restrictions may constitute a violation of applicable securities laws.

The companies in which Takeda directly and indirectly owns investments are separate entities. In this press release, “Takeda” is sometimes used for convenience where references are made to Takeda and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to subsidiaries in general or to those who work for them. These expressions are also used where no useful purpose is served by identifying the particular company or companies.

Forward-Looking Statements

This press release and any materials distributed in connection with this press release may contain forward-looking statements, beliefs or opinions regarding Takeda’s future business, future position and results of operations, including estimates, forecasts, targets and plans for Takeda. Without limitation, forward-looking statements often include words such as “targets”, “plans”, “believes”, “hopes”, “continues”, “expects”, “aims”, “intends”, “ensures”, “will”, “may”, “should”, “would”, “could”, “anticipates”, “estimates”, “projects” or similar expressions or the negative thereof. These forward-looking statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those expressed or implied by the forward-looking statements: the economic circumstances surrounding Takeda’s global business, including general economic conditions in Japan and the United States; competitive pressures and developments; changes to applicable laws and regulations, including global health care reforms; challenges inherent in new product development, including uncertainty of clinical success and decisions of regulatory authorities and the timing thereof; uncertainty of commercial success for new and existing products; manufacturing difficulties or delays; fluctuations in interest and currency exchange rates; claims or concerns regarding the safety or efficacy of marketed products or product candidates; the impact of health crises, like the novel coronavirus pandemic, on Takeda and its customers and suppliers, including foreign governments in countries in which Takeda operates, or on other facets of its business; the timing and impact of post-merger integration efforts with acquired companies; the ability to divest assets that are not core to Takeda’s operations and the timing of any such divestment(s); and other factors identified in Takeda’s most recent Annual Report on Form 20-F and Takeda’s other reports filed with the U.S. Securities and Exchange Commission, available on Takeda’s website at: https://www.takeda.com/investors/sec-filings-and-security-reports/ or at www.sec.gov. Takeda does not undertake to update any of the forward-looking statements contained in this press release or any other forward-looking statements it may make, except as required by law or stock exchange rule. Past performance is not an indicator of future results and the results or statements of Takeda in this press release may not be indicative of, and are not an estimate, forecast, guarantee or projection of Takeda’s future results.

###

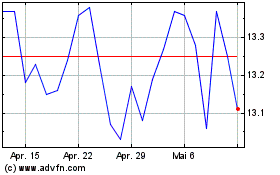

Takeda Pharmaceutical (NYSE:TAK)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Takeda Pharmaceutical (NYSE:TAK)

Historical Stock Chart

Von Mai 2023 bis Mai 2024