Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 Mai 2024 - 5:20PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

May, 2024

Commission File Number 1-15182

DR.

REDDY’S LABORATORIES LIMITED

(Translation of registrant’s name into English)

8-2-337, Road No. 3, Banjara Hills

Hyderabad, Telangana 500 034, India

+91-40-49002900

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ______

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

Indicate by check mark whether by furnishing the

information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

¨ No x

If “Yes” is marked, indicate below the file number assigned

to registrant in connection with Rule 12g3-2(b): 82-________.

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

DR. REDDY’S LABORATORIES LIMITED

(Registrant) |

| |

|

| Date: May 30, 2024 |

By: |

/s/ K Randhir Singh |

| |

|

Name: |

K Randhir Singh |

| |

|

Title: |

Company Secretary |

Exhibit 99.1

|

Dr.

Reddy’s Laboratories Ltd.

8-2-337,

Road No. 3, Banjara Hills,

Hyderabad

- 500 034, Telangana,

India.

CIN

: L85195TG1984PLC004507

Tel

: +91 40 4900 2900

Fax :

+91 40 4900 2999

Email

: mail@drreddys.com

www.drreddys.com |

May

30, 2024

National

Stock Exchange of India Ltd. (Scrip Code: DRREDDY-EQ)

BSE

Limited (Scrip Code: 500124)

New

York Stock Exchange Inc. (Stock Code: RDY)

NSE

IFSC Ltd (Stock Code: DRREDDY)

Dear

Sir/Madam,

| Sub: | Disclosure

pursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations,

2015 |

This

is in furtherance to our intimation dated January 30, 2024 and May 24, 2024, wherein we have informed about the investment by the Company

in equity shares of Aurigene Oncology Limited (“AOL”) (formerly, Aurigene Discovery Technologies Limited), a wholly-owned

subsidiary of the Company, upto an amount of Rs. 6,500 million, and AOL will make similar investment in equity shares of Aurigene Pharmaceutical

Services Limited (“APSL”), a wholly-owned subsidiary of AOL and a step-down wholly-owned subsidiary of the Company.

In

this connection, we further inform that AOL has made an investment of Rs. 649,99,99,520/- in APSL and APSL has allotted 11,60,71,420

equity shares of Rs. 10 each at a premium of Rs. 46/- per share to AOL on May 30, 2024.

The

details required under Regulation 30 of the SEBI Listing Regulations, read with SEBI Circular No. SEBI/HO/CFD/CFD-PoD-1/P/CIR/2023/123

dated July 13, 2023, with respect to the above fund infusion is given in Annexure enclosed herewith.

This

is for your information and records.

Thanking

you.

Yours

faithfully,

For

Dr. Reddy’s Laboratories Limited

K

Randhir Singh

Company

Secretary, Compliance Officer and Head-CSR

Encl:

as above

Annexure

Disclosure

under Part A Para A(i) of Schedule III read with Regulation 30 of the SEBI (Listing Obligation and Disclosure Requirements) Regulations,

2015

Sl.

No |

Particulars |

Description |

| 1 |

Name

of the target entity, details in brief such as size, turnover etc.

|

Aurigene

Pharmaceutical Services Limited (“APSL”), a wholly-owned subsidiary of Aurigene Oncology Limited (“AOL”)

(formerly, Aurigene Discovery Technologies Limited), and a step down wholly-owned subsidiary of the Company. The fund infused by

AOL in APSL is to support the capex and working capital requirements of APSL. The turnover of APSL for FY2024 was Rs. 443 Crores.

|

| 2 |

Whether

the acquisition would fall within related party transaction(s) and whether the promoter/ promoter group/ group companies have any

interest in the entity being acquired? If yes, nature of interest and details thereof and whether the same is done at “arms-length” |

The

investment in APSL is a related party transaction, as AOL and APSL are wholly owned subsidiaries and accordingly a related party

to the Company. The investment is done based on valuation report of an Independent Valuer and on arm’s length basis. Except

as stated above, the promoter/ promoter group/ group companies have no interest in AOL and APSL. |

| 3 |

Industry

to which the entity being acquired belongs |

APSL

is a contract research, development, and manufacturing organization (CRO/CDMO) providing end-to-end solutions in chemistry, and biology

[discovery, development and manufacturing]. |

| 4 |

Objects

and effects of acquisition (including but not limited to, disclosure of reasons for acquisition of target entity, if its business

is outside the main line of business of the listed entity) |

The

fund infused by AOL in APSL is to support the capex and working capital requirements of APSL. |

| 5 |

Brief

details of any governmental or regulatory approvals required for the acquisition |

Not

applicable. |

| 6 |

Indicative

time period for completion of the acquisition |

APSL

has allotted 11,60,71,420 Equity shares of Rs.10 each at a premium of Rs. 46/- to AOL on May 30, 2024. |

| 7 |

Nature

of consideration- whether cash consideration or share swap and details of the same |

Cash

consideration |

| 8 |

Cost

of acquisition or the price at which the shares are acquired |

Cash

consideration of Rs. 649,99,99,520/- towards subscription of equity shares of 11,60,71,420 equity shares of Rs.10 each at a premium

of Rs. 46/-. |

| 9 |

Percentage

of shareholding/ control acquired and/ or number of shares acquired |

APSL

is a wholly owned subsidiary of the AOL and step down wholly owned subsidiary of the Company. |

| 10 |

Brief

background about the entity acquired in terms of products/line of business acquired, date of incorporation, history of last 3 years

turnover, country in which the acquired entity has presence and any other significant information (in brief) |

APSL

is a contract research, development, and manufacturing organization (CRO/CDMO) providing end-to-end solutions in chemistry, and biology

[discovery, development and manufacturing]. The company was incorporated on 16th of September, 2019. The turnover of the

company for the previous 3 years is shown in below table:

|

| |

|

FY2024 |

Rs.

443 Crores |

|

| |

|

FY2023 |

Rs.

331 Crores |

|

| |

|

FY2022 |

Rs.

361 Crores |

|

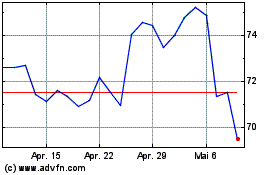

Dr Reddys Laboratories (NYSE:RDY)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Dr Reddys Laboratories (NYSE:RDY)

Historical Stock Chart

Von Jun 2023 bis Jun 2024