McGraw-Hill Divests Education Arm - Analyst Blog

27 November 2012 - 4:20PM

Zacks

The McGraw-Hill Companies

Inc. (MHP) recently announced that it has entered into an

agreement with Apollo Global Management LLC (APO)

to divest its education division for $2.5 billion.

The move is a strategic attempt on the company’s behalf to

restructure its portfolio of businesses and concentrate more on

high growth operations, thereby enhancing shareholder value through

proper capital allocation.

The company expects to close the deal by the year end or early 2013

and will receive $250 million in senior unsecured notes, carrying

an annual coupon of 8.5%.

What led to the Decision?

This company has been scrutinizing its business segments for

sometime as it lost substantial market value over the last 5 years.

To add to its woes, its rating agency was criticized for its

decision to downgrade the U.S. economy. Further, the New York based

hedge fund, Jana Partners and the Ontario Teachers' Pension Plan,

were pushing the company to split into four separate

organizations.

In addition, the company’s education division has been confronting

shrinking revenues due to reduced spending on textbooks by the

government. Further, the company is facing execution risk

associated with its plans to develop its education division into a

subscription-based model through digital delivery.

McGraw-Hill engaged The Goldman Sachs Group Inc.

(GS) and Evercore Partners Inc. (EVR) as the

financial advisors to guide the company through the evaluation

process.

Birth of McGraw-Hill Financial

McGraw-Hill stated that the company will be known as McGraw Hill

Financial, upon the completion of the deal and will primarily focus

on capital and commodities markets and will include iconic brands

like S&P Ratings, S&P Capital IQ, S&P Indices, Platts

and Commercial Markets.

The company added that it expects revenues of approximately $4.4

billion from McGraw-Financial in 2012 with approximately 40% of it

coming from international avenues.

Moving ahead, McGraw-Hill expects to bear the impairment charges of

approximately $450 million to $550 million in the fourth quarter of

2012 related to the sale. Moreover, the company will utilize

the proceeds from sales (approximately $1.9 billion net of tax) to

buyback shares, reduce short-term debt obligations and for

strategic acquisitions.

Currently, we have a long-term 'Neutral' rating on McGraw-Hill,

which competes with Pearson plc (PSO). Moreover,

the company holds a Zacks #3 Rank, which translates into a

short-term ‘Hold’ recommendation.

APOLLO GLOBAL-A (APO): Free Stock Analysis Report

EVERCORE PARTNR (EVR): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

PEARSON PLC-ADR (PSO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

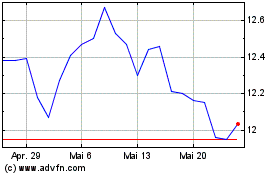

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024