UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of November 2024

1-15240

(Commission File Number)

JAMES HARDIE INDUSTRIES plc

(Translation of registrant’s name into English)

1st Floor, Block A

One Park Place

Upper Hatch Street, Dublin 2, D02, FD79, Ireland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F..X.... Form 40-F.........

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Not Applicable

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Not Applicable

TABLE OF CONTENTS

Forward-Looking Statements

This Form 6-K contains forward-looking statements. James Hardie Industries plc (the “company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the company’s officers, directors or employees to analysts, institutional investors, existing and potential lenders, representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include:

•statements about the company’s future performance;

•projections of the company’s results of operations or financial condition;

•statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products;

•expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants;

•expectations concerning the costs associated with the significant capital expenditure projects at any of the company’s plants and future plans with respect to any such projects;

•expectations regarding the extension or renewal of the company’s credit facilities including changes to terms, covenants or ratios;

•expectations concerning dividend payments and share buy-backs;

•statements concerning the company’s corporate and tax domiciles and structures and potential changes to them, including potential tax charges;

•statements regarding tax liabilities and related audits, reviews and proceedings;

•statements regarding the possible consequences and/or potential outcome of legal proceedings brought against us and the potential liabilities, if any, associated with such proceedings;

•expectations about the timing and amount of contributions to AICF, a special purpose fund for the compensation of proven Australian asbestos-related personal injury and death claims;

•expectations concerning the adequacy of the company’s warranty provisions and estimates for future warranty-related costs;

•statements regarding the company’s ability to manage legal and regulatory matters (including but not limited to product liability, environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and

•statements about economic or housing market conditions in the regions in which we operate, including but not limited to, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence.

Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements.

Forward-looking statements are based on the Company’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the Company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 20 May 2024, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former Company subsidiaries; required contributions to AICF, any shortfall in AICF funding and the effect of currency exchange rate movements on the amount recorded in the Company’s financial statements as an asbestos liability; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the Company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the Company’s products; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; currency exchange risks; dependence on customer preference and the concentration of the Company’s customer base; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; use of accounting estimates; and all other risks identified in the Company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The Company cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from those referenced in the Company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the Company’s current expectations concerning future results, events and conditions. The Company assumes no obligation to update any forward-looking statements or information except as required by law.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Change in substantial holding |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | |

| | James Hardie Industries plc |

| Date: 22 November 2024 | | By: /s/ Aoife Rockett |

| |

| | Aoife Rockett |

| | Company Secretary |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Change in substantial holding |

James Hardie Industries plc 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. Directors: Anne Lloyd (Chairperson, USA), Peter-John Davis (Aus), Persio Lisboa (USA), Renee Peterson (USA), John Pfeifer (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Nigel Stein (UK), Harold Wiens (USA). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 19 November 2024 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Substantial Holding Notice As required under ASX Listing Rule 3.17.3 please see attached copy of the substantial holding notice received by James Hardie on 15 November 2024. Regards Aoife Rockett Company Secretary This announcement has been authorised for release by the Company Secretary, Ms Aoife Rockett. Exhibit 99.1

Standard Form TR-1 Standard form for notification of major holdings NOTIFICATION OF MAJOR HOLDINGS 1. Identity of the issuer or the underlying issuer of existing shares to which voting rights are attachedii: JAMES HARDIE INDUSTRIES PLC 2. Reason for the notification (please tick the appropriate box or boxes): [ ] An acquisition or disposal of voting rights [ ] An acquisition or disposal of financial instruments [ ] An event changing the breakdown of voting rights [ ] Other (please specify)iii: 3. Details of person subject to the notification obligationiv : Name: FIL Limited City and country of registered office (if applicable): Pembroke, Bermuda 4. Full name of shareholder(s) (if different from 3.)v: 5. Date on which the threshold was crossed or reachedvi: 13th of November 2024 6. Date on which issuer notified: 15th of November 2024 7. Threshold(s) that is/are crossed or reached: 3% 8. Total positions of person(s) subject to the notification obligation: % of voting rights attached to shares (total of 9.A) % of voting rights through financial instruments (total of 9.B.1 + 9.B.2) Total of both in % (9.A + 9.B) Total number of voting rights of issuervii Resulting situation on the date on which threshold was crossed or reached 2.96% 0.00% 2.96% 429,459,768 Position of previous notification (if applicable) 3.17% 0.00% 3.17%

9. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii: A: Voting rights attached to shares Class/type of shares ISIN code (if possible) Number of voting rightsix % of voting rights Direct Indirect Direct Indirect AU000000JHX1 12,690,948 2.96% SUBTOTAL A 12,690,948 2.96% B 1: Financial Instruments according to Regulation 17(1)(a) of the Regulations Type of financial instrument Expiration datex Exercise/ Conversion Periodxi Number of voting rights that may be acquired if the instrument is exercised/converted. % of voting rights SUBTOTAL B.1 B 2: Financial Instruments with similar economic effect according to Regulation 17(1)(b) of the Regulations Type of financial instrument Expiration datex Exercise/ Conversion Period xi Physical or cash settlementxii Number of voting rights % of voting rights SUBTOTAL B.2

10. Information in relation to the person subject to the notification obligation (please tick the applicable box): [ ] Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuer.xiii [ ] Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv: Namexv % of voting rights if it equals or is higher than the notifiable threshold % of voting rights through financial instruments if it equals or is higher than the notifiable threshold Total of both if it equals or is higher than the notifiable threshold FIL Limited FIL Financial Services Holdings Limited FIL Investment Management (Australia) Limited FIL Limited FIL Financial Services Holdings Limited FIL Investment Management (Singapore) Limited FIL Limited FIL Financial Services Holdings Limited FIL Responsible Entity (Australia) Limited FIL Limited FIL Financial Services Holdings Limited

FIL Holdings (UK) Limited FIL Investments International 11. In case of proxy voting: [name of the proxy holder] will cease to hold [% and number] voting rights as of [date] 12. Additional informationxvi: Done at Dublin on 15th of November 2024.

Notes i. Persons completing this form should have regard to the requirements of the Transparency (Directive 2004/109/EC) Regulations 2007 as amended (the “Regulations”), the Central Bank of Ireland’s Transparency Rules (the “Transparency Rules”) and Commission Delegated Regulation (EU) 2015/761 of 17 December 2014. ii Full name of the legal entity and other identifying specification of the issuer or underlying issuer, provided it is reliable and accurate (e.g. address, LEI, domestic number identity). iii Other reason for the notification could be voluntary notifications, changes of attribution of the nature of the holding (e.g. expiring of financial instruments) or acting in concert. iv This should be the full name of (a) the shareholder; (b) the natural person or legal entity acquiring, disposing of or exercising voting rights in the cases provided for in Regulation 15(b) to (h) of the Regulations (Article 10 (b) to (h) of Directive 2004/109/EC); or (c) the holder of financial instruments referred to in Regulation 17(1) of the Regulations (Article 13(1) of Directive 2004/109/EC). As the disclosure of cases of acting in concert may vary due to the specific circumstances (e.g. same or different total positions of the parties, entering or exiting of acting in concert by a single party) the standard form does not provide for a specific method how to notify cases of acting in concert. In relation to the transactions referred to in points (b) to (h) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the following list is provided as an indication of the persons who should be mentioned: - in the circumstances foreseen in letter (b) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the natural person or legal entity that acquires the voting rights and is entitled to exercise them under the agreement and the natural person or legal entity who is transferring temporarily for consideration the voting rights; - in the circumstances foreseen in letter (c) of the Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the natural person or legal entity holding the collateral, provided the person or entity controls the voting rights and declares its intention of exercising them, and natural person or legal entity lodging the collateral under these conditions; - in the circumstances foreseen in letter (d) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the natural person or legal entity who has a life interest in shares if that person or entity is entitled to exercise the voting rights attached to the shares and the natural person or legal entity who is disposing of the voting rights when the life interest is created; - in the circumstances foreseen in letter (e) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the controlling natural person or legal entity and, provided it has a notification duty at an individual level under Regulation 14 of the Regulations (Article 9 of Directive 2004/109/EC), under letters (a) to (d) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC) or under a combination of any of those situations, the controlled undertaking; - in the circumstances foreseen in letter (f) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the deposit taker of the shares, if he can exercise the voting rights attached to the shares deposited with him at his discretion, and the depositor of the shares allowing the deposit taker to exercise the voting rights at his discretion; - in the circumstances foreseen in letter (g) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the natural person or legal entity that controls the voting rights; - in the circumstances foreseen in letter (h) of Regulation 15 of the Regulations (Article 10 of Directive 2004/109/EC), the proxy holder, if he can exercise the voting rights at his discretion, and the shareholder who has given his proxy to the proxy holder allowing the latter to exercise the voting rights at his discretion (e.g. management companies). v Applicable in the cases provided for in Regulation 15(b) to (h) of the Regulations (Article 10 (b) to (h) of Directive 2004/109/EC). This should be the full name of the shareholder who is the counterparty to the natural person or legal entity referred to in Regulation 15 of the Regulations (Article 10 Directive 2004/109/EC) unless the percentage of voting rights held by the shareholder is lower than the lowest notifiable threshold for the disclosure of voting rights holdings in accordance with the requirements of the Regulations and the Transparency Rules. vi The date on which threshold is crossed or reached should be the date on which the acquisition or disposal took place or the other reason triggered the notification obligation. For passive crossings, the date when the corporate event took effect.

vii The total number of voting rights shall be composed of all the shares, including depository receipts representing shares, to which voting rights are attached even if the exercise thereof is suspended. viii If the holding has fallen below the lowest applicable threshold in accordance with the Regulations and the Transparency Rules the holder is not obliged to disclose the extent of the holding only that the holding is “below 3%” or “below 5%” as appropriate. ix In case of combined holdings of shares with voting rights attached "direct holding" and voting rights "indirect holding", please split the voting rights number and percentage into the direct and indirect columns – if there is no combined holdings, please leave the relevant box blank. x Date of maturity/expiration of the financial instrument i.e. the date when right to acquire shares ends. xi If the financial instrument has such a period – please specify this period – for example once every 3 months starting from [date]. xii In case of cash settled instruments the number and percentages of voting rights is to be presented on a delta-adjusted basis (Regulation 17(4) of the Regulations/Article 13(1a) of Directive 2004/109/EC). xiii If the person subject to the notification obligation is either controlled and/or does control another undertaking then the second option applies. xiv The full chain of controlled undertakings, starting with the ultimate controlling natural person or legal entity, has to be presented also in cases in which only on subsidiary level a threshold is crossed or reached and the subsidiary undertaking discloses the notification, as only thus will the markets get a full picture of the group holdings. In the case of multiple chains through which the voting rights and/or financial instruments are effectively held, the chains have to be presented chain by chain leaving a row free between different chains (e.g.: A, B, C, free row, A, B, D, free row, A, E, F etc.). xv The names of controlled undertakings through which the voting rights and/or financial instruments are effectively held have to be presented irrespective of whether the controlled undertakings cross or reach the lowest applicable threshold themselves. xvi Example: Correction of a previous notification.

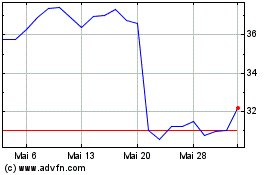

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

Von Nov 2023 bis Nov 2024