0001331520false00013315202022-02-242022-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 17, 2025

_________________________________

HOME BANCSHARES, INC.

(Exact name of Registrant as Specified in Its Charter)

_________________________________

| | | | | | | | |

| Arkansas | 001-41093 | 71-0682831 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

719 Harkrider, Suite 100

Conway, Arkansas 72032

(Address of Principal Executive Offices) (Zip Code)

(501) 339-2929

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | HOMB | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure.

On January 17, 2025, Home BancShares, Inc. (the “Company”) issued a press release announcing the increase in the number of shares authorized for repurchase under the Company’s previously approved stock repurchase program. A copy of the press release is attached as Exhibit 99.1 to this Current Report.

The information in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the U.S. Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference in any filing under the U.S. Securities Act of 1933, as amended.

Item 8.01 Other Events

On January 17, 2025, the Board of Directors (the “Board”) of Home BancShares, Inc. (the “Company”) authorized an increase in the shares of the Company’s common stock available for repurchase under its stock repurchase program, which was originally approved by the Board in January 2008 and most recently amended in January 2021, to renew the authorization to 20,000,000 shares. As of January 17, 2025, a total of approximately 13,244,493 shares remained available for repurchase under the existing repurchase authorization, resulting in an increase of 6,755,507 shares of common stock available for repurchase.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Home BancShares, Inc. |

| | | |

| Date: | January 21, 2025 | By: | /s/ Jennifer C. Floyd |

| | | Jennifer C. Floyd |

| | | Chief Accounting Officer |

| | | |

EXHIBIT 99.1

| | | | | |

| For Immediate Release: | January 21, 2025 |

Home BancShares, Inc. Increases Share Repurchase Program and

Announces First Quarter Cash Dividend

Conway, AR – Home BancShares, Inc. (NYSE: HOMB) (“Home” or “the Company”), parent company of Centennial Bank (“Centennial”), announced today that its Board of Directors has authorized an increase in the shares available for repurchase and has declared its regular quarterly cash dividend.

On January 17, 2025, the Board of Directors of Home BancShares, Inc. authorized an increase in the shares of the Company’s common stock available for repurchase under its stock repurchase program, which was originally approved by the Board in January 2008 and most recently amended in January 2021, to renew the authorization to 20,000,000 shares. As of January 17, 2025, a total of approximately 13,244,493 shares remained available for repurchase under the existing repurchase authorization, resulting in an increase of 6,755,507 shares of common stock available for repurchase.

“We always want to maintain the ability to purchase stock, and it seemed prudent at this time to increase the number of shares available for repurchase,” said John Allison, Chairman and CEO of HOMB.

In addition, the Board of Directors has declared a regular $0.195 per share quarterly cash dividend payable March 5, 2025, to shareholders of record February 12, 2025. This cash dividend is consistent with the quarterly dividends paid during the third and fourth quarters of 2024.

This release contains forward-looking statements regarding the Company’s plans, expectations, goals and outlook for the future, including future financial results. Statements in this press release that are not historical facts should be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of future events, performance or results. Forward-looking statements of this type speak only as of the date of this news release. By nature, forward-looking statements involve inherent risks and uncertainties. Various factors could cause actual results to differ materially from those contemplated by the forward-looking statements. These factors include, but are not limited to, the following: economic conditions, credit quality, interest rates, loan demand, real estate values and unemployment, including the ongoing impacts of inflation; the ability to identify, complete and successfully integrate new acquisitions; the risk that expected cost savings and other benefits from acquisitions may not be fully realized or may take longer to realize than expected; diversion of management time on acquisition-related issues; the availability of and access to capital and liquidity on terms acceptable to us; legislative and regulatory changes and risks and expenses associated with current and future legislation and regulations; technological changes and cybersecurity risks and incidents; the effects of changes in accounting policies and practices; changes in governmental monetary and fiscal policies; political instability, military conflicts and other major domestic or international events; the impacts of recent or future adverse weather events, including hurricanes, and other natural disasters; disruptions, uncertainties and related effects on credit quality, liquidity and other aspects of our business and operations that may result from any future public health crises; competition from other financial institutions; potential claims, expenses and other adverse effects related to current or future litigation, regulatory examinations or other government actions; potential increases in deposit insurance assessments, increased

regulatory scrutiny or market disruptions resulting from financial challenges in the banking industry; changes in the assumptions used in making the forward-looking statements; and other factors described in reports we file with the Securities and Exchange Commission (the “SEC”), including those factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 26, 2024.

Home BancShares, Inc. is a bank holding company, headquartered in Conway, Arkansas. Its wholly-owned subsidiary, Centennial Bank, provides a broad range of commercial and retail banking plus related financial services to businesses, real estate developers, investors, individuals and municipalities. Centennial Bank has branch locations in Arkansas, Florida, Texas, South Alabama and New York City. The Company’s common stock is traded through the New York Stock Exchange under the symbol “HOMB.” The Company was founded in 1998. Visit www.homebancshares.com or www.my100bank.com for more information.

####

FOR MORE INFORMATION CONTACT:

Donna Townsell

Director of Investor Relations

Home BancShares, Inc.

(501) 328-4625

v3.24.4

Cover

|

Feb. 24, 2022 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 17, 2025

|

| Entity Registrant Name |

HOME BANCSHARES, INC.

|

| Entity Incorporation, State or Country Code |

AR

|

| Entity File Number |

001-41093

|

| Entity Tax Identification Number |

71-0682831

|

| Entity Address, Address Line One |

719 Harkrider

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Conway

|

| Entity Address, State or Province |

AR

|

| Entity Address, Postal Zip Code |

72032

|

| City Area Code |

501

|

| Local Phone Number |

339-2929

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

HOMB

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001331520

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

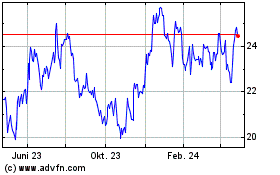

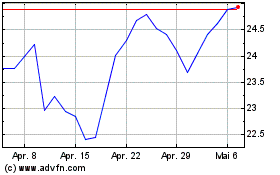

Home BancShares (NYSE:HOMB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Home BancShares (NYSE:HOMB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025