Home BancShares, Inc. Increases Share Repurchase Program and Announces First Quarter Cash Dividend

21 Januar 2025 - 11:15PM

Home BancShares, Inc. (NYSE: HOMB) (“Home” or “the Company”),

parent company of Centennial Bank (“Centennial”), announced today

that its Board of Directors has authorized an increase in the

shares available for repurchase and has declared its regular

quarterly cash dividend.

On January 17, 2025, the Board of Directors of

Home BancShares, Inc. authorized an increase in the shares of the

Company’s common stock available for repurchase under its stock

repurchase program, which was originally approved by the Board in

January 2008 and most recently amended in January 2021, to renew

the authorization to 20,000,000 shares. As of January 17, 2025, a

total of approximately 13,244,493 shares remained available for

repurchase under the existing repurchase authorization, resulting

in an increase of 6,755,507 shares of common stock available for

repurchase.

“We always want to maintain the ability to

purchase stock, and it seemed prudent at this time to increase the

number of shares available for repurchase,” said John Allison,

Chairman and CEO of HOMB.

In addition, the Board of Directors has declared

a regular $0.195 per share quarterly cash dividend payable March 5,

2025, to shareholders of record February 12, 2025. This cash

dividend is consistent with the quarterly dividends paid during the

third and fourth quarters of 2024.

This release contains forward-looking statements

regarding the Company’s plans, expectations, goals and outlook for

the future, including future financial results. Statements in this

press release that are not historical facts should be considered

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are not guarantees of future events, performance or

results. Forward-looking statements of this type speak only as of

the date of this news release. By nature, forward-looking

statements involve inherent risks and uncertainties. Various

factors could cause actual results to differ materially from those

contemplated by the forward-looking statements. These factors

include, but are not limited to, the following: economic

conditions, credit quality, interest rates, loan demand, real

estate values and unemployment, including the ongoing impacts of

inflation; the ability to identify, complete and successfully

integrate new acquisitions; the risk that expected cost savings and

other benefits from acquisitions may not be fully realized or may

take longer to realize than expected; diversion of management time

on acquisition-related issues; the availability of and access to

capital and liquidity on terms acceptable to us; legislative and

regulatory changes and risks and expenses associated with current

and future legislation and regulations; technological changes and

cybersecurity risks and incidents; the effects of changes in

accounting policies and practices; changes in governmental monetary

and fiscal policies; political instability, military conflicts and

other major domestic or international events; the impacts of recent

or future adverse weather events, including hurricanes, and other

natural disasters; disruptions, uncertainties and related effects

on credit quality, liquidity and other aspects of our business and

operations that may result from any future public health crises;

competition from other financial institutions; potential claims,

expenses and other adverse effects related to current or future

litigation, regulatory examinations or other government actions;

potential increases in deposit insurance assessments, increased

regulatory scrutiny or market disruptions resulting from financial

challenges in the banking industry; changes in the assumptions used

in making the forward-looking statements; and other factors

described in reports we file with the Securities and Exchange

Commission (the “SEC”), including those factors set forth in our

Annual Report on Form 10-K for the year ended December 31, 2023,

filed with the SEC on February 26, 2024.

Home BancShares, Inc. is a bank holding company,

headquartered in Conway, Arkansas. Its wholly-owned subsidiary,

Centennial Bank, provides a broad range of commercial and retail

banking plus related financial services to businesses, real estate

developers, investors, individuals and municipalities. Centennial

Bank has branch locations in Arkansas, Florida, Texas, South

Alabama and New York City. The Company’s common stock is traded

through the New York Stock Exchange under the symbol “HOMB.” The

Company was founded in 1998. Visit www.homebancshares.com or

www.my100bank.com for more information.

FOR MORE INFORMATION CONTACT:Donna TownsellDirector of Investor

RelationsHome BancShares, Inc.(501) 328-4625

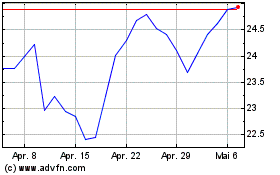

Home BancShares (NYSE:HOMB)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

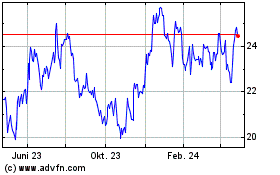

Home BancShares (NYSE:HOMB)

Historical Stock Chart

Von Feb 2024 bis Feb 2025