Form 8-K - Current report

14 Januar 2025 - 12:21PM

Edgar (US Regulatory)

0000313143false00003131432025-01-142025-01-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 14, 2025

HAEMONETICS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Massachusetts | | 001-14041 | | 04-2882273 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

125 Summer Street

Boston, MA 02110

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 781-848-7100

(Former name or former address, if changed since last report.)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

|

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $.01 par value per share | HAE | New York Stock Exchange |

| | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging Growth Company |

| ☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 8.01 Other Events.

On January 13, 2025, Haemonetics Corporation (the “Company”) completed the sale of its whole blood assets within its Blood Center business unit to GVS, S.p.A. for total cash consideration of up to $67.8 million, including $45.3 million upfront (after giving effect to certain customary adjustments) and up to $22.5 million in contingent consideration based on sales growth over the next three years and achievement of certain other milestones, and consistent with such other terms previously disclosed in the Company’s Current Report on Form 8-K dated December 3, 2024.

The Company also issued a press release on January 14, 2025 announcing the completion of the transaction, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The press release shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | Press Release issued by Haemonetics Corporation on January 14, 2025. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | |

| | | | |

| | HAEMONETICS CORPORATION | |

| | | | |

| January 14, 2025 | | By: | /s/ Christopher A. Simon | |

| | Name: | Christopher A. Simon | |

| | Title: | President and Chief Executive Officer |

| | | | |

| | | | | | | | |

Investor Contacts: | | Media Contact: |

Olga Guyette, Vice President-Investor Relations & Treasury (781) 356-9763 olga.guyette@haemonetics.com | | Josh Gitelson, Sr. Director-Global Communications (781) 356-9776 josh.gitelson@haemonetics.com |

| | |

David Trenk, Manager-Investor Relations (203) 733-4987 david.trenk@haemonetics.com | | |

Haemonetics Completes Sale of Whole Blood Assets to GVS, S.p.A

BOSTON, Jan. 14, 2025 -- Haemonetics Corporation (NYSE: HAE), a global medical technology company focused on delivering innovative medical solutions to drive better patient outcomes, today announced that it has completed the previously announced sale of its whole blood assets to GVS, S.p.A ("GVS”), one of the world's leading manufacturers of filter solutions for applications in the healthcare and life sciences sectors. In connection with the closing of this transaction, GVS has acquired Haemonetics' portfolio of proprietary whole blood collection, processing and filtration solutions, along with Haemonetics' manufacturing facility in Covina, California where certain of these products are produced, and related equipment and assets located at Haemonetics’ manufacturing facility in Tijuana, Mexico.

The transaction comprises a total cash consideration of up to $67.8M, including $45.3M upfront after giving effect to certain customary adjustments, and up to $22.5M in contingent earn-outs over the next four years. The Company intends to use the proceeds from this transaction for general corporate purposes and additional investments in growth initiatives. Haemonetics will provide further details regarding the financial impact of this transaction on its fiscal year 2025 guidance during its third-quarter earnings call, scheduled for February 6, 2025, at 8:00 AM ET.

Haemonetics' Blood Center business will continue to manufacture and provide customers with its full line of apheresis solutions for automated blood collection. These include devices and disposable kits that support a variety of apheresis collections, including platelets, plasma and red cells, and ensure efficient blood center operations.

ABOUT HAEMONETICS

Haemonetics (NYSE: HAE) is a global healthcare company dedicated to providing a suite of innovative medical products and solutions for customers, to help them improve patient care and reduce the cost of healthcare. Our technology addresses important medical markets: blood and plasma component collection, the surgical suite and hospital transfusion services. To learn more about Haemonetics, visit www.haemonetics.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements do not relate strictly to historical or current facts and may be identified by the use of words such as "may," "will," "should," "could," "would," "expects," "plans," "anticipates," "believes," "estimates," "projects," "predicts," "forecasts," "foresees," "potential" and other words of similar meaning in conjunction with statements regarding, among other things, (i) the anticipated benefits to Haemonetics arising from the completion of the transaction; (ii) statements regarding Haemonetics’ strategies, positioning, resources, capabilities and expectations for future performance; and (iii) the assumptions underlying or relating to any such statement. Such forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon Haemonetics' current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties.

Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, the failure to realize the anticipated benefits of the transaction, including from non-achievement of any commercial milestone required to receive all or part of the additional contingent consideration, or the transaction having an unanticipated impact; Haemonetics' ability to predict accurately the demand for its products and products under development and to develop strategies to address its markets successfully; and the impact of competitive products and pricing and technical innovations that could render products marketed or under development by Haemonetics obsolete. These and other factors are identified and described in more detail in Haemonetics' filings with the U.S. Securities and Exchange Commission. Haemonetics does not undertake to update these forward-looking statements.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

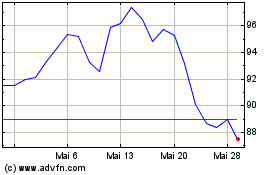

Haemonetics (NYSE:HAE)

Historical Stock Chart

Von Mär 2025 bis Mär 2025

Haemonetics (NYSE:HAE)

Historical Stock Chart

Von Mär 2024 bis Mär 2025