First Trust Intermediate Duration Preferred & Income Fund Declares its Monthly Common Share Distribution of $0.1325 Per Share...

20 Februar 2020 - 10:40PM

Business Wire

First Trust Intermediate Duration Preferred & Income Fund

(the "Fund") (NYSE: FPF) has declared the Fund’s regularly

scheduled monthly common share distribution in the amount of

$0.1325 per share payable on March 16, 2020, to shareholders of

record as of March 3, 2020. The ex-dividend date is expected to be

March 2, 2020. The monthly distribution information for the Fund

appears below.

First Trust

Intermediate Duration Preferred & Income Fund (FPF):

Distribution per share:

$0.1325

Distribution Rate based on the February

19, 2020 NAV of $25.33:

6.28%

Distribution Rate based on the February

19, 2020 closing market price of $24.74:

6.43%

The majority, and possibly all, of this distribution will be

paid out of net investment income earned by the Fund. A portion of

this distribution may come from net short-term realized capital

gains or return of capital. The final determination of the source

and tax status of all 2020 distributions will be made after the end

of 2020 and will be provided on Form 1099-DIV.

The Fund is a non-diversified, closed-end management investment

company that seeks to provide a high level of current income. The

Fund has a secondary objective of capital appreciation. The Fund

will seek to achieve its investment objectives by investing in

preferred and other income-producing securities. Under normal

market conditions, the Fund will invest at least 80% of its Managed

Assets in a portfolio of preferred and other income-producing

securities issued by U.S. and non-U.S. companies, including

traditional preferred securities, hybrid preferred securities that

have investment and economic characteristics of both preferred

securities and debt securities, floating rate and fixed-to-floating

rate preferred securities, debt securities, convertible securities

and contingent convertible securities.

First Trust Advisors L.P. ("FTA") is a federally registered

investment advisor and serves as the Fund's investment advisor. FTA

and its affiliate First Trust Portfolios L.P. ("FTP"), a FINRA

registered broker-dealer, are privately-held companies that provide

a variety of investment services. FTA has collective assets under

management or supervision of approximately $146 billion as of

January 31, 2020 through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds and separate managed

accounts. FTA is the supervisor of the First Trust unit investment

trusts, while FTP is the sponsor. FTP is also a distributor of

mutual fund shares and exchange-traded fund creation units. FTA and

FTP are based in Wheaton, Illinois.

Stonebridge Advisors LLC ("Stonebridge"), the Fund's investment

sub-advisor, is a registered investment advisor specializing in

preferred and hybrid securities. Stonebridge was formed in December

2004 by First Trust Portfolios L.P. and Stonebridge Asset

Management, LLC. The company had assets under management or

supervision of approximately $11.6 billion as of January 31, 2020.

These assets come from separate managed accounts, unified managed

accounts, unit investment trusts, an open-end mutual fund, actively

managed exchange-traded funds, and the Fund.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost. There can be no assurance that the Fund’s investment

objectives will be achieved. The Fund may not be appropriate for

all investors.

Principal Risk Factors: The Fund is subject to risks, including

the fact that it is a non-diversified closed-end management

investment company.

Preferred/hybrid and debt securities in which the Fund invests

are subject to various risks, including credit risk, interest rate

risk, and call risk. Credit risk is the risk that an issuer of a

security will be unable or unwilling to make dividend, interest

and/or principal payments when due and that the value of a security

may decline as a result. Credit risk may be heightened for the Fund

because it invests in below investment grade securities, which

involve greater risks than investment grade securities, including

the possibility of dividend or interest deferral, default or

bankruptcy. Interest rate risk is the risk that the value of

fixed-rate securities in the Fund will decline because of rising

market interest rates. Call risk is the risk that performance could

be adversely impacted if an issuer calls higher-yielding debt

instruments held by the Fund.

Because the Fund is concentrated in the financials sector, it

will be more susceptible to adverse economic or regulatory

occurrences affecting this sector, such as changes in interest

rates, loan concentration and competition.

Investment in non-U.S. securities is subject to the risk of

currency fluctuations and to economic and political risks

associated with such foreign countries.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in the Fund are spelled out in the

shareholder reports and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA,

the Internal Revenue Code or any other regulatory framework.

Financial advisors are responsible for evaluating investment risks

independently and for exercising independent judgment in

determining whether investments are appropriate for their

clients.

The Fund's daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200220005940/en/

Press Inquiries Jane Doyle 630-765-8775 Analyst Inquiries Jeff

Margolin 630-915-6784 Broker Inquiries Jeff Margolin

630-915-6784

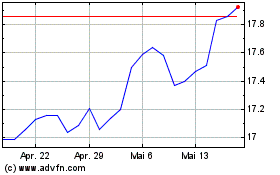

First Trust Intermediate... (NYSE:FPF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

First Trust Intermediate... (NYSE:FPF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025