UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 11-K

Annual Report Pursuant to Section 15(d) of the

Securities Exchange Act of 1934

þ Annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2023

Or

¨ Transition report pursuant to Section 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission file number 000-54863

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Eaton Personal Investment Plan

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Eaton Corporation plc

Eaton House

30 Pembroke Road

Dublin 4, Ireland

D04 Y0C2

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | EATON PERSONAL INVESTMENT PLAN |

|

| Date: June 18, 2024 | By: | Retirement and Investment Committee |

|

|

| By: | /s/ Adam Wadecki |

| | | Adam Wadecki |

| | | Senior Vice President and Controller |

| | | Eaton Corporation |

EATON PERSONAL INVESTMENT PLAN

FINANCIAL STATEMENTS

WITH

REPORT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

December 31, 2023

| | | | | |

| INDEX |

| |

| Page |

| |

| Report of Independent Registered Public Accounting Firm | |

| |

| Financial Statements: | |

| |

| Statement of Net Assets Available for Benefits | 2 |

| |

| Statement of Changes in Net Assets Available for Benefits | 3 |

| |

| Notes to Financial Statements | 4-10 |

| |

| Supplemental Schedule: | |

| |

| Schedule of Assets Held for Investment Purposes at End of Year | 11 |

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Plan Participants of the Eaton Personal Investment Plan

and the Retirement and Investment Committee of Eaton

Opinion on the Financial Statements

We have audited the accompanying Statement of Net Assets Available for Benefits of the Eaton Personal Investment Plan (“Plan”) as of December 31, 2023 and 2022, and the related Statement of Changes in Net Assets Available for Benefits for the years then ended, and the related notes and schedule (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the Schedule of Assets Held for Investment Purposes at End of Year as of December 31, 2023 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with Department of Labor’s (DOL) Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Meaden & Moore, Ltd.

We have served as the Plan’s auditor since 2005.

Cleveland, Ohio

June 18, 2024

STATEMENT OF NET ASSETS AVAILABLE FOR BENEFITS

Eaton Personal Investment Plan

| | | | | | | | | | | |

| December 31 |

| 2023 | | 2022 |

| ASSETS | | | |

| Receivable - Employer contributions | $ | 72,549 | | | $ | 63,376 | |

| Receivable - Employee contributions | 172,616 | | | 147,818 | |

| Receivable - Interest | 5,174 | | | 3,419 | |

| Notes receivable from participants | 4,292,339 | | | 3,932,091 | |

| | | |

| Total Receivables | 4,542,678 | | | 4,146,704 | |

| | | |

| Investments at Fair Value: | | | |

| Plan interest in Eaton Savings Trust | 176,357,257 | | | 152,284,070 | |

| | | |

| Investments at Contract Value: | | | |

| Plan interest in Eaton Savings Trust | | | |

| Eaton Stable Value Fund | 25,659,106 | | | 29,204,975 | |

| | | |

| Total Investments | 202,016,363 | | | 181,489,045 | |

| | | |

| Net Assets Available for Benefits | $ | 206,559,041 | | | $ | 185,635,749 | |

| | | |

See accompanying notes.

2

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

Eaton Personal Investment Plan

| | | | | | | | | | | |

| Year Ended December 31 |

| 2023 | | 2022 |

| Additions to Net Assets Attributed to: | | | |

| Contributions: | | | |

| Employer | $ | 3,651,225 | | | $ | 3,278,504 | |

| Employee | 10,508,971 | | | 9,852,453 | |

| Rollover | 562,160 | | | 862,340 | |

| | | |

| Total Contributions | 14,722,356 | | | 13,993,297 | |

| | | |

| Investment Gain (Loss) | | | |

| Investment gain (loss) from Eaton Savings Trust | 33,451,896 | | | (27,834,299) | |

| Interest income on notes receivable from participants | 250,373 | | | 191,019 | |

| | | |

| Total Investment Gain (Loss) | 33,702,269 | | | (27,643,280) | |

| | | |

| Deductions from Net Assets Attributed to: | | | |

| Benefits paid to participants | 24,980,640 | | | 25,309,274 | |

| Administrative expenses | 96,257 | | | 104,250 | |

| | | |

| Total Deductions | 25,076,897 | | | 25,413,524 | |

| | | |

| Net Increase (Decrease) | 23,347,728 | | | (39,063,507) | |

| | | |

| Net Transfers to other plans | (2,424,436) | | | (654,655) | |

| | | |

| Net Assets Available for Benefits: | | | |

| Beginning of Year | 185,635,749 | | | 225,353,911 | |

| | | |

| End of Year | $ | 206,559,041 | | | $ | 185,635,749 | |

See accompanying notes.

3

NOTES TO FINANCIAL STATEMENTS

Eaton Personal Investment Plan

1 Description of Plan

The following description of the Eaton Personal Investment Plan ("Plan") provides only general information. Participants should refer to the Plan document and summary plan description, which are available from the Company's Human Resources Department upon request, for a complete description of the Plan's provisions.

General:

Effective July 1, 1996, Eaton Corporation ("Company" or "Plan Sponsor") established the Plan. The Company is a subsidiary of Eaton Corporation plc ("Eaton"). On May 1, 1998, the Company amended the Plan and restated certain articles therein to qualify the Plan as a profit sharing plan under Section 401(a) of the Internal Revenue Code ("Code") and to include a cash or deferred arrangement intended to qualify under Section 401(k) of the Code. The Plan was amended and restated effective January 1, 2015. The three most recent amendments to the Plan were dated May 2, 2022, December 15, 2022, and December 21, 2023.

Eligibility:

The Plan provides that all active and former union employees who belong(ed) to the unions listed in the Plan document, will be (were) eligible for membership in the Plan on the date at which the employee has (had) completed the specified probationary period, as stated in the applicable collective bargaining agreement.

Contributions:

Employee Contributions - Employees may make before-tax or after-tax contributions. Certain employees may make Roth Contributions. Maximum employee contribution percentages are determined by the applicable collective bargaining agreement. Catch-up contributions are permitted in the Plan, allowing participants age 50 and older to defer an additional amount of their compensation, as prescribed by the Internal Revenue Code. Effective January 1, 2019, employees at certain locations who are classified on and after a specified effective date as new hires, rehires, and/or certain transfers are automatically enrolled in the Plan at a rate of 6% of eligible compensation, as specified in the applicable collective bargaining agreement. Rollover contributions from other plans are also accepted, provided certain specified conditions are met.

Employer Contributions (Matching) - Certain eligible participants of the Plan may receive a matching contribution of 50% up to 6% of their deferred compensation as specified in the applicable collective bargaining agreement.

Employer Contributions (Retirement) - As specified in the applicable collective bargaining agreement, certain eligible participants of the Plan may receive a Company contribution based on hours worked or compensation. Additionally, beginning June 1, 2018, the Plan provides that employees at certain locations who are classified on and after a specified effective date as new hires, rehires, and/or certain transfers shall be eligible for non-elective 2% Eaton Retirement Contributions, not to exceed 2% of their eligible compensation, as specified in the applicable collective bargaining agreement.

Employee and Employer contributions are determined and recorded at the time compensation is paid.

Contributions are subject to limitations on annual additions and other limitations imposed by the Internal Revenue Code, as defined in the Plan document.

4

1 Description of Plan, Continued

Participants' Accounts:

Each participant's account is credited with the participant's contributions, employer contributions, and an allocation of the Plan's earnings, and is charged with an allocation of applicable administrative expenses. Allocations, if any, are based on participant account balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant's account.

Vesting:

All participants are 100% vested in elective deferrals, rollover contributions made to the Plan, and actual earnings thereon. Vesting in company contributions is subject to certain provisions as defined by the Plan.

Notes Receivable from Participants:

Participants may borrow from their fund accounts up to a maximum equal to the lesser of $50,000 or 50% of their account balance (excluding certain employer contributions), reduced by their highest outstanding loan balance during the preceding 12 months. Loan terms range from 1-5 years except for loans used for the purchase of a primary residence which may have a longer term. The loans are secured by the balance in the participant's account and bear interest at a rate based on the prime interest rate as determined by the Plan Administrator. Principal and interest are paid through payroll deduction for active employees. Terminated employees are permitted to make loan payments directly to the Plan’s recordkeeper. Loans are valued at unpaid principal plus accrued unpaid interest.

Hardship Withdrawals:

Hardship withdrawals are permitted in accordance with Internal Revenue Service guidelines.

Payment of Benefits:

Upon termination of service, retirement, death or total and permanent disability, a participant is eligible to receive a lump sum amount equal to the value of his or her account. A participant may choose to take partial withdrawals. Benefits are recorded when paid.

Investment Options:

Contributions may be invested in any of the fund options available under the Plan.

2 Summary of Significant Accounting Policies

Basis of Accounting:

The financial statements of the Plan are prepared on the accrual basis of accounting.

Investment Valuation and Income Recognition:

The Plan's trustee is Fidelity Management Trust Company, and the Plan's investments, excluding notes receivable from participants, were invested in the Eaton Savings Trust ("Master Trust"), which was established for the investment of assets of the Plan and the Eaton Savings Plan. The fair value of the Plan’s interest in the individual funds of the Master Trust is based on the value of the Plan’s interest in the fund as of January 1, 2002, plus actual contributions and allocated investment income (loss) less actual distributions.

5

2 Summary of Significant Accounting Policies, Continued

Securities traded on a national securities exchange are valued at the last reported sales price on the last business day of the Plan year. Investments traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the average of the last reported bid and asked prices. Common/collective trust funds and separate accounts are valued at the redemption value of the units held at year-end. Participant transactions (purchases and sales) occur daily with no restrictions and there are no unfunded commitments. The common/collective trust and separate accounts have varying investment strategies ranging from mirroring specific market indexes, asset allocation strategies, and bond performance. However, in high volume liquidation demand periods, the Trustee may, at their discretion, delay liquidation requests so that it is in the best interest of all participants in the fund. The Eaton Stable Value Fund invests primarily in investment contracts issued by insurance companies, banks or other financial institutions, including investment contracts backed by high-quality fixed income securities.

Investments held by a defined contribution plan are required to be reported at fair value, except for fully benefit- responsive investment contracts. Contract value is the relevant measure for that portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts, because contract value is the amount participants normally would receive if they were to initiate permitted transactions under the terms of the Plan.

Purchases and sales of securities are recorded on a trade-date basis.

Use of Estimates:

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Administrative Fees:

Administrative costs, management fees and expenses of the Plan are paid by the Trustee from the Master Trust unless such costs, fees and expenses are paid by the Company. Participants pay the recordkeeping fees and administrative expenses with a flat quarterly fee deducted from their accounts. Certain transaction costs are paid by the participants. Certain investments in the Plan have revenue sharing agreements with the Trustee. Revenue credits are recorded in administrative expenses and allocated to participants who hold these investments.

Plan Termination:

The Company may amend, modify, suspend, or terminate the Plan. No amendment, modification, suspension, or termination of the Plan shall have the effect of providing that any amounts then held under the Plan may be used or diverted to any purpose other than for the exclusive benefit of members or their beneficiaries.

Risks and Uncertainties:

The Master Trust's investments, as listed in Footnote 4, have varying degrees of risk, such as interest rate, credit and overall market volatility risks. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and such changes could materially affect the amounts reported in the Statement of Net Assets Available for Benefits.

Subsequent Events:

Management evaluates events occurring subsequent to the date of the financial statements in determining the accounting for and disclosure of transactions and events that affect the financial statements.

Subsequent events have been evaluated through the report date which is the date the financial statements were available to be issued.

6

3 Tax Status

On December 28, 2016, the Internal Revenue Service stated that the Plan, as then designed, was in compliance with the applicable requirements of the Internal Revenue Code. The Plan has been amended; however, the Plan Administrator and the Plan's tax counsel believe that the Plan is currently designed and being operated in compliance with the applicable requirements of the Internal Revenue Code. Therefore, they believe that the Plan was qualified and the related trust was tax-exempt as of the financial statement date.

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken uncertain tax positions that more likely-than-not would not be sustained upon examination by applicable taxing authorities. The Plan Administrator has analyzed tax positions taken by the Plan and has concluded that, as of December 31, 2023, there are no uncertain tax positions taken, or expected to be taken, that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions. No audits for any tax periods are in progress.

4 Investments

Fidelity Management Trust Company, Trustee and Recordkeeper of the Plan, holds the Plan's investment assets and executes investment transactions, and all investment assets of the Plan are pooled for investment purposes in the Master Trust.

The following tables present the assets of the Master Trust and the Plan's interest in each of the investments held by the Master Trust at December 31:

| | | | | | | | | | | | | | |

| 2023 | | Master Trust Balances | | Plan's Interest in Master Trust Balances |

| | | | |

| Common collective trusts | | $ | 3,722,801,311 | | | $ | 116,650,859 | |

| Registered investment companies | | 1,437,570,636 | | | 32,794,536 | |

| Eaton ordinary shares | | 1,742,903,156 | | | 22,512,550 | |

| Guaranteed investment contracts | | 360,844,577 | | | 24,568,124 | |

| U.S. government securities | | 88,242,182 | | | 2,616,371 | |

| Interest bearing cash | | 73,154,889 | | | 2,205,053 | |

| Corporate debt instruments | | 15,559,410 | | | 461,335 | |

| Non interest bearing cash | | 7,129,235 | | | 211,381 | |

| Total investments | | 7,448,205,396 | | | 202,020,209 | |

| Receivables | | 6,150,462 | | | 229,961 | |

| Liabilities | | (7,881,017) | | | (233,807) | |

| | | | |

| Total | | $ | 7,446,474,841 | | | $ | 202,016,363 | |

7

4 Investments, Continued

| | | | | | | | | | | | | | |

| 2022 | | Master Trust Balances | | Plan's Interest in Master Trust Balances |

| | | | |

| Common collective trusts | | $ | 3,073,529,504 | | | $ | 102,571,788 | |

| Registered investment companies | | 1,235,704,974 | | | 29,252,965 | |

| Eaton ordinary shares | | 1,221,047,740 | | | 16,028,966 | |

| Guaranteed investment contracts | | 448,397,416 | | | 28,591,497 | |

| U.S. government securities | | 90,370,436 | | | 2,890,547 | |

| Interest bearing cash | | 52,935,345 | | | 1,448,385 | |

| Corporate debt instruments | | 19,338,834 | | | 618,563 | |

| Non interest bearing cash | | 511,312 | | | 16,355 | |

| Total investments | | 6,141,835,561 | | | 181,419,066 | |

| Receivables | | 3,768,156 | | | 153,891 | |

| Liabilities | | (2,653,132) | | | (83,912) | |

| | | | |

| Total | | $ | 6,142,950,585 | | | $ | 181,489,045 | |

At December 31, 2023, and 2022, respectively, the Eaton Fixed Income Fund was comprised of U.S. government securities (76% and 79%), corporate debt instruments (13% and 17%), interest bearing and non interest bearing cash (11% and 2%), and other investments (0% and 2%).

Investment income and net appreciation or depreciation in the fair value of the investments of the Master Trust are allocated to the individual plans based upon the average balance invested by each plan in each of the individual funds of the Master Trust. The following table sets forth the investment income and net appreciation or depreciation in the fair value of investments of the Master Trust allocated to the participating plans for the years ended December 31:

| | | | | | | | | | | |

| 2023 | | 2022 |

| | | |

| Interest and dividend income | $ | 92,053,085 | | | $ | 101,931,255 | |

| Net appreciation (depreciation) in fair value | 1,480,028,235 | | | (1,174,226,390) | |

| | | |

| $ | 1,572,081,320 | | | $ | (1,072,295,135) | |

5 Party-in-Interest Transactions

Party-in-interest transactions include the investments in the ordinary shares of Eaton and the investment funds of the Trustee and the payments of administrative expenses by the Company. Such transactions are exempt from being prohibited transactions. In addition, the Plan has arrangements with various service providers and these arrangements qualify as party-in-interest transactions.

During 2023 and 2022, the Plan received $344,841 and $351,190 in ordinary share dividends from Eaton.

6 Benefit-Responsive Investment Fund

The Plan holds the Eaton Stable Value Fund, a fund co-managed by Insight Investment Management (Insight) and Pacific Investment Management Company LLC, that invests in benefit-responsive investment contracts. The fund is credited with earnings on the underlying investments and charged for participant withdrawals and administrative expenses. The traditional guaranteed investment contract issuers are contractually obligated to repay the principal and a specified interest rate that is guaranteed to the Plan and the synthetic contract issuers are contractually obligated to guarantee the payment of a specific interest rate to the Plan.

8

6 Benefit-Responsive Investment Fund, Continued

As described in Footnote 2, because the guaranteed investment contracts are fully benefit-responsive, contract value is the relevant measurement attribute for that portion of the net assets available for benefits attributable to the guaranteed investment contract. Contract value, as reported to the Plan by Insight and Pacific Investment Management Company LLC, represents contributions made under the contracts, plus earnings, less participant withdrawals and administrative expenses. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value.

There are no reserves against contract value for credit risk of the contract issuer or otherwise. The crediting interest rate is based on a formula agreed upon with the issuer, but it may not be less than zero percent. Such interest rates are reviewed quarterly for resetting.

Certain events limit the ability of the Plan to transact at contract value with the issuers. The Plan Administrator does not believe that the occurrence of any such value event, which would limit the Plan's ability to transact at contract value with participants, is probable.

The issuer may terminate the contract for cause at any time.

7 Fair Value Measurements

In accordance with Accounting Standards Codification 820, the Plan has categorized the financial instruments, based on the degree of subjectivity inherent in the valuation technique, into a fair value hierarchy of three levels, as follows:

•Level 1 - inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

•Level 2 - inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

•Level 3 - inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2023, and 2022.

Registered investment companies (mutual funds), Company stock funds and bond funds: Valued at the net asset value ("NAV") of shares held by the Master Trust at year-end.

Common collective trusts: Valued at the net unit value of units held by the trust at year-end. The unit value is determined by dividing the total value of fund assets by the total number of units of the Fund owned.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while management believes the valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

9

7 Fair Value Measurements, Continued

The following table sets forth by level on a recurring basis, within the fair value hierarchy, the Master Trust's investments at fair value as of December 31, 2023. There are no investments which fall under Level 3 of the hierarchy.

| | | | | | | | | | | | | | | | | |

| Level 1

Fair Value | | Level 2

Fair Value | | Totals |

| | | | | |

| Registered investment companies | $ | 1,437,570,636 | | | $ | — | | | $ | 1,437,570,636 | |

| Common collective trusts | — | | | 3,730,162,645 | | | 3,730,162,645 | |

| Company stock funds | — | | | 1,785,676,693 | | | 1,785,676,693 | |

| Bond funds | — | | | 116,196,482 | | | 116,196,482 | |

| | | | | |

| Total investments at fair value | $ | 1,437,570,636 | | | $ | 5,632,035,820 | | | $ | 7,069,606,456 | |

The following table sets forth by level on a recurring basis, within the fair value hierarchy, the Master Trust's investments at fair value as of December 31, 2022. There are no investments which fall under Level 3 of the hierarchy.

| | | | | | | | | | | | | | | | | |

| Level 1

Fair Value | | Level 2

Fair Value | | Totals |

| | | | | |

| Registered investment companies | $ | 1,235,704,974 | | | $ | — | | | $ | 1,235,704,974 | |

| Common collective trusts | — | | | 3,079,073,933 | | | 3,079,073,933 | |

| Company stock funds | — | | | 1,256,261,263 | | | 1,256,261,263 | |

| Bond funds | — | | | 113,891,892 | | | 113,891,892 | |

| | | | | |

| Total investments at fair value | $ | 1,235,704,974 | | | $ | 4,449,227,088 | | | $ | 5,684,932,062 | |

10

SCHEDULE OF ASSETS HELD FOR INVESTMENT PURPOSES AT END OF YEAR

Form 5500, Schedule H, Part IV, Line 4i

Eaton Personal Investment Plan

EIN 34-0196300

Plan Number 162

December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | |

| (a) | (b) | | (c) | | (d) | | (e) |

| Identity of Issue, | | Description of Investment Including | | | | |

| Borrower, Lessor, | | Maturity Date, Rate of Interest, | | | | Current |

| or Similar Party | | Collateral, Par or Maturity Value | | Cost | | Value |

| | | | | | | |

| * | Interest in Eaton Savings Trust Master Trust | | Master Trust | | N/A | | $ | 176,357,257 | |

| * | Interest in Eaton Stable Value Fund - See Footnote 1 | | Guaranteed Investment Contract | | N/A | | 25,659,106 | |

| * | Participant Loans | | 4.0 - 9.50%; various maturity dates | | N/A | | 4,292,339 | |

| | | | | | | |

| | | | | | | $ | 206,308,702 | |

| Footnote 1 - denotes contract value. | | | | | | |

| * | Party-in-interest to the Plan. | | | | | | |

11

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8 No. 333-185206) pertaining to the Eaton Personal Investment Plan of our report dated June 18, 2024, with respect to the financial statements of the Eaton Personal Investment Plan included in this Annual Report (Form 11-K) for the years ended December 31, 2023 and 2022.

/s/ Meaden & Moore, Ltd.

Cleveland, Ohio

June 18, 2024

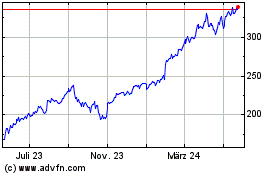

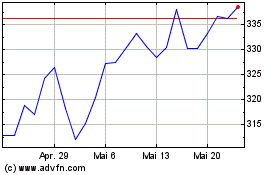

Eaton (NYSE:ETN)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Eaton (NYSE:ETN)

Historical Stock Chart

Von Jun 2023 bis Jun 2024