Acquisition Expands EMCOR’s Electrical

Capabilities Through a Suite of Complementary and Comprehensive,

Mission-Critical Services, Increasing Presence in High Growth

Sectors

EMCOR Group, Inc. (the “Company”) (NYSE: EME) today announced

that it has entered into a definitive agreement to acquire Miller

Electric Company (“Miller Electric”), a leading electrical

contractor serving high growth areas across the Southeastern U.S.,

for $865 million in cash, subject to customary adjustments. The

boards of directors of both companies unanimously approved the

transaction.

Headquartered in Jacksonville, Florida, Miller Electric designs,

installs, maintains, upgrades, and replaces complex electrical

systems and related technologies across the Southeast. Miller

Electric is a trusted partner to more than 1,000 clients across a

broad array of industries, with a focus on high growth sectors

including data centers, manufacturing, and healthcare. With a

workforce of more than 3,500 highly skilled professionals and a

scaled commercial electrical contractor platform with 21 branch

locations, Miller Electric delivers expertise to its clients that

extends beyond traditional electrical contracting into systems

integration, repairs and maintenance, building automation, energy

and sustainability solutions, and engineering services.

Miller Electric has a strong growth, margin, and free cash flow

profile, with approximately 90% of the company’s revenues currently

generated from Florida and the greater Southeastern U.S., where

EMCOR has limited electrical construction presence today. EMCOR

expects Miller Electric to generate approximately $805 million in

revenue and approximately $80 million in Adjusted EBITDA in

calendar year 2024. As of November 2024, Miller Electric had $755

million in remaining performance obligations.

“The team at Miller Electric has built a legacy of delivering

high-quality solutions beyond traditional electrical contracting

and staying ahead of industry trends through their commitment to

innovation,” said Tony Guzzi, Chairman, President, and Chief

Executive Officer of EMCOR. “Their service-first mindset,

long-standing reputation of excellence, and forward-thinking

approach have positioned Miller Electric as a leading

non-residential electrical and technology contractor in the

Southeastern United States.”

Mr. Guzzi added, “The addition of Miller Electric expands

EMCOR’s electrical capabilities through their suite of

comprehensive, mission-critical services and bolsters our already

strong presence in high-growth areas including data centers,

manufacturing, and healthcare. With a complementary geographic

footprint, this transaction enables us to enhance our ‘local

execution, national reach’ strategy as we broaden our overall

construction services platform. Importantly, Miller Electric is

also a great fit with our EMCOR Values and culture of operational

excellence with their 97-year track record of safety and

innovation.”

“The Miller Electric team has consistently demonstrated

excellence within their end markets,” said Dan Fitzgibbons,

President and CEO of EMCOR Electrical Construction Services. “By

leveraging advanced technologies such as virtual design and

construction, along with prefabrication techniques, they have a

proven record of continually improving project efficiency and

quality for their clients. Like EMCOR, Miller Electric not only

enhances project execution, but also empowers their workforce

through continuous development and training, sharing key methods

and practices across the organization. I want to extend a warm

welcome to the entire Miller Electric team and look forward to

collaborating to drive the business forward.”

“For nearly a century, we have taken great pride in delivering

innovative electrical solutions and building strong relationships

with our clients and partners,” said Henry Brown, Chief Executive

Officer at Miller Electric. “Joining forces with EMCOR will allow

us to further enhance our services and offerings, leveraging

additional resources to expand our reach and continue leading the

way in serving our clients in the evolving energy and

infrastructure landscape. We are confident EMCOR is the right

partner for us, bringing a long-term approach and deep

understanding of our business, culture, and values. EMCOR will

allow us to reach our full potential as a company and create even

more opportunities for our employees and the communities we serve.

We look forward to continuing our growth for years to come as part

of the EMCOR family of companies.”

Upon completion of the acquisition, Miller Electric will operate

within EMCOR’s Electrical Construction Services segment under Dan

Fitzgibbons, President and CEO of EMCOR Electrical Construction

Services. Henry Brown will continue to serve as CEO of Miller

Electric with the Miller Electric leadership team remaining in

place. Miller Electric will remain headquartered in Jacksonville,

Florida.

Transaction Details

EMCOR expects to fund the transaction through cash on hand with

an expected close in the first half of 2025, subject to customary

closing conditions. Hart-Scott-Rodino approval has already been

obtained for the transaction.

The transaction is expected to be modestly accretive to EMCOR’s

earnings per share in 2025 with further accretion in future

years.

Additional information about the transaction can be found in an

investor presentation, which has been posted to EMCOR’s investor

relations site. Details of the transaction will also be discussed

when EMCOR releases its fourth quarter and full year 2024 earnings

results on February 26, 2025.

Advisors

Evercore is serving as financial advisor to EMCOR, and Ropes

& Gray LLP is serving as its legal advisor. Stephens is serving

as financial advisor to Miller Electric, and Driver, McAfee,

Hawthorne & Diebenow, PLLC is serving as its legal advisor.

About EMCOR

EMCOR Group, Inc. is a Fortune 500 leader in mechanical and

electrical construction services, industrial and energy

infrastructure and building services. This press release and other

press releases may be viewed at the Company’s website at

www.emcorgroup.com. EMCOR routinely posts information that may be

important to investors in the “Investor Relations” section of our

website at www.emcorgroup.com. Investors and potential investors

are encouraged to consult the EMCOR website regularly for important

information about EMCOR.

About Miller Electric Company

Miller Electric is a 97-year-old company based in Jacksonville,

Florida with 21 branch offices located throughout the United

States. We provide energy and technology infrastructure solutions

for our clients and work in various markets including data centers,

healthcare, manufacturing, commercial, and institutional. We are

also dedicated to creating a more sustainable future through the

advancement of EV charging infrastructure.

Learn more at http://www.mecojax.com and

http://www.MillerEV.com.

Forward Looking Statements

This press release contains forward-looking statements. Such

statements speak only as of this press release, and EMCOR assumes

no obligation to update any such forward-looking statements, unless

required by law. These forward-looking statements include

statements regarding the proposed acquisition of Miller Electric,

including timing to closing, the anticipated benefits of the

proposed acquisition of Miller Electric, and the anticipated

financial impact of the proposed acquisition of Miller Electric.

These forward-looking statements involve risks and uncertainties

that could cause actual results to differ materially from those

anticipated (whether expressly or implied) by the forward-looking

statements. Accordingly, these statements do not guarantee future

performance or events. Applicable risks and uncertainties include,

but are not limited to, uncertainties as to the timing of the

acquisition; the occurrence of any event, change or other

circumstance that could give rise to the termination of the

acquisition agreement; the ability of the parties to consummate the

proposed acquisition on a timely basis or at all; the satisfaction

of the conditions precedent to the consummation of the proposed

acquisition; transaction and integration costs; the risk that the

acquisition will divert management’s attention from EMCOR’s ongoing

business operations or otherwise disrupts EMCOR’s ongoing business

operations; changes in EMCOR’s businesses during the period between

now and the closing; inability to achieve expected results in

earnings per share and cash position; and adverse business

conditions, including labor market tightness and/or disruption,

productivity challenges, the impact of claims and litigation, the

nature and extent of supply chain disruptions impacting

availability and pricing of materials, global conflicts, and

inflationary trends more generally, including fluctuations in

energy costs. Certain of the risk factors associated with EMCOR’s

business are also discussed in Part I, Item 1A “Risk Factors,” of

the Company’s 2023 Form 10-K, and in other reports filed from time

to time with the Securities and Exchange Commission and available

at www.sec.gov and www.emcorgroup.com. Such risk factors should be

taken into account in evaluating our business, including any

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114453472/en/

EMCOR

Investors

Andrew G. Backman Vice President Investor Relations (203)

849-7938

FTI Consulting, Inc. Investors: Blake Mueller (718) 578-3706

Media

Joele Frank, Wilkinson Brimmer Katcher Andi Rose / Viveca Tress

(212) 355-4449

Miller Electric Company

Media

Kerri Stewart Chief Strategy Officer kstewart@mecojax.com (904)

962-9425

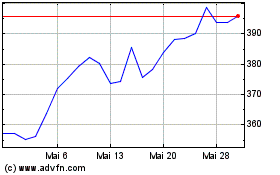

EMCOR (NYSE:EME)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

EMCOR (NYSE:EME)

Historical Stock Chart

Von Jan 2024 bis Jan 2025