0000906345false00009063452024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 1, 2024

CAMDEN PROPERTY TRUST

(Exact name of Registrant as Specified in Charter)

| | | | | | | | |

| Texas | 1-12110 | 76-6088377 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number)

| (I.R.S. Employer Identification Number) |

11 Greenway Plaza, Suite 2400, Houston, Texas 77046

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (713) 354-2500

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common shares of beneficial interest, par value $0.01 per share | | CPT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected to not use the extended transition period for complying with any new or revised financial accounting standards provided pursuant of Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

The information contained in Item 5.02 below is incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

As previously announced, effective as of October 1, 2024, William W. Sengelmann retired as Executive Vice President - Real Estate Investments of Camden Property Trust (the “Company”). In connection with Mr. Sengelmann’s retirement, the Company and Mr. Sengelmann entered into a Separation and Release Agreement, effective as of October 1, 2024, pursuant to which Mr. Sengelmann received various payments representing the anticipated value of previously accrued for amounts he would have been eligible to receive in February 2025 had he been an employee of the Company at such time.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

Number Title

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 1, 2024 CAMDEN PROPERTY TRUST

By: /s/ Michael P. Gallagher

Michael P. Gallagher

Senior Vice President - Chief Accounting

Officer

SEPARATION AND RELEASE AGREEMENT

1.Parties. The parties to this Separation and Release Agreement (“Agreement”) are William W. Sengelmann, the employee (for yourself, your family, beneficiaries and anyone acting for you) (“you”), and your employer, Camden Property Trust (together with its subsidiaries, the “Employer”).

2.End of Employment. Your employment with the Employer ended on October 1, 2024 (“Separation Date”). Regardless of whether you sign this Agreement, you will receive your final pay including accrued and unused vacation.

3.Separation Pay. As consideration for your promises in this Agreement, if you enter into and abide by this Agreement and continue to comply with all company policies and procedures after you sign this Agreement, you will receive the following:

Separation Pay: A lump sum payment of $2,204,550.25, minus applicable deductions and withholdings, by check made payable to you, payable on the next regular payroll date on which payments may be processed after you sign this Agreement and the revocation period has expired, provided such payroll date is at least three (3) business days after such date. The Employer will issue an IRS Form W-2 to you reflecting these payments (the “Separation Pay”).

You agree that the Separation Pay is an item of value being provided in exchange for your promises in this Agreement, and that you are not otherwise entitled to the Separation Pay.

You agree that you received payment in full for any salary, bonuses, equity awards, other incentives, and all other compensation and benefits earned through the Separation Date. You agree that all of the equity awards granted to you by Employer either: (i) were paid in full prior to the Separation Date; or (ii) terminated on the Separation Date, and in any case you have no further rights with respect thereto or in respect thereof.

4. General Release. You release the Employer (plus its affiliates, predecessors, successors and any other entity related to it and all of its and their past and present trust managers, officers, employees and anyone else acting for any of them – all together “Releasees”) from all claims of any type to date, known or unknown, suspected or unsuspected, to the fullest extent allowed by law, including but not limited to anything to do with your employment or the end of your employment. This means you give up all claims and rights related to:

•pay, compensation, or benefits including bonuses, commissions, equity, expenses, incentives, insurance, paid/unpaid leave, profit sharing, or separation pay/benefits;

•compensatory, emotional or mental distress damages, punitive or liquidated damages, attorney fees, costs, interest or penalties;

•violation of express or implied employment contracts, covenants, promises or duties, intellectual property or other proprietary rights;

•unlawful or tortious conduct such as assault or battery; background check violations; defamation; detrimental reliance; fiduciary breach; fraud; indemnification; intentional or negligent infliction of emotional distress; interference with contractual or other legal rights; invasion of privacy; loss of consortium; misrepresentation; negligence (including negligent hiring, retention, or supervision); personal injury; promissory estoppel; public policy violation; retaliatory discharge; safety violations; posting or records-related violations; wrongful discharge; or other federal, state or local statutory or common law matters;

•discrimination, harassment or retaliation based on age, benefit entitlement, citizenship, color, concerted activity, disability, ethnicity, gender, gender identity and expression, genetic information, immigration status, income source, jury duty, leave rights, military status, national origin, parental status, reproductive health decision making, protected off-duty conduct, race, religion, retaliation, sexual orientation, union activity, veteran status, whistleblower claims in court (including under Sarbanes-Oxley, Dodd-Frank, and the False Claims Act claims), other legally protected status or activity; or any allegation that payment under this Agreement was affected by any such discrimination, harassment or retaliation, failure to accommodate or failure to engage in the interactive process; and

•any participation in any class or collective action against any Releasee.

5. Release Exclusions and Other Exceptions. Nothing in this Agreement restricts your rights with respect to claims or disputes that arise after the date you sign this Agreement or the factual basis thereof, including but not limited to: claims for breach of this Agreement; and claims that cannot be waived, such as for unemployment or worker’s compensation benefits. Nothing in any part of this Agreement limits your rights to: (i) file a charge or complaint with any administrative agency, such as the U.S. Equal Employment Opportunity Commission or the National Labor Relations Board, or a state fair employment practices agency, or communicate directly with or provide information (including testimony) to an agency, or otherwise participate in an agency proceeding; or (ii) communicate with law enforcement or your attorney. You nonetheless give up all rights to any money or other individual relief based on any agency or judicial decision, including class or collective action rulings. However, you may receive money properly awarded by the U.S. Securities and Exchange Commission (SEC) as a reward for providing information to that agency.

6. Promise Not To Sue. A “promise not to sue” means you promise not to sue any Releasee in court. This is different from the General Release provided for in Section 4 above. Besides releasing claims covered by the General Release, you agree never to sue any Releasee for any reason covered by the General Release. If you sue a Releasee in violation of this Agreement: (i) you shall be required to pay that Releasee’s reasonable attorney fees and other litigation costs incurred in defending against your suit; or alternatively (ii) the Employer can require you to return all but $100.00 of the Separation Pay provided to you under this Agreement. In that event, the Employer shall be excused from any remaining obligations that exist solely because of this Agreement.

7. Whistleblowing. You agree that: (i) no one has interfered with your ability to report within the Employer possible violations of any law, and (ii) it is the Employer’s policy to encourage such reporting.

8. Return of Employer Property. You have returned (or you will before receiving any Separation Pay/benefits) all the Employer property you possessed or controlled, including any confidential information, cellular phone, laptop or other computer, other business equipment, credit cards, keys, software or work product. The Employer property includes all originals plus hard copies and electronic versions of all documents, such as e-mails, facsimiles, files, handbooks, letters, manuals, memoranda, power points, records and reports. You also agree to reconcile promptly any outstanding expense accounts.

9. Future Cooperation. You agree to make yourself available to assist the Employer with transitioning your duties as well as with any investigations, legal claims, or other matters concerning anything related to your employment. You specifically agree to make yourself available to the Employer upon reasonable notice for interviews and fact investigations, to testify without requiring service of a subpoena or other legal process, and to voluntarily provide the Employer any employment-related documents you possess or control. “Cooperation” does not mean you must provide information favorable to the Employer; it means only that you will upon the Employer’s request provide information you possess or control. If the Employer requests your cooperation, it will reimburse you for reasonable time and expenses, provided you submit appropriate documentation.

10. Non-Disparagement. Except as expressly provided otherwise in this Agreement, including any applicable state law requirements, you promise not to libel, slander, or say anything, verbally or in writing, directly or indirectly, that you know to be false or misleading about any Releasee.

11. Non-Admission. Neither the Employer's offer reflected in this Agreement nor any payment under this Agreement are an admission that you have a viable claim against the Employer or any other Releasee. Each Releasee denies all liability.

12. Confidentiality of Agreement. The terms of this Agreement are strictly confidential. You will not communicate the terms of this Agreement to any third party, whether verbally or in writing, by any means, including by social media. Any disclosure by you will cause the Employer irreparable harm that money cannot undo. Accordingly, violation of this section will entitle the Employer to temporary and permanent injunctive relief. Except as required by law, you have not disclosed and will not disclose the terms of this Agreement to anyone except your immediate family members and your legal/financial advisors. Each of them is bound by this Confidentiality of Agreement provision, and a disclosure by any of them is a disclosure by you.

13. Other Post-Employment Restrictions.

•Confidential Employer Information. You will not disclose or use any Employer information other than for the Employer’s benefit, except as required by applicable law. Confidential Employer Information (herein so called) is not limited to trade secrets; it includes any non-public Employer information related to the Employer’s business (or the business of any entity/person with which the Employer does business), such as budgets, customer/client lists, development, finances, marketing, operations, patents, pricing, research, resources, strategies, systems or technologies. You remain bound by any confidential information provisions of any prior agreement with the Employer. You will inform the

Employer immediately if you receive a legal demand to disclose Confidential Employer Information, and you will not disclose such information while the Employer obtains a judicial ruling regarding the demand. Notwithstanding the above, pursuant to the federal Defend Trade Secrets Act, you cannot be held criminally or civilly liable under any federal or state trade secret law for disclosing a trade secret if that disclosure is made: (i) in confidence to a federal, state or local government official, either directly or indirectly, or to any attorney, and for the sole purpose of reporting or investigating a suspected violation of law; or (ii) in a complaint or other document filed in a lawsuit or similar proceeding, provided that filing is made under seal.

◦Solicitation of Clients/Customers. If you worked with or learned Confidential Employer Information about any Employer clients/customers in your last year of work for the Employer, then for one year after you sign this Agreement you will not, directly or indirectly, in any manner solicit any such client/customer to remove any business or divert any prospective business from the Employer.

◦Solicitation of Employees. For one year after you sign this Agreement, you will not, directly or indirectly, in any manner solicit any person to: end employment or another contractual relationship with the Employer; interfere with such a relationship; or hire any person who was employed by or contracted with the Employer to perform work or services during your last year of work for the Employer.

◦Non-Compete. For one year after you sign this Agreement, you will not perform any work, in any capacity, for a competitor that is: (i) similar to your work for the Employer during your last year of employment, and (ii) in the geographic area of your work during that year.

◦Reasonable Restrictions. You agree that the post-employment restrictions above are reasonable in duration, geographic area, and scope; and necessary to protect the Employer's goodwill and other business interests. You further agree that breaching any of those covenants will cause the Employer immediate irreparable harm and will entitle the Employer to temporary and permanent injunctive relief.

14. Applicable Law. This Agreement shall be interpreted under federal law if that law governs, and otherwise under the laws of the State of Texas, without regard to its choice of law provisions.

15. Severability. If a court finds any part of this Agreement unenforceable, that part shall be modified and the rest enforced. If a court (or arbitrator) finds any such part incapable of being modified, it shall be severed and the rest enforced.

16. Enforcement. If you breach this Agreement, the Employer shall be entitled to preliminary and permanent injunctive relief plus attorneys’ and experts’ fees the Employer incurs in enforcing this Agreement, unless otherwise expressly provided elsewhere in this Agreement, plus any additional relief determined to be appropriate. A decision not to enforce this Agreement does not waive future enforcement.

17. Individual Agreement. This Agreement has been negotiated individually and is not part of a group exit incentive or other termination program.

18. Entire Agreement. This Agreement is the complete understanding between you and the Employer. It replaces any other agreements, representations or promises, written or oral.

19. Time to Consider. You have had at least twenty-one (21) days within which to consider this Agreement after receiving it. You must sign and return this Agreement to the Employer during this review period if you want to receive the Separation Pay/benefits set forth in this Agreement.

20. Time to Revoke. After you sign this Agreement, you have seven (7) days to revoke it by sending written notice of revocation to the representative of the Employer signing below. This Agreement is not effective or enforceable until the revocation period expires. If you revoke this Agreement, you will not receive the Separation Pay/benefits offset forth in this Agreement.

21. Other Representations. You agree:

•You have received all pay, compensation, benefits, leave, time off, and/or expense reimbursements you are due to date, including for overtime or vacation/PTO;

◦You have not suffered any on‑the-job injury for which you have not already filed a claim, and the end of your employment is not related to any such injury;

◦You do not have any pending lawsuits against the Employer;

◦You were advised in writing, by getting a copy of this Agreement, to consult with an attorney before signing below;

◦You have had the opportunity to negotiate this Agreement with the Employer, and this Agreement shall not be construed for or against either party as a drafter of its terms;

◦You have relied on your own informed judgment, or that of your attorney if any, in deciding whether to sign this Agreement; and

•You are signing this Agreement knowingly and voluntarily.

| | | | | | | | | | | |

/s/ William W. Sengelmann August 29, 2024 WILLIAM W. SENGELMANN (Date)

|

By: /s/ Allison Dunavant September 10, 2024 CAMDEN PROPERTY TRUST (Date)

|

| Name: | Allison Dunavant |

| Title: | Senior Vice President –

Human Resources |

| | | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

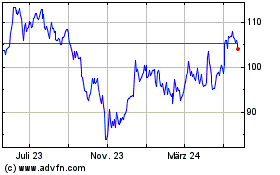

Camden Property (NYSE:CPT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

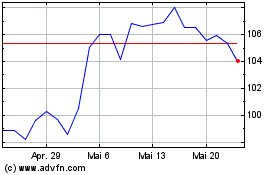

Camden Property (NYSE:CPT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024