The new ETFs add to the iShares Build ETF

line-up to expand granular access to U.S. companies

UC Investments (University of California)

committed as an early investor of the iShares Nasdaq Top 30 Stocks

ETF (QTOP)

The increasing prominence of mega-cap stocks in recent years

underscores the critical need for investors to modernize the way

they capture growth of some of the world’s most well-known

companies. Today, BlackRock announced the launch of three new ETFs

to empower investors with simple solutions to express more granular

views on the largest companies listed in the U.S.

The new ETFs are part of the iShares Build ETFs – a new toolkit

to provide investors with portfolio building blocks to customize

their U.S. market cap exposure with the convenience and flexibility

of an ETF. The iShares Top 20 U.S. Stocks ETF (NYSE:TOPT), iShares

Nasdaq Top 30 Stocks ETF (Nasdaq:QTOP), and iShares Nasdaq-100

ex-Top 30 ETF (Nasdaq:QNXT) – join established ETFs, iShares MSCI

USA Equal Weighted ETF (EUSA) and iShares S&P 100 ETF (OEF), to

broaden easy access to manage U.S. equity exposure.

“The iShares Build ETFs help investors harness the power of

growth and innovation within the largest U.S. companies in a

precise way,” said Rachel Aguirre, U.S. Head of iShares Products

at BlackRock. “Now is the time for investors to rethink their

market exposure and how they can aim to capitalize on the growth

potential of these companies.”

“The beauty of these ETFs is that they can be used by investors

looking for more targeted exposure to mega caps or those looking to

broaden their exposure to large, well-known companies,” added

Rachel Aguirre.

The U.S. capital market has undergone significant transformation

in the past two decades, but there are limited new solutions to

help investors better manage their market cap exposure. In 2000,

the entire U.S. stock market was valued at $15 trillion. Fast

forward to today, the largest eight companies alone are worth $15

trillion. More importantly, the top 20 largest companies in the

S&P 500 Index have contributed more than two-thirds (68%) of

the Index’s return over the past three years, demonstrating their

ability to drive outsized stock market returns.1

The ability to easily access or customize U.S. market cap

exposure in an ETF is pertinent to various investor types –

including first-time investors, model builders, institutional

investors, and especially financial advisors, as their portfolios

are meaningfully underweight mega-cap stocks.2

“iShares Build ETFs extend BlackRock’s effort to democratize

easy access to investment opportunities,” said Jagdeep Singh

Bachher, the University of California’s Chief Investment

Officer. “At the University of California, we believe in

empowering individual investors, particularly young investors, with

straight-forward tools to gain exposure to innovative companies

that are poised to grow. That’s why we are pleased to be an early

investor in QTOP, which allows investors big and small to easily

add growth companies to their portfolios.”

Fund Name

Ticker

Expense ratio

Holdings

iShares Top 20 U.S. Stocks ETF

TOPT

0.20%

Top 20 largest U.S. companies in the

S&P 500 across sectors such as technology, consumer goods,

communication, healthcare and financial services sectors

iShares Nasdaq Top 30 Stocks ETF

QTOP

0.20%

30 of the largest and most innovative

non-financial companies including mega cap stocks in the technology

sector

iShares Nasdaq-100 ex Top 30 ETF

QNXT

0.20%

One-ticker solution to the next potential

industry leaders across sectors such as technology, healthcare,

consumer goods, and industrial sectors

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1,400+ exchange traded funds (ETFs) and $4.2

trillion in assets under management as of September 30, 2024,

iShares continues to drive progress for the financial industry.

iShares funds are powered by the expert portfolio and risk

management of BlackRock.

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses which may be obtained by

visiting www.iShares.com or www.blackrock.com. Read the prospectus

carefully before investing.

Investing involves risk, including possible loss of

principal.

Funds that concentrate investments in specific industries,

sectors, markets or asset classes may underperform or be more

volatile than other industries, sectors, markets or asset classes

and the general securities market.

Index performance is for illustrative purposes only. Index

performance does not reflect any management fees, transaction costs

or expenses. Indexes are unmanaged and one cannot invest directly

in an index. Past performance does not guarantee future

results. Index performance does not represent actual Fund

performance. For actual fund performance, please visit

www.iShares.com or www.blackrock.com.

This information should not be relied upon as research,

investment advice, or a recommendation regarding any products,

strategies, or any security in particular. This material is

strictly for illustrative, educational, or informational purposes

and is subject to change.

The iShares Funds are not sponsored, endorsed, issued, sold or

promoted by MSCI Inc., Nasdaq, Inc., or S&P Dow Jones Indices

LLC. None of these companies make any representation regarding the

advisability of investing in the Funds. BlackRock Investments, LLC

is not affiliated with the companies listed above.

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved.

BLACKROCK and iSHARES are trademarks of BlackRock,

Inc. or its affiliates. All other trademarks are those of their

respective owners.

1 FactSet, as of 9/20/2024. Past performance is no guarantee of

future results. 2 BlackRock, as of 8/31/2024. Based on a BlackRock

study of 23,000 model portfolios. Morningstar, BlackRock, Aladdin

as of 7/31/24. For illustrative purposes only. Analysis based on

22,983 portfolios. These attributes are calculated for each

portfolio as a weighted average of the underlying holdings. The

portfolio-level metrics are then averaged in each risk profile

cohort to arrive at the numbers presented. Allocations are

calculated using only models that contain at least one product from

that category. “Broad Equity Benchmark” is represented by a

hypothetical blended benchmark of 75% S&P 1500 TR index and 25%

MSCI ACWI ex USA IMI NR index.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024649702/en/

Media Joanna Yau Joanna.Yau@BlackRock.com

646.856.7274

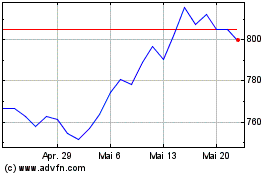

BlackRock (NYSE:BLK)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

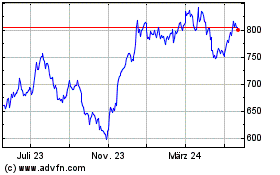

BlackRock (NYSE:BLK)

Historical Stock Chart

Von Nov 2023 bis Nov 2024