Offers advisors the convenience and simplicity

of a bond ladder within an ETF

Today, BlackRock announced plans to expand its iShares®

iBonds® ETF franchise with a suite of defined maturity bond ladder

ETFs. The iShares iBonds 1-5 Year Ladder ETFs aim to offer advisors

the convenience and simplicity of a bond ladder within an ETF.

“In 2010, BlackRock pioneered defined maturity ETFs with the

introduction of iBonds ETFs, helping advisors build bond ladders

and efficiently manage multiple client accounts,” said Karen Veraa,

Head of U.S. iShares Fixed Income Strategy at BlackRock. “The

iShares iBonds Ladder ETFs will be a seamless extension to the

iBonds franchise, seeking to provide a turnkey solution to bond

laddering while making investing easier and more affordable. This

approach will simultaneously offer advisors and their clients the

ability to manage interest rate risk, seek higher yields, and

enhance portfolio diversification.”

Fund

Name

Index Name

Ticker

Exchange

iShares® iBonds® 1-5 Year Treasury

Ladder ETF

BlackRock iBonds® 1-5 Year Treasury Ladder

Index

LDRT

NYSE Arca

iShares® iBonds® 1-5 Year TIPS

Ladder ETF

BlackRock iBonds® 1-5 Year TIPS Ladder

Index

LDRI

NYSE Arca

iShares® iBonds® 1-5 Year Corporate

Ladder ETF

BlackRock iBonds® 1-5 Year Corporate

Ladder Index

LDRC

NYSE Arca

iShares® iBonds® 1-5 Year High

Yield and Income Ladder ETF

BlackRock iBonds® 1-5 Year High Yield and

Income Ladder Index

LDRH

NYSE Arca

The iShares iBonds 1-5 Year Ladder ETF suite will consist of

four fund of funds across U.S Treasuries, investment grade, high

yield, and TIPS. The ETFs will seek to track a BlackRock index that

consists of an equal 20% allocation to five iShares iBonds ETFs in

their respective asset classes spanning five consecutive

termination years. Each index will be reconstituted and rebalanced

annually by replacing the iShares iBonds ETF that terminates in the

current year with one that terminates five years forward and

assigning equal weights to each constituent.

With over $32 billion in assets under management, the iShares

iBonds ETF franchise spans several asset classes, including U.S.

Treasuries, municipals, investment grade, high yield, and TIPS.

Since inception, BlackRock has launched 88 iShares iBonds ETFs,

with 53 still active. 1

BlackRock manages over $1 trillion in fixed income ETFs

globally, up nearly 40% since 2021.2

As of October 28, 2024, the registration statements of the Funds

are effective but not yet available to trade. BlackRock intends to

launch the Funds before the end of year.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1400+ exchange traded funds (ETFs) and $4.2

trillion in assets under management as of September 30, 2024,

iShares continues to drive progress for the financial industry.

iShares funds are powered by the expert portfolio and risk

management of BlackRock.

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses, which may be obtained by

visiting the iShares Fund and BlackRock

Fund prospectus pages. Read the prospectus carefully before

investing.

Investing involves risk, including possible loss of

principal.

The iShares iBonds® Laddered ETFs (the Funds) are fund of funds

and seek to track the investment results of a BlackRock iBonds® 1-5

Year Ladder Index (the “Underlying Index”). The Underlying Indexes

are composed exclusively of underlying iShares iBonds ETFs (“iBonds

ETFs” or “Underlying Funds”) (as determined by BlackRock Index

Service, LLC (the “Index Provider”) that themselves seek investment

results corresponding to their own underlying indexes.

Fixed income risks include interest-rate and credit risk.

Typically, when interest rates rise, there is a corresponding

decline in the value of debt securities. Credit risk refers to the

possibility that the debt issuer will not be able to make principal

and interest payments.

Non-investment-grade debt securities (high-yield/junk bonds) may

be subject to greater market fluctuations, risk of default or loss

of income and principal than higher-rated securities.

An investment in the Fund is not insured or guaranteed by the

Federal Deposit Insurance Corporation or any other government

agency and its return and yield will fluctuate with market

conditions.

TIPS can provide investors a hedge against inflation, as the

inflation adjustment feature helps preserve the purchasing power of

the investment. Because of this inflation adjustment feature,

inflation protected bonds typically have lower yields than

conventional fixed rate bonds and will likely decline in price

during periods of deflation, which could result in losses.

Government backing applies only to government issued securities,

and does not apply to the funds.

The iShares® iBonds® Ladder ETFs will hold 5 iBonds ETFs (the

“Underlying Funds”), spanning 5 consecutive maturity years. The

Underlying Index is reconstituted each June such that the iBonds

ETF with the nearest maturity is removed from the Underlying Index

and the iBonds ETF with a five-year maturity is added. If an iBonds

ETF is not available for a given maturity year within the five-year

range, the Underlying Index will hold fewer iBonds ETF

constituents.

An investment in the Fund(s) is not guaranteed, and an investor

may experience losses, including near or at the reconstitution

date. Unlike a direct investment in a bond that has a level coupon

payment and a fixed payment at maturity, the Fund(s) will make

distributions of income that vary over time. In the final months of

each Underlying Funds’ operation, as the bonds it holds mature, its

portfolio will transition to cash and cash-like instruments. As a

result, its yield will tend to move toward prevailing money market

rates, and may be lower than the yields of the bonds previously

held by the Underlying Fund and lower than prevailing yields in the

bond market.

The Funds’ distributions and liquidation proceeds are not

predictable at the time of investment and the Funds do not seek to

return any predetermined amount. The rate of Fund distribution

payments may adversely affect the tax characterization of an

investor’s returns from an investment in the Fund relative to a

direct investment in bonds. If the amount an investor receives as

liquidation proceeds upon the Fund’s termination is higher or lower

than the investor’s cost basis, the investor may experience a gain

or loss for tax purposes.

Investment in a fund of funds is subject to the risks and

expenses of the underlying funds.

Funds that concentrate investments in specific industries,

sectors, markets or asset classes may underperform or be more

volatile than other industries, sectors, markets or asset classes

and than the general securities market.

The Funds are distributed by BlackRock Investments, LLC

(together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or

promoted by BlackRock Index Services, LLC,

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved.

BLACKROCK and iSHARES are trademarks of BlackRock,

Inc. or its affiliates. All other trademarks are those of their

respective owners.

________________________

1

BlackRock, as of October 2024.

2

BlackRock, as of September 30, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029535253/en/

MEDIA: Jenna Merchant Jenna.merchant@blackrock.com

929-348-0152

Catherine Sperl Catherine.sperl@blackrock.com

631-951-1599

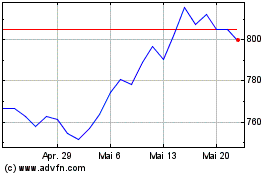

BlackRock (NYSE:BLK)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

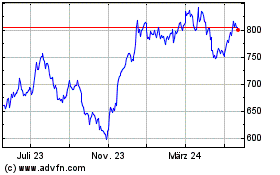

BlackRock (NYSE:BLK)

Historical Stock Chart

Von Nov 2023 bis Nov 2024